Groupon Inc. (NASDAQ: GRPN) was trading lower ahead of Tuesday’s earnings report. The culprit may be RetailMeNot Inc. (NASDAQ: SALE), after it fell 25% on disappointing revenues. Groupon is a daily deals and e-commerce site, and RetailMeNot operates a digital coupon marketplace. The companies will try to differentiate themselves, but the investing community may not.

As far as the Thomson Reuters consensus estimates, Groupon has estimates $0.01 in earnings per share (EPS) and $761.8 million in revenues. Estimates for the following quarter are $0.03 EPS and $760.6 million in revenues.

Update at 1:30 p.m. Eastern Time: WhisperNumber.com has sent us word that the earnings whisper number is $0.03 per share. They said that Groupon has only a 38% positive surprise history (in only 3 of 8 reports).

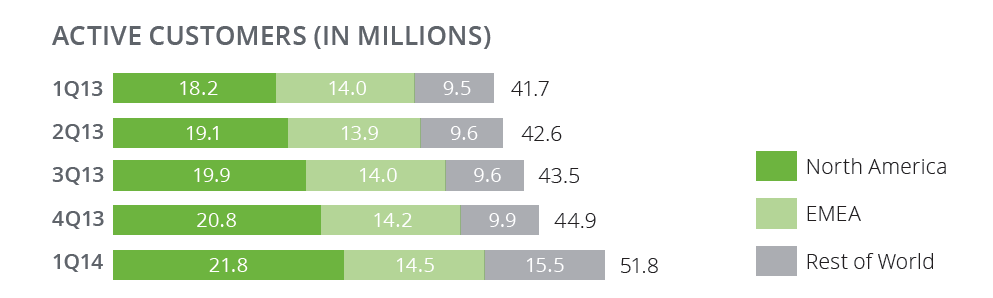

24/7 Wall St. would warn readers that Groupon is one of the companies that refer to their gross billings on top of just revenue. Last quarter that was $1.82 billion (up 29%) in gross billings, versus $757.6 million (up 26%) in total revenues. We have also included a chart from the company’s last earnings report to show its active user growth (see below).

Also keep in mind that Groupon has had seven acquisitions in 2013 and has completed two acquisitions in 2014 of TMON and Ideeli for international expansion.

ALSO READ: Can FireEye Live Up to Earnings Expectations?

Groupon shares were down over 2% at $6.86 in late morning trading Tuesday, and its 52-week range is $5.18 to $12.76. The Thomson Reuters consensus analyst price target is $8.58. While Groupon trades at 68 times expected 2014 earnings, it trades at a more reasonable 27.5 times expected 2015 earnings.

As far as the drag from RetailMeNot, that company reported on Monday that its total revenues rose by 37% to $59.5 million. Its organic net revenues outside of acquisitions rose 34%. Still, the company had net income of $4.3 million and an adjusted EBITDA of $19.7 million.

Update at 1:30 p.m. Eastern Time: Groupon had been hugging its 50-day moving average up until the last couple of days. Since rallying, the $6.85 or so share price is now well above that 50-day moving average of $6.31. Groupon’s longer-term 200-day moving average is up all the way at $9.42.

One last parting note on Groupon: it was just included in our weekend coverage of stocks under $10, where Sterne Agee maintained its whopping (and almost unbelievable) $12 price target.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.