Population and Social Characteristics

Where Homelessness Worsened (and Improved) the Most: All States Ranked

Published:

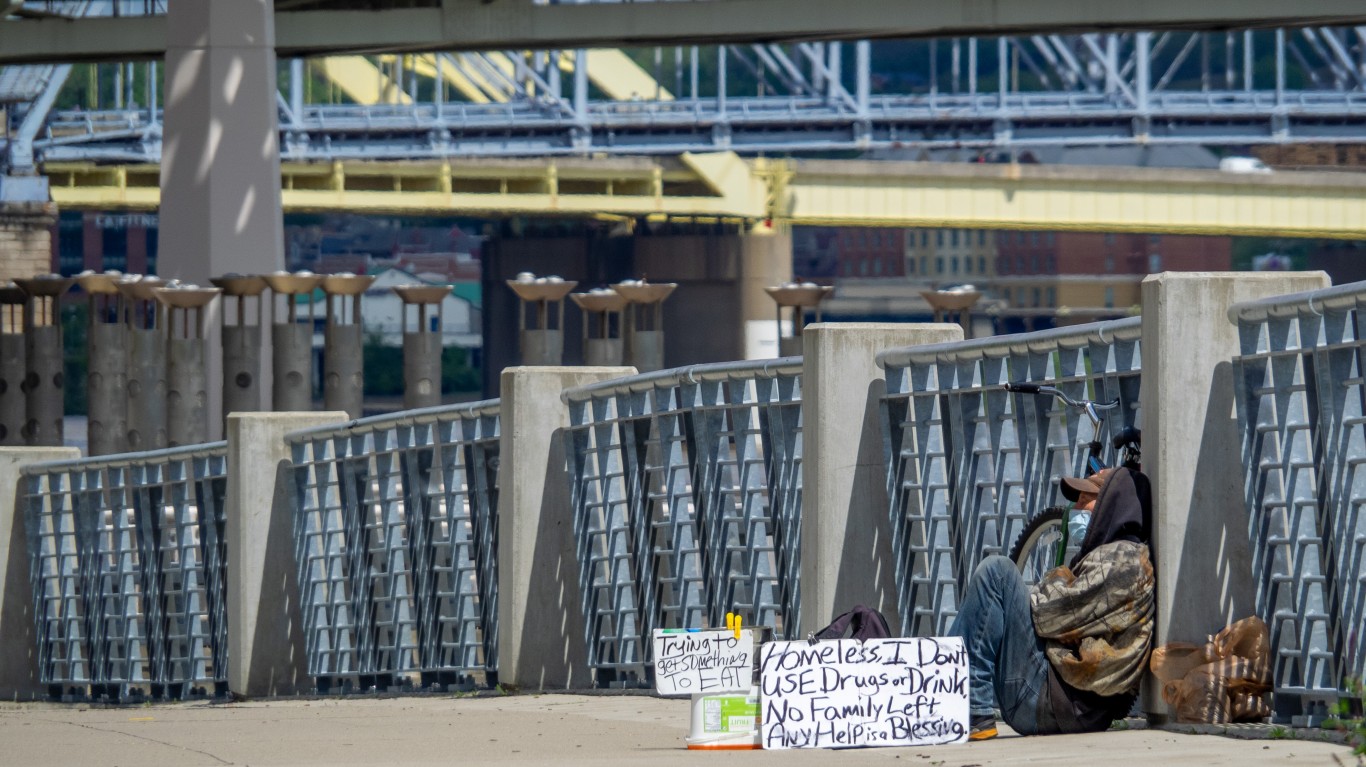

The U.S. Supreme Court is about to weigh in on homelessness in April. Homelessness has reached a record high in 2023 — approximately 653,100 people were experiencing homelessness on a single night in January, a 12% increase from 2022. At the same time, state and local jurisdictions have argued that a lower court decision has prevented them from addressing homeless encampments.

The 2018 decision has barred authorities from enforcing local ordinances that prohibit sleeping and camping in parks and on public property. The 9th U.S. Circuit Court of Appeals ruled it was unconstitutional to punish homelessness. Among the people experiencing homelessness in 2023, 60% were staying in sheltered locations, while 40% were unsheltered. So the question is where is homelessness getting worse.

To find the states where homelessness improved and worsened the most, 24/7 Wall St. reviewed point-in-time homelessness data from the HUD. States and the District of Columbia are ranked by the percent change in homelessness over the five-year period — 2018 to 2023. All homelessness data is from the HUD. State population totals are from the Census Bureau Vintage 2023 and from the 2018 American Community Survey. Median household income data are also from the respective annual ACSs.

Compared to 2018, when 552,830 people were experiencing homelessness nationwide, homelessness increased by 18.1% by 2023. Looking at individual states, homelessness declined in just 12 states as well as in D.C. In the rest, homelessness worsened, growing by more than the national average in 18 states, and by more than 50% in six states. (Also see: Who are the Homeless in Every State.)

While the court ruling affected mostly Western states, the three states where homelessness worsened the most over the five-year period are in the Northeast.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.