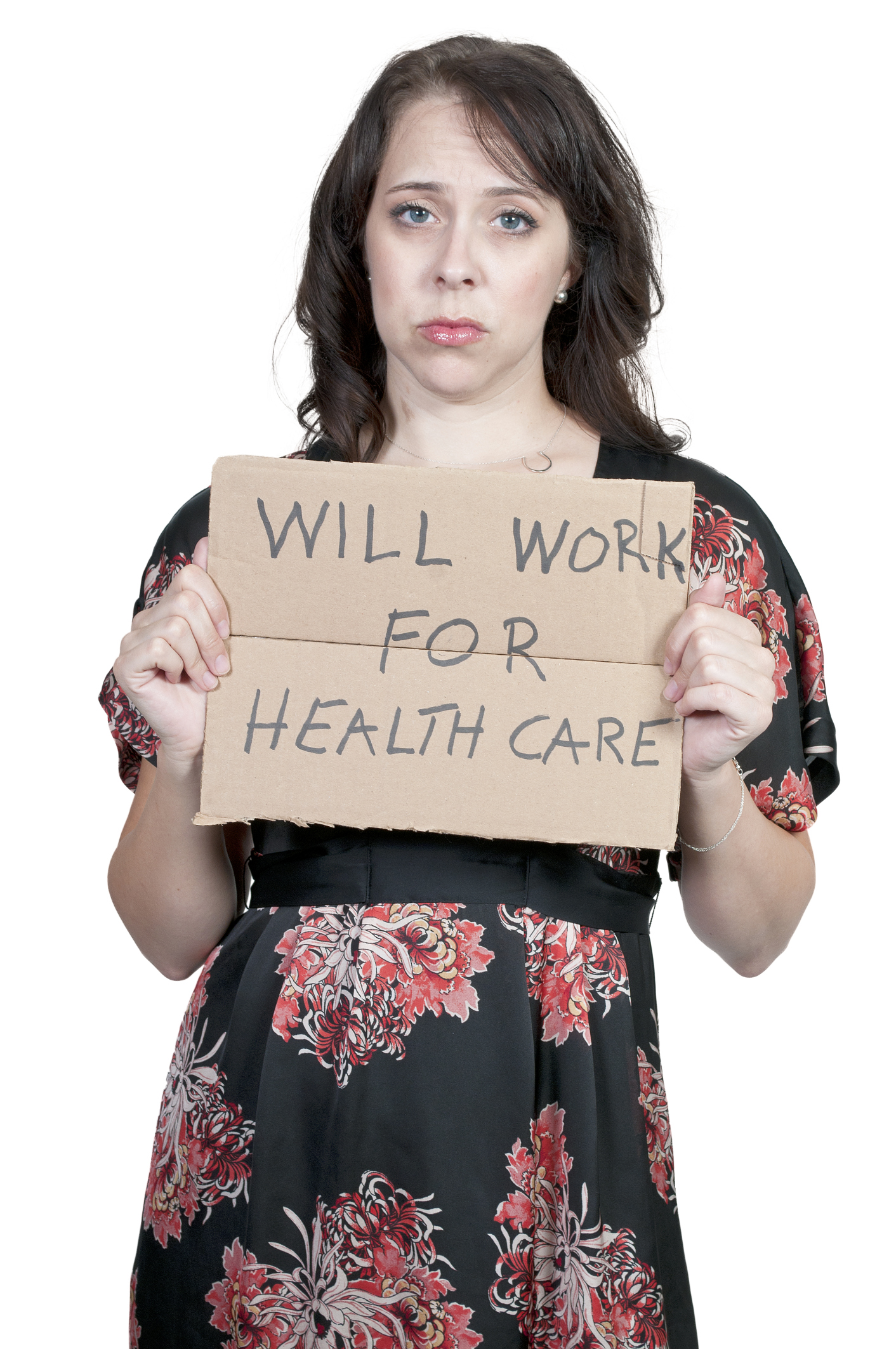

Health and Healthcare

10 States With The Worst Health Coverage

Published:

Last Updated:

Last year, just under 15% of the U.S. population did not have health insurance coverage. But as the different stages of the Affordable Care Act roll out over the next few years — and more Americans become insured — this rate is likely to fall.

For now though, health insurance remains out of reach for many Americans. In states like Florida and Alaska, more than one in five residents are without insurance. And an estimated 22.5% of Texans didn’t have health insurance last year. Based on data recently released by the U.S. Census Bureau, 24/7 Wall St. reviewed the 10 states with the lowest rates of health insurance coverage in the U.S in 2012.

People 65 and older are automatically eligible for Medicare. Nationally, 15.5% of the population is covered by this program. Several of the states with lower overall coverage rates have disproportionately fewer residents over 65, and as a result they have lower rates of Medicare coverage.

The opposite is also true. In Florida, where 20.1% of the population is without health insurance, has the the second-highest proportion of residents covered by Medicare.

The other large public health insurance program, Medicaid, covers Americans who cannot afford coverage. Roughly 18% of the population is covered under the program. Many of the states with the lowest health insurance coverage have relatively low median household income and high poverty rates. But, like Medicare, there does not appear to be a strong relationship between high Medicaid coverage and lower overall rates of uninsured residents.

In an interview with 24/7 Wall St., Peter Cunningham, senior fellow at Center for Studying Health System Change, explained that while Medicare and Medicaid can impact a state’s health insurance coverage rate. While Medicaid plays a small roll, “It’s really the variation in the rates of employer-provided private insurance coverage that drives the variation in uninsured rates,” Cunningham said.

Indeed, over 65% of the U.S. population is covered through private health insurance, and the vast majority of that is through employers. All of the 10 states with the lowest overall health insurance coverage rates had among the lowest rates of employer-provided insurance.

These states have low rates of employer-provided insurance, Cunningham explained, because of the industries that are common in these states. Most of these states have lower proportions of higher paying jobs or unionized manufacturing jobs, in which employers tend to provide insurance. In fact, all but one of these states had below the national average manufacturing employment. “We all talk about the decline of American manufacturing, but it’s still the case that in a lot of states, the traditional manufacturing jobs still play a pretty big role.”

Cunningham also explained that states with high uninsurance rates are typically poorer because lower-wage jobs are much less likely to provide health insurance coverage. Cunningham gave the example of Florida. “The economy in Florida is based on tourism. A lot of the service and hospitality sector jobs don’t pay a lot and don’t offer health benefits. It’s a very different economy than states that have much lower uninsured rates.” Florida had the lowest rate of employer-provided health insurance in the country.

Based on the Census Bureau’s 2012 American Community Survey, 24/7 Wall St. reviewed the 10 states with the lowest percentage of the population covered by a health insurance plan. We also reviewed a variety of additional data from the ACS for 2012, including age distribution, poverty, income, and the proportion of residents covered by private insurance, Medicaid and Medicare. We also reviewed 2012 average unemployment rates from the U.S. Bureau of Labor Statistics.

These are the ten states with the worst health coverage.

10. Arizona

> Pct. without health insurance (2012): 17.6%

> Unemployment rate (2012): 8.3% (16th highest)

> Poverty rate: 18.7% (8th highest)

> Pct. aged 65 and over: 14.8% (13th highest)

An estimated 17.6% of Arizona residents lacked health insurance in 2012, well above the national rate of 14.8%. Children living in the state were also less likely than minors nationwide to be insured. An estimated 13.2% of the population under 18 lacked health coverage in 2012, well above the 7.2% of minors across the U.S. Only in a few states were Americans less likely to receive health coverage from their work than in Arizona. State Governor Jan Brewer has supported the expansion of Medicaid in Arizona under the Affordable Care Act, which the state’s legislature approved in June. This could provide coverage to hundreds of thousands of uninsured residents.

Also read: States where people go hungry

9. California

> Pct. without health insurance (2012): 17.9%

> Unemployment rate (2012): 10.5% (2nd highest)

> Poverty rate: 17.0% (18th highest)

> Pct. aged 65 and over: 12.1% (6th lowest)

California had among the highest rates of uninsured residents as of 2012. As such, it is among the states standing to benefit the most from the Affordable Care Act, which will begin open enrollment in less than a week. Benefiting the most may mean paying the most, however. Californians will end up paying some of the highest rates in the country under the new legislation, according to recent news reports. Last year, the portion of Californians on Medicaid was above the national average rate. However, About half the population received health insurance from an employer. This could be explained by California’s high unemployment rate, which was second-worst in the country.

8. Montana

> Pct. without health insurance (2012): 18.0%

> Unemployment rate (2012): 6.0% (14th lowest)

> Poverty rate: 15.5% (25th highest)

> Pct. aged 65 and over: 15.8% (5th highest)

The proportion of Montana residents without health insurance coverage has remained effectively unchanged for the past three years. Just 48% of the state’s population in 2012 had employer-based coverage, one of the lowest rates in the country. Nationally, the rate was close to 55% last year. Montana has among the lowest proportion of jobs in manufacturing in the country, which are more likely to provide health benefits. When the Affordable Care Act’s penalty for large businesses that do not provide insurance takes effect in 2015, more Montana businesses will be affected. In the U.S., roughly 4% of companies have more than 50 employees. In Montana, it is an estimated that as many as 37% do.

7. New Mexico

> Pct. without health insurance (2012): 18.4% (tied-5th highest)

> Unemployment rate (2012): 6.9% (19th lowest)

> Poverty rate: 20.8% (2nd highest)

> Pct. aged 65 and over: 14.1% (tied-24th lowest)

New Mexico had the nation’s second highest poverty rate in 2012, at 21.5%. Across the country, poorer households are less likely to have insurance coverage, and this was especially the case in New Mexico. As many as 26.6% of the state’s households earning less than $25,000 annually were uninsured in 2012. But while the state’s Medicaid expansion will extend coverage to many more poor New Mexicans, private insurance coverage remains relatively sparse. As of last year, 22.4% of employed workers lacked health coverage, among the worst figures in the nation. Overall less than 55% of New Mexico residents had private health insurance coverage of any kind, the lowest rate of any state in the U.S.

6. Oklahoma

> Pct. without health insurance (2012): 18.4% (tied-5th highest)

> Unemployment rate (2012): 5.2% (5th lowest)

> Poverty rate: 17.2% (15th highest)

> Pct. aged 65 and over: 14.1% (tied – 24th lowest)

The portion of Oklahoma’s population without health insurance did not change considerably between 2011 and 2012. The state’s unemployment rate was relatively low last year, but the proportion of unemployed residents without health insurance was well-above the national rate. Less than half the population received health coverage through an employer, compared to close to 55% of the U.S. population. Under the Affordable Care Act scheduled to come into effect next month, Oklahomans will be better off than most state-residents because medical care is considerably cheaper in Oklahoma than it is elsewhere.

5. Georgia

> Pct. without health insurance (2012): 18.4% (tied-5th highest)

> Unemployment rate (2012): 9.0% (9th highest)

> Poverty rate: 19.2% (6th highest)

> Pct. aged 65 and over: 11.5% (4th lowest)

Last year 43.8% of unemployed workers in the U.S. did not have health insurance, while in Georgia, 53.6% of the unemployed were uninsured. However, Governor Nathan Deal, an outspoken opponent of the Affordable Care Act, has elected not to expand Medicaid or set up a state-controlled insurance exchange. The state’s Insurance Commissioner Ralph Hudgens drew scrutiny last month when he stated that Georgia was doing “everything in [its] power to be an obstructionist.”

4. Florida

> Pct. without health insurance (2012): 20.1%

> Unemployment rate (2012): 8.6% (12th highest)

> Poverty rate: 17.1% (17th highest)

> Pct. aged 65 and over: 18.2% (the highest)

Florida is one of just four states where at least a fifth of the population didn’t have health insurance in 2012. While the state’s relatively large elderly population means that a disproportionately high percentage of Floridians were covered under Medicare, the younger adult population were much more likely to be without insurance than other states. As many as 28.8% of those between the ages of 18 and 64 didn’t have health coverage compared to just over 20% nationally. The New York Times reported that, in defiance of the Affordable Care Act, Florida’s government has been reluctant to offer its residents information on the the federal insurance exchanges that will allow residents to shop for the most affordable plan.

3. Alaska

> Pct. without health insurance (2012): 20.5%

> Unemployment rate (2012): 7% (22nd lowest)

> Poverty rate: 10.1% (2nd lowest)

> Pct. aged 65 and over: 8.5% (the lowest)

Although Alaska is one of the nation’s wealthiest states, with a median income of $67,712 in 2012, it also has a relatively large number of residents who were uninsured. This may be due in part to the seasonal nature of much of Alaska’s workforce — such workers often either do not receive insurance from their employers or do not keep their insurance after their work has ended. Last year, 21.4% of workers who were employed did not have health insurance, one of the highest rates in the nation. But for Alaskans hoping to obtain health insurance under the Affordable Care Act, premiums in the state will be higher than anywhere else in the nation, exempting for Wyoming.

2. Nevada

> Pct. without health insurance (2012): 22.2%

> Unemployment rate (2012): 11.1% (the highest)

> Poverty rate: 16.4% (19th highest)

> Pct. aged 65 and over: 13.0% (11th lowest)

Nevada minors were the most likely in the country to lack health insurance. An estimated 16.6% were not covered, more than double the national rate. In general, the likelihood of not having health insurance is much higher for those without a high school diploma. In Nevada, due to a poor graduation rate, the chances of this happening are significantly worse. Nevada also has the largest portion in the nation of households earning under $25,000 per year without health insurance. Under the Affordable Care Act in Nevada, those earning under 400% of the national poverty rate will be eligible for tax credits. Nevada will likely be one state relying on this provision the most. The state also has the highest proportion of residents employed in service jobs, which are less likely than many jobs to provide health benefits.

1. Texas

> Pct. without health insurance (2012): 22.5%

> Unemployment rate (2012): 6.8% (17th lowest)

> Poverty rate: 17.9% (11th highest)

> Pct. aged 65 and over: 10.9% (3rd lowest)

Not only did Texas have the highest rate of uninsured people in 2012, but the state also had among the highest portion of uninsured children, elderly, and unemployed people. Additionally, over 30% of adults under 65 were uninsured in the state. Texas lawmakers have been opposed to the Affordable Care Act, with Texas Senator Ted Cruz speaking for over 20 hours in an attempt to block the law from taking effect.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.