When it comes to Social Security, there is no question that there are many myths about it that too many people believe to be true. Whether it’s that Social Security is going private or that it will be bankrupt in the next few years, there is no shortage of things many people believe that they likely shouldn’t.

Social Security is one of the most essential and best-funded programs in the United States. Because of its visibility, there are many myths about the Social System program and how it works. There is a constant false belief that the Social Security program is on the verge of bankruptcy. Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. If you’ve saved and built a substantial nest egg for you and your family; get started by clicking here here.(Sponsor)

Key Points

One of the most important programs in the United States, Social Security, is relied on by almost 68 million Americans annually. As the single largest expense in the US budget every year, everyone should be familiar with debunking key Social Security myths.

10. Undocumented Immigrants

This is a controversial myth, but it is an important one that is very relevant today. The belief is that undocumented immigrants are “raiding” the Social Security fund and taking money away from American citizens who should be receiving the money.

Supporting The Program

If you dig a little beneath the surface of this myth, you will discover that undocumented workers actually help the Social Security program. In 2022 alone, undocumented immigrants contributed $25.7 billion to the program, according to a July 2024 report.

9. Government Raids

This myth has been perpetuated for far too long, and while it’s primarily political, it’s still regularly featured on mainstream media programs. As it stands today, the Social Security program is centered around two trust funds that pay benefits, and the myth is that these trusts are often “raided” to pay for other government programs.

Kind Of True

There is a little bit of truth to this myth, as Social Security funding can be used to pay for other government initiatives. However, this money isn’t just used as the US Treasury has to replace it by law if and when it ever uses Social Security funding.

8. Only For Retirement

Today, there is a very popular myth that Social Security only exists to help out the retired. While Social Security does make up the lion’s share of the benefits issued by the Social Security Administration, it’s not the only people being helped.

A Safety Net

If you are disabled or the spouse of a deceased Social Security beneficiary recipient, you also qualify for benefits. Disability benefits are a major component of the program and an often overlooked piece of the Social Security pie to provide financial support to anyone having trouble returning to the workforce.

7. No Taxes Required

A major misconception about the Social Security program is that you don’t or won’t need to pay taxes on any money you receive. Part of the reason this myth feels so widespread is that it was true, at least until 1984, when Ronald Reagan overhauled the tax provision for the program.

Yes, You Pay Taxes

While it is true that you won’t pay state taxes if you live in one of the 41 states where this is current law, federal taxes are another story. Currently, you pay taxes on 50% of your earnings if your salary is between $25,000 and $34,000 as an individual and $32,000 to $44,000 for a married, jointly filed couple. Anyone who exceeds this income threshold will pay taxes on up to 85% of the earnings you receive from the program. Your actual tax level is based on your total earnings and associated tax bracket.

6. Won’t Replace Your Income

There is a current belief that Social Security can and will replace the entirety of your income during retirement. The hope is that if you don’t have savings or a 401(k), Social Security will provide enough income to pay all of your bills.

Part Of Your Income

As the Social Security program stands today, the numbers indicate it should provide you with around 40% of beneficiaries’ pre-retirement earnings. The hope is that this is enough to help lower-wage workers, but there is no scenario in which Social Security should replace 100% of pre-retirement earnings.

5. Cost of Living Increases

Since 1975, the Social Security Administration has been trying to keep up with the rising cost of living in the United States. This increase is calculated based on a federal index of prices, which will show if the cost of living is increasing. However, the myth is that these increases are guaranteed.

No Adjustment Required

The reality is that since 1965, there have been only three years without cost-of-living increases: 2010, 2011, and 2016. This is all the evidence you need to show that any myth about a guaranteed cost-of-living increase is false.

4. Bumped Up Payments

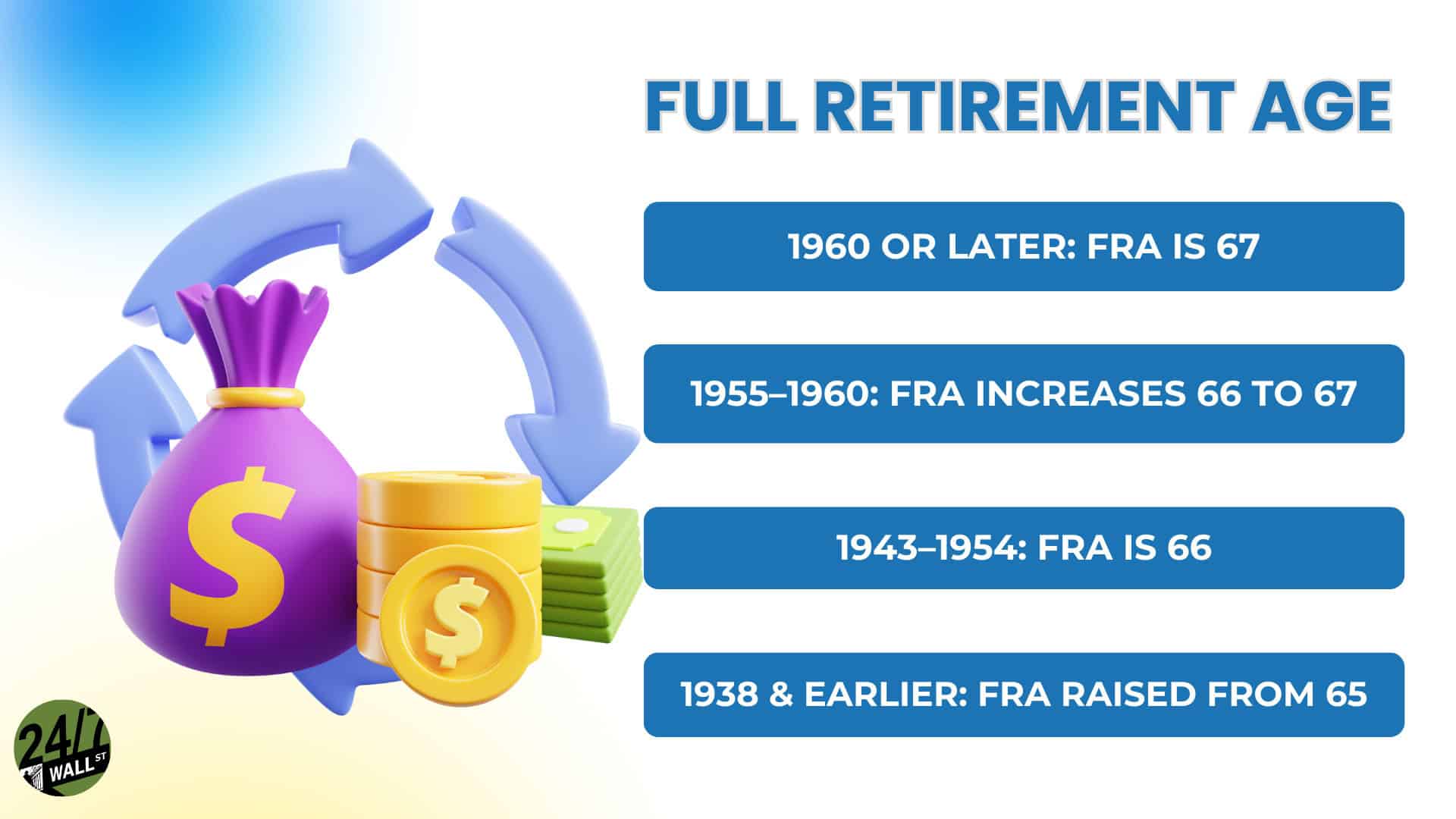

There is a common misconception that anyone who takes their payments early, potentially when they turn 62, can “bump up” their earnings once they hit Full Retirement Age at 67. Unfortunately, this is inaccurate, and the truth is complicated.

Cancel and Restart

With this myth, the reality is that you can look to “bump up” your earnings, but it’s not nearly as simple as you want it to be. The real-world requirement to receive higher benefits is to cancel your current Social Security claim within the first 12 months, repay everything you have received, and then wait until you are re-eligible to file and receive larger payments.

3. 35 Years of Earnings

The Social Security program determines how much money you will receive based on your highest 35 years of earnings in your lifetime. However, the myth is that your Social Security benefit is calculated only on income you earned before you turned 65, which isn’t accurate.

Any Age Works

In the case of anyone still working after they turn 65, you can use any of the years you earned as part of the top 35 years of earnings. As long as any earnings after 65 are high enough to be part of your earnings, they would be included in the calculated amount of money you would receive from Social Security.

2. Benefit Claims At 62

A common misunderstanding about the Social Security program is that you must start taking benefits at age 62. Thankfully, this is a definite myth. The truth is that 62 is the earliest age you can begin drawing benefits, but it is not the only age you can start taking your benefits.

Full Retirement Age

When drawing your benefits, it should be emphasized again that 62 is the earliest age, but 67 is the recommended age. Known as Full Retirement Age, 67 is the first age you can begin taking your benefits at 100% payout, whereas taking your benefits at 62 would reduce your overall payout/income by 30%.

1. Social Security Bankruptcy

The biggest myth about Social Security is that the program is on the verge of bankruptcy. According to reports from the Social Security Administration, at 100% benefit levels, the program can only sustain its current payouts until 2035 before reducing payment benefits, potentially leaving some people without full payments.

The Financial Reality

The bottom line is that as long as people work in the United States and pay taxes to the Social Security Administration, the program will continue to be funded. The 2035 timeline and 100% benefit funding are true, but the idea that the program will be bankrupt and shut down is entirely false.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.