Politics

The Most Ridiculous Ways the Federal Government Has Wasted Tax Dollars

Published:

Last Updated:

You know the government wastes money. But just how much it wastes, and what insanely ridiculous projects it wastes it on will Blow. Your. Mind. Prepare to read it and weep. Literally.

The average American’s lifetime earnings is about $1.5 million. Yes, believe it or not most working Americans will quite likely be millionaires in this lifetime even at entry level wages. They’re just getting it trickled out to them at at $15 an hour, 40 hours a week, 50 weeks a year, for 50 years. And all the taxes you pay? On average, the government’s share adds up to 34.7% or about $520,000. So how’s the government spending your hard-earned half a million dollars? Read on and decide which of these projects you’d be most happy to spend a lifetime working to pay for.

One government agency decided to give a grant of over $288,000 to create affinity groups within ornithological societies. What does that mean? The government wanted to help people with particular characteristics to have a space to pursue their career or hobby of studying birds with people who they enjoyed being with. Sounds like the kind of thing that folks could do on their own on social media, to be honest. The organization that approved the grant: the National Science Foundation. Kinda makes you wonder what kind of science you could do for that amount of money to learn about, oh, birds for example.

The Cost of Bird Watching Affinity Groups to you: 29 years of taxes.

OR, instead the government could pay for three mental health professionals to work with 1,000 public school students, providing crucial counseling and support and offering timely intervention to those in crisis.

The National Endowment for the Humanities spent nearly $389,000 to fund an 18-episode podcast series about “how magical beliefs and practices have evolved in the United States from the early 1600s to the present.” I don’t know about you, but for $25 I would spend 5 minutes Googling and nicely formatting a 10-page list of podcasts, documentaries, articles, and books already out there on this subject for them.

The cost of magical education to you: 39 years of taxes.

OR, that money could provide over 1 million meals for people in need of food assistance.

The Department of the Interior spent $12 million building a 30-court pickleball complex in Las Vegas. Of course, it would be ignorant to think that money could be collected from corporate sponsorships from say, some sort of business that specializes in gambling and entertainment and spends millions on advertising and would love to attract more upper-middle class retirees. Or like, 30 such establishments, one per court. What a preposterous idea.

So Vegas pickleball enthusiasts are costing you 1200 years of taxes. But since you don’t have all those lifetimes to pay for that, pick out 23 of your family and friends to go in together with you on this project. Forever.

OR, you could hire a doctor for 50% of the VA hospitals in the country, taking care of the medical needs of tens of thousands of veterans every year.

The government spent money during the pandemic to help small businesses survive the lockdown period and economic slowdown. The Shuttered Venue Operators Grant was supposed to help small entertainment venues, arts organizations, and similar businesses survive. It was presented as a way to help young artists and middle class people stay afloat. But here are some of the largest payouts it made:

It’s nice to know these young artists were able to maintain their . . . middle class lifestyle . . . during that difficult period.

Supporting rich stars with tax money will cost you 20,000 years of taxes. But, since you can’t do that, we’re going to need a Boeing 747 with 400 passengers who will now work their entire lives lives for . . . wait for it . . . NICKELBACK and friends.

OR, how about funding NASA’s Planetary Defense Coordination Office, which tracks potentially hazardous asteroids that could end all life on Earth? It costs $150 million a year. And you’d have $50 million left over to build some missiles to shoot at a killer asteroid instead of just watching it coming.

The government paid about $1.4 billion in coronavirus relief payments to dead people.

When the government mailed out all those $1,200 stimulus payments, some people got an extra for a deceased spouse or other family member. Now there’s an ethical dilemma for you.

Throwing money at graves during Covid will set you back 140,000 years of taxes. We can’t put all that responsibility on you and all your reincarnations, though. Let’s make every resident of the randomly selected town of Luverne, Alabama (pop. 2,800) work the rest of their lives to give money to the dead.

OR, how’s about we spend that $1.4 billion on the Department of Commerce’s plan to invest in domestic semiconductor production so we don’t have to import this vital technology from Asia? We can all get behind strengthening supply chains and national security, right?

The federal government has too much office space . . . and it doesn’t even own it all, it rents! The Feds spend about $5 billion annually on office leases and $2 billion on maintenance. A GAO report found that 17 out of 24 agencies actually use only a quarter of their office space, and this is a problem that was going on well before COVID. Some agencies even spent millions on new furniture for half-empty offices that have remained so as workers have continued to do their jobs remotely.

Your cost of renting unused space for your government: a cool 1 million years of tax money. But never fear, we can get you off the hook by just making all 20,000 fans at a Chicago Bulls game at the United Center grind away at their jobs for the next 50 years instead.

OR, maybe we could use that money to equip all 1.3 million active duty U.S. military personnel with full body armor and helmets (including blast-proof underwear. It’s a real thing. You know, the term “military brief” has more than one meaning . . . )

If you want to torture yourself, check out the US Debt Clock for real-time counters showing you just how fast the U.S. national debt is increasing. Let’s put it this way, the last five digits are running up faster than the total when you’re pumping gas. As of February 25, 2025, the debt stands at more than $36.5 trillion, and the interest alone will cost over $1 trillion this year alone.

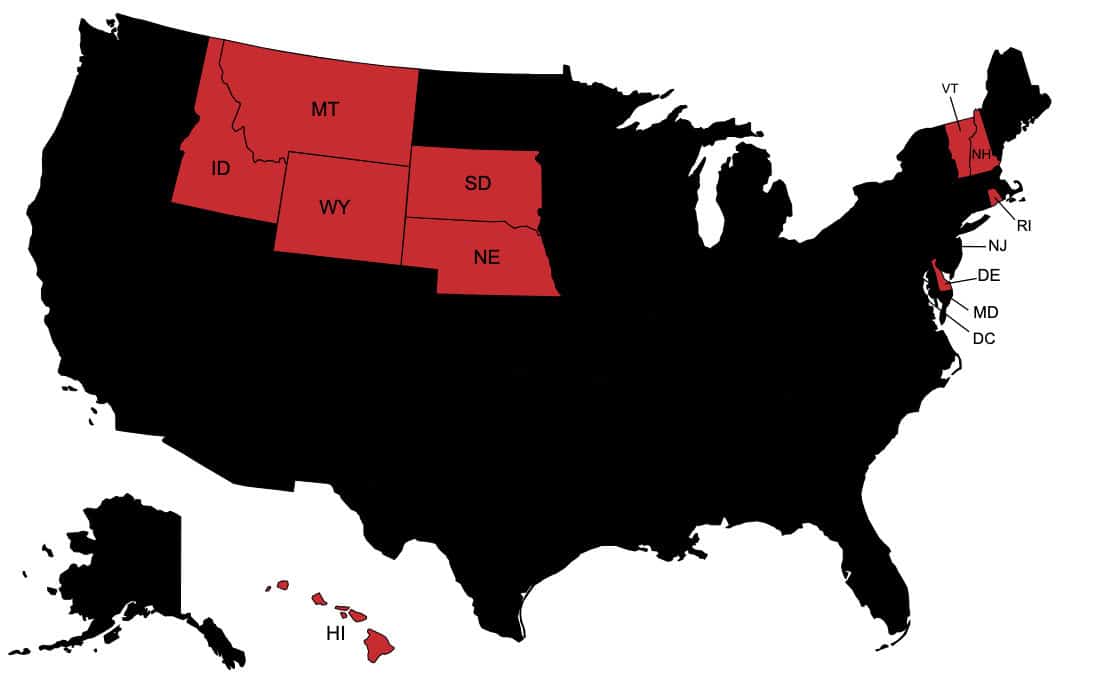

Cost to you: about 100 million years of tax-paying work. You know, if you had started in the Cretaceous Era when your ancestors were little tree shrews, you could have paid off this 2025-year-only debt interest by now. Ok, we will cut you some slack again. We’ll make all 2 million people in Nebraska work and pay taxes for a lifetime to take care of the interest on the national debt for this year alone.

And let’s go ahead and look at the following 5 years of interest and make sure we have this covered. From 2025-2030, it would take a lifetime of taxes paid by the entire populations of 10 states (about 20 million people total), all to pay the interest on the national debt . . . and making exactly zero progress in paying it off . . . because of wasteful government spending.

OR, instead, seeing as how 45% of public roadways in the U.S. are in poor or mediocre condition, $1 trillion a year for 2-4 years could fix every decaying road in the country. If you don’t like that, it could pay for Medicare completely, with $200 million left over. It could fund a mission to Mars and probably start a colony there. Or best of all, how about the government send each of the 80 million taxpayers in the country a check for $12,500? The question is, can you be trusted not to spend it on something foolish? Hmmm, that’s a tough one . . .

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.