Practically every worker looks forward to retirement. However, according to a survey by the RAND Corporation, as many as 29% of all Americans are not adequately prepared to retire. While many retirees rely on benefits like Social Security, savings are another key part of retirement planning.

While many articles throw around a magic number for how much you “should” have saved by age 55, the reality is – it’s not a one-size-fits-all answer. The general recommendation is 4.5 to 8 times your annual salary.

As you can see, that is a huge range. You should also consider factors specific to you, like your health and lifestyle. Someone who wants to travel the world will need much more money than someone who would rather sit at home and read a book!

We’ll guide you through the journey of retirement planning below. We’ll talk about why starting early is important and provide you with some investment strategies to help you reach your goal.

Why Planning Early Matters

The power of compound interest was often called the “eighth wonder of the world” by Albert Einstein, and for good reason. With the power of compound interest, you can snowball your money into a massive amount. It takes a very small amount to turn into a massive boulder years down the line!

It’s a bit like planting a seed. In a year, the seed will grow into a small sapling. However, ten years down the line, the tree will be massive! Growth speeds up as the tree gets bigger. It compounds.

Therefore, the earlier you start saving, the more time your money will be exposed to compound interest. If you want a substantial nest egg by 55, we highly recommend saving long before 55 comes around.

Saving eight times your income can seem overwhelming. However, you don’t literally have to put back eight times your income when you can rely on interest to help you out!

A small amount saved consistently over the years can go a long way. You don’t need to save huge chunks of your income in most cases. You just need a plan and consistency.

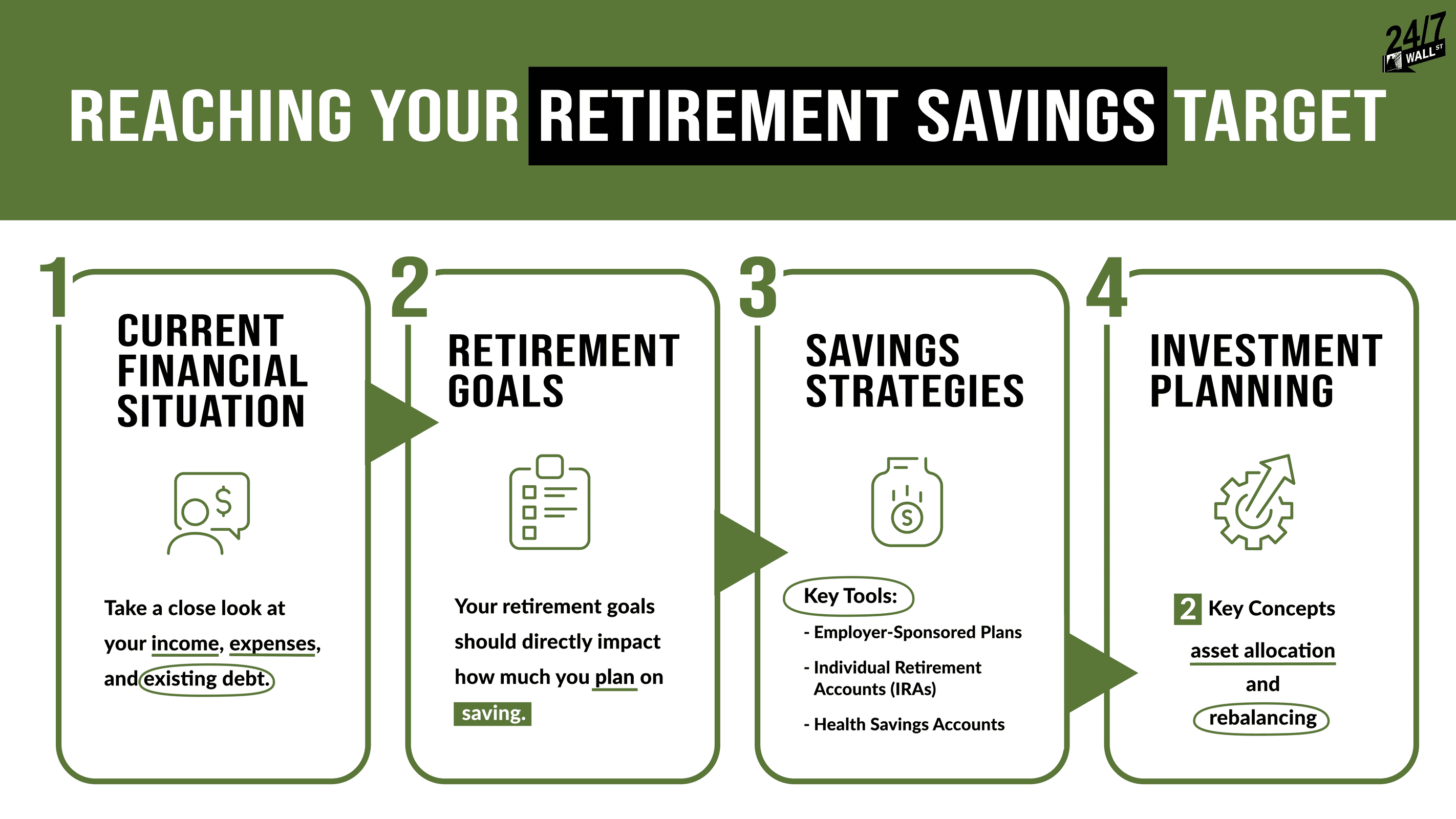

Reaching Your Retirement Savings Target

In practically every case, some plan is better than no plan. Still, a good plan is better than a bad plan. To reach your retirement savings goals, we recommend erring on the side of practicality. Yes, you can absolutely live on ramen and save half your income, but how long will you stick to that plan?

1. Current Financial Situation

Building a secure retirement starts with understanding your current financial situation. Take a close look at your income, expenses, and existing debt. You need to know how much money you have going in and where it is going. Once you have a clear view, you can find places where you can potentially save.

Of course, again, be practical. Yes, you can cut your food budget in half or trade in your car for a junker. However, neither of these are very practical situations. On the other hand, cutting back on streaming services or cooking at home instead of eating out is much more doable.

2. Retirement Goals

Retirement should be a time for you to live your best life. However, what counts as your “best life” depends on your preferences. What do you want to do during retirement? When you think of retirement, what do you look forward to? Your retirement goals should directly impact how much you plan on saving.

Someone who only wants to upkeep their current lifestyle may only need 4.5 times their current income saved. Someone who wants to travel extensively may need more than eight times their income.

3. Savings Strategies

Now that you have a better idea of your financial goals and retirement lifestyle, it’s time to start saving. There are many ways you can go about this, and the best option for you can vary. Some key tools include:

- Employer-Sponsored Plans: Many employers offer retirement savings plans like 401(k)s. These plans allow you to contribute some of your salary directly into retirement. Sometimes, they even offer matching contributions, which are basically free money. We recommend at least putting in enough to take advantage of this match!

- Individual Retirement Accounts (IRAs): IRAs are another potential avenue if you don’t have an employer-sponsored plan. There are two main types. Traditional IRAs offer tax-deductible contributions. In other words, you don’t pay taxes when you put the money in. However, you must pay taxes when you take the money out! Roth IRAs work oppositely. The money is taxed when you put it in, but you can pull money out after retirement without paying taxes.

Typically, retirement plans have contribution limits. You can only put so much in annually. That’s another reason it’s important to start saving early! These limits can change each year, too, so it’s important to stay on top of them.

You may also want to consider additional savings vehicles, like Health Savings Accounts, especially if you expect high healthcare costs. HSAs allow you to contribute pre-tax dollars to cover qualifying medical expenses.

4. Investment Planning

You must consider an investment strategy once you have your money in a savings vehicle. How you invest your money directly impacts whether you meet your retirement goals or not. There are two key concepts to consider here: asset allocation and rebalancing.

You don’t want to invest solely in one asset class, such as stocks. Asset allocation involves spreading your investments across many types of assets, such as stocks, bonds, and real estate.

This diversification helps spread out your risk. Your ideal asset allocation depends on your risk tolerance. Someone closer to retirement might prioritize stability with a higher allocation toward bonds. In comparison, someone younger with a longer time horizon might be comfortable with a higher allocation toward stocks for potentially greater growth.

Your allocation shouldn’t stay the same over the years, though. Instead, you should regularly adjust your portfolio to align it with your target. This process is called rebalancing. This helps you maintain the desired level of risk and keeps your investment strategy on track.

This investment strategy helps ensure your money is exposed to interest like you want it to be. Preferably, your investments should grow steadily and weather market fluctuations, putting you in a stronger position to achieve your goals.

Beyond Your Savings Target: Other Considerations

Saving enough to reach 4.5 to 8 times your annual income by 55 is important. However, it isn’t the only thing you should consider when planning your retirement. There are several other sources of income you may receive. If you receive any of these, the amount you need to save may be lower.

Here are some common additional sources of income:

- Social Security Benefits: Most retirees receive Social Security benefits. These provide a safety net. However, your Social Security benefits can vary widely, so it’s important to understand how Social Security works before factoring this income in.

- Pensions: Traditional pensions can provide a steady income stream for some during retirement. If you qualify for a pension, be sure to factor it in!

- Rental Properties: Many retirees invest in real estate and rely on rental income in retirement.

These additional income streams can be very helpful for those trying to maximize their retirement. You can use any of these streams alongside saving and investing. You may need less retirement savings if you plan on receiving a pension or have rental properties. On the other hand, if you only qualify for a small Social Security benefit, you may need to save even more.

It’s important to consider your retirement savings as part of your overall retirement strategy, not just as a number in your bank account.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.