Nike Inc. (NYSE: NKE) reported its fiscal third-quarter financial results on Thursday after the close of trading. The sports apparel giant had very strong earnings, but this would have been far better had its currency issues not been such a drag. Nike reported $0.89 in earnings per share (EPS) on $7.46 billion in revenue, compared to Thomson Reuters consensus estimates of $0.84 in EPS on $7.62 billion in revenue. The same quarter from the previous year had $0.76 in EPS on $6.97 billion in revenue.

Gross margin for the third quarter expanded by 140 basis points to 45.9%. This benefit came from a continued shift in mix to higher margin products, but it was partially offset by higher product input and warehousing costs.

During the third quarter, Nike repurchased a total of 6.5 million shares for approximately $612 million as part of the four-year, $8 billion program approved by the board of directors in September 2012. As of the end of the third quarter, a total of 74.1 million shares had been repurchased under this program for approximately $5.3 billion, an average cost of $71.13 per share.

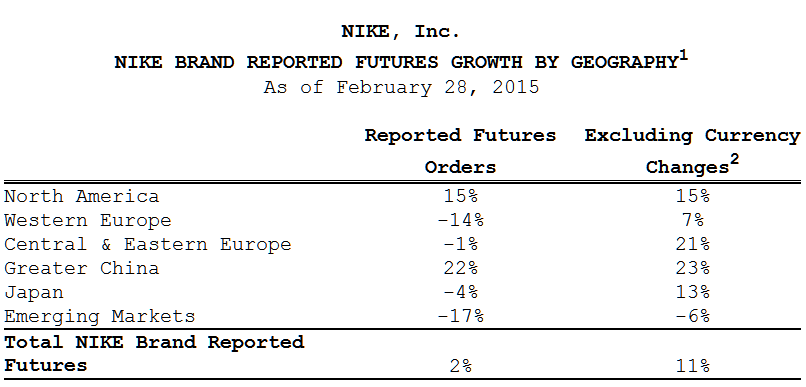

Worldwide futures orders that were scheduled for delivery between March 2015 and July 2015 were up 2%. As you can see in the table below, it would be much higher at 11% excluding currency changes. In terms of its growth, Nike is on point, but the company just needs to get through this currency storm before it can truly realize all the revenue it is currently missing out on.

ALSO READ: Tag Heuer, Google and Intel to Challenge Apple Watch

Mark Parker, president and CEO of Nike, said:

Our strong third quarter results show that our growth strategies are working, even under challenging macroeconomic conditions. Nike has the ability to deliver consistent shareholder value due to the strength of our brand, our relentless commitment to innovation and our powerful portfolio that allows us to invest in the opportunities with the highest potential for growth as well as manage risk.

Shares of Nike closed Thursday up 0.8% at $98.32. Following the release of the earnings report, shares were up another 0.5% or so in the after-hours trading session. The stock has a consensus analyst price target of $102.24 and a 52-week trading range of $70.60 to $99.76.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.