If you’re in your 50s, it makes sense to pay attention to what Warren Buffett says. After all, he became a billionaire at age 56, and now, at a lively 93 years old, he is worth an astounding $139 billion. Only 8 people in the world have larger fortunes! Now, truth be told, the man got an early start, and if you’re not a billionaire yet . . . well, odds are you won’t be. But you don’t need to be. Forbes says that as of 2024, there there are just 2,781 billionaires in the world. We’re betting you can find ways to be happy on less, like many of the other 8 billion people in the world.

But that’s also why it’s worth listening to Warren Buffett. Because he doesn’t just talk about making money. He talks about how to live a fulfilling life. And his practical advice for investing can apply not only to finances but to the way we use and multiply other resources such as time and energy, and who and what we spend them on. So, we’ve scoured the internet for quotes that might particularly speak to people who have achieved the half-century mark—a time when we realize we’re not immortal, but we are still at the prime of our life and have a lot of contributions to the world to make.

Loving Our 50s

Although the culture idealizes youth, many people actually feel more confident and content in midlife. With their education behind them, their career firmly established, a network of family and friends, and their health intact, 50-somethings may feel they are truly at the prime of their lives. It’s also a time when empty nesters can focus on their own relationship after decades of centering the family around their children.

Watching the Clock

Life is not rosy for everyone at this age, though. This stage of life can be challenged by divorce, adult children returning home to live for a while or forever, and sometimes substantial responsibilities for raising your grandchildren. At this age, many individuals and couples are also playing catch-up on retirement savings after years when the contingencies of life prevented them from doing little more than living paycheck to paycheck. For some people, it can also be a time when some health issues might start to arise, reminding us of the need to take care of ourselves.

1. “Price is what you pay. Value is what you get.”

Why is this relevant?

- As we age, inflation can frustrate and frighten us as we plan for future financial needs.

- With a single-minded desire to save money, we could buy inferior products and services that must be redone later.

- We need to consider not only the financial costs but how much time we would have to sacrifice if we take a DIY approach.

You Get What You Pay For

Some people take great pride in doing household projects themselves: things like mowing the yard, doing repairs, and getting on the roof to clean the gutters. Sometimes, they might even be critical of neighbors and others who hire a lawn service or repair person to take care of those jobs for them. This attitude just considers the price, though, not the value received for it. The quality of the work will often be greater with a professional. But more than that, you’ve saved yourself time that can be spent with the people you love or doing more skilled and valuable labor; you’ve saved yourself wasted materials that have to be bought again when you inevitably mess up; and you’ve protected yourself from potential injuries that could set back all your priorities for a long time. All of those things go into the value you’re getting for the $50 you spent to have your yard mowed.

2. “Investment must be rational; if you can’t understand it, don’t do it.”

Why is this relevant?

- New technologies tantalize us with the idea of getting in on the ground floor with the next Apple or Amazon.

- Other people, including our adult children, might try to get us to invest in new and unproven opportunities.

- In our 50s we have a shorter timeframe for retirement investing and need to keep our investments in areas that are tried and true.

Mama Didn’t Raise No Dummy

By midlife, we have enough experience to know that there are plenty of opportunities—and people—who are too good to be true. Sometimes we throw our healthy caution to the wind, though. Maybe we’re afraid of being left out of an amazing investment that could help us compensate for lost time. Or maybe someone we know, love, and trust is so certain and insistent that we should get into it that we don’t want to disappoint them and make decisions that are against our better judgment. Buffet urges investing in things that might seem simple, boring, and conventional to others but will give us a reliable return on our hard-earned money.

3. “A very rich person should leave his kids enough to do anything but not enough to do nothing.”

Why is this relevant?

- At this age, many people are unduly stressed by the goal of leaving an inheritance for their children.

- A large inheritance can rob children of the knowledge and character-building developed through hard work and ingenuity.

- You and your children will likely benefit far more from meaningful time together than through generating more cold, hard cash.

Don’t Kill Your Kids with Kindness

You don’t have to look far to find examples of rich, entitled kids wasting a fortune passed down to them from more enterprising ancestors. Young people can be spoiled in more than one way by wealth: not developing a work ethic; not appreciating the value of money, time, and possessions; not interacting with solid, salt-of-the-earth people of other social classes; and expecting to buy their way out of bad behavior and life’s problems. One of the most valuable gifts we can give our children is to allow them to get toughened by experiencing real life without the “bubble wrap” of a large inheritance.

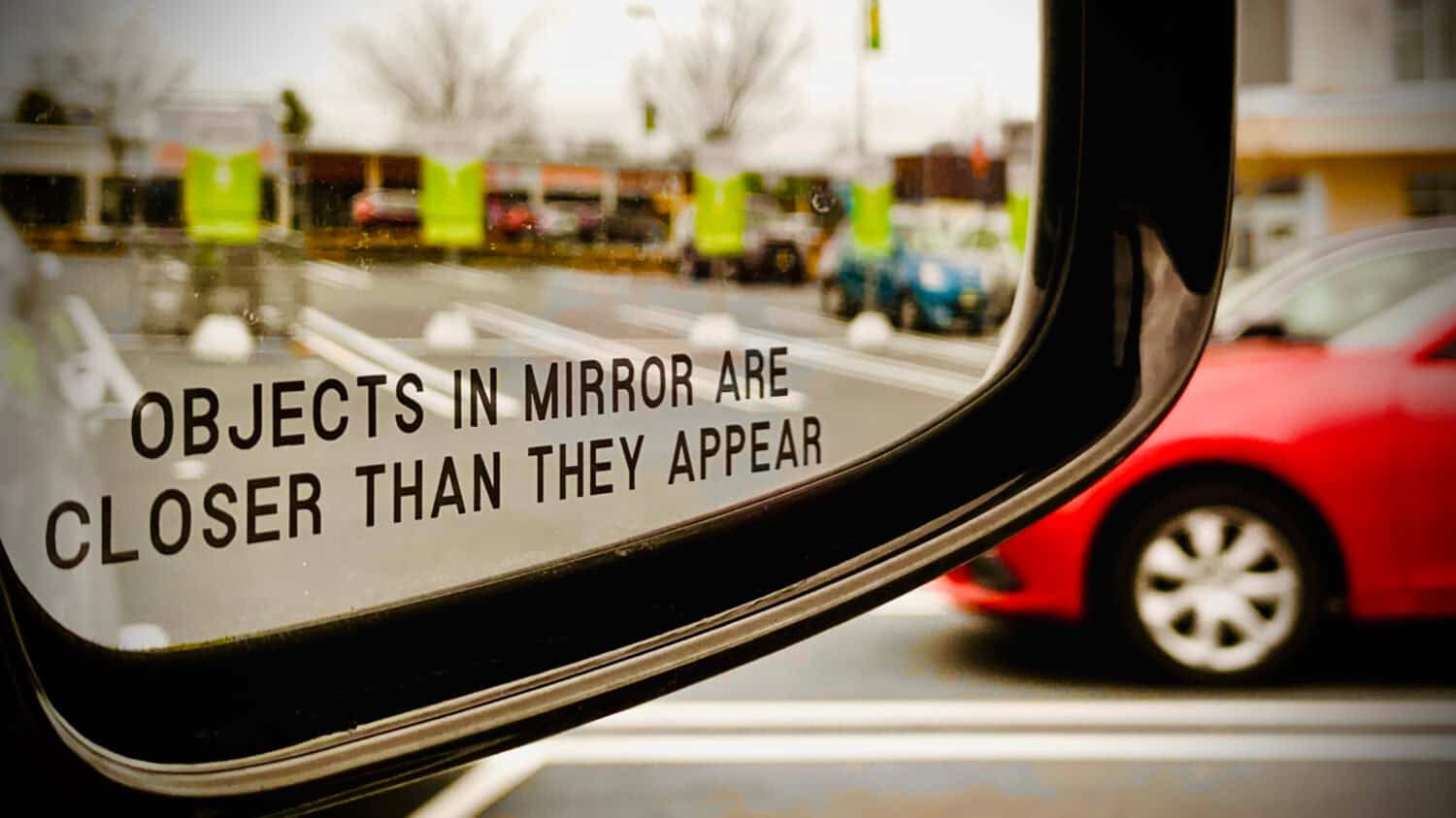

4. “In the business world, the rearview mirror is always clearer than the windshield.”

Why is this relevant?

- Midlife is often a time when we take stock of where we’ve been and may regret some of our life choices.

- We may feel more secure judging our own actions from the past than working through present decisions with unknown future consequences.

- Spending too much time ruminating can cause us to miss current opportunities that may be even more consequential than our past mistakes.

Don’t Drive Looking Backwards

Remember that scary scene from Jurassic Park when the T-rex is chasing a jeep? We see it through the rear-view mirror, gaining at terrifying speed, while clearly printed on the mirror are the words, “Objects in mirror are closer than they appear.” Horrifying! That’s what our past can feel like. We think about how everything might have been different for us if we had only taken a different path at key junctures in our lives. Yes, hindsight is 20/20. But why not consider not only what would be better in your life if you had made different decisions but what would be worse? A healthier approach would be to realize that the past is outside our control, but the present is not. So, let’s put all our energy and ingenuity into crafting a life today that we can look back on with satisfaction tomorrow.

5. “I buy expensive suits. They just look cheap on me.

Why is this relevant?

- We live in a youth- and appearance-oriented culture. It is not a kind environment to people who are showing signs of age.

- Culture can influence us to spend too much time and attention on external things that only give us marginal gains, if any.

- In our 50s, we can be confident enough to buck social trends and focus more on practicality than popularity.

Who Are We Trying to Impress?

In the animal kingdom, young males need to compete with one another, posture for females, and go through a mating ritual that maximizes the possibility of strong offspring that will survive to repeat the whole process. Let’s be honest. Clothes, cosmetics, cars—these all amount to feathers, fur, and fights to win us the best mate we can find.

At that dating-and-mating stage, spending on those things might seem like a good investment to some people, though you might question what kind of person it attracts. And some people in their 50s may indeed divorce and seek to start a new family with a younger spouse. But if that’s not your case, then midlife is a time when we can let go of all that “dress to impress” stress and just be ourselves: comfortable jeans, worn boots, favorite hat, and all. And if anyone doesn’t like that, well, they can just move along.

6. “The best thing I did was to choose the right heroes.”

Why is this relevant?

- We may have set unrealistic goals earlier in life because of the role models we chose for ourselves.

- Heroes whose example helped us when we were younger may not be appropriate for our current stage of life.

- At midlife, we may have a more nuanced and perceptive idea of where heroes may be hiding in plain sight.

Time for New Heroes?

Comic book superheroes are larger-than-life in every way imaginable: they have superpowers you can only dream of, do world-changing feats that win them the admiration of the masses, and, of course, have some of the coolest duds and modes of transportation around. But they’re fantasy.

In the same way, the real-life “heroes” we choose for ourselves may also be less than meets the eye. Celebrities go through hours of hair and makeup work, and their photos are still photoshopped. Successful entrepreneurs exaggerate the truth about how much money they have and how much they enjoy their lifestyle. Meanwhile, real heroes live courageously, facing daily struggles others may know nothing about. Whether in business or in just living life, look for those unsung heroes who keep moving forward in life whether or not they are noticed or applauded for it.

7. “The smarter the journalists are, the better off society is.”

Why is this relevant?

- Today, there is real controversy over how much we can trust the media and how beneficial or harmful they are in society.

- With news media, we would be left in the dark to sort through baseless rumors to try to understand the world around us.

- Buffet’s advice reminds us to seek out smart journalists who do their job well as our information sources.

Check Your Sources

American culture changes extraordinarily rapidly, especially in this era of sprinting technological advancement. None of us can keep up with all the changes. It’s easy to start feeling out-of-touch and nostalgic for a time of life when things felt less complicated. Life can feel even more frightening and overwhelming when we’re bombarded by sensationalist news stories that are purely designed to get “clicks” and “likes” to generate advertising revenue, often by scaring your socks off. We need some of the information media provides. This is how we can follow important stories affecting our lives, voting behavior, and investment strategies. But we can choose to limit our exposure only to those sources that are reputable and responsible, not sensationalist.

8. “Basically, when you get to my age, you’ll really measure your success in life by how many of the people you want to have love you actually do love you.”

Why is this relevant?

- For some people, midlife can feel lonely due to the “empty nest” or divorce.

- Some individuals find they have over-committed to career goals and life feels unbalanced.

- Financial success can leave us wondering whether people value us for who we are or what we can give them.

Do We Love What Can Love Us Back?

Weddings are a good illustration of how we often invest in the wrong things for long-term happiness. Couples spend tens of thousands of dollars and countless hours getting the details of one day right. But do they invest equivalently in therapy to work through the issues that can undercut the relationship? Often we invest more in the wedding than the marriage.

Similarly, money is always a means to an end, not an end in itself. You’ve heard the expression “time is money.” So, making money efficiently allows us to buy time from other people and get more done—hiring a personal assistant, a housekeeper, or just going out to eat rather than cooking at home—all these are ways of using money to leverage other people’s time. But if we just use that time to make more money, we have to ask, “what’s the point?” And how do our relationships atrophy from neglect while we focus on the wrong thing?

9. “It’s never paid to bet against America. We come through things, but it’s not always a smooth ride.”

Why is this relevant?

- In a rapidly changing world, we can feel unsettled about what life will be like for our children and grandchildren.

- We might look back with nostalgia—and selective memory—on an earlier era we think was better.

- Taking a broader perspective can reassure us that our country and the American people are highly resilient in new and challenging circumstances.

Just Breathe. It’s Gonna Be OK

If you’re in your 50s, you remember a childhood with no microwaves, cell phones, computers, flat-screen TVs, ATMs, bar codes, GPS, or online shopping. It’s easy to romanticize that as a simpler time. That’s especially the case if we think about the social changes that have happened and created controversy and division. But if we step back and look at the whole history of the country, the people who lived during the Revolution, the Civil War, and the World Wars had no certainty that the country would survive. And in the postwar era, we have lived with the real possibility of a global conflict that could end all life on the planet.

And yet we go on, living our daily lives, finding joy in our relationships and whatever pleasures we experience along the way. And we leave the country to the next generation to handle as they see fit and live with the consequences of their choices for good or bad. For our part, we can refuse to be easily alarmed and continue steadily on the course we have set for ourselves. And this is part of the wisdom that comes with having lived for half a century in a stable, prosperous country.

It’s Your Money, Your Future—Own It (sponsor)

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.