Lululemon Athletica Inc. (NASDAQ: LULU) is set to report earnings on Thursday before the market opens, followed by a conference call on Thursday morning as well. After such a magnificent drop and after months of controversy, 24/7 Wall St. wants to know if this earnings report can act as a catalyst to bring back investors into what had been one of the greatest growth stories before problems began to surface.

Thomson Reuters has consensus estimates at $0.29 in earnings per share and $376.77 million in revenues. This compares to the results for the same quarter a year ago of $0.39 earnings per share and $344.51 million in revenues.

Estimates for the coming quarter are $0.38 in earnings per share and $422.18 million in revenues, which would compare to the prior year’s quarter of $0.45 earnings per share and $422.2 million in revenues.

With shares recently trading at $39.19, the consensus analyst price target is currently only at $42.93. The yoga and exercised themed apparel maker has a 52-week trading range of $36.26 to $77.75.

Lululemon shares hit their 52-week low in June, and the highest daily price in August was $42.09, with a closing high of $41.67.

READ ALSO: Can New Product Lines Really Save Quiksilver?

What is interesting here is that, despite all the problems, Lululemon is expected to post growth this year and next. Last year’s fiscal revenue of $1.59 billion compares to Thomson Reuters estimates of $1.78 billion for this fiscal year (January 2015) and $2.01 billion for next fiscal year (January 2016).

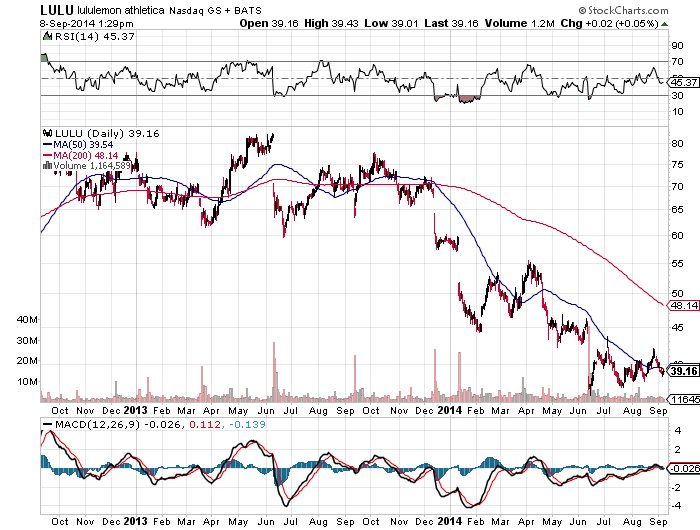

A review of the stock chart is focused more on shorter-term moving averages. The stock has been trading around its 50-day moving average on several occasions in the past two months, and the 50-day moving average as of Monday was $39.54. To show how long things have been challenged here, the 200-day moving average was way up at $48.14 as of Monday. A chart review from StockCharts has been provided below.

The most recent short interest report showed that 24.4 million Lululemon shares were short as of August 15, 2014. This was down from 27 million shares short at the end of July, and it was the lowest short interest back to the April 30 settlement date.

As far as how Lululemon is valued against consensus estimates, the stock trades at 22.5 times this year’s expected earnings and about 19.5 times next year’s expected earnings.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.