RadioShack Corp. (NYSE: RSH) is in serious trouble financially. Or is it? We have recently seen one of the credit ratings agencies warn of a potential restructuring taking place in late 2014 or in 2015, a move that could wipe out shareholders of the common stock.

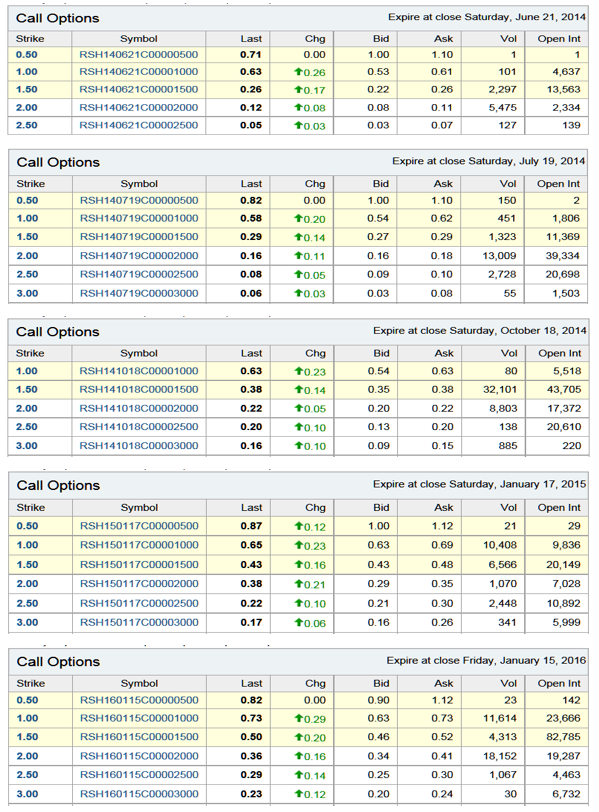

So, why are RadioShack call options seeing trading volume that is through the roof? We have seen more than 100,000 contracts trade among the various monthly expirations, with strike prices of $1.00, $1.50, $2.00 and $2.50. That is in excess of 10 million shares worth of stock on a fully leveraged basis.

What investors and traders alike need to consider is that most investors consider a stock already an option when its stock price is close to $1.00. That being said, this was a very big day in options volume (see Yahoo! Finance montage below).

In many cases the trading volume was larger than the entire open interest of each series. That is unusual in and of itself. Now consider that RadioShack’s trading volume is down to an average of 3.7 million shares per day. Its stock volume with almost three hours until the close was 10 million shares.

ALSO READ: America’s Nine Most Damaged Brands

The long and short of the matter is that the tail is wagging the dog in this trade. It is supposed to be that news and expected events drive equities and options volume, but in this case it seems that the options trading is driving the interest in the stock.

This is the sort of pattern that drives the rumor mill, regardless of the actual intentions of the trade. One could always argue that this could even be a hedging transaction or a supplemental transaction made by holders of the debt.

RadioShack shares were up just over 10% at $1.46 shortly after 1:00 p.m. EST on Thursday. Its 52-week range is $1.12 to $4.36.

Stay tuned.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.