Personal Finance

5 Common Bank Fees You Can Usually Get Waived, If You Know What You're Doing

Published:

Banks generate revenues from a number of different avenues. Lending, financing, investment banking, and mortgages are just some of the larger platforms. Another area that banks generate sizable fees on a cumulative basis is through service fees. Luckily, there are ways to avoid these fees proactively, as well as reactively.

Service and penalty fees are a huge revenue source for banks.

Oftentimes, these fees are erroneously charged or automatically charged and lack explicit notification, often going undetected for months or years.

A number of fees can easily be waived by linking accounts or taking other steps. Others can often be waived upon request in order for the bank to minimize negative word of mouth or social media criticism and to keep client funds from moving to a competitor.

Earn up to 3.8% on your money today (and get a cash bonus); click here to see how. (Sponsored)

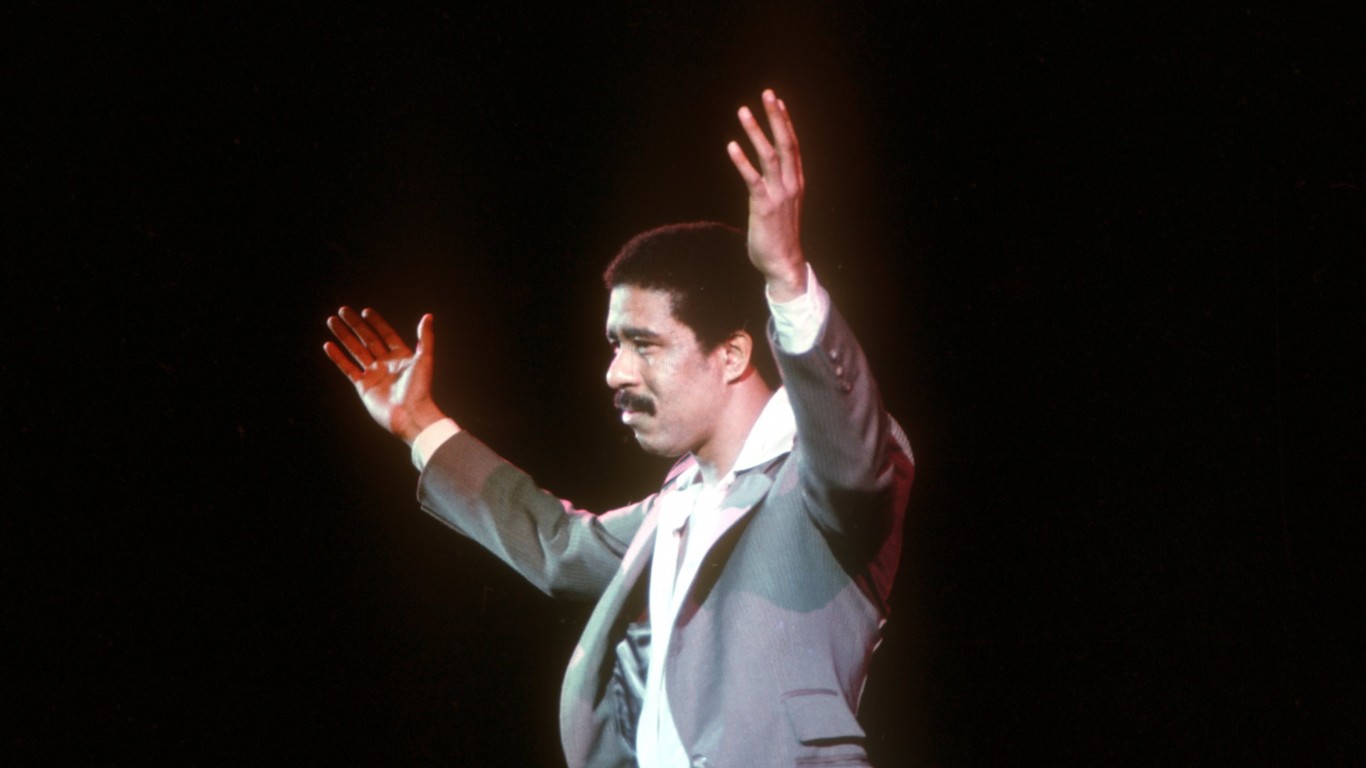

In the movie Superman 3 (1983), comedian Richard Pryor portrays Gus Gorman, a computer whiz who changes his paycheck from $143.80 to $85,789.90 by stealing the fractions of a cent that are rounded off in his employer’s favor on paychecks ending with zero, i.e., ten, twenty, or 30 cents, et. al.

Certain banks have a fee-to-revenue ratio of 40% or even higher, so they are definitely a profit center for the industry. The largest banks often charge a bevy of fees automatically on new accounts. Even on accounts that meet criteria for exemption, they are often charged due to the systems being on autopilot, unless the customer notifies the bank’s service center. Other bank fees can be avoided with the right proactive steps when opening a new account, or even retroactively, by opting out of certain services that may be deemed unnecessary.

Even though the fees may seem small, ranging from 75 cents to a few dollars, they can cumulatively total over $100-$200 per account over the course of a year. Multiplying that by the total number of accounts a bank might have, such as Citibank, which has 200 million accounts, and the small amounts can add up quickly, the totals can run into the billions.

1) Monthly Service Fees: the bread and butter service fee of banks is the one they charge you for the privilege of letting you keep your money with them (sarcasm intentional). While a number of new online-only banks that also offer High Yield Savings Accounts will not charge service fees, most of the large banks with multiple branches do, and the fees can range anywhere from a monthly $5 to $25 per account, depending on the daily average balance.

Solution: Short of finding a bank that does not charge monthly service fees, find one with the lowest minimum balance, and then see if that calculation can be based on a combined checking and savings account balance, which will often manage to stay above the minimum more easily than the checking one alone, as a majority of people use checking accounts for monthly bills and expenses.

2) Excessive Withdrawal Fees: Many banks have a 6 withdrawal limit per month on non-transactional accounts, such as savings accounts. This was originally a policy to comply with federal banking law under Regulation D, but was rescinded during the pandemic. The original notion behind Regulation D was to help protect accounts from fraud and to prevent a potential run on a bank that falls below cash reserve minimums. Banks have maintained the policy, regardless.

Solution: Transfer sufficient funds to checking accounts in advance in order to avoid triggering the withdrawal monthly maximum threshold.

3) Overdraft Fees: This is a common fee for charges that may run as much as $30 or so when the bank covers transactions on an account with insufficient funds. In the pre-digital era, this would be when a paper check “bounces”. Optional Overdraft Protection Fees are also offered by banks that are charged monthly as an “insurance policy” against incurring overdraft fees.

Solution: You can program an account to issue email and smartphone alerts when an account balance falls below a specified amount. This will inform you to add more funds or stop using that account until fresh funds have been added.

4) Non-Network ATM Fees: Withdrawing cash from an ATM that doesn’t have your bank’s name displayed on it may be outside of its network, and thus subject to a non-network fee. These ATM machines are often found at laundromats, video arcades, and take-out restaurants that do not take debit or credit cards. These fees are what your banks will charge on top of the fees that the ATM machine charges to give you cash.

Solution: Use a debit card for a small purchase at a grocery store or other vendor that will give you cash back.

5) Wire Transfer and Bank Check Fees: Banks charge fees for issuing official bank checks or for sending wire transfers when a large amount needs to be sent quickly, Banks will charge anywhere from $10 to a percentage of the amount being sent if the wire transfer is international.

Solution: If one has access to Zelle, Venmo, or other e-pay platforms, these can transfer sums for free up to several thousand dollars. It may be necessary to spread a larger amount over several payments. If the recipient also has an account in a branch of the bank in their city, a ledger transfer can also be accommodated.

There are a number of other types of bank fees that can be avoided, under the right circumstances. Accounts with deposits of $100,000 or more will give the client substantially greater clout in waiving many of these fees as a perk the bank will offer to keep the assets under management and away from a competitor.

Additionally, it doesn’t hurt to ask a bank to waive certain occasional or first-time fees incurred. Banks will often make the accommodation to avoid negative social media publicity if it doesn’t appear it will be a recurring charge.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.