The National Retail Federation has forecast that holiday sales during November and December will rise between 3.6% and 5.2% over 2019. However, the forecast for a very sharp increase comes from e-commerce, with the expectation of 20% to 30% improvement. Many physical stores, based on those numbers, get left behind over the course of the holidays. One forecast, in particular, shows an extremely sharp drop in traffic to brick-and-mortar locations. For some retailers, such a drop would end the chance of recovery from pandemic-savaged foot traffic.

Data from research firm Zenreach shows that retail traffic dropped to well under 20% of normal over the early stages of the pandemic, particularly from March through May. It then staged a modest recovery. However, Zenreach forecasts this recovery will end entirely. Their forecast includes both stores and restaurants. By year-end, these experts say, traffic will be only 21.5% of what it was last year. Rising COVID-19 infections will be mostly to blame.

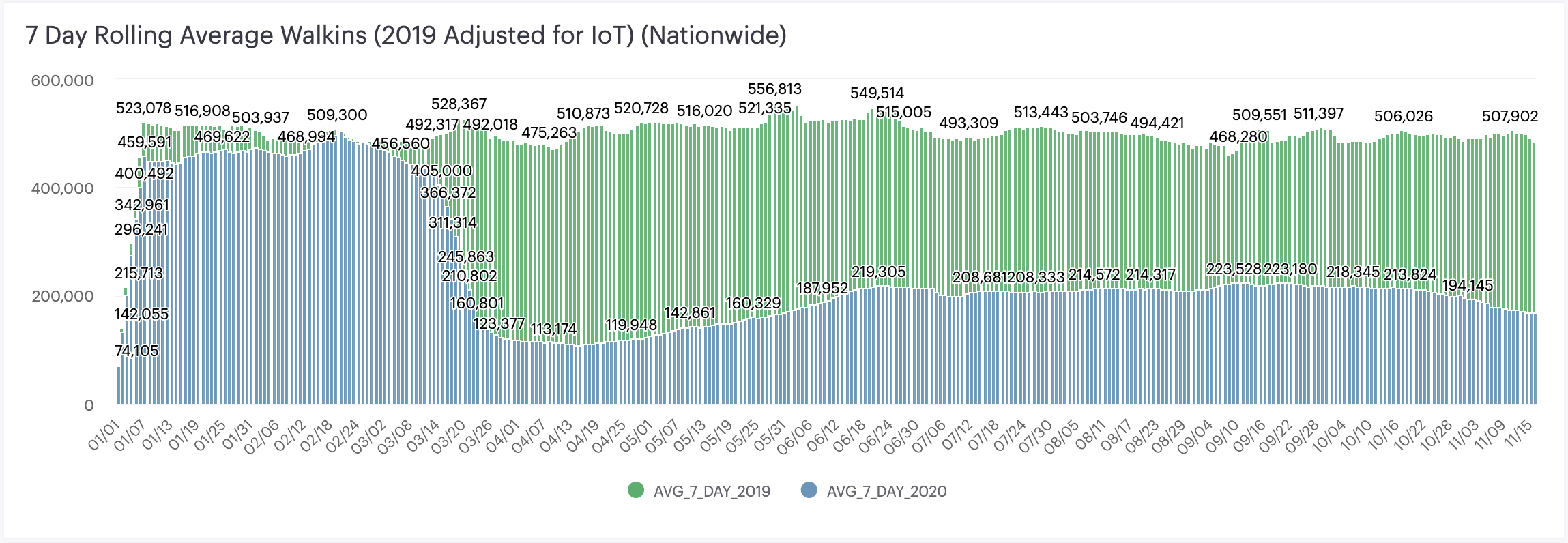

The Zenreach term for store traffic is “walk-ins.” Their current figures show: “Last year at this time, the 7-day rolling average of walk-ins was just over 500,000. The current 7-day rolling average is under 200,000 walk-ins, sitting at 35% of last years normal.” The figure already has started to decline. The researchers added: “The spikes in COVID-19 infection rates in nearly every state across the country appears to be having a major impact on the tentative recovery seen during the summer months.”

Most likely to be terribly affected are retailers that already have lost much of their traffic and have had to lay off people and, in some cases, raise money. Macy’s sits high on this list. So do Kohl’s and Nordstrom. J.C. Penney has barely survived a brush with bankruptcy and faces another drop in revenue. Additionally, countless smaller retailers face similar difficulties.

The hoped-for return of foot traffic for brick-and-mortar retailers won’t happen.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.