Many people spend decades looking forward to retirement. But achieving it requires careful planning. Retirement isn’t something that just falls into your lap!

Traditionally, the focus was on saving a specific dollar amount by each age. Theoretically, this kept you on the straight and narrow path to retirement. At around 60, it’s often suggested that you have 6 to 11 times your salary.

However, retirement planning is not that simple, and this range is absolutely huge! While having a significant nest egg by 60 is undeniably important, this isn’t the only (or even most important) thing you should consider.

We’ll look at how to determine how much you need for retirement, which will affect how much you should have saved by 60. Everything from healthcare costs to your lifestyle should be considered.

Importance of a Nest Egg by 60

While saving a specific amount by 60 isn’t necessarily important, that doesn’t mean you shouldn’t save for retirement at all. In fact, the average retirement age is currently 64, though the Social Security Administration doesn’t consider “full retirement age” to be until 65 or 67. Preferably, you should wait until then to file for Social Security.

There are many benefits to saving before 60. While you can potentially save enough for retirement after 60, it’s much more challenging. You won’t be able to take advantage of much compound interest, and you may have to cut your lifestyle way back to save enough.

Plus, saving money allows you to live the retirement you want. Many people look forward to traveling after retirement. A sizable nest egg is required to make this happen, though.

That said, if you’re approaching 60 and haven’t saved much, now is absolutely the time to start. The earlier you start, the more you’ll be able to take advantage of interest. Even a few months of compound interest can go a long way!

Strategic Planning for Retirement

Of course, saving money doesn’t mean much unless you have a plan for it. It’s important to plan strategically, which means factoring in future expenses and potential income sources. In many cases, you’ll have some income into retirement, whether you have Social Security benefits or a pension.

Healthcare costs are one of the major expenses in retirement. Medicare covers a significant portion of healthcare costs. However, it doesn’t cover everything. You’ll likely want to purchase supplemental insurance and have extra money for out-of-pocket expenses. It’s always better to overprepare than underprepare!

You should also consider the possibility of long-term care. Many people need long-term care as they age. Even if you’d like to avoid this as much as possible, sometimes assisted living homes are necessary (even if only temporarily). These can be expensive!

Make sure you plan for higher healthcare costs, as they increase overall as we age.

Often, income doesn’t stop completely when you retire. There are many potential sources to consider:

- Social Security Benefits: Most retirees receive Social Security. This can provide some supplemental income into retirement. However, it’s important to understand how Social Security works so that you can plan accordingly.

- Pension Plan: Some employers still offer a traditional pension plan, which will provide a stable income through retirement. You should factor these payments into your calculations if you qualify for one.

- Part-Time Income: Some retirees work part-time into retirement to supplement their income or just because they love their work!

- Rental Income: If you invest in real estate, you can use it as a source of passive income into retirement. However, don’t forget to factor in management responsibilities and potential vacancies.

Retirement planning is just like budgeting. It’s money in and money out. However, you must consider how your financial needs might shift (like increased healthcare) after retirement. Your income will also change, of course, and you’ll need to ensure you have enough saved to fill in the gap.

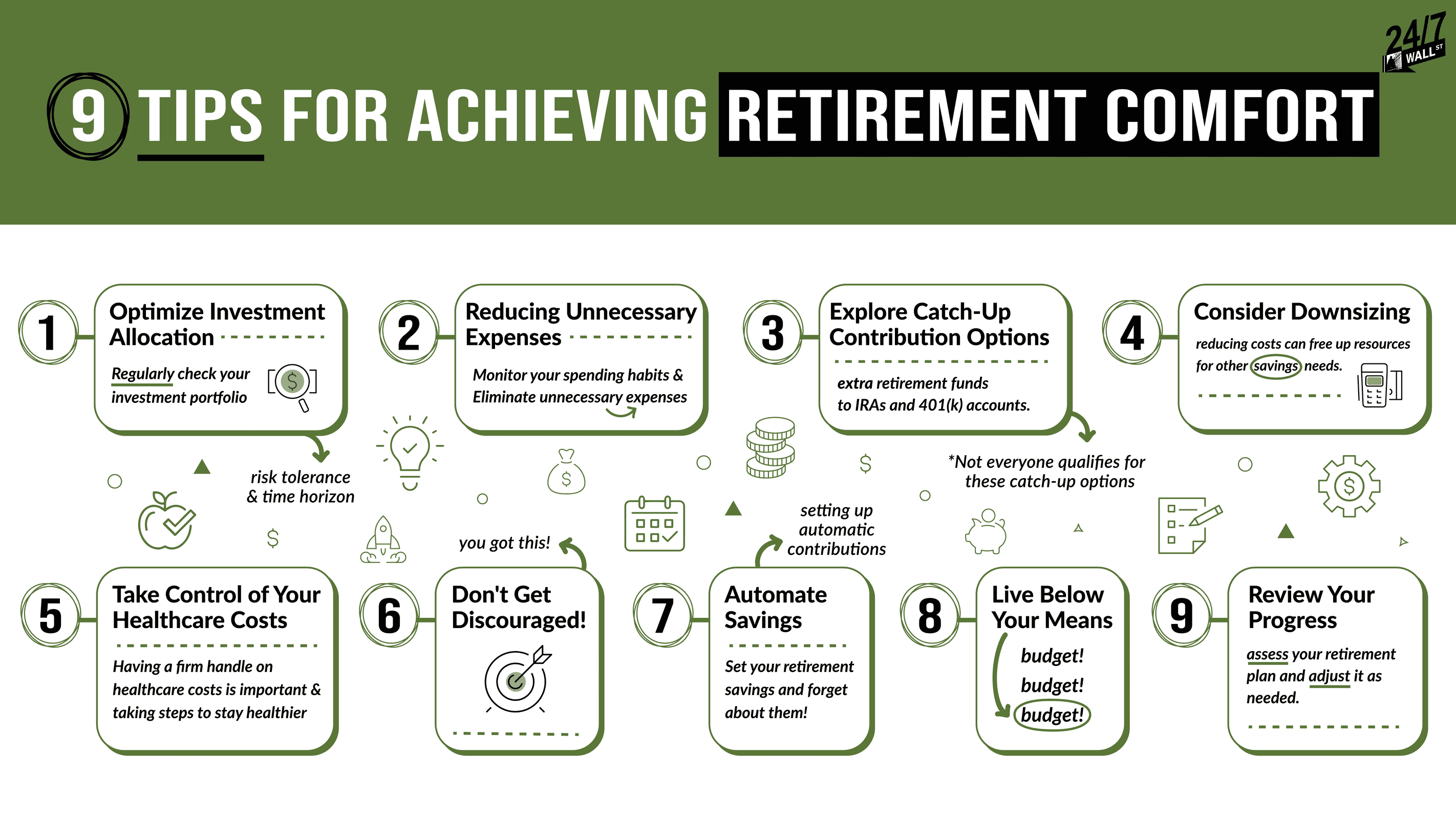

9 Tips for Achieving Retirement Comfort

You need a sizable nest egg by the time you’re 60. Preferably, you should have 6 to 11 times your salary saved. However, even if you haven’t reached this goal by 60, strategic planning can help you bridge the gap!

1. Optimize Investment Allocation

Regularly check your investment portfolio to ensure it’s working for you. It should align with your risk tolerance and time horizon for retirement. However, if you’re starting to save late, you may need to adjust either or both of these factors.

You may have to accept more risk if you’re far behind your goal. That said, if you do have enough, it’s generally recommended to lean toward a more conservative investment closer to retirement to prioritize capital preservation.

2. Reducing Unnecessary Expenses

Monitor your spending habits and watch for areas you can cut back on. Eliminate unnecessary expenses to allocate more funds towards your retirement. This process may be particularly important if you’re behind on your savings goal. If you aren’t saving enough for retirement, you must figure out why and adjust.

3. Explore Catch-Up Contribution Options

Sometimes, you can contribute extra retirement funds to IRAs and 401(k) accounts. Consider these catch-up options if you’re over 50 and behind on adding to these funds. Not everyone qualifies for these catch-up options, though.

4. Consider Downsizing

Happiness in retirement isn’t solely dependent on the amount of money you have saved. It also depends on the amount of money you need. For the best results, some retirees may need to look into downsizing, especially if you’re not reaching your retirement goal. Moving to a smaller home can help reduce housing costs, freeing up resources for other needs (like saving).

5. Take Control of Your Healthcare Costs

Having a firm handle on healthcare costs is important, especially as you age. If you don’t understand healthcare insurance, coverage limitations, and similar aspects of paying for healthcare, now is the time to learn.

Healthcare costs will likely take up even more of your budget as you age, so the sooner you understand them, the better.

Consider taking steps to stay healthier, too. Because healthcare costs so much, implementing an exercise routine or eating better can save you money.

6. Don’t Get Discouraged

Having goals is important, especially when it comes to savings! However, it’s important not to get discouraged and give up altogether. Even a little bit of money can go a long way. If you can’t save much now, save what you can. You’ll thank yourself later!

7. Automate Savings

The power of compound interest is real. The earlier you start saving, the more time your money has to grow. Consider setting up automatic contributions to your retirement accounts, like a 401(k) or IRA. This ensures you save consistently and removes the temptation to spend that money elsewhere.

If you never see the money in your account, you won’t spend it. Set your retirement savings and forget about them!

8. Live Below Your Means

Depending on your needs and income, you should save a certain amount each month. However, the only way to do this is via a budget. If you don’t have a budget, reaching your goals will be nearly impossible. The money will go somewhere and may not be in your savings.

Consider your budget regularly and adjust where you can free up additional funds. Theoretically, if you stick to your budget, you should be able to reach your savings goals! (Of course, sticking to the budget can be challenging.)

9. Review Your Progress

It’s important to periodically assess your retirement plan and adjust it as needed. Your financial plan should also adapt as your life circumstances and goals evolve. Consider scheduling an annual review with a financial advisor to ensure you’re on track.

Even if you don’t see a financial advisor, you can sit down with your spouse to review your budget and see where your savings are. Adjust accordingly if your savings aren’t where you want them to be.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.