Population and Social Characteristics

10 Warren Buffett Quotes Every 60-Year-Old Needs to Hear

Published:

Last Updated:

Warren Buffett, the Oracle of Omaha, has built his fortune by investing in undervalued companies with strong foundations and long-term growth potential. He is the chairman and CEO of Berkshire Hathaway (NYSE: BRK-B), a multinational conglomerate that owns a diverse range of businesses. Buffett’s investment philosophy emphasizes patience and discipline. Witty and humble, Buffett is also a prolific philanthropist, having pledged most of his wealth to charitable causes through his Giving Pledge initiative. Now in his ninth decade, Buffett’s advice continues to inspire investors around the world. Continue reading to discover 24/7 Wall St.’s 10 Warren Buffett quotes every 60-year-old needs to hear. Which ones speak to you?

Warren Buffett is one of the most well-respected investors of the last half century with a record that speaks for itself. Buffett’s advice is straightforward and easy to understand for the seasoned trader as well as the novice investor. So, whether you’re looking to improve your game or you’re just getting started, Buffett’s solid advice will push you in the right direction.

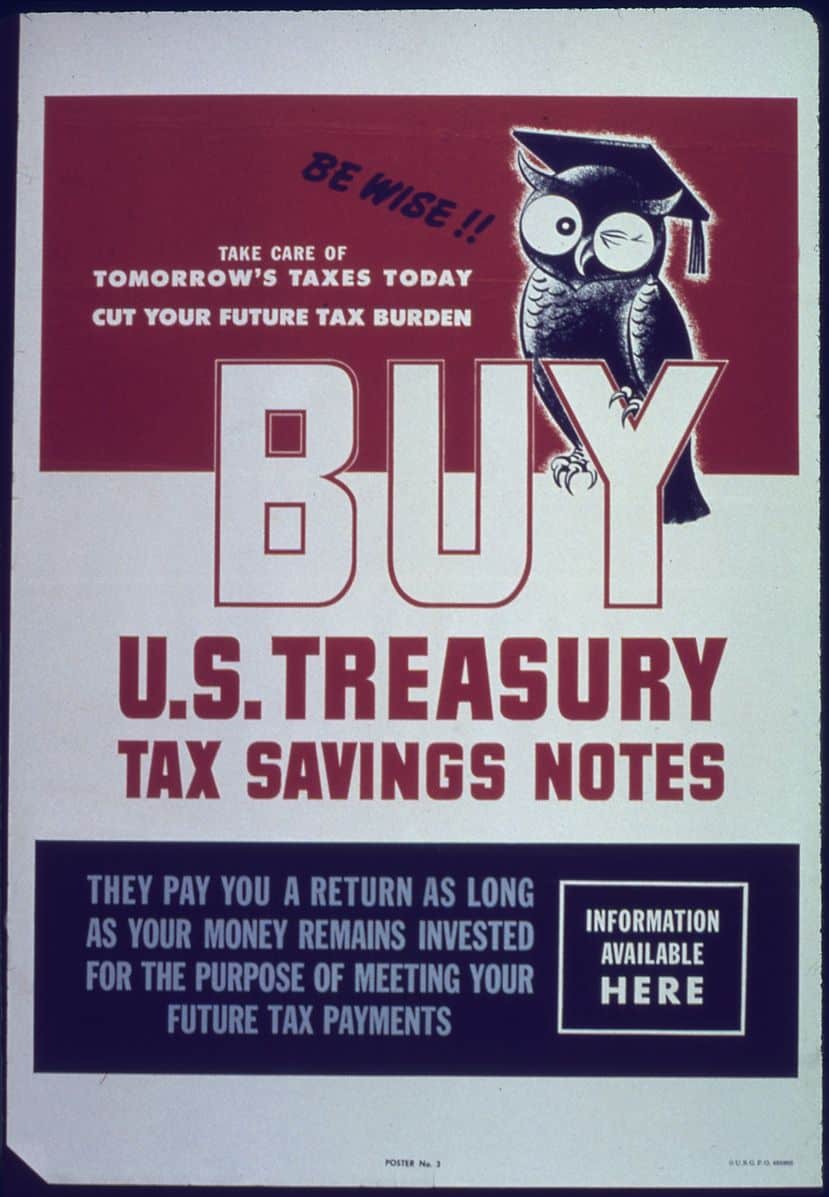

In the not-so-distant past (think mid-20th century), cash equivalents were considered sound investments. After the crash of 1929, investors were understandably leery of the stock market. Government-backed securities seemed a safer alternative. And while cash equivalents are historically less dicey, they offer lower returns compared to other assets. In today’s diversified world, with decidedly more options available to investors, cash equivalents are not as popular as they once were. From lower interest rates to inflation risk, the returns just aren’t that great.

Building a good reputation requires tenacity, integrity, and time. Earning trust doesn’t happen overnight, it happens over time. Demonstrating one’s competence, credibility, and consistency in the long haul is how a good reputation is fashioned. However, it takes very little time to tarnish a stellar rep. At the first misstep, the scrutiny begins, with cancel culture nipping at its heels. Save the risky behavior for the market.

One of the things Warren Buffett is suggesting with this piece of advice is that while it’s dandy to correctly predict market trends, going beyond passive speculation to active investing is the winning move. Digging deeper, he is also encouraging investors to anticipate challenges that they may encounter in the market and to plan ahead to mitigate any unforeseen issues.

Buffett’s words are nothing new. You can’t soar with eagles if you’re hanging out with turkeys, walk with the wise and get wise; associate with fools and get fooled, and show me your friends, and I’ll show you your future all speak to the same. Regardless of how many different ways there are to say if you lie down with dogs, you’ll wake up with fleas, it’s sound wisdom. If you’re not where you wish to be, seek out a mentor, You are the company you keep, after all.

Money can do a lot of things – it opens doors and affords opportunities as it eases financial stress. But the one thing money doesn’t do is change the fundamental character of an individual. As such, Warren Buffett must have been a pretty decent fellow prior to making his fortune. But I’m guessing with very little effort, you can come up with a couple of billionaires who weren’t and aren’t.

Warren Buffett also said, Tell me who your heroes are and I’ll tell you who you’ll turn out to be. I do have to wonder, though, if it’s choice or nature that informs who our heroes are. I suppose it could be a combination. The characteristics and qualities of the individuals who become our heroes (or mentors) are those that run deep in us and are the crux of the initial infatuation. If you’re unhappy with your station in life, look around. Are you associating with those who will lift you up or tear you down? Seek out the former and learn from them.

There’s more to investing than history. While trends and patterns are undoubtedly important to understanding the stock market, one must also be aware of market dynamics, risk analysis/management, and diversification and valuation. Unless you’re a seasoned or savvy investor, you’re more likely to be successful in the market if you rely on a professional. Would you attempt to pull your own tooth, or set a broken bone? Yeah.

Don’t measure your success against your neighbor’s. Simply because your neighbors appear to be living the life of Reilly doesn’t mean that they are. Some people are comfortable accruing a lot of debt. But the losses that come with that mindset are staggering. From high-interest rates to lost retirement savings, the strain of living beyond one’s means will eventually take its toll. So, while those in your orbit are living large in the present, their futures might not be that bright.

By our sixth decade of life, we’ve come to understand what’s important and what’s not. And Warren Buffett is in his ninth decade, so you know he knows. And what he has discovered is that one’s legacy is love. Whether it’s the love of family, friends, or community, the feelings that extend beyond the material world are the ones that matter most. As such, Buffett has inspired others to give the bulk of their estates to charitable causes through his Giving Pledge initiative. “Give your children enough to do anything, but not enough to do nothing,” is another piece of Buffett’s wisdom.

This advice seems good on the surface, but considering the diversity of today’s market one should ascertain that the companies they like are embraced by others as well. We all have our idiosyncratic interests, and some of them may be more investment-worthy than others. If your peculiarly specific niche enthusiasm is not the best long-term investment, consider giving to a Kickstarter (or similar) campaign, and look for a more pedestrian endeavor in which to invest for your future.

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.