Politics

This Is What Harris and Trump Are Promising to Do to Help Small Businesses

Published:

One of the most important issues to voters in this election cycle is the economy. One aspect of that is the small business sector. These are the plans of the two candidates for small businesses. When comparing the two economic plans, Alex Beene, the Financial Literacy teacher at the University of Tennessee at Martin said, “When it comes to encouraging small business growth, both campaigns are making significant attempts to gain the votes of those who have either recently started or plan to start a business.”

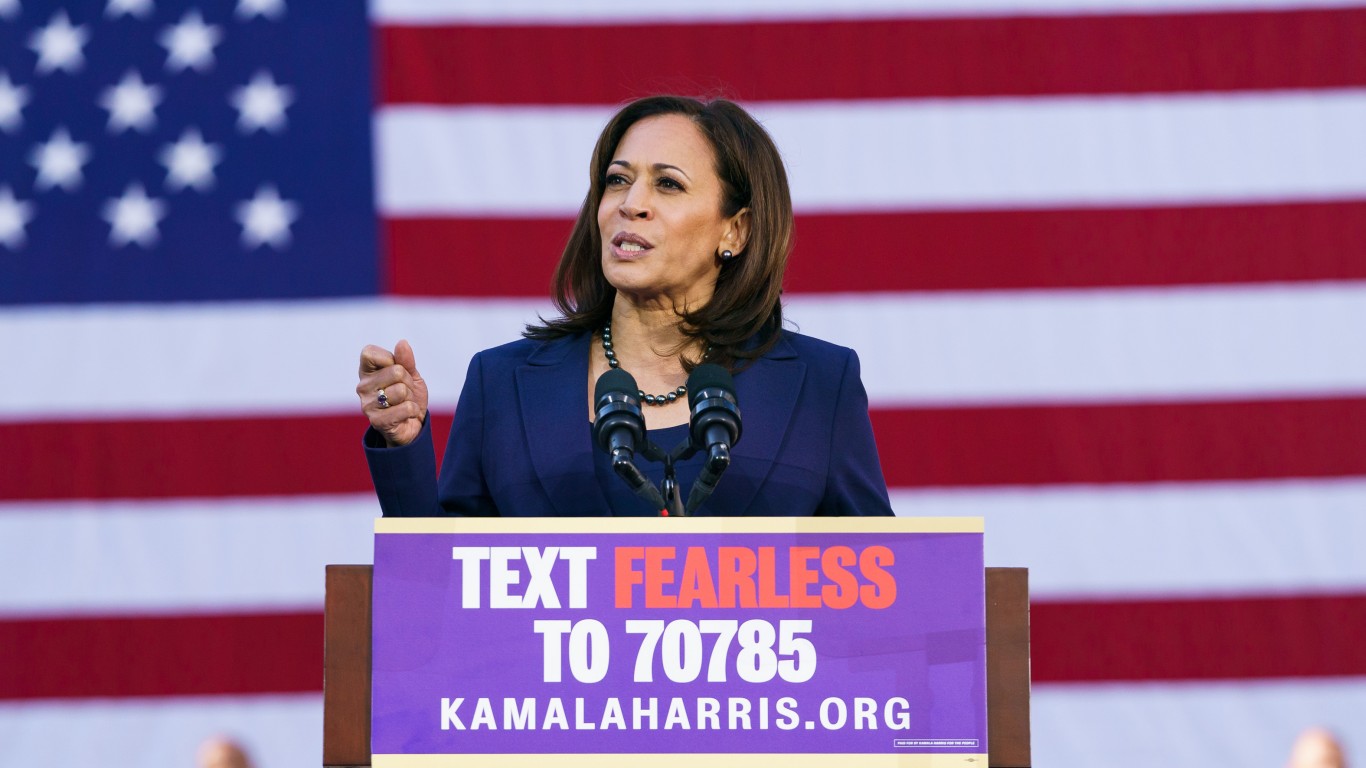

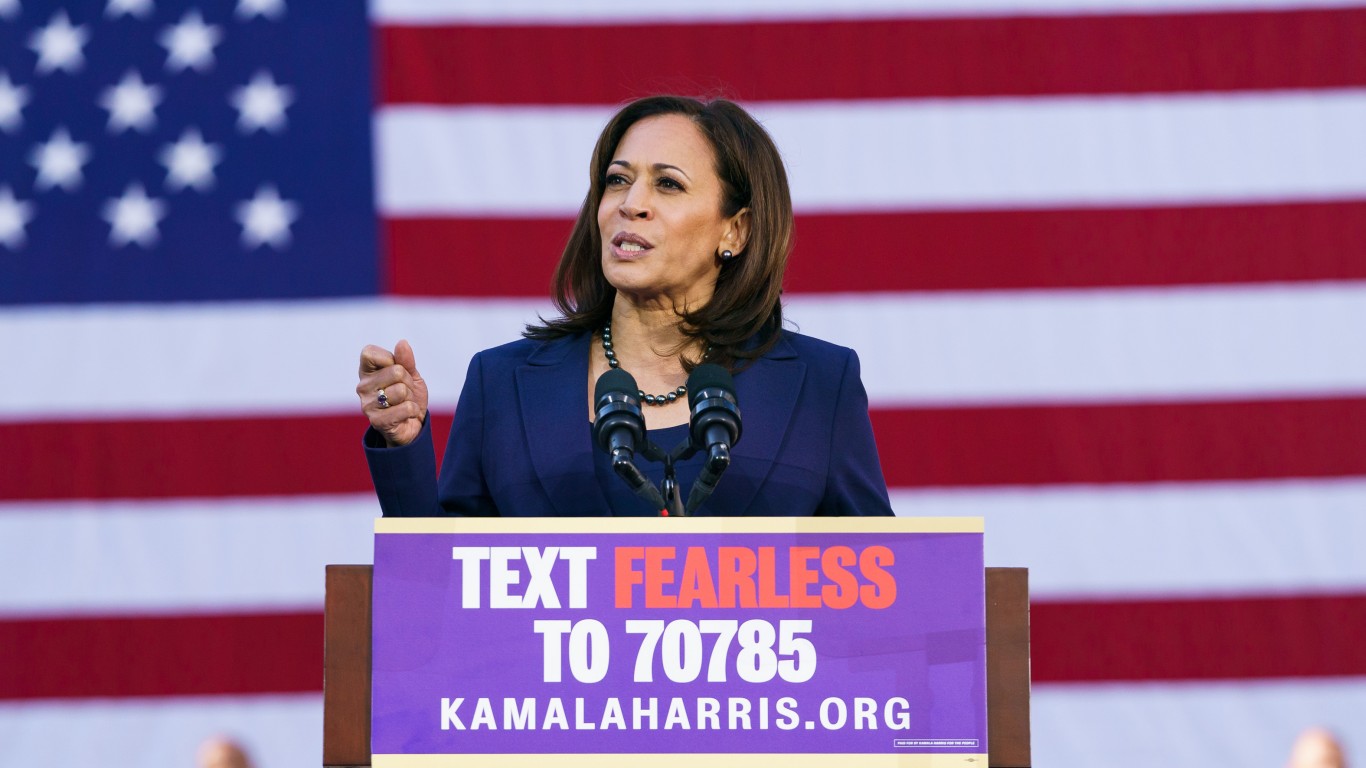

On her economic strategy, Vice President Kamala Harris said, “As President, one of my highest priorities will be to strengthen America’s small business. So first, we’re gonna help more small businesses and innovators get off the ground.” Vice President Harris has a goal to receive 25 million new small business applications over the course of her first term. That is a lofty goal, and she has specific plans to achieve that.

According to Shavon J. Smith, a Washington-based business attorney, it costs the average small business owner around $40,000 to launch and support that business in the first year. This is a large hurdle for many potential entrepreneurs. To combat this issue, Vice President Harris wants to increase the tax deduction for small businesses to $50,000, rather than the current tax deduction of $5,000. Businesses would be able to claim this deduction until they turn a profit. She also plans to provide zero-interest and low-interest loans to established small businesses that want to expand.

“Expanding this tax credit would make [ starting a small business] more affordable, helping get more businesses started and making it more likely to survive that crucial first year,” Mark Zandi, the Chief Economist at Moody’s Analytics, told USA Today. This plan is estimated to increase America’s debt by $1.4 trillion over the next 10 years.

Vice President Harris also wants the federal government to increase directly supporting small businesses by spending 1/3rd (33.33%) of all contract dollars employing them rather than the current 27.2%. Another expense for business owners, small and large, is inflation on materials and other goods. Vice President Harris says she is going to crack down on corporate price gouging to address artificial inflation on goods.

Former President Donald Trump doesn’t have a plan specific to small businesses. Rather, he has a general economic plan that would affect all businesses. Of Trump’s plan, Gene Marks of the small-business consulting firm, The Marks Group said, “Will a Trump presidency be good for a typical small business? It depends on the business, its industry, and its location; we live in a big country with a giant economy, so one can’t always generalize.”

Former President Trump wants to increase tariffs on imports. He says that he will increase tariffs by as much as 10–20% on foreign countries that he says have been, “ripping us off for years.” For China specifically, he wants to increase the tariffs as high as 60 percent on imported goods. Zandi believes that these higher tariffs could drive up costs for both consumers and companies.

Marks also told The Hill, “Businesses that rely on overseas suppliers, particularly those in China are going to struggle. Trump will move to further increase tariffs on many Chinese imports and probably will do the same for other countries where he perceives that America is on the short end (or countries he just doesn’t like- sorry, Canada).”He went on to say that many studies have shown that the tariff increases during Trump’s first term were detrimental to several industries. This would increase core material costs for a ton of industries.

Trump also plans to implement an across-the-board tax cut. He wants to reduce the tax rate for companies that produce within the United States to 12% from 15%. These tax cuts are estimated to add $3.6 trillion to the national debt over the next 10 years. In regards to Trump’s broad sweeping tax cuts, Kevin Thompson, Founder and Finance Expert at 9i Capital Group said, “Trump tax cuts will help corporations and support business, while likely making the USA more alluring for business. Yet, this does nothing to help offset major government issues such as deficit spending. This will ultimately create a larger deficit due to bringing in less money.”

Another point in his plan is to crack down on Immigration and conduct a mass deportation of undocumented workers, including employed skilled workers. It is the opinion of most economists that this would do a lot of damage to businesses and production in America. Many companies in most sectors rely on undocumented skilled workers.

In regards to reducing inflation, Former President Trump says he will, “sign an executive order directing every cabinet secretary and agency head to use every tool and authority at their disposal to defeat inflation and bring consumer prices rapidly down.” In response to this strategy, Mark Zandi said, “Trump’s plan would increase inflation.” He explains that it would lead to a diminished economy with slower growth, higher unemployment rates, higher inflation rates, and ultimately higher deficits and debts.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.