Politics

The Average American Can’t Answer These Simple National Debt Questions

Published:

In finance, it’s fair to say there are questions many Americans can’t answer. While many might feel more confident answering questions about their finances today than they did a few years ago, the same isn’t true if you ask them about the national debt.

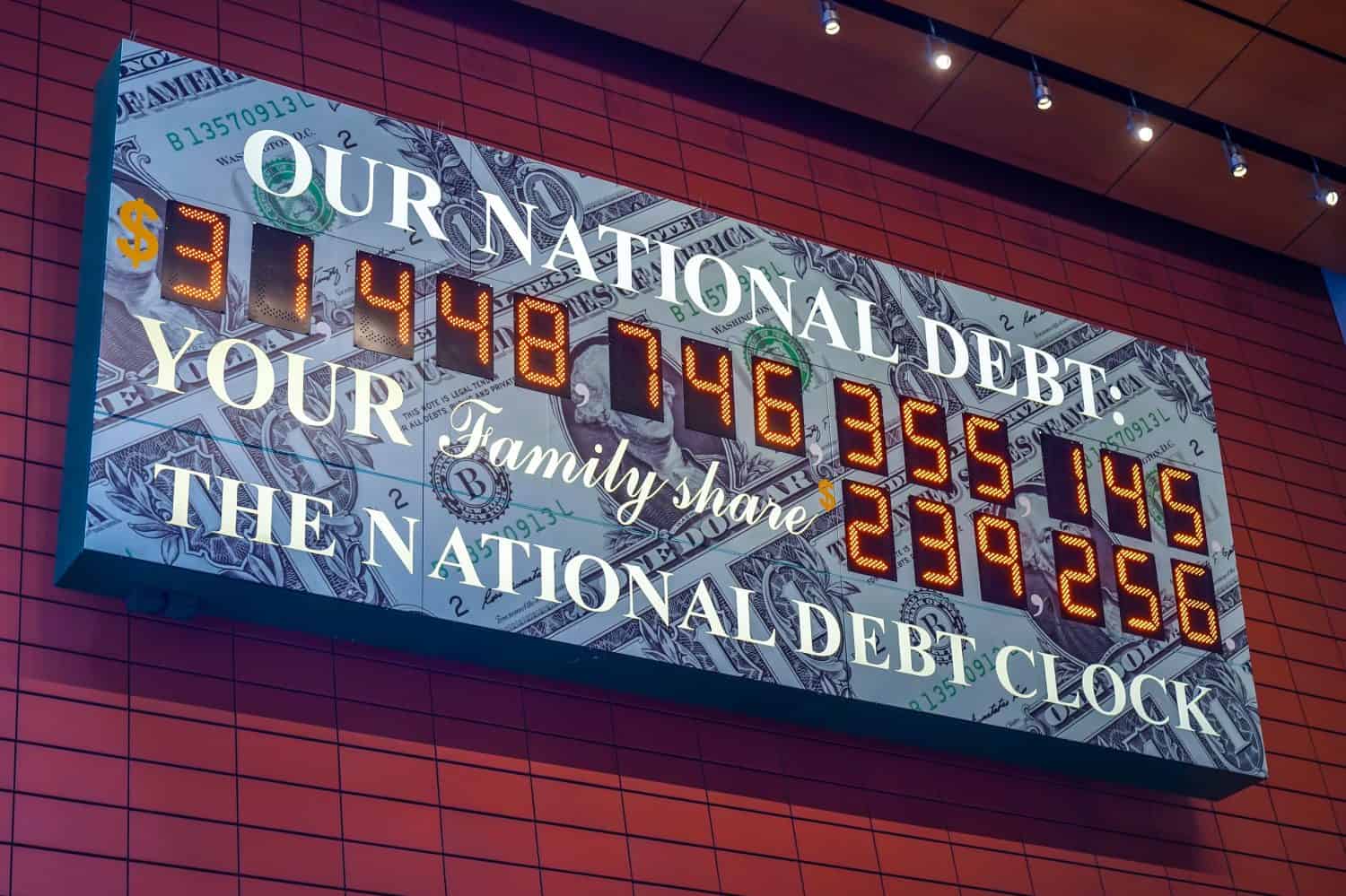

The national debt, which recently exceeded $35 trillion, includes debt held by public and federal trust funds. Because of this, federal spending has become increasingly under public scrutiny, with 57% of Americans looking to reduce the budget deficit as a top priority, according to research gathered by Pew Research Center.

Even though this statistic shows an interest in the national debt, the average American cannot answer these simple questions.

What is the national debt?

The national debt is the dollar amount the “federal government has borrowed to cover the outstanding balance of expenses incurred over time.” Should the federal government spend more money in a fiscal year than it has taken in from revenue sources like taxes, it creates a budget deficit.

What is the Current National Debt?

As of November 8, 2024, the United States national debt was equivalent to approximately $35.95 trillion. The debt will likely grow as compounded interest on the existing debt is added to the total.

What Is the Difference Between a Deficit and National Debt?

When you think of a standard deficit, it’s the shortfall that takes place within a single-year period where the government spends more than it takes in. The national debt is the culmination of multiple years of deficits, all adding to what is now owed by the government, including debts from past years.

How Does The US Government Borrow Money?

If you think about the US government borrowing money, it’s using methods like issuing treasury bills and bonds that individuals, investors, corporations, and foreign governments can all purchase. When you purchase any bond or treasury bill, you are essentially lending the US government money, hoping they will pay you back with interest. Bills and notes typically have a shorter runaway with interest, but treasury bonds are long-term investments that can, therefore, make more money.

Which government body owns part of the U.S. national debt?

Alongside international bodies, mutual funds, private citizens, and pension funds are also large holders of government debt. The Federal Reserve Bank owns about one-third of all domestic-held debt. Last but not least, Social Security and other existing federal programs make up another one-third of national debt holdings.

Which country is the largest shareholder of US national debt?

In 2024, Japan will own the largest share of foreign-held debt. Japan is believed to be owed over $1 trillion, while China, in second place, is owed around $870 million.

What is the debt ceiling?

Most Americans would be unlikely to answer any question related to the debt ceiling. However, the answer is straightforward: It’s a legally set limit on how much national debt the US government can accrue. In other words, the debt ceiling limits how much money the US can borrow. Congress can choose to raise the debt ceiling, but if they do not, the US government could defeat and wreak havoc on the global economy.

Why does the United States keep borrowing money and not just balance the budget?

One of the most important questions the average American can ask is critical to understand. The answer is that the US spends a lot, including money on national defense, Medicare, Social Security, and interest payments on the existing amount of debt. With all these expenses, there usually isn’t any money left to balance the budget.

What would happen if the US hit its debt ceiling and Congress didn’t raise it?

There’s a general thought that this would be bad for the stock market as the US would need to rely solely on its incoming revenue to cover federal expenses. The likelihood is that the government wouldn’t have the money necessary to continue all of its programs, so federal employees might not get paid, and the same goes for creditors. Programs like Social Security could also be potentially suspended, which would be devastating for millions of Americans.

How does the national debt affect the lives of everyday Americans?

For the most part, Americans shouldn’t have much day-to-day impact from the national debt. However, in the long term, increases in taxes or cuts to federal programs like Social Security could dramatically affect all Americans’ lives. Of course, any increase in taxes means less money in the hands of Americans that can and should be used to go and spend at the mall, which helps drive the overall economy.

When was the last time the US had no national debt?

You would have to go back to 1835 when then-President Andrew Jackson focused heavily on debt repayment as part of his administration. Unfortunately, these efforts were short-lived, as the US had to resume borrowing shortly after this year and has carried debt since then.

How does the US national debt compare to that of other countries?

Because of its excessive spending, especially on programs like defense, the United States is unsurprisingly high on the list of countries with large debt levels. However, countries like Japan have a higher debt-to-GDP ratio. The overall size and importance of the US economy enable it to still be resilient even against strong economic forces, which is why the US dollar is so important.

Does the US own more debt than its GDP?

Yes, the United States debt-to-GDP ratio has long exceeded 100%, unsurprisingly meaning that the government owes more than the country produces yearly. Economists track this number globally to see how sustainable the national debt level would be relevant to the country’s total economic output.

Do Social Security and Medicare hold a significant amount of the national debt?

Yes, one of the more interesting observations from those wanting to privatize Social Security is how much it contributes to the national debt. As the two largest spending programs in the federal government, it’s believed that 80% of the deficit’s rise between 2023 and 2032 will result from increased spending on Social Security and Medicare. Ultimately, Social Security and Medicare are responsible for nearly 40% of the national debt.

How much does $35 trillion equal in terms of debt?

Let’s try to put this $35 trillion into perspective. If you were to cover the cost of a public four-year college degree for every high-school student for the next 103 years, you wouldn’t run out of money. This also amounts to around $266,000 per household or around $104,000 for every person in America. If you asked every household in the country to contribute $1,000 monthly to pay down the debt, it would take 22 years to pay off.

How much does the US spend daily on interest payments toward the national debt?

The answer is an incredible $3 billion daily on interest payments alone. This has been calculated and verified by various sources, including Fortune Magazine and Apollo Global Management, all of which indicated that the daily interest expense has risen from its previous $2 billion daily.

True or false: The US government can never default on debt obligations.

This is 100% false, as the United States could potentially default on its debt obligations, which would likely result from Congress failing to agree to raise the debt ceiling. While this is all very theoretical, it’s not to say it’s impossible, and it would have dramatic consequences globally.

When was the last time the US government ran a budget surplus?

The easy answer is that in 2001 the federal government ran a budget surplus due to President Bill Clinton’s budget. This meant that the tax revenue coming into the federal government was more than the amount required to pay the government’s expenses. Surprisingly, this has only happened four times in the last 50 years.

How does inflation affect the national debt?

When you live in a time like we’re living in now, 2024, high inflation means an increase in interest rates, which raises the cost of borrowing and makes debt repayment more costly. During lower inflation periods, making debt payments is less costly.

Why can’t the US print more money to pay the national debt?

If the United States were to suddenly print billions or even trillions of dollars to pay down the debt, the value of US currency would drop worldwide. This would likely destabilize the US economy and cause the dollar to no longer be the world’s most accepted currency.

How can the United States keep going without running up the national debt?

There is a strong mix of opinions on this subject. Many economists and policymakers want to cut government spending and start paying off debt. The same can be said for policymakers who want to raise taxes while decreasing spending to ensure the national debt doesn’t get too out of hand.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.