2014 has been another great year for stocks, and the bull market is now nearing its sixth year. With valuations getting stretched and with many sectors not having performed up to expectations, investors have to start wondering about what will come in 2015 — in particular, which sectors and stocks will outperform the market. So, 24/7 Wall St. is evaluating some of the 2014 Dow Jones Industrial Average (DJIA) lagging stocks for their prospects. Is it possible that the food giant McDonald’s Corp. (NYSE: MCD) could end up being the best performing DJIA stock in 2015?

Before deciding this is just ludicrous, an exercise of history has to be considered. McDonald’s has many problems, but it is still ranked only as the eighth worst DJIA stock of 2014. The Golden Arches shares are actually up 1.8% so far in 2014, thanks in part to that 3.5% dividend yield. The effort here is not to make major bold predictions, but to see if the analysts and investment community are simply too negative based on all the known events.

When 24/7 Wall St. conducted its methodology for the 2014 DJIA Bull and Bear Case, the analysts covering DJIA stocks were indicating gains of only about 3.2% before dividends. The Dow is currently up 8% so far in 2014. But now let’s consider what was expected from McDonald’s in its bull and bear case for 2014. Analysts were calling for a gain of almost 7%, which would have made it in the top third of the 25 DJIA stocks we evaluated.

It turns out that McDonald’s has been riddled with problems in growing same-store sales. In fact, those sales have by and large been negative. Now you have an incredibly strong U.S. dollar, which could work against it in the existing international growth markets. And then there are the constant labor pressures — what happens if McDonald’s and its franchisees have to end up paying a minimum wage that averages $10, $12, or even $15 an hour?

ALSO READ: What Could Make Chevron and Exxon the Best 2015 Dow Stocks

Another negative has been the notion that consumers are changing. Young eaters prefer to eat healthier food. And McDonald’s hasn’t exactly been able to convince consumers to come and think of McDonald’s as a destination for salads, grilled chicken, healthy juices and other items that may be less fattening than burgers and fries. So what could make McDonald’s the surprise Dow stock winner of 2015?

The first admission is that when analysts are positive, they are often too positive. And when they are pessimistic, they are often caught up only in the moment’s negativity. McDonald’s is now trading at about 17 times expected 2015 earnings per share expectations. Imagine if the analysts are simply too pessimistic in their outlook — what if McDonald’s earned $5.75 or $6.00 per share versus the consensus estimate of $5.58. Or imagine if McDonald’s total revenue growth gets back to 3% or 5% rather than the flat revenues expected in 2015 after an expected 1.4% revenue drop in 2014.

Millions of Americans still eat at McDonald’s each and every day. The same is true internationally. The fast-food giant also does offer a lot of food for a low price. Now consider that the market was so pessimistic that shares dipped back under $90 briefly, hitting 52-week lows. With the stock back up at $95, maybe that negative sentiment simply went too far. Maybe.

ALSO READ: What Could Make IBM The Best DJIA Stock of 2015

McDonald’s has tried to shake things up already. Now consider that activist investors could start to get involved — and Jana Partners has already disclosed a 0.1% stake. What if McDonald’s can recapture some of its ground in China, and what if it can expand better in India as it has wanted to? Also consider that the McDonald’s dividend of just over 3.5% is actually the fourth highest stock dividend yield of the 30 DJIA stocks.

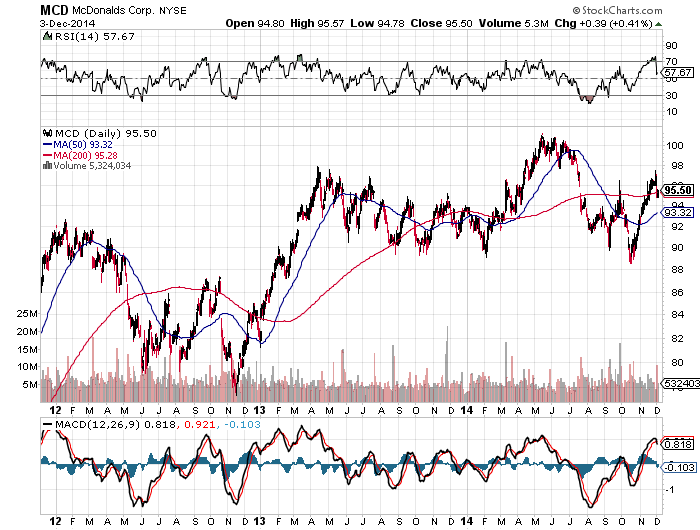

Trading at $95.50 now, its 52-week trading range is $89.34 to $103.78. At the start of 2014, analysts were expecting McDonald’s to rise to $103.50 or so, and now the consensus price target is only $97.04, and the highest analyst price target is all the way up at $110. A three-year McDonald’s stock chart (from StockCharts.com) has been provided below.

24/7 Wall St. would remind readers that there is almost a month left in 2014, so it is still too soon to be determining which Dow stock will be the best stock of 2015. Still, investors often look at DJIA laggards to see if they can catch a big bounce in the year ahead. Whether that is coming is something we will evaluate immediately after the start of 2015.

ALSO READ: What Apple’s New Street-High Price Target of $150 Really Means

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.