Services

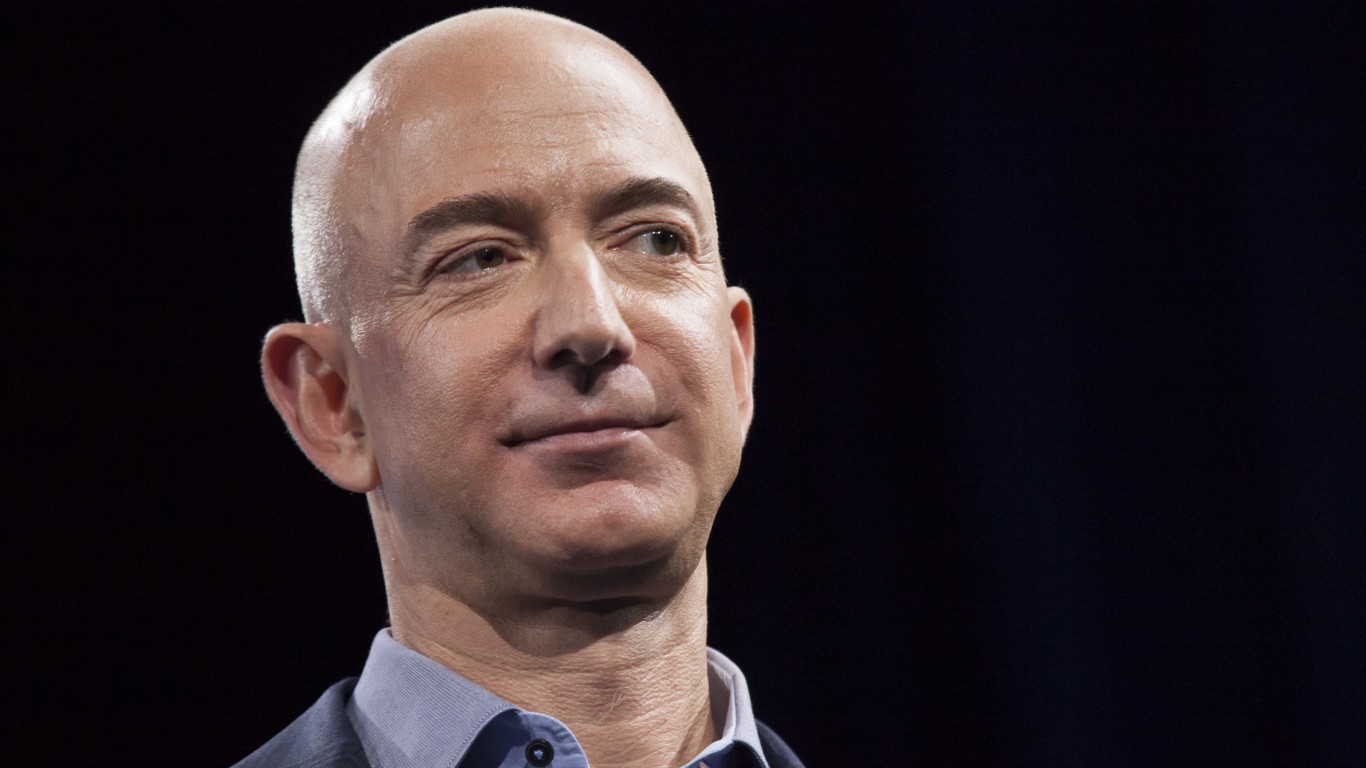

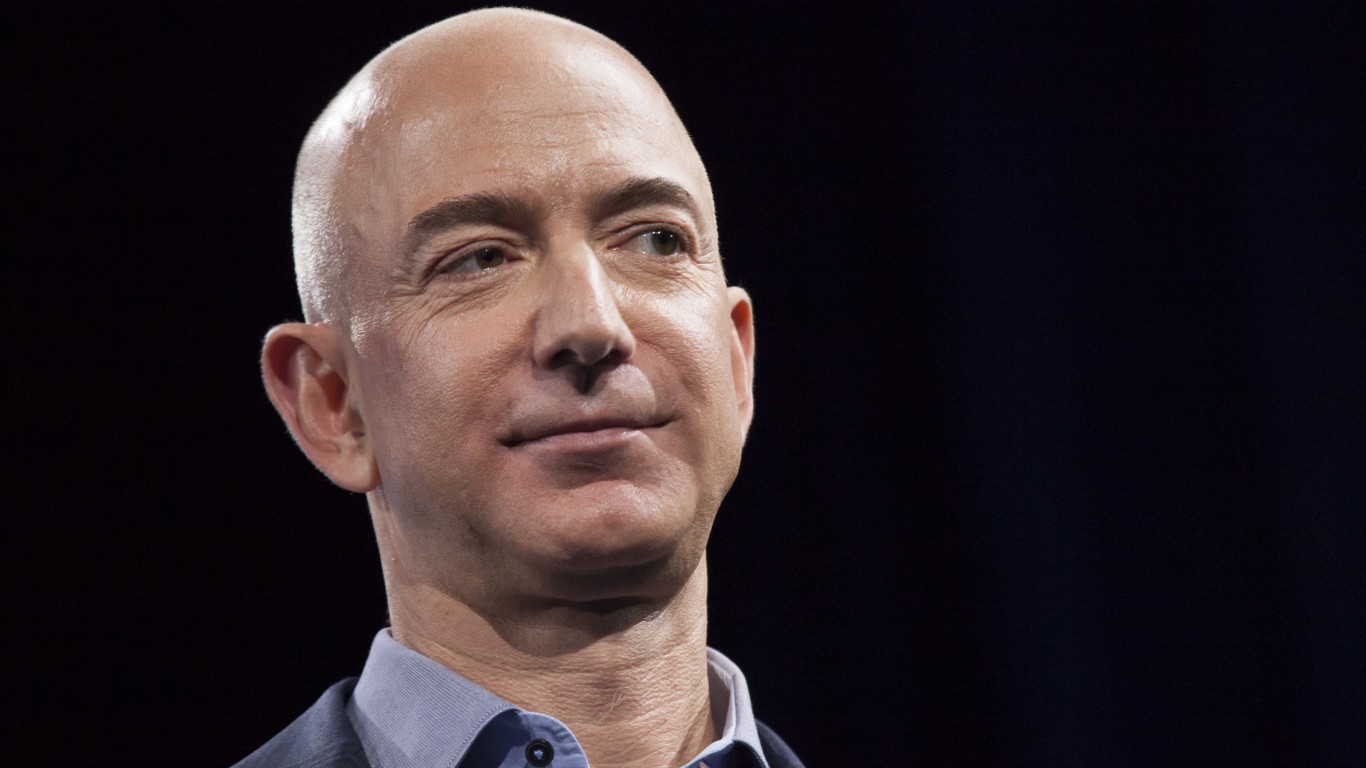

Will Amazon Stock Make Jeff Bezos the First Trillionaire?

Published:

Last Updated:

While the coronavirus pandemic has decimated the U.S. economy and many businesses are struggling to survive, Amazon.com Inc. (NASDAQ: AMZN) has been riding a wave of unprecedented demand. And last week the question was raised, will Amazon founder and chief executive Jeff Bezos become the world’s first trillionaire?

The question was prompted by a study from New York-based Comparisun, a content and comparison platform for medium and small businesses. It said that Bezos could potentially become the world’s first trillionaire as early as 2026 if his net worth continues growing at its present rate, about 34% on average over the last five years. This even takes into account the $38 billion he paid to his ex-wife in their divorce settlement.

When the projection surfaced, social media reacted strongly. In general, the comments were unfavorable. One tweeted that “No one and I do mean no one should have that type of money.” Another said “it’s unsafe and awful” while a third called it “morally wrong.”

Here are other tweets:

If Jeff Bezos’ net worth does reach a trillion (he’s still a way off yet), he will be worth more than the individual GDPs of 179 countries with a combined population of 3.4bn (43.7% of all humans alive today). https://t.co/G5TO8zetZE

— Has Jeff Bezos Decided To End World Hunger? (@HasBezosDecided) May 14, 2020

Democratic U.S. House member Bonnie Watson Coleman weighed in:

Jeff Bezos is expected to become the 1st trillionaire as he consolidates the retail market during coronavirus.

Now Amazon is telling its workers (who have faced significant risk) that it’ll be ending their hazard pay at the end of MAY!

Atrocious greed.https://t.co/JOcsZBwSGo

— Rep. Bonnie Watson Coleman (@RepBonnie) May 13, 2020

Kimberly Graham, who is seeking the Democratic nomination for U.S. Senate in Iowa, wrote:

The Federal Minimum Wage is still $7.25 an hour.

The system is rigged by people like Jeff Bezos for people like Jeff Bezos.https://t.co/MIPy4KMymc

— Kimberly Graham For US Senate (IA) (@KimberlyforIowa) May 14, 2020

The Comparisun projection makes a lot of big assumptions, including that the value of the online shopping behemoth will continue rising as much as it has in the last five year, that Bezos’ personal wealth will continue growing at the same rate, and that Bezos will not make a huge philanthropic gift in an effort to address a large global problem.

Stock market analysts expect Amazon stock to outperform over the long term. Even after lockdowns because of the COVID-19 pandemic are lifted, a portion of the population will mostly stay at home after businesses reopen. They’ll continue to shop online and enjoy entertainment from streaming services, like Amazon Prime.

In first-quarter earnings reported last month, Amazon said that it had $5.01 in earnings per share (EPS) and $75.5 billion in revenue, compared with consensus estimates that called for $6.25 in EPS and $73.6 billion in revenue. In the same period of last year, Amazon reported $7.09 in EPS and $59.70 billion in revenue.

The company said it expects to see net sales in the range of $75 billion to $81 billion, and income ranging from an operating loss of $1.5 billion to an operating profit of $1.5 billion in the second quarter.

A loss is possible because the company says it will spend $4 billion in response to COVID-19. Some Amazon workers have contracted the disease, resulting in a few protests over worker safety. The company says it will spend $300 million in the next quarter to develop testing capabilities for its workforce.

Shares of Amazon closed Monday at $2,409.78, off from the 52-week high of $2,475. Amazon shares have risen nearly 30% year to date. In comparison, the S&P 500 is down over 10% for the same period.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.