Politics

These Are the Most Dire Consequences of America's Rising National Debt

Published:

You’ve probably heard about America’s rising national debt levels. Indeed, it’s been quite the hot topic over a number of years. While there are no quick and easy solutions, there is a slate of potential risks that could arise in the future that investors should have on their radars.

Though it may be difficult to fully sidestep any potential impact from continuously rising national debt levels (now sitting at more than $36 trillion), I do think that staying tuned in could prove wise as you navigate a climate that may or may not have more than just a pothole in the road ahead.

Let’s check in on a few things to keep tabs on as America’s debt levels look to move higher from here.

A rising national debt load may weigh heavily on economic growth and cause other unintended consequences.

Are you ahead, or behind on retirement? SmartAsset’s free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don’t waste another minute; get started by clicking here here.(Sponsor)

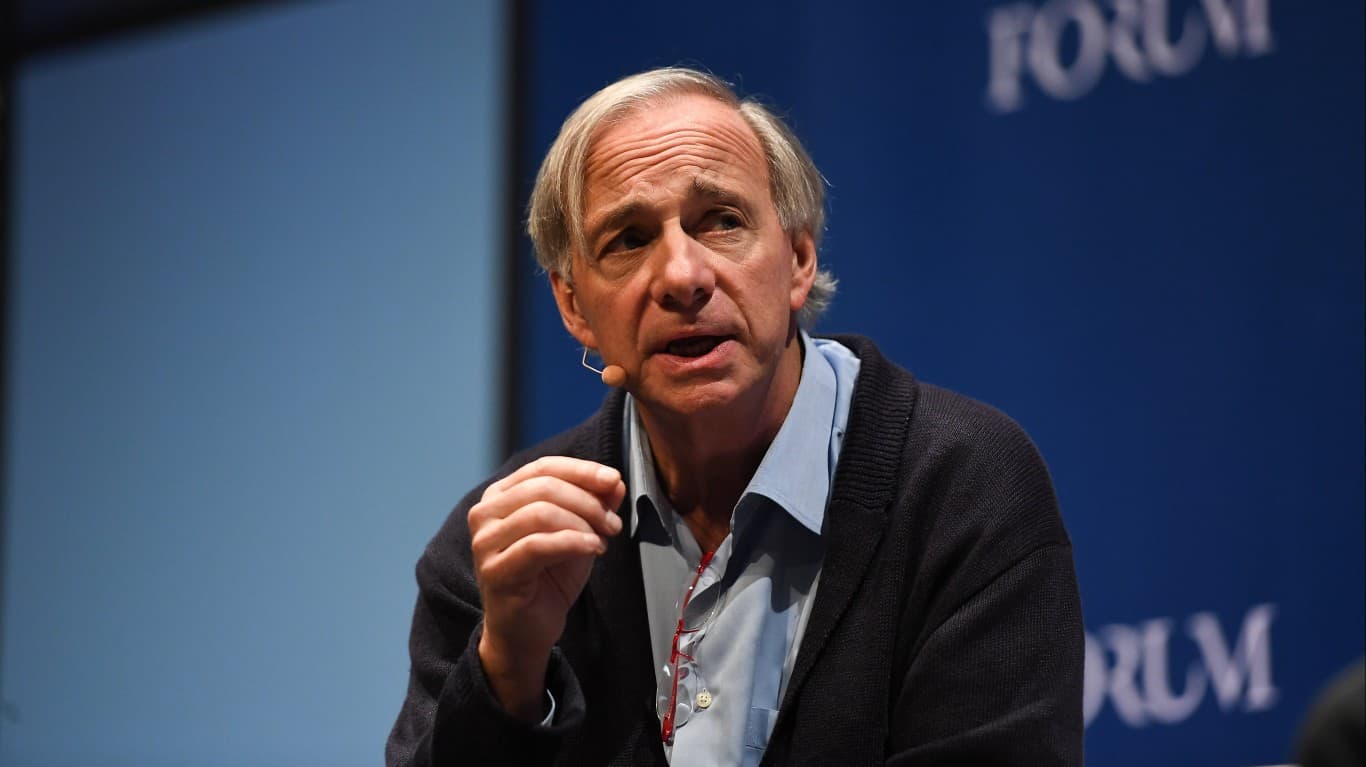

Indeed, a fairly bright light was shone on the U.S. debt this week when Ray Dalio, the brilliant billionaire investor behind Bridgewater Associates, remarked about the potential for a looming debt crisis. He went as far as to warn that the U.S. could be in for an “economic heart attack” in the future. Just how far into the future?

Perhaps within three years if fiscal action isn’t taken to reduce the deficit, according to Dalio. Indeed, it’s hard not to be quite concerned, especially with the deficit accounting for around 7.5% of America’s gross domestic product (GDP). Ideally, Dalio wants to see the deficit reduced to 3% of GDP.

Furthermore, Dalio compared America’s debt load to “plaque” in the “circulatory system.” The good news is that plaque can be removed and it’s not too late for administrations to make the healthy moves to avoid a potentially nasty fate, at least in my opinion. While it’s an interesting comparison Dalio has made, I think that only time will tell if the economy is headed for a disastrous fate within three years if debt levels aren’t trimmed away in a timely manner.

It’s not just Dalio who’s growing concerned with the national debt. Some big-name economists, including the great CEO of JP Morgan (NYSE:JPM), Jamie Dimon, have expressed concern.

The higher the national debt, the more interest there will be. Undoubtedly, such interest payments could have been reinvested in economic growth. Fortunately, it appears that investments to bolster economic growth aren’t yet being hindered.

Notably, the Trump administration recently pulled the curtain on the Stargate project, a massive $500 billion bet on the future of artificial intelligence (AI). Indeed, AI is a profound technology that could have a tremendous uplifting effect on the economy. And I do believe the potential productivity and GDP-boosting benefits could allow the economy to keep humming along, even given where national debt levels stand today.

Moving ahead, lower interest rates, which would reduce the interest burden of the debt, while boosting economic growth and the AI trade, could be in the cards. If tariffs aren’t imposed for a duration that would cause lasting inflation, I do think markedly lower rates are a possibility.

Combined with increased fiscal responsibility, and I do think the current debt load doesn’t have to slow America’s economy in its tracks. Perhaps AI could play a huge role in improved fiscal responsibility and greater economic growth in the latter half of this decade.

A significant debt crisis is something nobody wants to think about. But the good news is that it’s on the radars of many and the calls for action may be answered sooner rather than later. Undoubtedly, a debt crisis could have a fairly vicious impact on financial markets.

Though it’s impossible to gauge the magnitude of the crisis and the reaction in markets, I do think that the greenback would be in for quite the hit. Indeed, precious metals, like gold, may be a great place to seek shelter from such financial crises.

The metal has already been hot of late, recently flirting with $3,000 per ounce. Though time will tell where gold heads from here, I continue to view the asset as a great place to be amid high uncertainty, inflation threats, potential currency devaluation, or even debt crises.

For now, I’d not make any rash decisions, as a course correction may very well be underway. Indeed, it’s not too late to avoid such a dire fate, especially as calls in Congress for greater “fiscal responsibility” grow louder.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.