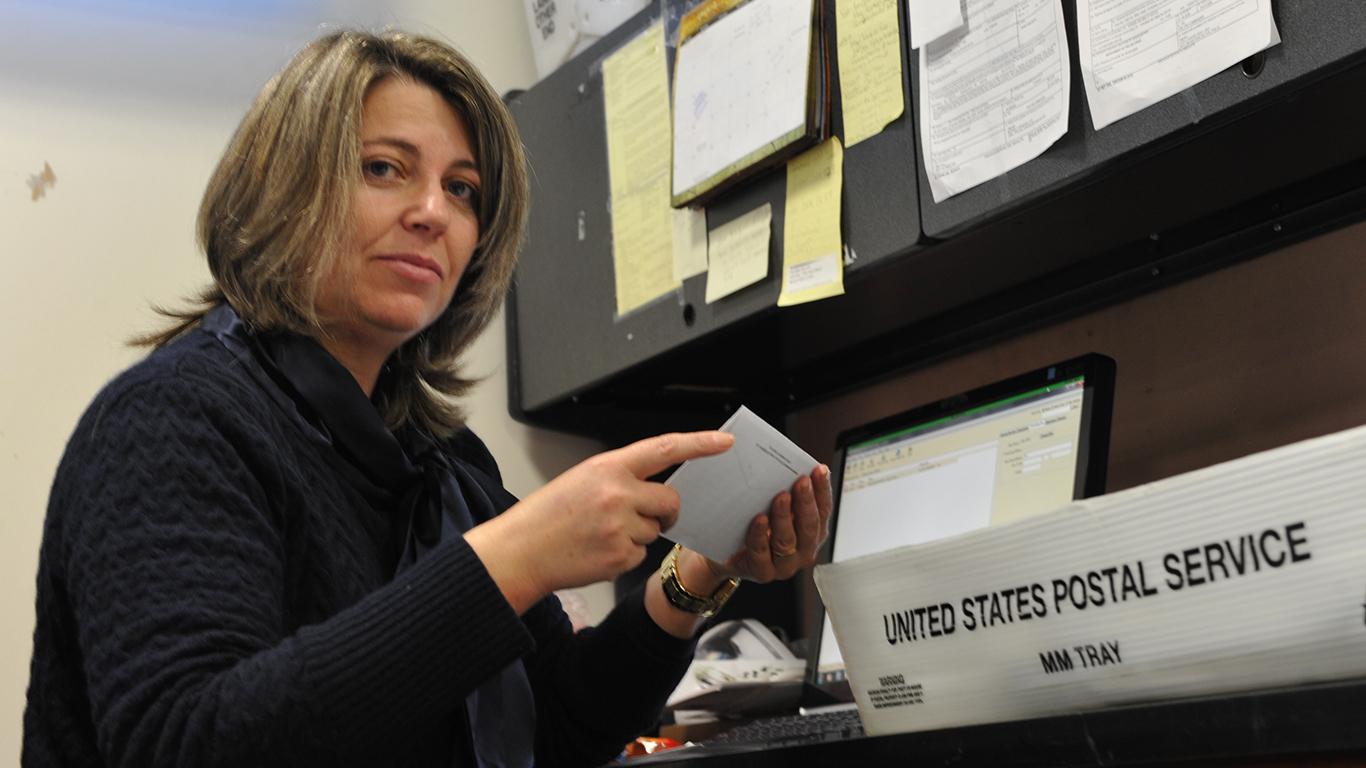

Based on several studies, the typical U.S. Postal Service (USPS) employee makes approximately $60,000. Most of the service’s 600,000 career employees also get extremely generous benefits upon retirement. Prefunded retirement costs have cost the USPS billions of dollars. New legislation should take away this obligation. Postal worker pay should be contrasted with the real median personal income in the United States of just below $38,000, according to the St. Louis Federal Reserve.

The USPS pay rates come from PayScale, Comparably and Post Office Placement. That puts USPS worker compensation at 57% higher than the real median personal income of the working population. Is it any wonder the USPS struggles to make money?

The USPS loss grew by $2 billion in the fiscal year just ended. It blamed higher inflation. Usually, companies handle inflation-based losses with cost cuts, including layoffs. To be firmly in the black, the USPS would need to trim $1 billion in expenses. Revenue growth is not a solution. The fiscal year’s revenue grew only 1.9% to $78.5 billion. Shipping and package revenue dropped and so did international business. Revenue from marketing mail (which includes so-called junk mail) rose. So did revenue from First-Class Mail.

Mail volume declined 1.2% for the year, another sign the USPS needs to cut costs. The need for those 600,000 full-time workers shrinks if unit volume continues to fall.

There is a fiction that the USPS needs to support over 32,000 locations, many of which are in small towns. It gives no reasonable explanation for this. A spirited defense, with a P&L for each location, would help.

The USPS also continues to deliver mail six times a week. This is unnecessary, particularly with the rise of email and the presence of UPS and FedEx.

The USPS is a disservice to America as long as it overpays workers, has too many offices and delivers mail too often.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.