Whole Foods Market Inc. (NASDAQ: WFM) is set to report earnings this week. Unfortunately for the organic and natural foods leader, at least one firm has moderated some of its bullish stance ahead of earnings. One of the issues is a fear that Whole Foods could run into earnings headwinds, which might make shareholders think that the best part of last year’s recovery has been seen.

Oppenheimer maintained its Outperform rating on Whole Foods, but the firm’s Rupesh Parikh lowered the official price target back down to $57 from $65 in the call. Parikh sees a lack of comparable store sales upside dampening the potential for a positive catalyst.

With earnings due on Wednesday, Parikh thinks that this is one of the trickier quarters to call. More importantly, he said:

We believe comp trends have slowed and could potentially fall short of consensus forecasts. Comp shortfalls have generally represented negative catalysts for shares. As we look at the setup this quarter, we believe investors have started to bake in moderating comparable trends following recent underperformance and a now more discounted valuation. However, a lack of comparable upside likely limits the potential for a meaningful positive catalyst.

The long and short of the matter is that the firm thinks customers could see only a modest relief rally, but the firm could see shares falling to the mid $40s, based on historical trough levels on a relative price-to-earnings basis. This left Oppenheimer’s official stance being that investors should wait to add to positions after the quarter rather than jumping ahead of the earnings report.

ALSO READ: 5 Top Pick Modern Bricks-and-Clicks Retailers to Buy Now

Parikh forecasts a comparable store sales increase of about 5%, or even 4.5% outside of Easter, and it assumes a modest deceleration in two-year comparable trends from the first quarter. Weaker economic data has not helped, nor has an overhang from the commentary from United Natural Foods.

Another risk is how much the stock falls after weak comparable store sales. Parikh noted that Whole Foods shares have fallen about 4.5% on average after weak comparables, and he further pointed out that shares fell in seven of the past nine earnings reports when comparables missed expectations.

Additional risks to consider were as follows:

- Valuations have come in for leading U.S.-based retailers with a more significant correction for grocers.

- The $57 price target was brought down based upon a high-20s multiple applied to the 2016 earnings forecast.

- The firm does not expect comparable sales improvement every quarter.

- Kroger price cuts in natural and organic are a near-term risk for the entire specialty food retailing group.

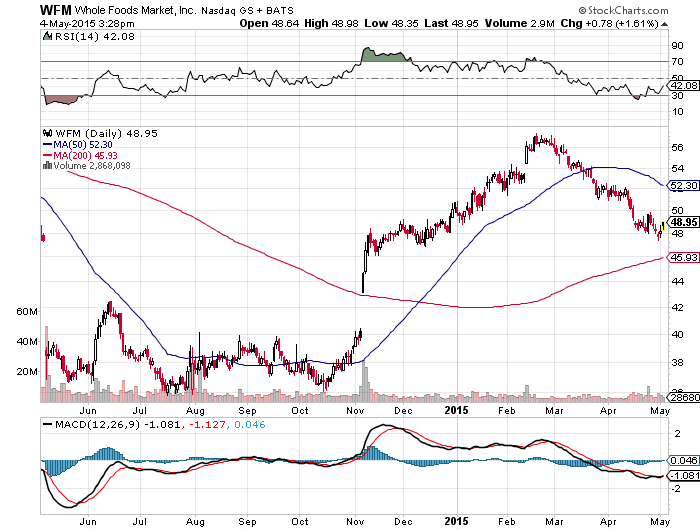

Whole Foods shares were up 1.5% at $48.91 late on Monday. The grocery chain has a 52-week range of $36.08 to $57.57, and the consensus analyst price target was last seen around $56. The highest analyst price target remains up at $67.

ALSO READ: 13 Stocks Under $10 With Massive Upside Targets

As you can see in the chart from StockCharts.com below, Whole Foods shares are currently caught in the middle of their 200-day and 50-day moving averages. Since the pullback in the past year, followed by the recovery, the first key resistance last summer before the big gap-up in November was just over $42 — and the low since that gap-up has been closer to $33.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: are you ahead, or behind on your retirement goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With SmartAsset’s free tool, you can connect with vetted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.