Politics

What Will Social Security Look Like Under Kamala Harris vs. Donald Trump

Published:

Key Takeaways:

In the upcoming election, Kamala Harris and Donald Trump present distinctly different visions for the future of Social Security. Neither candidate has been explicitly forthcoming in particular policy changes and reforms, and just because one candidate says something will happen doesn’t mean it will. (We have three branches of government, after all!)

However, we can get a general picture of how each candidate will approach Social Security.

Harris advocates for expanding benefits and increasing funding through higher taxes on the wealthy. On the other hand, Trump is more focused on preserving Social Security’s sustainability, which has been seriously questioned in the last decade.

Understanding these divergent approaches is important for voters concerned about Social Security benefits and the program’s long-term stability.

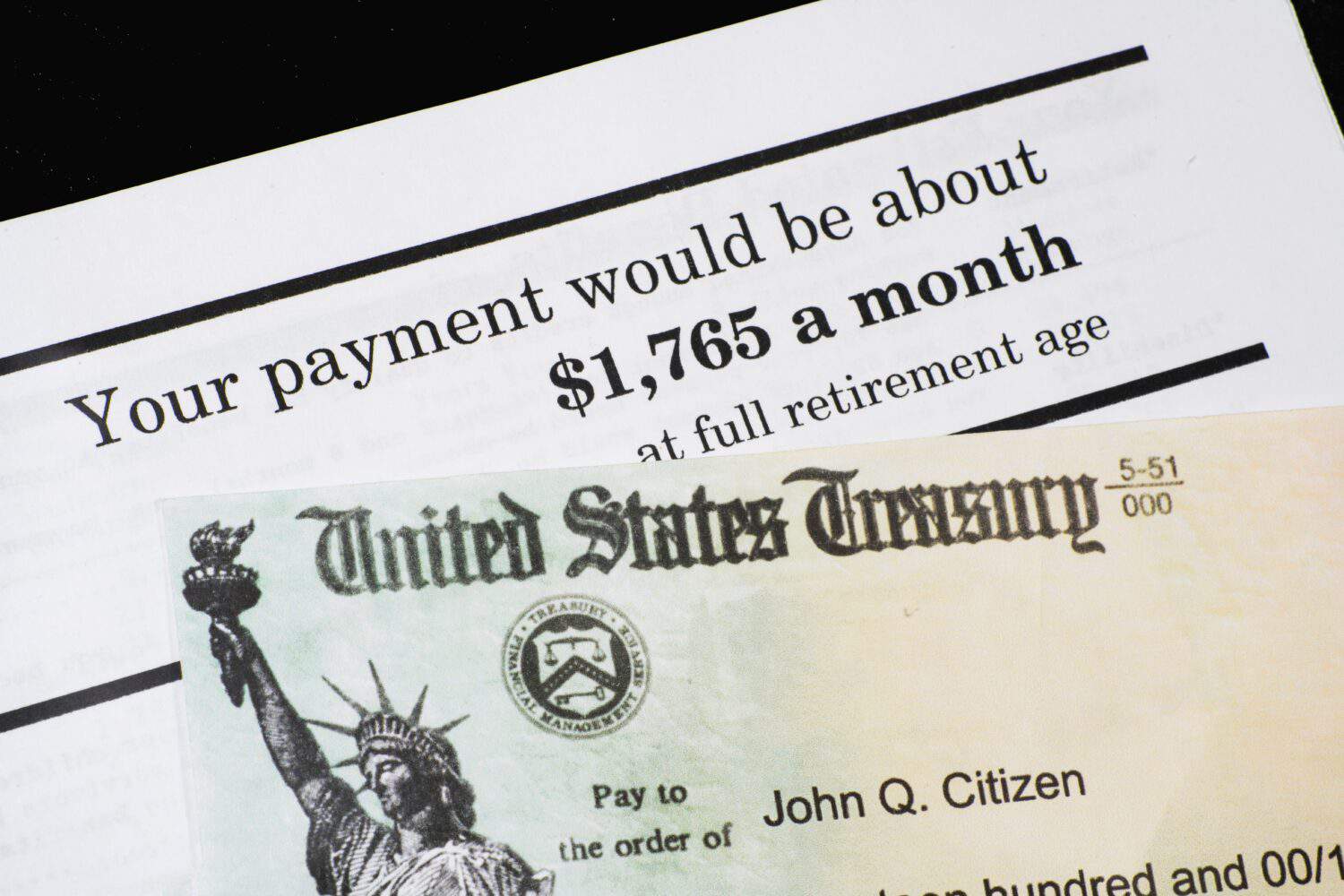

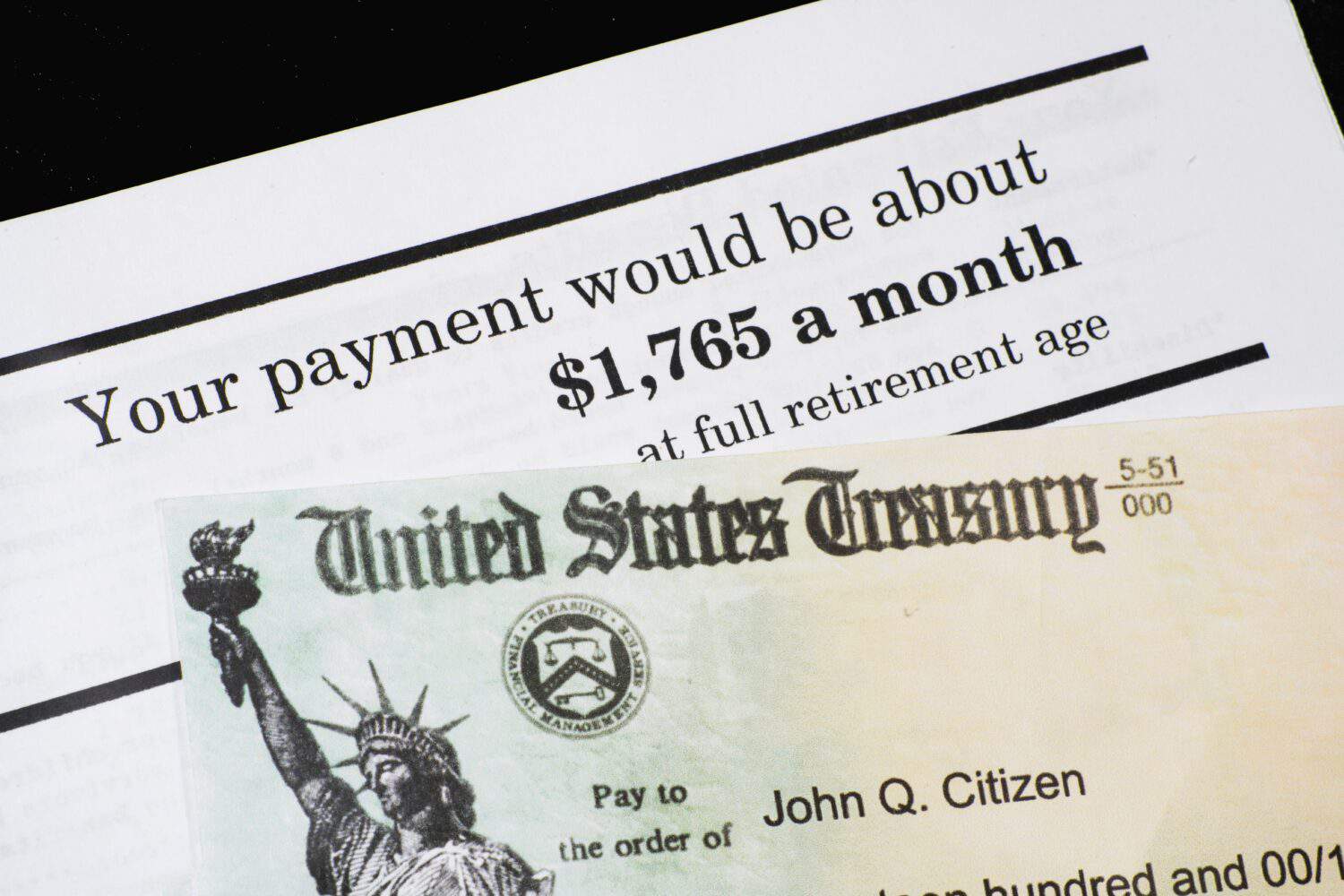

Kamala Harris’s approach to Social Security focuses on broadening the benefits available to recipients. Her plan focuses more on providing more benefits for low-income individuals and those with disabilities. Harris aims to ensure that Social Security payments better reflect the actual cost of living.

One key aspect of this proposal is enhancing the cost-of-living adjustments (COLA), which help Social Security benefits keep pace with inflation. COLA is not perfect, and Harris has recommended changing how it is formulated.

To support this plan, the program will need more funding. One way Harris may face this funding problem is to raise the taxable income of Social Security. At the moment, only earnings up to a certain amount are subject to Social Security taxes. Harris suggests lifting this cap to $400,000 or higher.

This move will lead the wealthy to pay more into Social Security, allowing for her proposed expansions. This reform plays into Harris’s broad concern with income inequality.

Harris has made other policy suggestions that also affect retirees. For instance, she’s mentioned lowering the cost of prescription drugs, particularly insulin. Because older Americans tend to pay more for healthcare, this can significantly affect how their Social Security benefits are used.

Trump’s approach to Social Security is about preserving the program’s funding and core function. He is focused on ensuring its long-term viability, which has been up in the air for some time. Trump has advocated for a range of reforms to address Social Security’s financial challenges, focusing on measures to balance the budget and reduce the federal deficit.

His proposed reforms make the program more sustainable without drastically altering the benefits received by current or future retirees.

This approach mirrors broader fiscal policy priorities, which tend to emphasize reducing government spending.

Trump has not officially announced a plan to privatize Social Security, but that is a direction some believe he will take. Privatization involves shifting some of Social Security’s investment functions towards private holders.

Critics argue that privatization could alter the guaranteed nature of the benefits. However, proponents believe privatization would lead to higher returns and greater personal control over retirement savings.

Trump emphasizes the need for fiscal responsibility in his Social Security plans. His overall strategy involves tackling the national debt, which could also influence his choices about Social Security. This focus on fiscal conservatism aims to ensure that Social Security remains financially stable without contributing to the overall budget deficit.

Okay, all this is great, but what does it all mean?

It’s important to remember that the presidential office is just one cog in our governmental machine. Therefore, one candidate’s thoughts on Social Security don’t necessarily translate directly into policy. Our government runs on concessions.

That said, each candidate’s approach to Social Security can impact those receiving Social Security benefits.

Harris’s plan aims to increase benefits, especially for low-income and disabled individuals, and enhance cost-of-living adjustments. If passed, this may result in higher monthly payments for some individuals. However, it may also put the program at a higher risk of defaulting in the future (or requiring some workers to pay higher taxes).

Trump’s plan is more about preserving what the program offers without sweeping changes. He aims to avoid reductions or cuts to the program now or in the future. That means making the program as sustainable as possible. This will likely lead to more modest changes but may increase the program’s sustainability.

Harris’s plan to raise the cap on taxable income aims to address Social Security’s funding issues by increasing revenue from higher-income earners. This approach could help solve the funding gap in Social Security by making wealthier individuals contribute more to its funding. This plan could potentially pay for the increased benefits she is proposing, as well.

Trump’s focus on fiscal responsibility and deficit reduction seeks to maintain Social Security’s solvency through budgetary reforms rather than direct funding increases. In other words, he wants to make the program as efficient as possible by reducing some of the red tape that takes up both time and money.

Both candidates want to make the program sustainable, but how they go about it is different.

Social Security works in both candidate’s broader economic policies.

Harris emphasizes raising benefits and increasing funding through higher taxes, potentially leading to greater economic equality. However, critics argue that raising taxes will impact high-income earners and business investment.

With its focus on sustainability, Trump’s approach could influence economic growth by affecting how Social Security is managed. Privatization, if pursued, might offer new investment opportunities but also carries risks associated with market volatility. His policies could also lead to a slower growth in Social Security benefits.

Both of these candidates want Social Security to function well into the future while meeting the needs of those who depend on it. They just emphasize different things. Trump is more concerned with “well into the future,” while Harris is more concerned with “meeting the needs of those who depend on it.”

It’s easy to see how each candidate’s views grew out of their larger economic policy.

Both of these candidates have very different approaches to Social Security.

Harris proposes raising benefits, especially for lower-income individuals. She wants to pay for these raised benefits through higher taxes on wealthy individuals. These new taxes may also make the program more sustainable in the future.

Her focus is largely on improving benefits and making cost-of-living adjustments that better meet the needs of vulnerable beneficiaries.

Trump emphasizes preserving Social Security into the future through fiscal responsibility. His main focus is on maintaining the program’s functions while preserving its long-term viability.

Social Security likely won’t change much for the average person under Trump, though future retirees may have a higher chance of receiving full benefits. On the other hand, Harris is more likely to make changes to Social Security benefits today, but future retirees may find that the program is defunct by the time they retire.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.