Perhaps the most interesting thing about the preliminary proxy statement that J.C. Penney Co. Inc. (NYSE: JCP) filed last week was that it included no shareholder resolutions. The company’s annual shareholders’ meeting is scheduled for May 22 and, like so many other annual meetings in the time of the coronavirus, this year’s meeting will be virtual. Does anyone care?

There’s not much to attract attendees. The board has proposed the reelection of all current members of the board. Other items on the agenda include ratifying the appointment of an auditing firm, adopting a long-term incentive plan for the company’s executives and other equally mundane items. The lack of excitement is pitched even higher (lower?) from having a share price of less than a dollar.

J.C. Penney stock trades at a level that anticipates an end to solvency. The retailer currently has over 850 stores and employs 95,000 people. The company has to be hoping that keeping that many people employed will qualify it to share in the stimulus package that Congress and the Trump administration have been working on. At the moment, the stock is trading at around $0.42 per share, up more than 3% since Monday’s close.

There Is Something Happening Here

A week before the company filed its preliminary proxy statement, it filed a report with the U.S. Securities and Exchange Commission (SEC). That report was related to discussions it had been having with a lender regarding “potential strategic transactions to enhance the Company’s capital structure.” Attached to the report were two slides that had been used in the discussions between J.C. Penney and the lender.

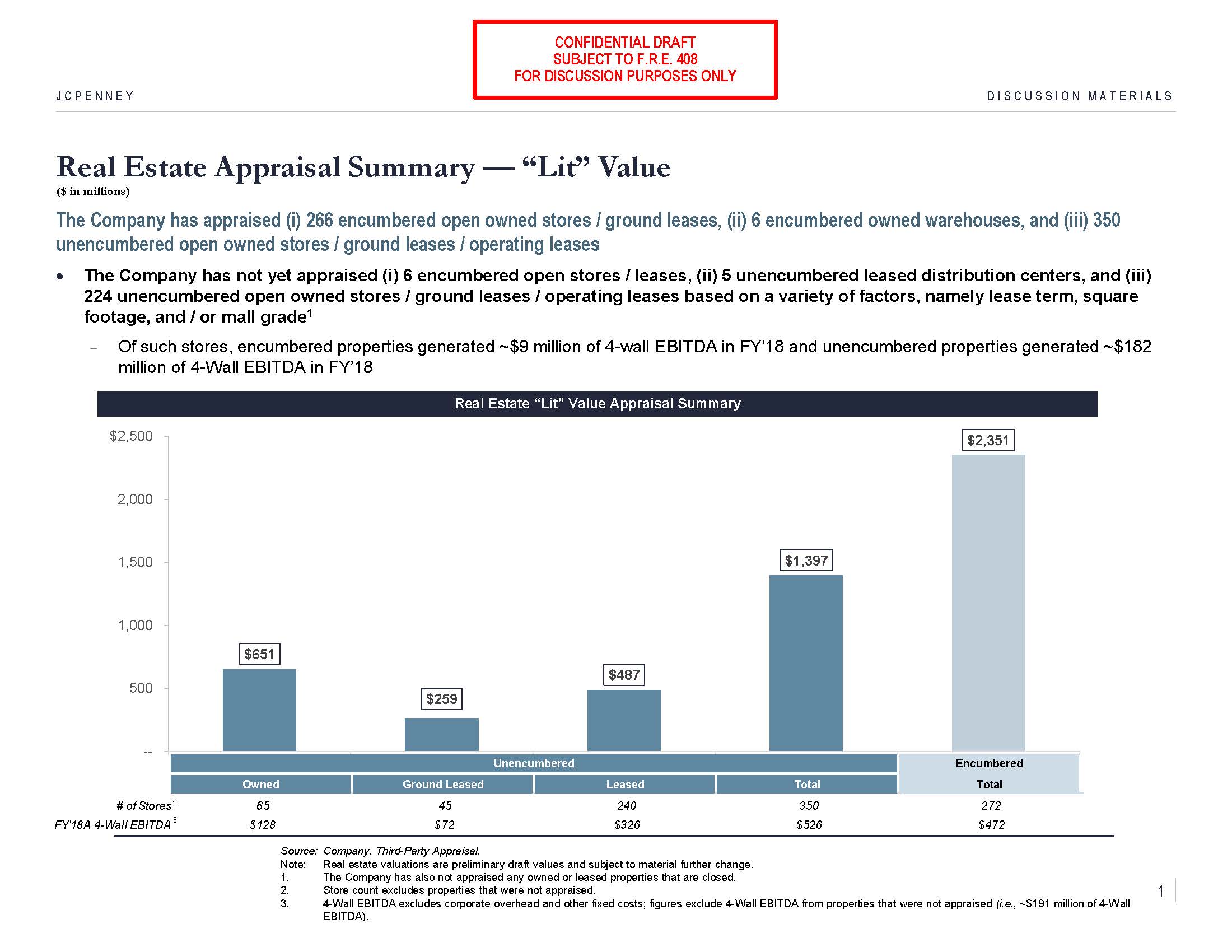

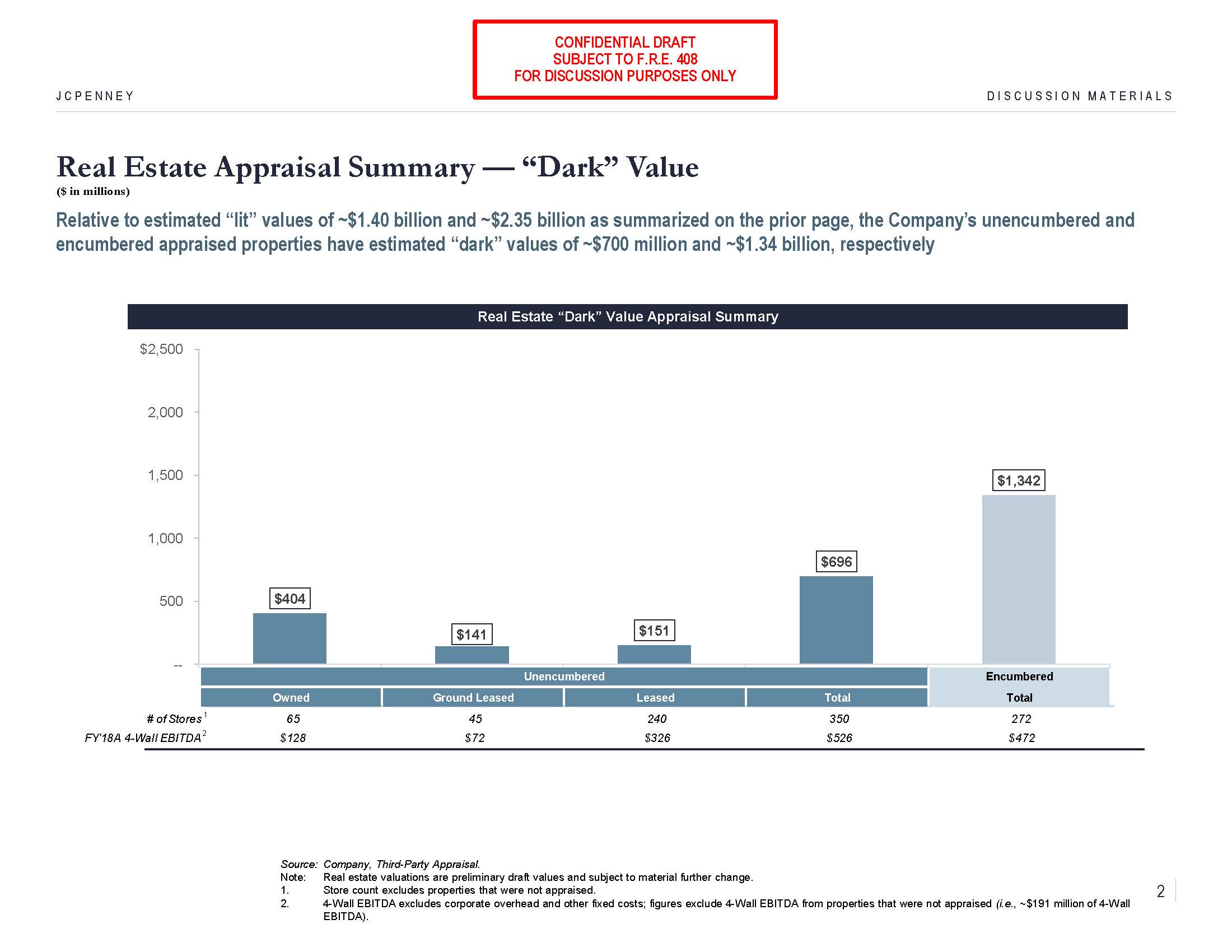

Called “cleansing material” because it discloses material information previously withheld from the public, the two slides offer summaries of real-estate appraisals of 272 encumbered J.C. Penney properties and 350 unencumbered properties. Appraisals have not been completed on 235 other properties.

The first slide illustrates the appraised value of the company’s properties if they remain open, the so-called lit value. The second slide illustrates the value of the properties if they are closed, the “dark” value.

The two slides also refer to “4-wall EBITDA” in 2018. J.C. Penney is not the only department store chain to discuss their business in “4-wall” terms, but it’s not a term in common use on the financial pages.

J.C. Penney’s 4-Wall Story

J.C. Penney offered these two slides to a potential lender in an effort to use the unencumbered properties as collateral for additional loans. The lender passed on the opportunity, likely because the appraised value of the unencumbered operating stores ($1.40 billion) was just over half the value ($2.35 billion) of the already encumbered properties.

Also, if J.C. Penney has to close the stores, the dark value of the unencumbered properties is not quite $700 million, compared to the dark value of the already encumbered properties ($1.34 billion).

What happens then if the company decides to close more of the currently operating stores in order to conserve cash? And how can J.C. Penney afford to keep the stores open with so many people across the United States under orders to remain at home in order to slow down the spread of the coronavirus?

Adding up the 4-wall EBITDA figures J.C. Penney provides here for its operating (lit) stores is also instructive. Combined, 4-wall EBITDA totaled $998 million in fiscal year 2018 (ended February 1, 2019). In its annual report, the company said annual EBITDA in 2018 totaled $568 million.

The 4-wall total does not include corporate overhead and other fixed costs. Nor does it include the impact of store closures for that year.

Retail Stores Don’t Operate on No Overhead

The 4-wall story did not withstand the scrutiny of J.C. Penney’s prospective lender and neither should it influence anyone else. Like EBITDA itself, it is a nonstandard number that can include pretty much anything the company wants to paste onto it. Adjusted EBITDA is even more problematic. Profits and earnings per share tell investors most of what they need to know about how a company and its management team are performing.

Made-up numbers like 4-wall EBITDA can include and exclude anything. In J.C. Penney’s case, no corporate overhead means no marketing expense and no corporate assistance for functions like personnel and maintenance.

Because EBITDA already excludes interest payments, taxes, depreciation and amortization, 4-wall EBITDA really measures only cash coming in from customers and cash going out for goods and wages. A 4-wall metric says nothing about management competence or compensation.

For a 4-wall metric to mean anything, all cash costs should be included and every store must justify its own existence. That is, the “every tub on its own bottom” rule.

J.C. Penney’s potential lenders weren’t impressed with the 4-wall story. There’s no reason they should have been. The stores left to put up as collateral are, even by this phony metric, not among J.C. Penney’s top performers.

Just like the coronavirus, which has a more devastating impact on the weak, the impact of the pandemic on weak businesses will be equally devastating. J.C. Penney is in no position to survive.

Find a Qualified Financial Advisor (Sponsor)

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.