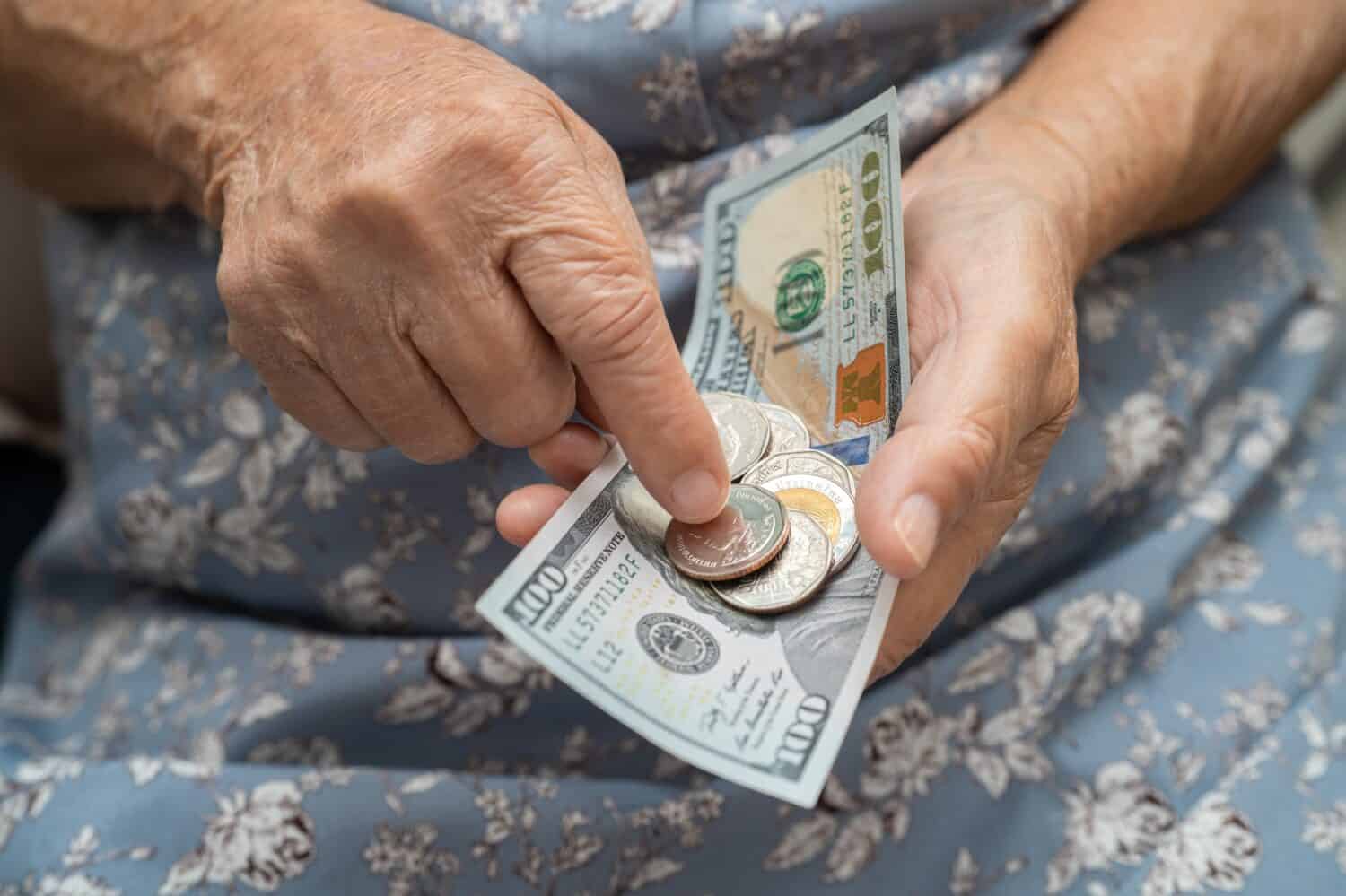

In August the Senior Citizens’ League predicted that Social Security recipients will get a Cost of Living Adjustment (COLA) of only 2.6% in their benefits this year. This is less than usual and may be inadequate to help many seniors keep pace with rising healthcare and living expenses. With tight budgets, many seniors are anxiously awaiting their next Social Security checks. We have the information you need to mark your calendar for your September payment.

24/7 Wall St. Insights

- Social Security offers several different types of benefits. Retirees should be aware of them all to avoid losing some of the money they’ve earned.

- The Social Security Administration web site has the payment dates for each type of benefit. Some payments are based on the date of your birthday.

- Don’t make a costly mistake. Here are some common social security mistakes to avoid.

- Also: invest wisely to supplement social security with 2 Dividend Legends To Hold Forever

Social Security Overview

Social Security is a program that was started during the Great Depression. It offers retirement, disability, survivors, and supplemental income benefits to those who need it most. The United States Social Security Administration administers the program. Social Security is funded by payroll taxes paid jointly by employers and their workers and from interest drawn from U.S. Treasury securities.

This is by far the largest program the federal government operates, at a cost of about $1.24 trillion a year. 70.6 million people benefit from the program, receiving an average of $1,767.03. That’s a huge improvement on the very first Social Security check ever issued, to a retired secretary named Ida May Fuller. Aunt Ida, as she was known, received $22.54 on January 31, 1940.

Will Social Security Run Out of Money?

There are always scary stories in the news about how Social Security is going to run out of money. This just simply is not going to happen. It is politically difficult to reform the program, so Congress tends to wait until the very last minute when there is no other choice, but you can bet the U.S. government will bail out the program as needed to keep it solvent. You also don’t have to worry that benefits for current recipients will be cut back, which would be political suicide. However, your cost of living increases may not always keep pace with inflation, and future generations may have to retire later and receive fewer benefits.

What Benefits Are Available?

You have to apply for Social Security benefits in order to receive them; they don’t kick in automatically. So be sure you’re aware of what is available, and apply for them right away if there’s a chance they apply to your situation. These are the benefits offered under the program:

- Retirement. As long as you have paid Social Security taxes for 10 or more years, you can begin drawing retirement benefit checks between the ages of 62 and 70. You’ll get higher benefits by waiting as long as possible to start drawing social security, but after age 70 there is no additional benefit to waiting.

- Social Security Disability Insurance (SSDI). Disability payments are available for people who have paid Social Security taxes for at least 5 years out of the last 1o and who have a disability that knocks them out of work for a year or more.

- Survivors benefits. When someone who has paid into the Social Security system passes away, their spouse or dependents can draw benefits depending on how much was paid into the system by the deceased.

- Supplemental Security Income (SSI). In some situations, additional assistance is needed for a person to survive. Adults or children with a disability or adults 65 and older with very limited financial means can receive an SSI benefit to assist with housing, nutrition, medication, and other essentials.

September 2o24 Social Security Payment Dates

The Social Security Administration has published the dates of payments in the Schedule of Social Security Benefit Payments 2024. Benefit payment dates are different depending on the recipient’s date of birth. If you don’t get your check exactly when you expect it, don’t panic. Wait three days to see if it comes, then contact the Social Security Administration.

Retirement and Disability

If you are drawing retirement or disability benefits based on your own work record, the payment date will depend on the day of the month you were born. If you are receiving survivor’s benefits, the payment date is based on the deceased person’s birth date. Why do they do it like this? The Social Security Administration sends out payments to about 67 million people every month, which is about 1 out of 5 Americans. They would be completely overwhelmed if they tried to accomplish it all on one day. So when can you expect your check?

- September 11: Recipients born between the 1st and the 10th

- September 18: Recipients born between the 11th and 20th

- September 25: Recipients born between the 21st and the 31st

Supplemental Security Income (SSI)

The Social Security Administration pays SSI benefits on the 1st of the month. If that day happens to be on a weekend, the government sends those checks on the Friday before the 1st. This is the case in September. The 1st falls on a Sunday, so September SSI checks will be posted on Friday, August 30.

Retirement Benefit Payment Date Exception

If you started drawing Social Security benefits before May 1997 or if you are receiving both Social Security and Supplemental Security Income, your SSI will be mailed out on the 1st and your Social Security on the 3rd. If either of these dates falls on a weekend, the payment will be made on the immediately preceding Friday. If this is your situation, these dates apply to you:

- August 30: September SSI benefit payment (moved to Friday Aug. 30 because September 1 is on a weekend).

- September 3: Retirement benefit payment

States That Tax Social Security

Social Security benefits are subject to federal taxation, but most states do not impose a state tax on social security. These 10 states do tax it, however: Colorado, Connecticut, Kansas, Minnesota, Montana, Nebraska, New Mexico, Rhode Island, Utah and Vermont. Most of these states do reduce the tax burden based on the age or income level of the person to avoid creating undue hardship.

You may want to sit down with a financial advisor to determine whether moving to another state to avoid these taxes would be financially beneficial to you enough to justify the inconvenience and expense of moving. In some cases, it would not require a distant move. For example, a resident of Omaha, Nebraska could avoid state social security taxation by moving just across the Missouri River to Council Bluffs, Iowa.

Stretch your Social Security Overseas

If you’re adventurous, consider retiring abroad to really stretch your Social Security benefits. In Mexico, for example, the cost of living is about half that in the United States. Panama, Costa Rica, and Uruguay are other popular destinations for American citizens retiring abroad. Before taking the plunge, research your options thoroughly, be prepared to learn a foreign language, downsize your life, and be willing to sacrifice some of the lifestyle and customs you’re used to in the United States. The sacrifice is worth it though, to have an adventure that may turn out to be the high point of your life.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.