Special Report

Best and Worst Run States in America -- An Analysis Of All 50

Published:

Last Updated:

How well run are America’s 50 states? The answer depends a lot on where you live.

How well run are America’s 50 states? The answer depends a lot on where you live.

For the second year, 24/7 Wall St. has reviewed data on financial health, standard of living and government services by state to determine how well each state is managed. Based on this data, 24/7 Wall St. ranked the 50 states from the best to worst run. The best-run state is Wyoming. The worst-run state is California.

Read: The Best Run States In America

Read: The Worst Run States In America

Comparing the 50 states can be a challenge because they are so different. Some states have abundant natural resources while others rely on service or innovation. State populations also can be more rural or more urban. Some had booming industries that are waning or that have disappeared altogether. Border states with large immigrant communities have populations that are growing rapidly. Many states in the Northeast are not growing at all. All of these factors affect the finances and the living conditions in a state.

Despite these differences, states can do a great deal to control their fate. Well-run states have a great deal in common with well-run corporations. Books are kept balanced. Investment is prudent. Debt is sustainable. Innovation is prized. Workers are well-chosen and well-trained. Executives, including elected and appointed officials, are retained based on merit and not politics.

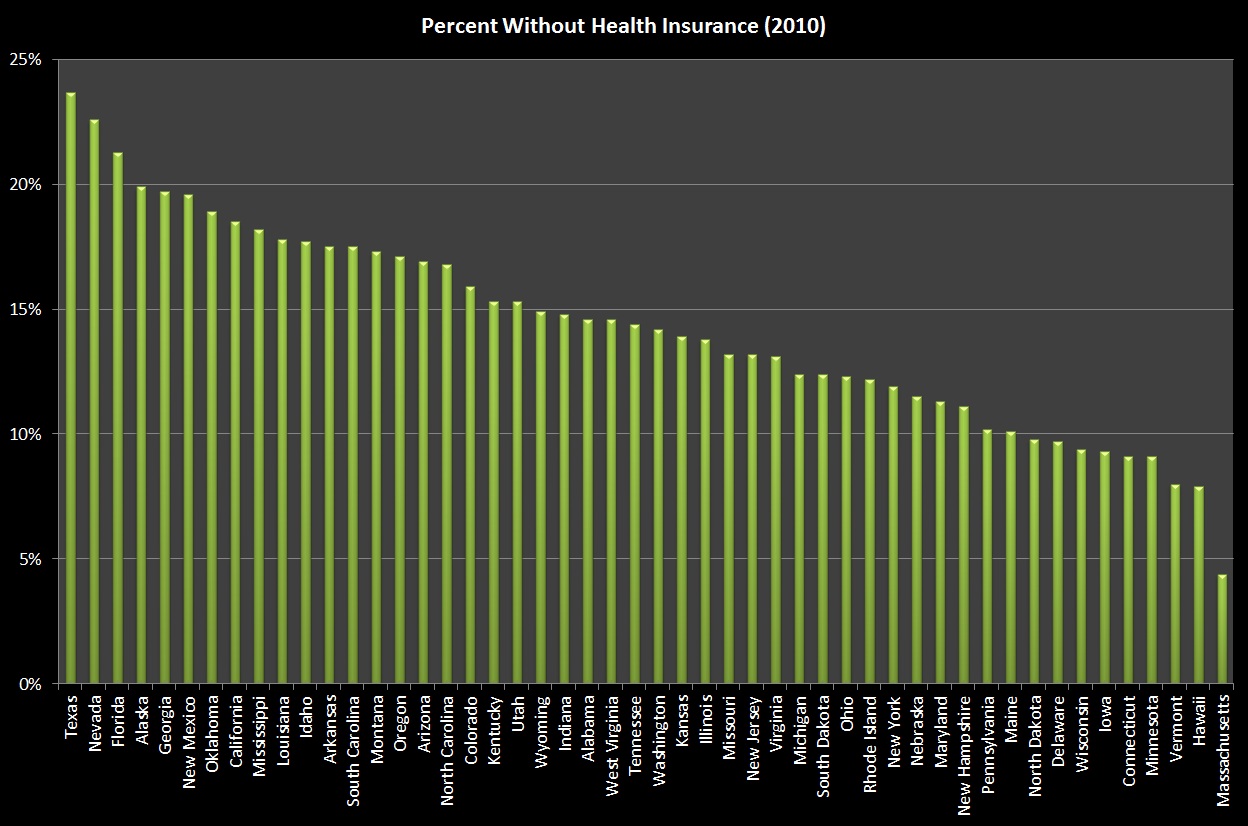

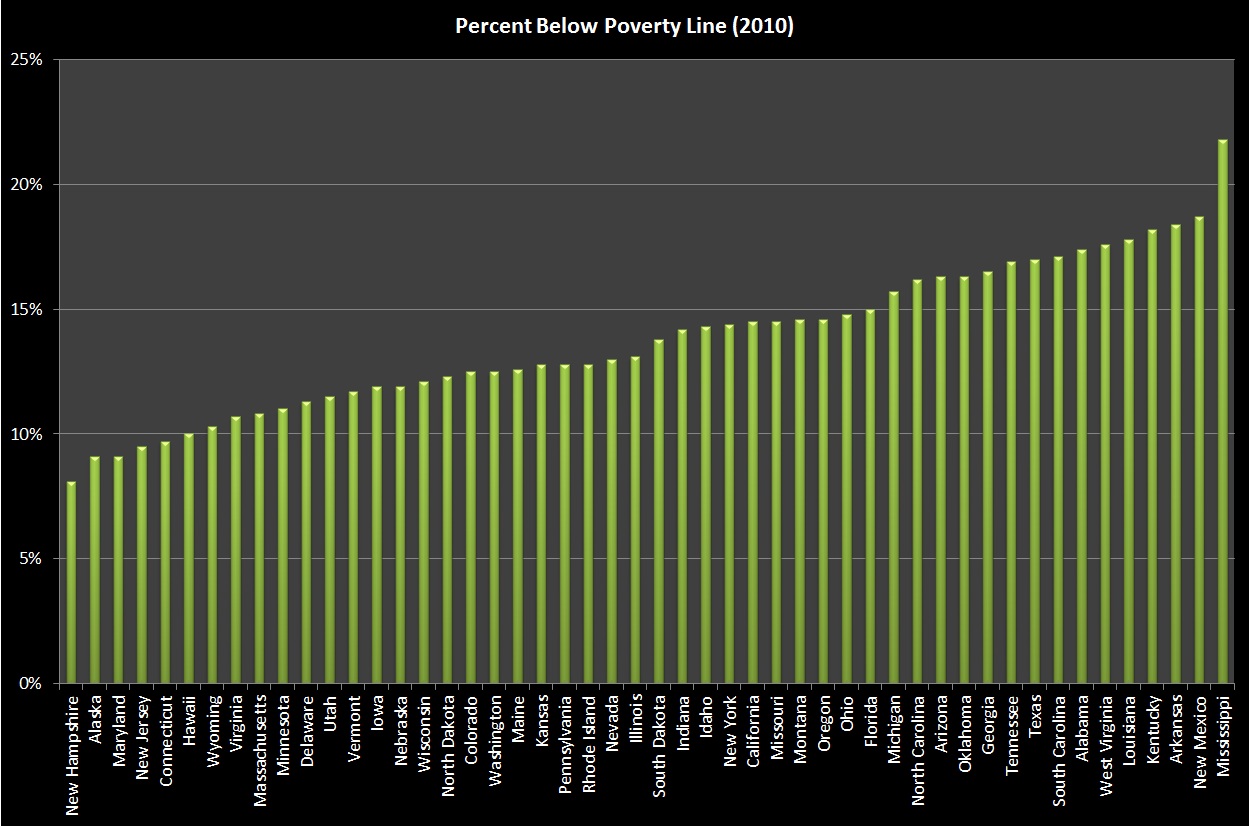

To determine how well — or how poorly — a state is run, 24/7 Wall St. weighed each state’s financial health based on factors including credit score and debt. We also evaluated how a state uses its resources to provide its residents with high living standards, reviewing dimensions such as health insurance, employment rate, low crime and a good education. We considered hundreds of data sets and chose what we considered to be the 10 most important measurements of financial and government management.

This year, as a new component of our analysis, 24/7 Wall St. obtained additional budget data for each state. Examining the state’s revenue and expenditures, and what each government opted to spend money on, allowed us to determine if a state overspent limited resources, failed to devote funds to an urgent need of its citizens or spent a great deal of money but with poor results. While we did not use expenditures or revenue in our ranking, these numbers reflect how a state is managed. Together with other budget data, living standards and government services, it provided a complete picture of the management of each state. A fuller accounting of our methodology can be found at the end of the article.

The 24/7 Wall St. Best and Worst Run States is meant to be an analysis that will focus the debate about state management and financial operations. The analysis should also serve to empower and inform citizens who want who want to better understand the impact government decisions have on each state.

This is 24/7 Wall St.’s Best and Worst Run States in America.

1. Wyoming

> State debt per capita: $2,452 (18th lowest)

> Pct. without health insurance: 14.9% (21st highest)

> Pct. below poverty line: 10.3% (7th lowest)

> Unemployment: 5.8% (6th lowest)

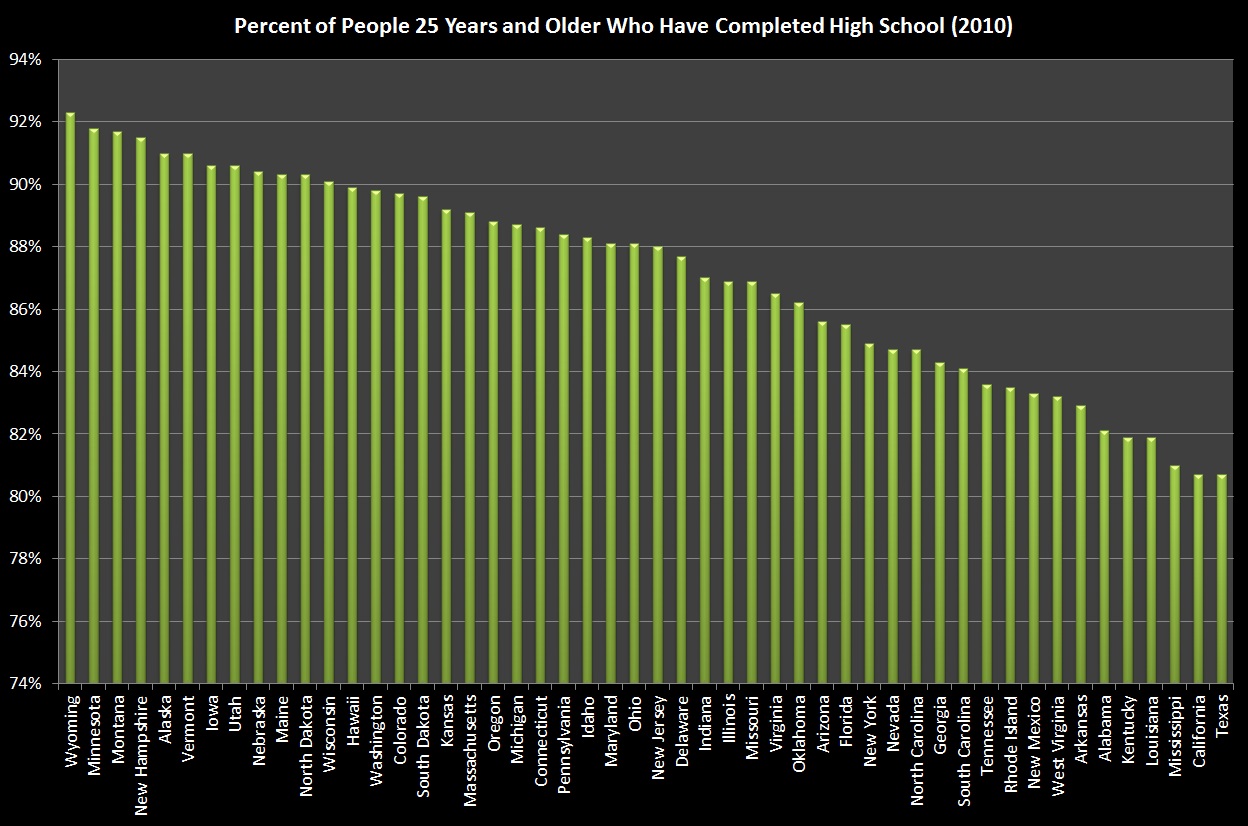

Wyoming comes in first place in 24/7 Wall St.’s Best Run States for the second year in a row. The state has high marks in many categories including high school graduation rate. A whopping 92.3% of state residents age 25 or older have at least a high school diploma — the highest rate in the country. The state also has the fourth lowest rate of violent crimes and the sixth lowest unemployment rate. Wyoming has the smallest population of any state in the country.

2. Nebraska

> State debt per capita: $1,407 (4th lowest)

> Pct. without health insurance: 11.5% (14th lowest)

> Pct. below poverty line: 11.9% (tied for 14th lowest)

> Unemployment: 4.2% (2nd lowest)

The state of Nebraska had the 21st lowest revenue per capita in the country in 2009 yet managed to spend more per capita that year than all but seven states. The state has the fourth lowest debt per capita, and it is one of 13 states with a perfect AAA credit rating. Besides being financially sound, Nebraska also has an unemployment rate of 4.2%, the second lowest rate in the country. The state also has relatively low poverty, high graduation rates and the seventh lowest rate of foreclosures last month.

Also Read: The States Doing The Most (and Least) To Spread The Wealth

3. North Dakota

> State debt per capita: $2,721 (20th lowest)

> Pct. without health insurance: 9.8% (9th lowest)

> Pct. below poverty line: 12.3% (17th lowest)

> Unemployment: 3.5% (the lowest)

One of the best measures of North Dakota’s success is its unemployment rate of 3.5% — the lowest in the country and one that has n0t been above 5% in over 20 years. While the state has relied on a stable agriculture sector to keep unemployment low, the booming oil industry has created a $1 billion surplus in the past three years. From 2009 to 2011 Montana was the only other state to report a surplus, according to the Center on Budget and Policy Priorities.

Click here to view a larger image of median household income

4. Minnesota

> State debt per capita: $1,790 (8th lowest)

> Pct. without health insurance: 9.1% (4th lowest)

> Pct. below poverty line: 11.0% (10th lowest)

> Unemployment: 6.9% (14th lowest)

Minnesota moved up in the ranking from fifth to fourth due to its improvement in several categories, including violent crime rate and health insurance coverage. In 2010, just 9.1% of state residents were without health insurance coverage — the fourth best rate in the country. The state also continues to excel in the areas it did last year. Some 91.5% of the state’s adult population has graduated high school — the second highest percentage in the country. The state also has the eighth lowest debt per capita.

5. Iowa

> State debt per capita: $2,117 (13th lowest)

> Pct. without health insurance: 9.3% (6th lowest)

> Pct. below poverty line: 11.9% (tied for 14th lowest)

> Unemployment: 6% (8th lowest)

Iowa’s greatest assets are its rates of educated and insured residents. Some 90.6% of residents 25 years and older have at least a high school diploma and only 9.3% of residents do not have health insurance. These are among the best rates in the country. Iowa also has an exceptionally low unemployment rate and the highest credit rating available, demonstrating its healthy economy.

6. Utah

> State debt per capita: $2,274 (15th lowest)

> Pct. without health insurance: 15.3% (20th highest)

> Pct. below poverty line: 11.5% (12th lowest)

> Unemployment: 7.4% (17th lowest)

Utah kept the same rank it had in our last survey. The state has the fifth-lowest violent crime rate in the country, as well as the seventh-highest graduation rate in the country. However, Utah had one of the higher foreclosure rates in the country in October, and 15.3% of the population — an above-average rate — is without health insurance.

7. Vermont

> State debt per capita: $5,514 (9th highest)

> Pct. without health insurance: 8% (3rd lowest)

> Pct. below poverty line: 11.7% (13th lowest)

> Unemployment: 5.8% (5th lowest)

Vermont does extremely well in a number of areas considered for this list. Residents are highly educated. It has the second lowest rate of violent crime in the country. It has the third lowest percentage of uninsured residents. However, the state has saddled its citizens with debt. Vermont’s debt per capita is more than $5,500, which is the ninth highest in the country.

Also Read: The Twenty-Five Most Valuable Blogs In America

8. Virginia

> State debt per capita: $3,100 (22nd lowest)

> Pct. without health insurance: 13.1% (20th lowest)

> Pct. below poverty line: 10.7% (8th lowest)

> Unemployment: 6.5% (10th lowest)

Virginia is the highest-ranked state in the southern U.S., largely because it does not suffer from many of the problems that plague the rest of the South. The state has a median income of $60,674, the eighth-highest in the country, as well as a poverty rate of 10.7%, which is the eighth lowest. The state also has the sixth-lowest violent crime rate in the country, with just 213 incidents taking place in 2010 for every 100,000 people.

9. Kansas

> State debt per capita: $2,086 (10th lowest)

> Pct. without health insurance: 13.9% (24th lowest)

> Pct. below poverty line: 12.8% (tied for 21st lowest)

> Unemployment: 6.7% (12th lowest)

Kansas has the 10th-lowest state debt per capita in the country. However, the state’s ranking may change as its debt grows. According to The Hutchinson News, borrowing by school districts has increased over 800% since 1990. Kansas has a relatively low unemployment rate of 6.7% compared to the national rate of 9.1%.

10. South Dakota

> State debt per capita: $4,485 (12th highest)

> Pct. without health insurance: 12.4% (18th lowest)

> Pct. below poverty line: 13.8% (25th highest)

> Unemployment: 4.6% (3rd lowest)

South Dakota rounds out our list of the 10 best-run states in the country. While the state is slightly below average in median income and poverty, otherwise things are going quite well in the state. South Dakota has the third-lowest unemployment rate in the country. It is also one of the few states to truly avoid the worst parts of the housing crisis. Just one in 4,352 homes was foreclosed in October — the fourth lowest rate in the country.

Read: The Worst Run States In America

11. Maryland

> State debt per capita: $4,133 (14th highest)

> Pct. without health insurance: 11.3% (13th lowest)

> Pct. below poverty line: 9.1% (tied for 2nd lowest)

> Unemployment: 7.4% (16th lowest)

Despite its relatively high state debt of $4,133 per person, Maryland has a credit rating of AAA, the highest available. The state also has a particularly low poverty rate. Only 9.1% of people are living below the poverty line — the third lowest in the country. These impressive figures may be the result of state lawmakers’ efforts, according to Al Passarella, research and policy associate at Advocates for Children and Youth, as reported in The Washington Times. However, the number of Maryland residents in poverty increased by nearly 80,000 from 2009 to 2010, the paper notes.

12. Hawaii

> State debt per capita: $5,328 (10th highest)

> Pct. without health insurance: 7.9% (2nd lowest)

> Pct. below poverty line: 10.0% (6th lowest)

> Unemployment: 6.4% (9th lowest)

Hawaii dropped two slots (from 10th to 12th) on our list because of the decline in median household income and an unchanged unemployment rate — many states have improved in the past year. However, the state’s overall picture is a positive one. Just 7.9% of state residents are without health insurance, the second-lowest rate in the country. Hawaii also ranks in the highest 10 for median household income, and among the lowest 10 in poverty and unemployment.

Also Read: Ten Brands That Will Disappear In 2012

13. New Hampshire

> State debt per capita: $6,357 (7th highest)

> Pct. without health insurance: 11.1% (12th lowest)

> Pct. below poverty line: 8.1% (the lowest)

> Unemployment: 5.4% (4th lowest)

New Hampshire has a poverty rate of only 8.1% — the lowest in the country and down from 8.5% last year. The state also has the third lowest rate of violent crime and the fourth lowest unemployment rate. The state’s finances are not perfect, however. It has the seventh highest debt per capita and a credit rating of AA, which is two grades below the best. The state government is trying to address this problem. On March 30, 2011, the New Hampshire House approved a bill that would make deep cuts to social and health programs and limit collective bargaining rights — aimed at restricting how unions impact these programs.

14. Maine

> State debt per capita: $4,092 (15th highest)

> Pct. without health insurance: 10.1% (10th lowest)

> Pct. below poverty line: 12.6% (20th lowest)

> Unemployment: 7.5% (18th lowest)

Maine has moved up three spots from last year’s ranking, partially because of improvements in health insurance coverage and unemployment. For the second year in a row, Maine sports the lowest violent crime rate in the country, at 122 incidents per 100,000 people. Fiscally, the state is not as sound as others. The state only has an AA credit rating. In the fiscal year 2009, the state had a debt of $4,092 per person, the 15th highest in the country.

15. Pennsylvania

> State debt per capita: $3,331 (25th highest)

> Pct. without health insurance: 10.2% (11th lowest)

> Pct. below poverty line: 12.8% (tied for 21st lowest)

> Unemployment: 8.3% (24th highest)

Only 10.2% of Pennsylvania residents go without health insurance. This includes residents covered under adultBasic, a state-funded health plan for low-income adults. This program was canceled early this year due to financial restrictions. In 2009, the state collected revenues of just over $3,000 per person. At the same time, it spent over $6,100 per person.

16. Wisconsin

> State debt per capita: $3,707 (19th highest)

> Pct. without health insurance: 9.4% (7th lowest)

> Pct. below poverty line: 12.1% (16th lowest)

> Unemployment: 7.8% (21st lowest)

Wisconsin would perform much better on our list if it were not for its fiscal scores. The state only has a AA credit rating, and its $3,707 of state debt per capita is the 19th worst in the country. However, the state performs better than average in median household income, poverty rate and unemployment. Also, just 9.4% of the state’s population is without health insurance, a better rate than all but six states.

17. Washington

> State debt per capita: $3,719 (18th highest)

> Pct. without health insurance: 14.2% (25th lowest)

> Pct. below poverty line: 12.5% (tied for 18th lowest)

> Unemployment: 9.1% (16th highest)

Washington state has moved down one slot from last year’s rank, partially due to an increase in unemployment and an increase in poverty rate. On the whole, the state performs better than average in most categories, including household income, violent crime rate and high school graduation. And while the state does not make it to the top 10 in any single category, it also avoids the bottom 10 in each.

18. Alaska

> State debt per capita: $9,505 (2nd highest)

> Pct. without health insurance: 19.9% (4th highest)

> Pct. below poverty line: 9.1% (tied for 2nd lowest)

> Unemployment: 7.6% (19th lowest)

Alaska performs exceptionally well in a number of categories. It has the second lowest percentage of people below the poverty line and the fifth highest percentage of adults with high school diplomas. However, the state has the second highest debt per capita. It also has the second highest rate of violent crime.

19. North Carolina

> State debt per capita: $2,138 (14th highest)

> Pct. without health insurance: 16.8% (17th highest)

> Pct. below poverty line: 16.2% (14th highest)

> Unemployment: 10.5% (8th highest)

North Carolina has jumped five spots compared to last year’s ranking, largely because of the substantial reduction in violent crime over the past year. The rate dropped from 467 violent crimes for every 100,000 residents in 2009, to 363 per 100,000 people in 2010. Despite a healthy budget, including a AAA credit rating and low debt per capita, North Carolina still performs worse than average in a number of categories, including high school graduation rate, unemployment, health insurance coverage and poverty.

20. Missouri

> State debt per capita: $3,218 (24th highest)

> Pct. without health insurance: 13.2% (21st highest)

> Pct. below poverty line: 14.5% (tied for 21st highest)

> Unemployment: 8.7% (22nd highest)

Missouri has moved up five spots from last year’s rank of 24 partly because its unemployment rate has decreased from 9.3% to 8.7%. The state also boasts a AAA credit rating from S&P thanks to state efforts to fund its debts.

21. Delaware

> State debt per capita: $6,796 (5th highest)

> Pct. without health insurance: 9.7% (8th lowest)

> Pct. below poverty line: 11.3% (11th lowest)

> Unemployment: 8.1% (23rd lowest)

Delaware has fallen 10 spots since last year’s ranking. It has the third highest rate of violent crime in the country, worse than it was last year. The state also has the fifth largest debt per capita. On the other hand, it has one of the lowest rates of residents without health insurance and a relatively small percentage of people living below the poverty line.

22. Connecticut

> State debt per capita: $8,088 (4th highest)

> Pct. without health insurance: 9.1% (4th lowest)

> Pct. below poverty line: 9.7% (5th lowest)

> Unemployment: 8.9% (tied for 20th highest)

Connecticut is a relatively wealthy state with the fourth greatest median household income in the country. This is reflected in the tax and spending habits of its government. In 2009, the state collected the sixth largest amount in revenue per capita and spent the eighth largest amount. The state has the fourth lowest percentage of residents without health insurance, thanks in part to state programs such as Charter Oaks Health Plan and Husky Healthcare. However, the state ranks fourth worst when it comes to state debt, owing $8,088 per person.

23. Indiana

> State debt per capita: $3,702 (20th highest)

> Pct. without health insurance: 14.8% (22nd highest)

> Pct. below poverty line: 14.2% (24th highest)

> Unemployment: 8.9% (tied for 20th highest)

Indiana ranks only 23nd on our list of best-run states, but that is a marked improvement from last year’s 29th spot. The state’s scores improved this year in unemployment, violent crime and the percentage of the state’s adult population with a high school diploma. The state still has a great deal of room for improvement, as it ranks in the bottom two-thirds for every single category except for credit rating.

Also Read: The Most Valuable Movie Franchises Of All-Time

24. Ohio

> State debt per capita: $2,423 (17th lowest)

> Pct. without health insurance: 12.3% (17th lowest)

> Pct. below poverty line: 14.8% (17th highest)

> Unemployment: 9.1% (17th highest)

Ohio’s state revenue in the fiscal year of 2009 was the fourth-lowest in the country. In the same time period, the state spent $71 billion, nearly three times that amount per resident. Despite that fact, Ohio still has an AA+ credit rating and a below-average debt per capita. Ohio scores worse than average on unemployment, median income, foreclosures and poverty. The state does slightly better on graduation rates. Ohio also spends a higher portion of its budget on education than most states.

25. Texas

> State debt per capita: $1,240 (2nd lowest)

> Pct. without health insurance: 23.7% (the highest)

> Pct. below poverty line: 17.0% (9th highest)

> Unemployment: 8.5% (23rd highest)

Texas managed to spend the third least per capita in 2009, and as a partial consequence has the second lowest debt per capita, a mere $1,240 per person. Austere spending comes at a price, however. Nearly a quarter of the state’s residents are without health insurance. Also, only 80.9% of Texans 25 years or older graduated from high school. While this is an improvement from its 2003 rate of 77%, it is tied with California for worst among all states.

26. Idaho

> State debt per capita: $2,284 (16th lowest)

> Pct. without health insurance: 17.7% (11th highest)

> Pct. below poverty line: 14.3% (23rd highest)

> Unemployment: 9% (19th highest)

Idaho has the seventh-lowest violent crime rate in the country, a manageable debt per capita and a AA+ credit rating. Otherwise, the state leaves much to be desired. It has the 11th highest rate of residents without health insurance coverage. It also had one of the highest foreclosure rates in the country last month. On a state and local level combined, Idaho spends less per capita than any state in the country on its population.

27. Montana

> State debt per capita: $4,903 (11th highest)

> Pct. without health insurance: 17.3% (13th highest)

> Pct. below poverty line: 14.6% (tied for 19th highest)

> Unemployment: 7.7% (20th lowest)

Montana’s neighbor, Wyoming, has a debt per capita of $2,452 and a AAA rating. Montana state debt per resident is almost exactly double that, and the state has a AA rating to show for it. Despite the fact that the state’s debt is higher, it actually spends significantly less per person in most key areas than Wyoming. The state has a high percentage of high school graduates among its adult population and a healthy housing market, but otherwise does relatively poorly. The state is worse than average in health insurance coverage and poverty. It also has the 11th lowest median household income in the U.S.

28. Oklahoma

> State debt per capita: $2,689 (19th lowest)

> Pct. without health insurance: 18.9% (7th highest)

> Pct. below poverty line: 16.3% (tied for 13th highest)

> Unemployment: 5.9% (7th lowest)

Oklahoma has improved since last year’s ranking, moving up from 32nd place to 27th. One significant change has been the state’s improved unemployment rate, which fell from 7% last year to 5.9%. Many of these new job gains fall within the professional and business services category, a field which can be spurred or hindered by state taxes. Home prices in Oklahoma have increased just under 18% since 2006. However, the state also has a fairly high percentage of residents without health insurance.

29. Tennessee

> State debt per capita: $773 (the lowest)

> Pct. without health insurance: 14.4% (25th highest)

> Pct. below poverty line: 16.9% (10th highest)

> Unemployment: 9.8% (11th highest)

Tennessee has less debt per capita than any state in the country, a mere $773 per person. In contrast, Massachusetts’ debt per resident is $11,357. Because of its low debt, the state has earned a credit rating of AA+ by Standard & Poor’s. The state spends the second-least per capita each year, which is helpful in keeping its debt low, but it also means many programs go underfunded. For example, it spends less per capita than any state in the country on education. It also happens to have the 11th lowest percentage of adults with a high school diploma.

30. Massachusetts

> State debt per capita: $11,357 (the highest)

> Pct. without health insurance: 4.4% (the lowest)

> Pct. below poverty line: 10.8% (9th lowest)

> Unemployment: 7.3% (15th lowest)

Massachusetts provides many benefits to its residents. For instance, as a result of its widely-talked about health insurance system, only 4.4% of people are uninsured — the lowest rate in the country. The state also spends a large amount on cash assistance for needy families and on pension benefits for retired state employees. To provide this much, however, the state must spend a lot. As a result, Massachusetts has the highest state debt per capita in the country.

31. Oregon

> State debt per capita: $3,284 (15th lowest)

> Pct. without health insurance: 17.1% (15th highest)

> Pct. below poverty line: 14.6% (tied for 19th highest)

> Unemployment: 9.6% (14th highest)

In 2009, Oregon had the second-lowest revenue per capita and spent the 20th most per capita in the state budget. Oregon has a higher-than-average rate of adults with a high school education, as well as the 12th-lowest violent crime rate in the country. But the state otherwise performs quite poorly. Oregon has worse-than-average poverty rate, health insurance coverage and unemployment. Meanwhile, the state had the ninth-highest foreclosure rate in the country in October — one in every 455 homes.

32. Georgia

> State debt per capita: $1,378 (3rd lowest)

> Pct. without health insurance: 19.7% (5th highest)

> Pct. below poverty line: 16.5% (11th highest)

> Unemployment: 10.3% (9th highest)

In the fiscal year 2009, Georgia’s revenue amounted to $3,419 per person, the 17th lowest revenue in the country. However, the state spent $4,217 per capita that year, the second-lowest expenditure per capita across all programs. The state spent just $984 per person that year on public welfare, the third-lowest amount in the country. This lack of spending contributed to the state’s poverty rate of 16.5% — the 11th highest in the country — and the nearly 20% without health insurance, the fifth highest percentage in the country.

33. Colorado

> State debt per capita: $3,454 (23rd highest)

> Pct. without health insurance: 15.9% (18th highest)

> Pct. below poverty line: 12.5% (tied for 18th lowest)

> Unemployment: 8.3% (25th highest)

Colorado has dropped from 25th place last year to 33rd this year. The state is hurt in part by its housing market. One in every 458 housing units were foreclosed in October 2011. Still, the has a rate of education that is relatively higher than most other states with just under 90% of residents 25 and older finishing a high school education.

Also Read: America’s Favorite Sodas Lose Their Fizz

34. New York

> State debt per capita: $6,288 (8th highest)

> Pct. without health insurance: 11.9% (15th lowest)

> Pct. below poverty line: 14.4% (22nd highest)

> Unemployment: 8% (22nd lowest)

New York state received the seventh greatest revenues per capita in the country and actually spent the sixth most per capita that same year. At $3,553, the state spends the fifth most per person on education. It also spends the most in the country on public welfare at $2,276 per person. However, this high spending has led to continuous fiscal problems in the state. New York has the eighth-highest debt per capita in the country as well as an S&P AA credit rating. Even with the high level of spending, New York falls short in many measurements. It is worse than average in violent crime, high school graduation, poverty and decline in home value since 2006.

35. Arkansas

> State debt per capita: $1,436 (5th lowest)

> Pct. without health insurance: 17.5% (13th highest)

> Pct. below poverty line: 18.4% (3rd highest)

> Unemployment: 8.2% (25th lowest)

Arkansas has the third highest rate of poverty in the country, which in turn hurts its ranking in other categories. It has the third lowest median household income. The state also has a low percentage of residents with high school diploma compared to the other states, as well as a high rate of violent crimes. However, the state has the fifth lowest state debt per capita.

36. Alabama

> State debt per capita: $1,738 (7th lowest)

> Pct. without health insurance: 14.6% (tied for 24th highest)

> Pct. below poverty line: 17.4% (7th highest)

> Unemployment: 9.8% (12th highest)

Alabama only has a AA credit rating, but it maintains one of the lowest debts per capita in the country, at just $1,738 per person. Also, foreclosures are near the average. Otherwise, the state performs among the worst in the country in nearly every considered metric. The state has the fifth-lowest median household income in the country, as well as a poverty rate of 17.4% — the seventh-highest in the country.

37. New Jersey

> State debt per capita: $6,551 (6th highest)

> Pct. without health insurance: 13.2% (21st lowest)

> Pct. below poverty line: 9.5% (4th lowest)

> Unemployment: 9.2% (15th highest)

Despite having the second highest median household in the country, New Jersey performs poorly in a number of areas. Most notably, the state has the sixth highest state debt per capita. Its credit rating was also downgraded from AA to AA- in February 2011 due to concerns over its massive retirement obligations.

38. Mississippi

> State debt per capita: $2,107 (12th lowest)

> Pct. without health insurance: 18.2% (9th highest)

> Pct. below poverty line: 21.8% (the highest)

> Unemployment: 10.6% (tied for 5th highest)

Mississippi has improved six slots from last year and is now out of the bottom 10. The state spends the 11th most in the country on public welfare, yet it remains the poorest in the country. Residents’ median income was just over $36,000 in 2010, with more than one in five living below the poverty line. Both of these statistics are the worst in the U.S. On the other hand, foreclosures in October were the fifth lowest in the country. Also, violent crime has dropped significantly in the state over the past year, from 304.6 incidents per capita in 2009 to 269.7 in 2010.

39. West Virginia

> State debt per capita: $3,578 (22nd highest)

> Pct. without health insurance: 14.6% (tied for 24th highest)

> Pct. below poverty line: 17.6% (6th highest)

> Unemployment: 8.2% (24th highest)

West Virginia has the sixth highest percentage of people living below the poverty line in the country. It also has the eighth lowest percentage of adults with a high school diploma and the second lowest median household income of $38,218. The state also collects far more in revenue compared to other states, while it spends about an average amount.

40. Florida

> State debt per capita: $2,104 (11th lowest)

> Pct. without health insurance: 21.3% (3rd highest)

> Pct. below poverty line: 15.0% (16th highest)

> Unemployment: 10.6% (tied for 5th highest)

Florida was hit hard by the housing crisis. Home values declined the third most-in the country between 2006 and 2010. In October, one in every 423 homes was foreclosed upon. The state spends very little relative to its budget, and so it maintains a low debt per capita and a AAA credit rating. However, its lack of expenditure on public welfare has not helped the state’s poor, unemployed and uninsured citizens. The state had the sixth highest unemployment rate in the country in September. Also, 21.3% of Florida’s population in 2010 was without health insurance, the third-highest rate in the country.

41. New Mexico

> State debt per capita: $4,004 (16th highest)

> Pct. without health insurance: 19.6% (6th highest)

> Pct. below poverty line: 18.7% (12th highest)

> Unemployment: 6.6% (11th lowest)

New Mexico has a relatively low unemployment rate of 6.6% compared with the national average of 9.1%. This is down from 8.6% one year ago. Other statistics are not as promising. At 18.7%, the state has the second highest poverty rate in the country. Worst still, almost 20% of New Mexicans do not have health insurance. The state also has the highest rate of violent crime in the country.

42. Louisiana

> State debt per capita: $3,914 (17th highest)

> Pct. without health insurance: 17.8% (10th highest)

> Pct. below poverty line: 17.8% (5th highest)

> Unemployment: 6.9% (13th lowest)

Louisiana remains in our bottom 10 again this year, although it has improved since last year, primarily because of decreases in unemployment and violent crime rate. In all, however, the state ranks poorly in most of the metrics we considered. Louisiana has the fifth-highest poverty rate in the country, the 10th-highest percentage of residents without health insurance coverage and the fifth lowest percentage of adults with a high school diploma.

43. Rhode Island

> State debt per capita: $8,716 (3rd highest)

> Pct. without health insurance: 12.2% (16th lowest)

> Pct. below poverty line: 12.8% (tied for 21st lowest)

> Unemployment: 10.5% (7th highest)

Rhode Island has many positive attributes, including low violent crime rate and a relatively low poverty rate. However, the state’s spending is exceptionally high, and it has accumulated $8,716 in debt per capita. Nearly 20% of expenditures are for public education, yet compared with other states it has the 10th lowest percentage of adults who have graduated from high school.

44. Kentucky

> State debt per capita: $3,107 (23rd lowest)

> Pct. without health insurance: 15.3% (20th highest)

> Pct. below poverty line: 18.2% (4th highest)

> Unemployment: 9.7% (13th highest)

Last year, 24/7 Wall St. named Kentucky the worst-run state in the country. The state saw slight improvements in the percentage of its population with high school diplomas and poverty rate. Violent crime dropped significantly — now the 10th-lowest rate in the country, compared to the 17th-lowest last year. Despite these improvements, Kentucky remains one of the poorest states in the country, ranking among the five worst for median income and poverty rate. It is also one of just four states to be awarded an unfavorable AA- credit rating, the third worst score awarded to any state.

45. South Carolina

> State debt per capita: $3,379 (24th highest)

> Pct. without health insurance: 17.5% (13th highest)

> Pct. below poverty line: 17.1% (8th highest)

> Unemployment: 11% (4th highest)

Fiscally speaking, South Carolina is relatively sound. It takes in the 27th most in revenue per capita and spends the 24th most in total expenditures per capita. Its state debt per capita is slightly below average. However, the state has the eighth highest poverty rate and the fourth highest unemployment rate. It also has the fifth highest rate of violent crime, with 597.7 crime committed per 100,000 people. This is actually an improvement from last year when the state’s violent crime rate was 731 per 100,000 — the worst in the country.

46. Nevada

> State debt per capita: $1,690 (6th lowest)

> Pct. without health insurance: 22.6% (2nd highest)

> Pct. below poverty line: 13.0% (24th lowest)

> Unemployment: 13.4% (the highest)

Nevada has dropped five places in our rankings. This drop is due primarily to its credit downgrade this year from AA+ to AA. Surprisingly, the state has one of the lowest debts per capita in the country, at just $1,690 per person. However, it has other financial woes that make it a long-term risk. Nevada properties declined 44.5% in value between 2006 and 2010, the worst decline in the country. In October alone, one in every 180 homes was foreclosed upon, easily the worst rate in the country. The state also has the second lowest percentage of residents covered by health insurance and the highest unemployment rate in the country.

47. Arizona

> State debt per capita: $1,882 (9th lowest)

> Pct. without health insurance: 16.9% (16th highest)

> Pct. below poverty line: 16.3% (tied for 13th highest)

> Unemployment: 9.1% (18th highest)

Arizona’s housing market was one of the worst hit in the country during the housing crisis. Home values have dropped 28.6% since 2006, the fourth worst rate in the country. In October 2011, one in every 259 housing units were foreclosed upon, which was the third worst rate that month in the U.S. Arizona also has one of the lowest credit scores in the country after its downgrade to AA- in 2009.

48. Michigan

> State debt per capita: $2,963 (21st lowest)

> Pct. without health insurance: 12.4% (18th lowest)

> Pct. below poverty line: 15.7% (15th highest)

> Unemployment: 11.1% (3rd highest)

Michigan has arguably suffered more than any state in post-industrial America. The state is one of just four with a credit rating of AA-, although its debt per capita is actually below average. The state ranks among the worst in the country for violent crime, unemployment, foreclosures and home price decline.

49. Illinois

> State debt per capita: $4,424 (13th highest)

> Pct. without health insurance: 13.8% (23rd lowest)

> Pct. below poverty line: 13.1% (25th lowest)

> Unemployment: 10% (10th highest)

Illinois has fallen from 43rd last year to the overall second-worst run state in the country. The state performs poorly in most categories, but is worst when it comes to its credit rating. Illinois has a credit rating of A+, the second worst given to any state, behind only California. The state has been on credit watch since 2008 because of budget shortfalls and legal challenges against then-governor Rod Blagojevich.

50. California

> State debt per capita: $3,660 (21st highest)

> Pct. without health insurance: 18.5% (8th highest)

> Pct. below poverty line: 14.5% (tied for 21st highest)

> Unemployment: 11.9% (2nd highest)

California has moved down one slot on from last year to earn the title of the worst-run state in the country. In the fiscal year 2009, the state spent $430 billion, roughly 14% of all the money spent by states in that year. Compared to its revenue, the state spent too much — California had the 10th lowest revenue per person, and spent the 15th most per person. California is the only state in the country to be rated A-, the lowest rating ever given to a state by S&P. Despite the huge amount the state spends each year, conditions remain poor. California has the second-lowest percentage of adults with a high school diploma in the country, the second-highest foreclosure rate and is tied for the second highest unemployment rate in the U.S.

Read: The Best Run States In America

Douglas A. McIntyre, Michael B. Sauter, Charles B. Stockdale, Ashley C. Allen

Methodology

24/7 Wall St. considered data from a number of sources, including Standard & Poor’s, the Bureau of Labor and Statistics, the U.S. Census Bureau, the Tax Foundation, Realty Trac, The Federal Bureau of Investigation and the National Conference of State Legislators. The Bureau of Labor Statistics provided unemployment data, Credit rating agency Standard & Poor’s provided credit ratings for all 50 states. The Tax Foundation provided state debt per capita for the fiscal year 2009. The FBI’s Uniform Crime Report provided violent crime rates by state. Realty Trac provided foreclosure rates. A significant amount of the data we used came from the U.S. Census Bureau’s American Community Survey. Data from ACS included percentage below the poverty line, high school completion for those 25 and older, median household income, percentage of the population without health insurance and the change in occupied home values from 2006 to 2010. These are the values we used in our survey. Once we reviewed the sources and compiled the final metrics, we ranked each state based on its performance in all the categories.

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.