When you look at all US presidents and their stock market performance, you might think of more modern times, when the market surged under Barack Obama as the country emerged from the Great Recession that began in 2008. However, Obama is only in second place.

Surprisingly, Calvin Coolidge was the president who oversaw the greatest stock market growth. Bill Clinton and Barack Obama were the next best performing presidents overseeing the stock market. Coolidge’s presidency saw a great economic boom, but the Great Depression wiped away progress. Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

Key Points

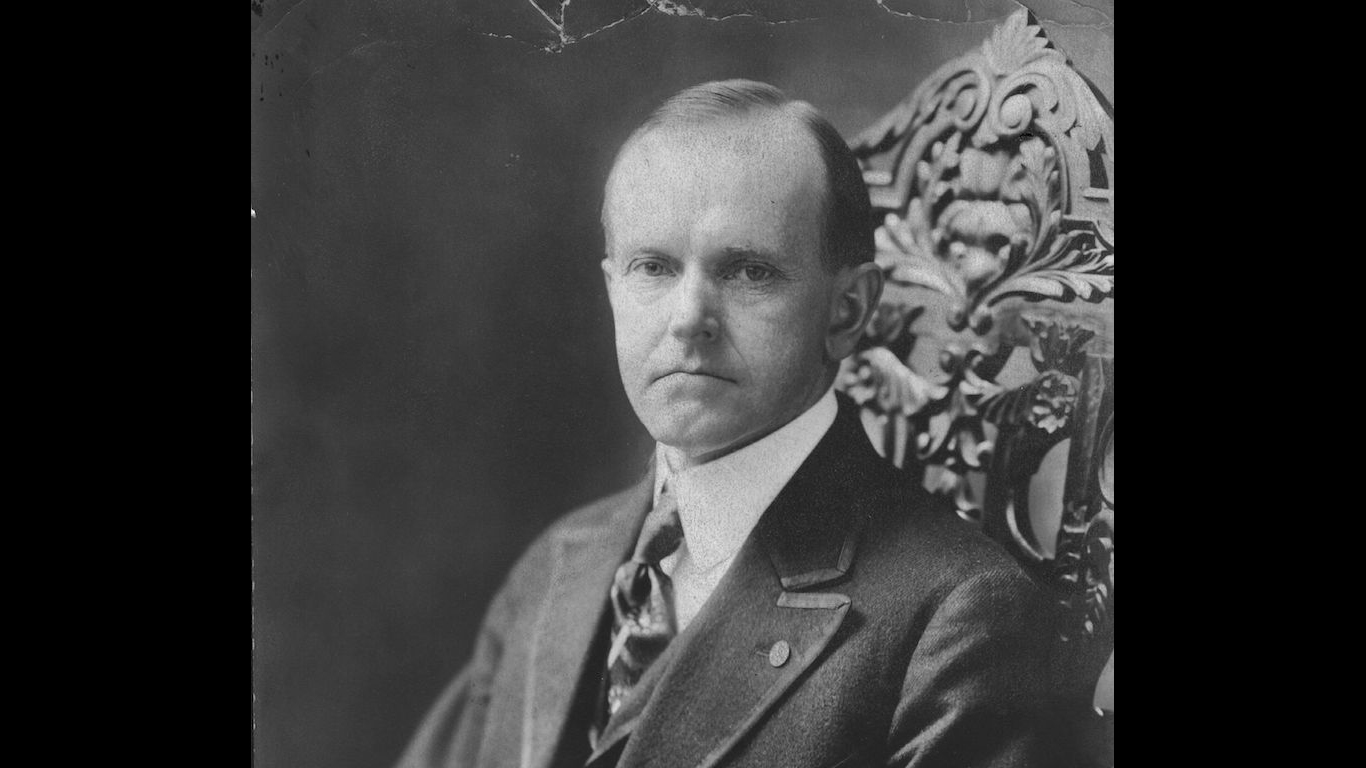

Surprisingly, it wasn’t Obama or even Clinton who oversaw the strongest economic performance in the market. Instead, Calvin Coolidge oversaw a massively positive stock price performance change of 208.52% and an average monthly return of 1.74% during his time in office.

22. Coolidge Assumes Presidency

Following President Harding’s death on August 20, 1923, Calvin Coolidge took office. He quickly signaled to the Treasury Department and Treasury Secretary Andrew Mellon that he wanted to maintain Harding’s current pro-business agenda.

21. Pro Business

If there is one self-evident truth about President Calvin Coolidge, it is that he was unapologetically pro-business. His speeches always contained a unified message about how vital business was to the economy and American prosperity. Coolidge regularly espoused his belief that the private sector and not the government should be responsible for being the economic engine of America, something that would continue boosting investor confidence during his administration.

20. First Address to Congress

On December 6, 1923, Coolidge issued his first address to Congress as President, and it was during this moment that he outlined a new economic vision. This vision included reducing taxes, which led directly to the Mellon plan. The plan, in part, focused on spurring investment back into the market, specifically by lowering taxes to drive more investment.

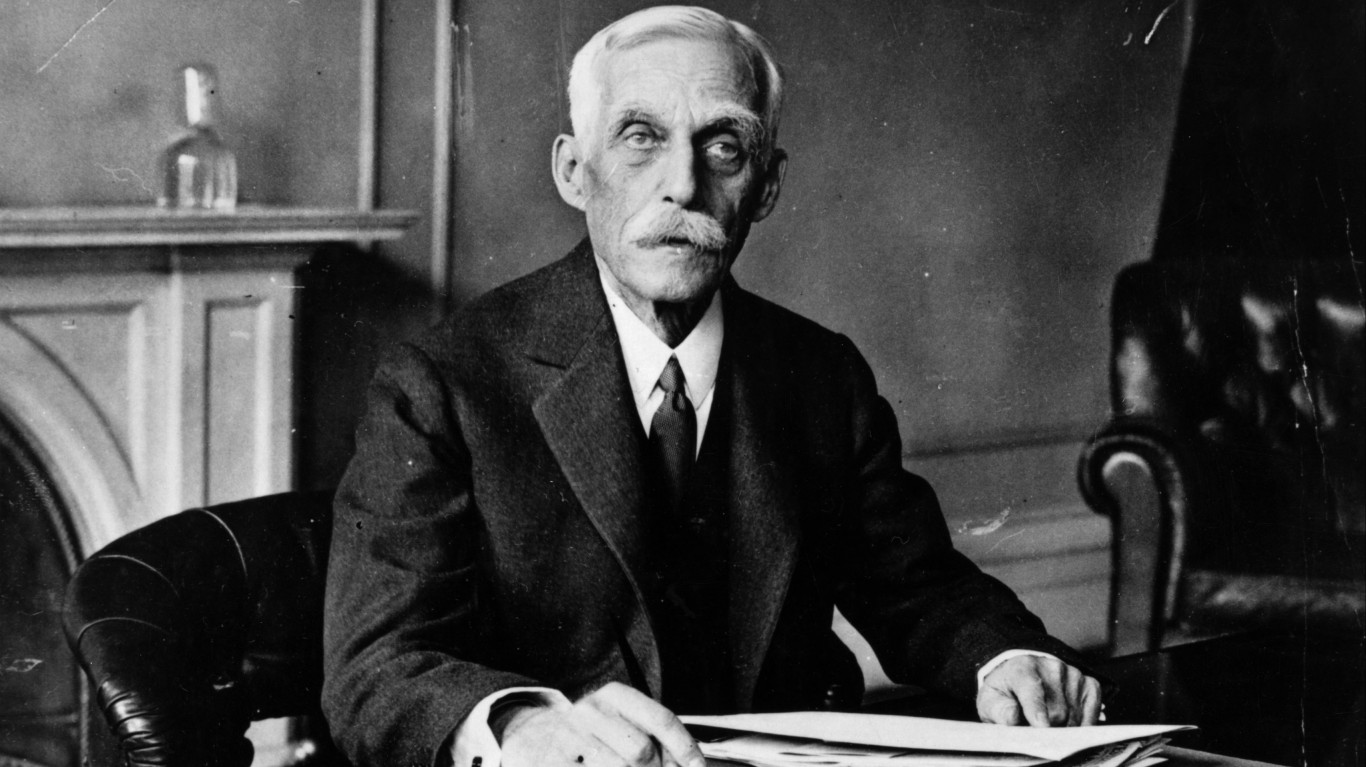

19. Andrew Mellon

While President Coolidge may have held the title, officially, those who look back at this period in American history regularly mention the importance of Andrew Mellon in Coolidge’s inner circle. Mellon’s influence as the Secretary of the Treasury helped push Coolidge toward many of his decisions that would allow the stock market to boom during his time in office. Mellon’s skill at managing government debt may be something Coolidge receives credit for, but Mellon deserves a lot of the credit.

Unfortunately, Mellon’s influence dropped almost immediately after the Wall Street Crash of 1929, which kicked off the Great Depression. This is an incredible fall from grace for someone who once presided over such a significant reduction in the national debt.

18. Revenue Act of 1924

When Coolidge signed the Revenue Act of 1924, he did so to free up money for the already wealthy investors who could put more money into the market. The act reduced the marginal income tax rate from 58% (top marginal tax) to 46% (income over $500,000) and reduced estate taxes. As a result, investors poured money into the market, which drove the DOW higher and played an integral role in the “roaring 20s.”

Considering that the top individual income tax rate in 1920 was a massive 73%, investors loved Coolidge’s actions, which would dramatically affect the amount of money wealthy investors were taking home every month.

17. Bureau of the Budget

With the Bureau of the Budget recording a surplus of $500 million in 1924, public confidence in the US economy was very strong. At the same time, the national debt had been reduced by over $1 billion, which reassured investors that it was a good time to invest in the market.

16. “Keep Cool with Coolidge”

As part of his re-election campaign, which Coolidge won with 54% of the vote, he campaigned saying, “Keep Cool with Coolidge.” The President’s mandate was to ensure public and investor faith in his hands-off approach. Again, he encouraged investors that the government would not overspend, leading to more market investment.

15. Federal Reserve

In January 1925, almost immediately following the New Year, the Federal Reserve began its efforts to stabilize the market after the economy had dipped slightly toward the end of the previous year. Plenty of borrowing took place as interest rates were held between 3% and 4%, which meant companies were expanding, and investor confidence began the new year riding high.

14. Inauguration Speech

During his March 1925 inauguration speech, Coolidge once again confirmed his desire to maintain the small (limited) government he believed was necessary for the country. Coolidge pushed back against the populist movement, which investors took as a positive sign for the country. In many ways, Coolidge’s decision-making was predictable, which meant the market was a safe vehicle for investment.

13. Dawes Plan

While the Dawes plan was negotiated in 1924, it wasn’t implemented until 1925 when Germany’s economy would return to stability and begin reparation payments to Allied nations. The resulting stability opened the door to increased exports from the US to Europe, which in turn provided increased investment in companies with international interests.

Dawes also played a role in the 1921 Budget and Accounting Act, through which Coolidge established a policy of assembling different government members in a giant hall to remind them of the necessity of saving and not spending.

12. Another Surplus

At the end of the US government’s fiscal year on June 30, 1925, the country saw another surplus and a debt drop to $20.5 billion. With Coolidge heavily focused on debt reduction, he would cut it by 25% during his presidency, but this also fueled investors’ belief the country was headed in the right direction and that economic growth would continue.

11. Revenue Act of 1926

When 1926 rolls around, the Revenue Act of 1926 takes place. Once again the top income rate is again slashed, this time down to 26%, and all surtaxes are gone for incomes under $100,000. This meant that millions of dollars were floated back into the economy, much of which went directly into the stock market. This tax rate was even lower than Ronald Reagan’s tax rate of 28%, another number that investors and the wealthy loved.

10. Air Commerce Act

When Coolidge signed the Air Commerce Act into law in 1926, it began regulating the new aviation industry and encouraging investors to consider an entirely new business vertical. This was a new sector for labor and technological progress, which only spurred market investment into companies that were leading the skies, so to speak.

9. Industrial Production

By the end of 1926, industrial production in the United States was up 70% from 1922. Automobiles, steel, and the electric industry were leading the charge. With Coolidge refusing to be heavy-handed with regulations, profits at companies in these industries were soaring, which meant investors were looking for big returns.

8. McNary-Haugen Farm Relief Bill

With Coolidge refusing to sign the McNary-Haugen Farm Relief Bill into law, Coolidge was sending a sign to the agricultural industry that the government would not impose significant regulations, allowing agro businesses to continue expanding and generate big profits, which led to increased market investment. In fact, Coolidge vetoed this bill not once, but twice, along with two bills for veteran pensions and bonuses, though Congress overrode the veterans bill.

7. Charles Lindbergh

On May 20, 1927, Charles Lindbergh completed his first solo transatlantic flight, which captured the American imagination and showcased American technological advancements. Not only was this a moment of national pride, but it increased investment in the market as a symbol of confidence in the Coolidge economy.

6. Dow Jones 1927

One of the most significant indicators that Coolidge’s economic decisions were moving the country in the right direction was that the Dow Jones hit 168 points on July 1, 1927. This was up from 100 in 1923, which showed annual GDP growth between 3-4%. With low unemployment around 3% and consistent tax cuts, the economic environment was ripe for driving stock prices to new highs.

5. Radio Broadcasting

In 1928, there was a period of rapid radio expansion, which created new opportunities for marketing and advertisements, especially for brands like RCA. As radios grew more widespread, increased marketing led to larger corporate profits and stock prices. Magazines also played a significant role during this time, but the advancement of the radio was a technological achievement.

Additionally, President Coolidge played a role in the radio’s growing importance, as he used a radio show twice a year to talk to the American people about economic progress.

4. Dow Approaches 200

By mid-1928, Coolidge’s policies had helped reduce the national debt to 17.6% billion while also creating another budget surplus. This moment summarizes Coolidge’s economic strengths. As the Dow now approached 200 points, it had doubled in under five years, all under Coolidge’s watch.

3. Retail Begins to Expand

Retail expansion was one of the most significant ways American culture changed during Coolidge’s presidency. The 1920s saw rapid growth of brands like Woolworth’s, which helped revolutionize how Americans shopped. Companies in the retail space were driving up the stock market amid a belief that this was not just a trend but a broader sign of strong consumer spending.

2. Infrastructure Support

During Coolidge’s administration, infrastructure projects across roads, bridges, and buildings significantly boosted. Unsurprisingly, this construction spurred economic growth as jobs were created, and transportation networks allowed for increased commercial expansion across the country. Without infrastructure, many of the projects that helped boost trade during Coolidge’s tenure would not have come to fruition.

1. Coolidge Leaves Office

Having announced he would not run for reelection, Coolidge left office on March 4, 1929, having overseen a stock market that tripled, with the Dow over 300 points. Unemployment was also at 1.8%, a hallmark achievement for Coolidge, along with his tax cuts, debt reduction, and hands-off approach to government intervention.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.