retirement

Social Security 2025: The new COLA Number Announced

Published:

Last Updated:

24/7 Wall St. Key Takeaways:

The Social Security Administration recently announced a 2.5% cost-of-living adjustment (COLA) for 2025. This means that over 72.5 million Americans will see an increase in their Social Security and Supplement Security Income.

2.5% translates to an increase in benefits by around $50 monthly, starting in January. At the same time, this increase is lower than last year’s 3.2%. That’s because inflation data was lower this year than in the previous year.

In this article, we’ll dive into the 2025 COLA in more depth and look at what it means for beneficiaries. For more information, see our Social Security guide.

The COLA is designed to help Social Security recipients keep pace with inflation and rising living expenses. Without it, Social Security would lose purchasing power.

The 2.5% COLA increase, which kicks in in January 2025, will provide a financial boost for millions of Americans. Most recipients will see their benefits increase by around $50.

This adjustment will help recipients have purchasing power similar to what they did last year. The SSA is basically saying the household expenses increased by $50 a month in the last year, and they’re raising Social Security to cover that extra.

The average COLA for the last decade has been around 2.6%. Therefore, this year’s increase is very similar to what we’ve seen in years prior. It’s slightly smaller, but that extra tenth of a percentage only translates to a few dollars.

Still, this should give beneficiaries the boost they need to keep up with rising inflation.

COLA adjustments are tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the changes in goods and services the average household purchases.

In addition to the usual COLA increase, other adjustments will also take effect in January 2025. One of the most notable changes is the rise in the maximum amount of earnings subject to Social Security taxes, known as the taxable maximum. For 2025, this limit will increase from $168,600 to $176,100.

This change is due to higher average wages. Because the average wage is higher, the limit increase needs to be raised, too.

Wage-based adjustments like this one help the program stay aligned with the income landscape, which is constantly evolving.

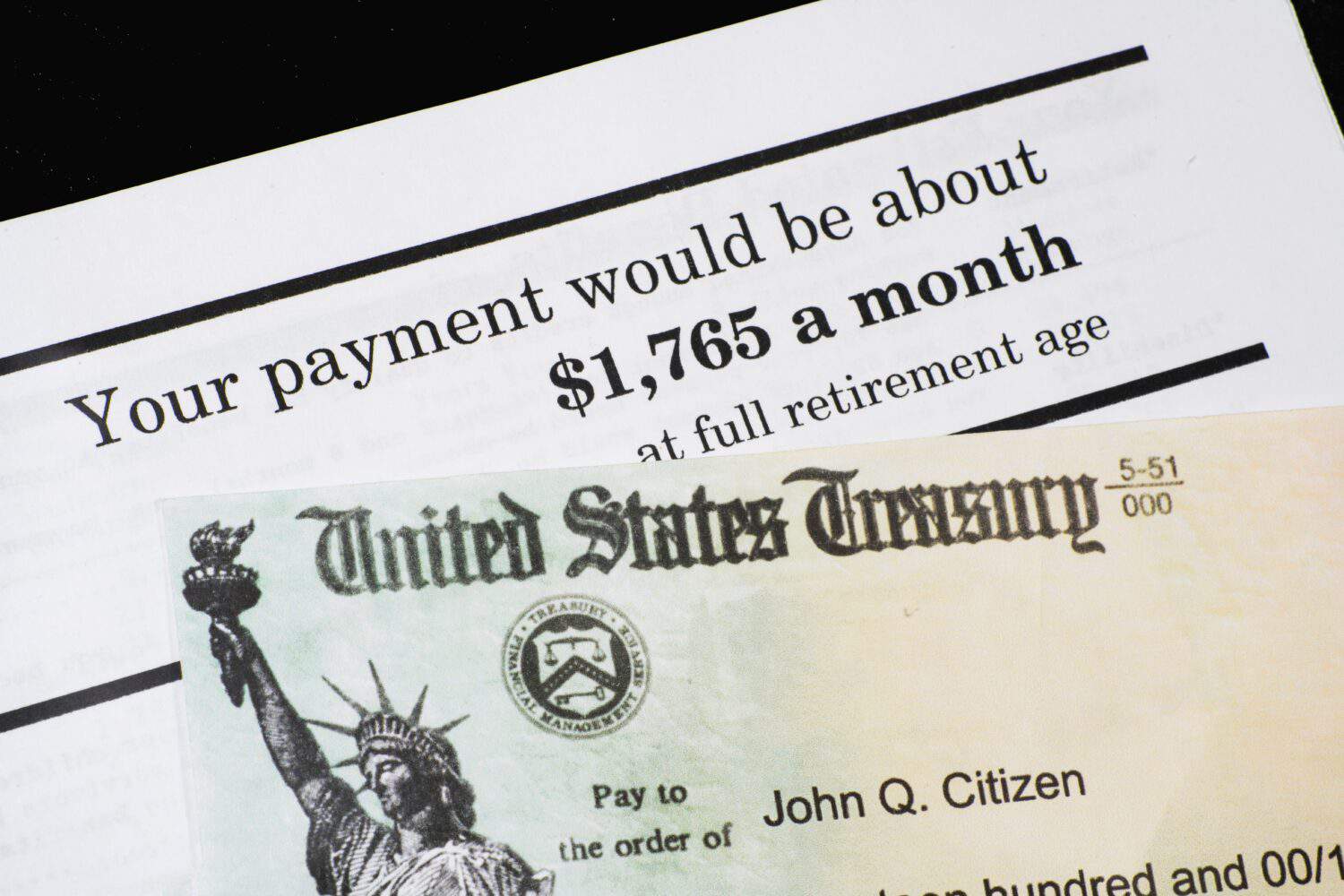

This year, the Social Security Administration has made it easier for beneficiaries to look at their new benefit information (which will change with the new COLA). Starting in December, all beneficiaries will receive a new COLA notice that will increase the exact dollar amount of your new benefits and deductions.

This paper should be pretty straightforward and should tell you exactly how much you can expect your monthly check to be in 2025.

You can also view your COLA notice online by logging into your personal My Social Security account. You can see your updated benefit details faster online. If you don’t have an account yet, you can make one before November 20th to see your new benefit amount.

This account also lets you see other updates and announcements from the Social Security Administration, so it’s a good idea to get one set up.

For those receiving Medicare, it’s important to keep an eye on how COLA and other Social Security changes may impact your Medicare premiums. Information about 2025 medicare changes will be available at Medicare.gov.

The final details about your benefit amount will be accessible through your Social Security account in late November. Keep an eye on a Medicare announcement that will come out at a similar time.

Medicare premiums can sometimes offset part of the COLA increase, so you need to review both your Social Security and Medicare statements to see how much money you’re really receiving extra each month.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.