Special Report

States With the Most (and Least) Student Debt

Published:

Last Updated:

Total student debt in the United States, at approximately $1.26 trillion, is the second largest consumer debt in the country after mortgages. The average debt of all U.S. college undergraduates, including those who did not take any student loans, is around $16,929 per student, according to new data from student loan news website the Student Loan Report.

The amount of debt a student is likely to have after graduation varies considerably between schools — and between states. Using data from the Student Loan Report, 24/7 Wall St. reviewed the average student debt burden in each state of undergraduates who graduated in the most recent school year.

Students graduating in Utah have the least debt, at an average of $7,527 per student. College students in New Hampshire lead the nation with average per-student debt at graduation of $25,740.

These are the states where college students graduate with the most debt.

Because average debt per student includes graduates who did not borrow, the actual debt burden of students who did take out loans is even higher. In Utah, the average debt of students who borrowed is $18,973 per student, second lowest in the country. In New Hampshire it is $36,101 per student, the highest in the country.

The proportion of students who graduate with loans in a state can largely affect the student debt burdens. In almost every state, a majority of undergraduates leave college with at least some debt. In 12 of the 25 states with the highest per-student debt, at least two-thirds of undergraduates leave school with student debt. In all states with low per-student debt, less than two-thirds of students leave with debt.

Looking only at students who borrowed and examining the average per-student debt in each state, the rank is closely aligned with this list. This means that not only are students in these states more likely to take loans, but also that these loans tend to be larger.

Graduates of private schools have more than 122% of the debt students who graduate from public universities and colleges have. Private postsecondary institutions outnumber public schools in 29 states, and this is more likely to be the case in states with above-average student debt per graduate.

Education advocate and research organization College Board estimates that to afford tuition, room, board, and other expenses a student must budget an average of $24,061 for in-state public colleges and $47,831 for private colleges, annually. Student loan company Sallie Mae and market research firm Ipsos conducted a study to find how families pay for college education. Most families turn to financial aid to help subsidize higher education costs. In the 2013-2014 academic year, 89% of undergraduate students received some form of financial aid.

While financial aid may help students cover a portion of education costs, generally, many sources are required to pay for the full cost. In the 2013-2014 academic year, grants and scholarships accounted for 31% of college costs. Another 30% of costs were covered by parent income and savings. Combined borrowing of students and their parents accounted for 22% of costs. The remainder came from student income and savings as well as relatives and friends.

To identify the states where college students graduate with the most student debt, 24/7 Wall St. reviewed the average debt per graduate of post secondary institutions in each state from the student loan news website Student Loan Report, which collected data on 1,238 U.S. colleges and universities. The percentage of graduates with debt per school and in each state is also from this report. Cost of attendance and median alumni earnings are from the U.S. Department of Education’s College Scorecard for the 2014-2015 academic year. Cost of attendance refers to total cost of college, including tuition, room and board, and other expenses minus grants and scholarships received. Median alumni earnings are from tax returns for alumni who received financial aid 10 years after beginning their degree program. All data are from the most recent period available. The sample of graduates in Delaware is not sufficient for comparison with other states.

These are the states with the most student debt.

50. Delaware

> Avg. debt at graduation: N/A

> Pct. of adults with at least a bachelor’s degree: 30.9% (19th highest)

> Median household income, ages 25-44: $65,770 (17th highest)

> Avg. debt as share of median household income: N/A

Due to a limited sample, average debt among students who graduate from college in Delaware cannot be compared to other states. For the two Delaware universities for which data is available — Delaware State University and University of Delaware — the average debt is $29,982 and $20,802 per student, respectively. By contrast, the average debt per college student nationwide is $16,929. Nearly two-thirds of students graduating from college in the state needed loans to pay for their education, one of the highest proportions compared with other states.

[in-text-ad]

49. Utah

> Avg. debt at graduation: $7,527

> Pct. of adults with at least a bachelor’s degree: 31.8% (16th highest)

> Median household income, ages 25-44: $66,042 (16th highest)

> Avg. debt as share of median household income: 11.4% (2nd lowest)

The typical college or university student in Utah leaves school with about $7,500 in unpaid student loans. Nationwide, those who graduate from private institutions tend to incur more debt than those who graduate from public schools.

While the three schools with the highest average student debt in Utah are private, Brigham Young University is a notable exception. Although it is a private institution, the average debt among BYU graduates is only $4,244, by far the lowest of any school reviewed in the state. Low debt among graduates is likely due to the university’s religious affiliation. Tithes from the Church of Jesus Christ of Latter-day Saints cover a considerable share of the school’s operating costs, and tuition for church members is roughly half the tuition for unaffiliated students.

48. Wyoming

> Avg. debt at graduation: $10,434

> Pct. of adults with at least a bachelor’s degree: 26.2% (13th lowest)

> Median household income, ages 25-44: $70,384 (12th highest)

> Avg. debt as share of median household income: 14.8% (3rd lowest)

Students at the University of Wyoming leave school with an average of roughly $10,400 in debt, among the least of any major state university. In Wyoming, where the typical home with a head of household between 25 and 44 years old earns $70,384 a year, the average student loan debt is just around 15% of median annual household income. Nationwide, debt accounts for 28% of median household income of the same age group. Wyoming’s four-year public universities offer the lowest in-state tuition on average in the country.

47. Nevada

> Avg. debt at graduation: $11,038

> Pct. of adults with at least a bachelor’s degree: 23.6% (7th lowest)

> Median household income, ages 25-44: $53,809 (16th lowest)

> Avg. debt as share of median household income: 20.5% (10th lowest)

Among students of the two universities reviewed in Nevada, bachelor’s degree recipients amass an average of $11,038 in debt. Average student debt is slightly higher among graduates of the University of Nevada, Las Vegas — the largest school in the state — than it is for graduates of its smaller sister school, the University of Nevada, Reno. Both universities are public, and public schools typically saddle students with less financial burden than private schools.

46. Louisiana

> Avg. debt at graduation: $11,275

> Pct. of adults with at least a bachelor’s degree: 23.2% (5th lowest)

> Median household income, ages 25-44: $51,040 (8th lowest)

> Avg. debt as share of median household income: 22.1% (12th lowest)

The average Louisiana college graduate leaves school with roughly $11,300 in loan debt, the fourth least of any state. While Louisiana’s college students accumulate nearly the least amount of debt in the country, the cost of education in the state is on the rise. The average tuition at a public four-year college in Louisiana has risen substantially since the 2011-2012 school year, from $5,588 — the second lowest in the country at the time — to $8,900 today. The 60% increase was the largest tuition hike of any state over the last five years, and is partly the result of the 2010 GRAD Act. The GRAD Act allows universities in the state to increase tuition upon meeting certain performance standards, and it has allowed some schools to more than double their undergraduate tuition. The average in-state tuition and fees at Louisiana State University, the state’s flagship school, rose from $5,233 in the 2009-2010 academic year to $10,814 for the 2016-2017 academic year.

45. Hawaii

> Avg. debt at graduation: $11,792

> Pct. of adults with at least a bachelor’s degree: 31.4% (18th highest)

> Median household income, ages 25-44: $74,003 (6th highest)

> Avg. debt as share of median household income: 15.9% (4th lowest)

Approximately half of recent college graduates in Hawaii left school with student loan debt, nearly the lowest proportion of all states. With such a large share of students leaving school debt-free, the average graduate in Hawaii has just $11,792 in student loan debt, far lower than the national average of $16,929 for students across the country.

[in-text-ad]

While students typically pay less at public institutions than private universities, students who choose to attend a public school outside of their home state still face high tuition and fees. This is especially the case in Hawaii, where the average out-of-state student at a public four-year university pays $20,120 more than the average in-state student, the third largest premium of any state.

44. New Mexico

> Avg. debt at graduation: $11,829

> Pct. of adults with at least a bachelor’s degree: 26.5% (14th lowest)

> Median household income, ages 25-44: $47,383 (4th lowest)

> Avg. debt as share of median household income: 25.0% (19th lowest)

The average debt of a New Mexico college student is approximately $12,000 at graduation, far less than the $17,000 in debt the average American student accumulates as an undergraduate. One reason for the smaller debt load is the relatively inexpensive cost of college in the state. The average in-state tuition at a public four-year university in New Mexico is $6,620, lower than in all but four other other states.

Despite the relatively small debt load, college is still a substantial expense compared to the average earnings of New Mexico residents. The typical home led by a householder between 25 and 44 years old earns just $47,383 a year, the third least of any state. On average, student debt at graduation in New Mexico accounts for 25.0% of median annual household income for 25 to 44 year olds, not far from the 27.8% national figure.

43. Arizona

> Avg. debt at graduation: $12,200

> Pct. of adults with at least a bachelor’s degree: 27.7% (19th lowest)

> Median household income, ages 25-44: $55,510 (19th lowest)

> Avg. debt as share of median household income: 22.0% (11th lowest)

The average undergraduate in Arizona leaves school with $12,200 in student debt, one of the smallest debt loads in the country. Of schools reviewed in the state, students accumulate the least amount of debt at the University of Arizona. Graduates of the University of Arizona leave school with $10,590 in student debt on average, roughly $1,600 less than the state average.

Like in most of the country, students in Arizona are more likely to accumulate debt at private universities. At the private schools Prescott College and Arizona Christian University, the average student graduates with more than $18,000 in debt. Similarly, more than two thirds of all students at the two private schools have some form of student debt by graduation compared to less than half of recent graduates from the public University of Arizona.

42. Oklahoma

> Avg. debt at graduation: $12,549

> Pct. of adults with at least a bachelor’s degree: 24.6% (9th lowest)

> Median household income, ages 25-44: $52,768 (14th lowest)

> Avg. debt as share of median household income: 23.8% (15th lowest)

The average debt burden of a student graduating from a college or university in Oklahoma is $12,549, lower than in all but a handful of other states. While Oklahoma students pay among the least of any state for higher education, the cost of attendance is on the rise. The average tuition at a four-year public school in the state rose from $6,467 in 2011-12 to $8,030 for the 2016-17 school year. The 24.1% increase was the fourth largest tuition hike of any state.

One explanation for Oklahoma’s low average student debt comes from the fact that so few students actually have debt at all. Upon graduation, barely over half of the class of 2015 had debt, the eighth smallest share of any state.

41. California

> Avg. debt at graduation: $12,554

> Pct. of adults with at least a bachelor’s degree: 32.3% (14th highest)

> Median household income, ages 25-44: $67,122 (15th highest)

> Avg. debt as share of median household income: 18.7% (5th lowest)

The average debt of college graduates in California is only $12,554, well below the corresponding debt burden in the majority of states. Average debt ranges widely across the state, and is closely tied to the share of graduates who relied on loans. Only 22% of Stanford alumni graduated with any debt, and partially as a result, the average per student debt at the University is only $4,672, the lowest of all 83 schools reviewed in the state.

California is home to an extensive public university system. The University of California system spans 10 campuses, currently enrolls 238,700 students, and has over 1.7 million alumni. More than two-thirds of students get some form of financial aid.

40. Florida

> Avg. debt at graduation: $12,836

> Pct. of adults with at least a bachelor’s degree: 28.4% (24th lowest)

> Median household income, ages 25-44: $51,873 (12th lowest)

> Avg. debt as share of median household income: 24.7% (17th lowest)

Florida has some of the least expensive universities in the country. The average tuition at a public four-year college in the state is just $6,360, lower than in any state other than Wyoming. Cheap tuition is likely one reason why just 53% of Floridians graduate with debt, a smaller share than in the vast majority of states. The average Florida college student leaves school with approximately $12,800 in student debt, a much lighter debt load than the $16,929 average national figure.

[in-text-ad]

While college is more affordable in Florida than in most of the country, educational attainment in the state is fairly average. An estimated 28.4% of Florida adults have at least a bachelor’s degree, a slightly smaller share than the 30.6% of Americans with similar educational attainment.

39. Alabama

> Avg. debt at graduation: $13,269

> Pct. of adults with at least a bachelor’s degree: 24.2% (8th lowest)

> Median household income, ages 25-44: $47,780 (5th lowest)

> Avg. debt as share of median household income: 27.8% (24th lowest)

A little more than half of all graduates from colleges and universities in Alabama last year had unpaid student loans, one of the smallest shares in the country. With fewer students incurring debt, the state’s average per-student debt is among the lowest in the country.

As is the case in many states, Alabama’s public school system likely drives down per-student debt. Students at public schools tend to graduate with a smaller debt burden than students at private schools. Some of the state’s largest schools are public, including the University of Alabama, which, with close to 30,000 full-time undergraduates enrolled, is one of the largest in the country. Less than half of UA’s students graduate with debt, and, as is the case with many state universities, in-state students are charged far less tuition than out-of-state students.

38. Colorado

> Avg. debt at graduation: $13,947

> Pct. of adults with at least a bachelor’s degree: 39.2% (2nd highest)

> Median household income, ages 25-44: $70,032 (13th highest)

> Avg. debt as share of median household income: 19.9% (8th lowest)

The average Colorado college student leaves school with roughly $14,000 in debt, approximately $3,000 less than the average student nationwide. Like most of the country, students with some of the lightest debt burdens in Colorado were educated at the state’s large, public universities. The average debt per graduating student at University of Colorado Boulder, for example, is $11,266.

The rising cost of attending college has led to rising student debt levels across the country. The average tuition at a four-year public university in Colorado has risen by 22.3% since the 2011-2012 school year, one of the sharpest increases in the country.

37. Washington

> Avg. debt at graduation: $14,057

> Pct. of adults with at least a bachelor’s degree: 34.2% (11th highest)

> Median household income, ages 25-44: $70,463 (11th highest)

> Avg. debt as share of median household income: 19.9% (9th lowest)

Students leave Washington colleges and universities with an average of $14,057 in debt, which is about $2,900 less than the average debt per student across the United States. Students may have even less debt now than they did a few years ago. The cost of college has been on the rise in recent years. In just the last five years, average in-state public tuition increased by 9.4%. In Washington, however, tuition fell by 8.4%, one of just three states in which average public tuition declined — and by far the largest such drop. At the state’s largest public institution, the University of Washington — which has more than 31,000 undergraduates enrolled — in-state tuition fell from $11,532 to $10,753 over the last five years ending with the current school year.

36. North Carolina

> Avg. debt at graduation: $14,057

> Pct. of adults with at least a bachelor’s degree: 29.4% (25th highest)

> Median household income, ages 25-44: $51,244 (10th lowest)

> Avg. debt as share of median household income: 27.4% (23rd lowest)

As is generally the case in other states, alumni of North Carolina’s largest public universities are among the least debt-ridden college graduates in the state. The average loan debt of a student at graduation from North Carolina State University is $9,604 and from University of North Carolina at Chapel Hill it is $8,252, each far less than the statewide average debt per student of $14,057.

Additionally, North Carolina’s largest and most prestigious private college is among the most affordable. While a year at Duke University costs an estimated $63,273, roughly half of all students receive financial aid with an average grant of $42,345. Students leave Duke with just $6,686 in debt on average, among the least of any school in the country.

35. Texas

> Avg. debt at graduation: $14,469

> Pct. of adults with at least a bachelor’s degree: 28.4% (24th lowest)

> Median household income, ages 25-44: $59,006 (25th lowest)

> Avg. debt as share of median household income: 24.5% (16th lowest)

The average loan debt of a Texas college student at graduation is $14,469, less than the average debt load of $16,929 per student nationwide. Like in most of the country, students take on less debt at large state public universities. At Texas A&M University and the University of Texas at Austin — which together account for roughly 18% of the 619,175 students enrolled in public Texas universities — students graduate with $10,439 and $11,661 in debt on average.

[in-text-ad]

One reason for the light debt burden among Texas graduates is the large share of students who pay in-state tuition, as opposed to out-of-state. At the average public four-year university in Texas, in-state tuition is $14,560 cheaper than out-of-state tuition, roughly the same as the national premium. An estimated 91% of the Class of 2018 is comprised of Texas natives, the largest share in the country.

34. Alaska

> Avg. debt at graduation: $14,544

> Pct. of adults with at least a bachelor’s degree: 29.7% (23rd highest)

> Median household income, ages 25-44: $74,592 (5th highest)

> Avg. debt as share of median household income: 19.5% (7th lowest)

The average debt per student at graduation in Alaska is $14,544, less than the $16,929 national average. This is due largely to the relatively low public tuition in the state and the small share of students who take loans. The average tuition and fees at a four-year public university in the state is $7,130, far less than the $9,650 national average.

While Alaska has some of the least expensive higher education in the country, public tuition has increased at more than twice the rate nationwide over the past five years. This may be one reason for the 10.3% decline in enrollment at the University of Alaska Fairbanks over the same period, the third most of any state’s flagship school.

33. Maryland

> Avg. debt at graduation: $14,744

> Pct. of adults with at least a bachelor’s degree: 38.8% (3rd highest)

> Median household income, ages 25-44: $78,600 (2nd highest)

> Avg. debt as share of median household income: 18.8% (6th lowest)

The average student loan debt of student leaving college in Maryland is $14,744, less than the $16,929 national figure. This is likely due to the relatively small share of Maryland students who take loans, which at 56% is less than most states. For many students who graduate with debt in Maryland, higher education is a worthwhile investment. Fewer than one in 10 indebted graduates in the state default on their loans within three years of leaving school, a smaller share than in most states.

Maryland residents are highly educated. An estimated 38.8% of adults in the state have at least a bachelor’s degree, the third highest share in the country. This may be partially due to the state’s large public university system. The University of Maryland, College Park had 25,272 students as of fall 2015, a larger enrollment than most state flagship schools.

32. Arkansas

> Avg. debt at graduation: $14,821

> Pct. of adults with at least a bachelor’s degree: 21.8% (4th lowest)

> Median household income, ages 25-44: $46,682 (3rd lowest)

> Avg. debt as share of median household income: 31.7% (12th highest)

In Arkansas, students leave college with $14,821 in debt on average, less than in most states. One reason for the small debt load is likely the cheap tuition in the state. The cost of tuition and fees at an average four-year public college in Arkansas is just $8,250, about $1,400 less than the national figure.

While tuition in Arkansas is lower than the national average, for many students the investment in higher education may not pay off immediately. For every 100 students in Arkansas who graduate with student loan debt, 14 default on their loans within three years of graduating, one of the highest default rates in the country.

31. Tennessee

> Avg. debt at graduation: $14,898

> Pct. of adults with at least a bachelor’s degree: 25.7% (11th lowest)

> Median household income, ages 25-44: $51,145 (9th lowest)

> Avg. debt as share of median household income: 29.1% (22nd highest)

Per-student debt among recent graduates of colleges and universities in Tennessee is slightly less than $15,000, lower than in the majority of other states. Heavily subsidized tuition for in-state students at public schools partially explains the relatively small debt burden.

Out-of-state students pay an average of $16,000 more a year than in-state students at public four-year universities in Tennessee. The difference in tuition is even greater at the University of Tennessee, the largest school in the state. Out-of-state students pay slightly less than $31,000 a year, while annual tuition for in-state students is slightly less than $13,000. Across the state, however, just 26.7% of undergraduates are non-natives, a smaller share than in the majority of states. Nearly nine in 10 of the 28,000 undergraduates at the University of Tennessee are natives to the state.

30. Montana

> Avg. debt at graduation: $15,909

> Pct. of adults with at least a bachelor’s degree: 30.6% (19th highest)

> Median household income, ages 25-44: $57,159 (23rd lowest)

> Avg. debt as share of median household income: 27.8% (25th lowest)

In every college and university examined in Montana, more than half of all students graduate with debt. Private schools tend to be more expensive than public ones, and as a result graduates of private institutions are often more likely to incur student debt. For example, more than three-quarters of recent graduates from the University of Great Falls, a private institution, left with student debt. Meanwhile, at the University of Montana, a school where in-state tuition is roughly a quarter that of out-of-state students, only 57% of graduates amass financial debt.

[in-text-ad]

29. Georgia

> Avg. debt at graduation: $15,947

> Pct. of adults with at least a bachelor’s degree: 29.9% (22nd highest)

> Median household income, ages 25-44: $53,215 (15th lowest)

> Avg. debt as share of median household income: 30.0% (18th highest)

The average student leaves Georgia schools with nearly $16,000 in debt, the equivalent of about two years of public tuition for in-state students. Students who attend public college or university in their home state often receive a discount on tuition. In Georgia, out-of-state students pay $16,700 more in tuition compared to in-state students tuition, one of the higher premiums of any state. However, a disproportionately large share of Georgia’s college students are state natives — 82.4% as of the fall of 2014, a higher share than in all but five states.

28. Virginia

> Avg. debt at graduation: $16,035

> Pct. of adults with at least a bachelor’s degree: 37.0% (6th highest)

> Median household income, ages 25-44: $70,715 (10th highest)

> Avg. debt as share of median household income: 22.7% (13th lowest)

Students graduating from four-year colleges and universities in Virginia amass an average of $16,035 in debt, roughly $900 less than the debt per student nationwide. However, education in the Old Dominion State is not especially cheap. For in-state students, Virginia’s public universities cost an average of about $3,000 more a year than the $9,560 in-state tuition across the country as a whole. Out-of-state students pay an average of over $4,000 more than out-of-state students at public institutions nationwide.

27. Missouri

> Avg. debt at graduation: $16,206

> Pct. of adults with at least a bachelor’s degree: 27.8% (21st lowest)

> Median household income, ages 25-44: $55,694 (20th lowest)

> Avg. debt as share of median household income: 29.1% (23rd highest)

Students who come from out of state to attend public college or university typically pay more than locals from the state. The average premium nationwide for out-of-state students at a public four-year institution is $15,280. In Missouri, however, out-of-state students only pay an average premium of $11,460, and 34.4% of students come from out of state. The state’s largest institution by enrollment, the University of Missouri at Columbia, has 35,425 current students, which is more than one fifth of the state’s total four-year public university enrollment for fall 2015 of 154,616. Tuition at the University of Missouri for in-state students is about $10,700.

26. Oregon

> Avg. debt at graduation: $16,453

> Pct. of adults with at least a bachelor’s degree: 32.2% (15th highest)

> Median household income, ages 25-44: $60,288 (24th highest)

> Avg. debt as share of median household income: 27.3% (22nd lowest)

Over the last five years, in-state tuition at public colleges and universities in Oregon has increased by 13.8%, outpacing the 9.4% average increase nationwide. Still, a four-year public school in Oregon is a relative bargain for state residents. Tuition is $19,270 more expensive on average for out-of-state students, one of the highest premiums of any state in the country. Despite the higher cost, about 45% of college students in Oregon are from out of state, a far larger than typical share.

On average, among both in-state and out-of-state students at both public and private universities, the average debt of college recent graduates in Oregon is $16,453, roughly $500 less than is typical nationwide.

25. North Dakota

> Avg. debt at graduation: $16,610

> Pct. of adults with at least a bachelor’s degree: 29.1% (25th lowest)

> Median household income, ages 25-44: $71,536 (8th highest)

> Avg. debt as share of median household income: 23.2% (14th lowest)

College graduates likely have an easier time finding a job in North Dakota than in most of the country. The state’s annual unemployment rate has been below 3% over the last three years, better than any other state over that period. A potent job market may be one reason for the small share of students in North Dakota who defaulted on their loans within three years of graduation. At just 6.5%, it is the smallest share of any state other than Massachusetts.

[in-text-ad]

North Dakota is also one of the least expensive states for out-of-state students. Tuition and fees at an average four-year public school in North Dakota is just $18,450 for out-of-state students, nearly the lowest nationwide.This may partly explain why more than half of North Dakota college students are from out of state, one of the largest such shares. Despite the low tuition, the average student graduates with $16,610 in debt, roughly the same as the national figure.

24. Vermont

> Avg. debt at graduation: $16,908

> Pct. of adults with at least a bachelor’s degree: 36.9% (7th highest)

> Median household income, ages 25-44: $64,054 (19th highest)

> Avg. debt as share of median household income: 26.4% (21st lowest)

Statewide, only 24% of college students in Vermont are also state residents, the smallest in-state enrollment share in the country. The same pattern holds at the University of Vermont, the largest school in the state. Only one in five students in the Class of 2019 are Vermont residents. The school remains immensely popular with out-of-state students despite higher tuition costs. A full year’s tuition, including room and board, costs out-of-staters about $54,000 compared to only $31,000 for Vermonters.

Average student debt for recent graduates of colleges and universities in the Green Mountain State is $16,908, roughly in line with the comparable national figure.

23. Maine

> Avg. debt at graduation: $16,929

> Pct. of adults with at least a bachelor’s degree: 30.1% (21st highest)

> Median household income, ages 25-44: $56,992 (22nd lowest)

> Avg. debt as share of median household income: 29.7% (20th highest)

The average debt after graduation for students of Maine universities is $16,929, in line with the national average. The cost of attending college is rising faster than wages, which partially explains the severity of the national student debt crisis. Nationwide, tuition at public four-year postsecondary institutions rose by nearly 10% over the past five years. Maine is an exception to this trend, however. The average tuition at four-year public universities in the state has actually declined in recent years, one of only a few states where tuition has not increased. Despite the decrease, the average in-state tuition at a public four-year university in Maine is $9,690, roughly the same as the national average.

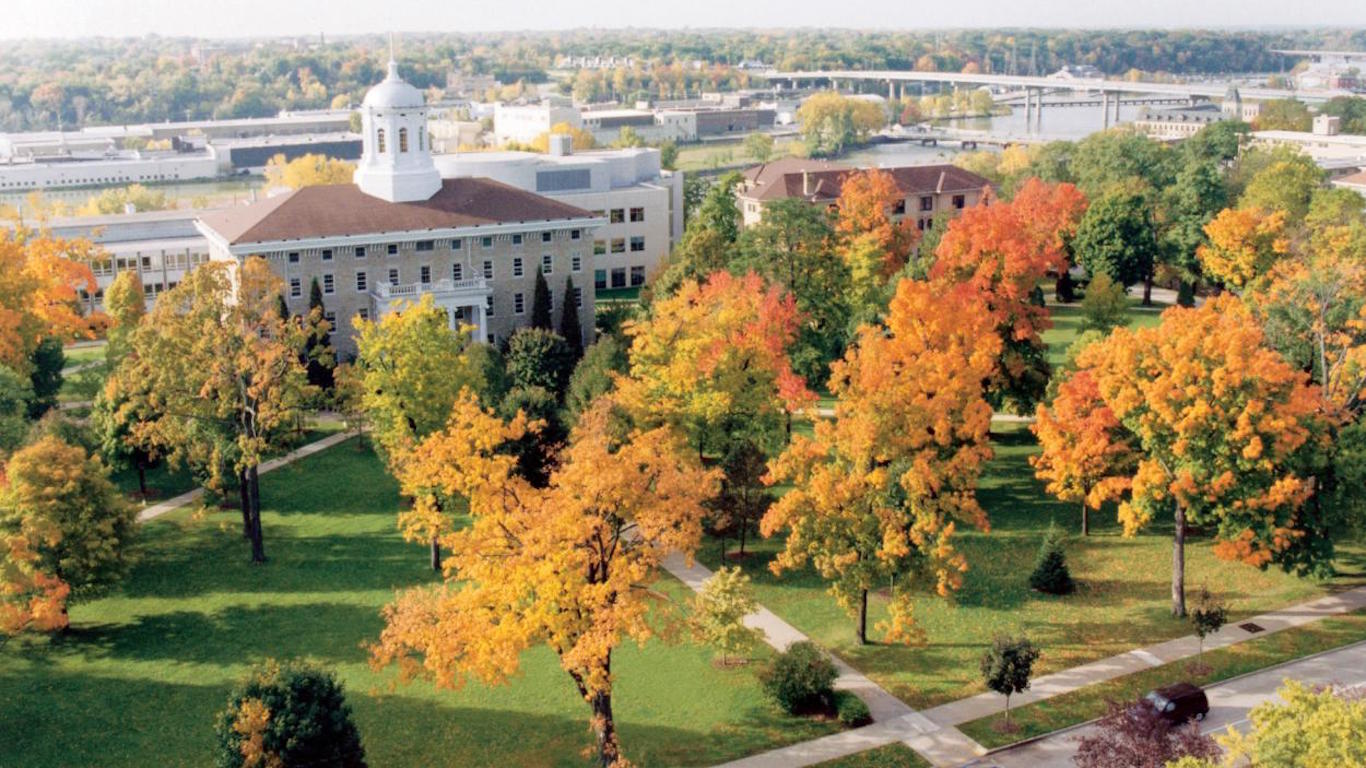

22. Indiana

> Avg. debt at graduation: $17,109

> Pct. of adults with at least a bachelor’s degree: 24.9% (10th lowest)

> Median household income, ages 25-44: $55,414 (18th lowest)

> Avg. debt as share of median household income: 30.9% (15th highest)

Indiana residents are much more likely to attend a college or university in state than most Americans. Slightly more than 85% of Indiana residents attend college in their home state, compared to about 74% of college students nationwide. At Indiana’s public schools, state residents get a relative bargain. The average tuition for in-state public school students is only $9,200, nearly $19,000 less than tuition for out-of-state students.

Despite the relative bargain, about six in 10 recent graduates in Indiana left school with student debt. The average debt burden across all students is $17,109, roughly in line with the national average.

21. Nebraska

> Avg. debt at graduation: $17,181

> Pct. of adults with at least a bachelor’s degree: 30.2% (20th highest)

> Median household income, ages 25-44: $60,576 (23rd highest)

> Avg. debt as share of median household income: 28.4% (25th highest)

Recent graduates of Nebraska schools have an average debt upon graduation of $17,181, slightly higher than the average of $16,929 across the United States. However, whether due to better incomes, favorable debt payment plans, or some other reason, just 8.2% of Nebraska students default on their debt within three years, one of the lowest default rates in the country.

While the state has above-average debt load per student, Nebraska natives attending school at the state’s largest public postsecondary institution, the University of Nebraska at Lincoln, are paying relatively little. In-state tuition and fees at the University of Nebraska are just $8,538. In other major public colleges and universities, even in-state tuition can be double that.

20. Kansas

> Avg. debt at graduation: $17,313

> Pct. of adults with at least a bachelor’s degree: 31.7% (17th highest)

> Median household income, ages 25-44: $58,614 (24th lowest)

> Avg. debt as share of median household income: 29.5% (21st highest)

The average student debt among graduates of colleges and universities across Kansas is $17,313, roughly $400 more than is typical nationwide. Excluding the 37% of graduates in the state free of student debt, the average debt per student is about $28,000.

[in-text-ad]

Average debt is lowest among graduates of the state’s two largest universities, the University of Kansas and Kansas State University. Both schools enroll over 19,000 undergraduates, and the average debt among all graduates is below $15,000. State residents pay an average of nearly $14,000 less in tuition and fees than out-of-state students at public schools in Kansas. More than two-thirds of college students in Kansas are also state residents.

19. South Carolina

> Avg. debt at graduation: $17,514

> Pct. of adults with at least a bachelor’s degree: 26.8% (17th lowest)

> Median household income, ages 25-44: $50,658 (7th lowest)

> Avg. debt as share of median household income: 34.6% (6th highest)

The average student debt at graduation in South Carolina is $17,514, which is about $590 higher than the average debt per student across the United States. However, 40% of all students graduated with no debt. The average amount owed for students who graduated with at least some debt is is $30,564, eighth highest in the country.

Whether it is due to the above average levels of debt or earnings potential in the state, South Carolina’s former students are more likely than most to be unable to make their monthly payments. An estimated 13.2% of students from the graduating class of 2013 defaulted on their loans within the first three years of leaving school, about two percentage points more than the national default rate for that class.

18. Kentucky

> Avg. debt at graduation: $17,591

> Pct. of adults with at least a bachelor’s degree: 23.3% (6th lowest)

> Median household income, ages 25-44: $51,422 (11th lowest)

> Avg. debt as share of median household income: 34.2% (8th highest)

More than 85% of students of colleges and universities in Kentucky are locals to the state. Nationwide, tuition at public institutions is often heavily subsidized for in-state residents. In Kentucky, out-of-state students pay an average of about $12,700 more in tuition and fees at public institutions than state residents. Still, tuition is on the rise for in-state residents. In the last half decade, in-state public university tuition has increased by an average of 17.2%, considerably faster than the 9.4% average increase nationwide.

Perhaps due in part to climbing tuition, the average debt among all recent graduates in Kentucky is $17,591, roughly $650 more than is typical nationwide.

17. Mississippi

> Avg. debt at graduation: $17,748

> Pct. of adults with at least a bachelor’s degree: 20.8% (3rd lowest)

> Median household income, ages 25-44: $43,916 (2nd lowest)

> Avg. debt as share of median household income: 40.4% (the highest)

In-state tuition at public universities in Mississippi has increased by 22.6% in the last half decade, one of the steepest tuition hikes of any state and more than double the average increase nationwide. Tuition at the state’s largest school, the University of Mississippi, rose by 26% over the same time period. Increasing tuition costs are not likely helping reduce student debt among recent graduates. The average debt load among the 62% of graduates from four-year institutions in the state with student debt is $29,942, higher than the corresponding figure in the vast majority of other states. Including those with no debt, the per student debt load is $17,748, about $800 higher than the national average.

16. Michigan

> Avg. debt at graduation: $18,174

> Pct. of adults with at least a bachelor’s degree: 27.8% (21st lowest)

> Median household income, ages 25-44: $55,190 (17th lowest)

> Avg. debt as share of median household income: 32.9% (10th highest)

The average college graduate in Michigan leaves school with $18,174 in student loan debt, about $1,200 more than the national average. Higher education is fairly expensive in Michigan. The average cost of tuition and fees at a four-year public university is $12,460, far higher than the $9,650 average cost nationwide. For out-of-state students, the expense is far greater. The average out-of-state student spends $22,380 more in tuition and fees than in-state students, the highest out-of-state premium in the country. This may be one reason for the low share of out-of-state students, which at less than 18% of the 2014 freshman class, is much lower than the 28% average nationwide.

15. Idaho

> Avg. debt at graduation: $18,228

> Pct. of adults with at least a bachelor’s degree: 26.0% (12th lowest)

> Median household income, ages 25-44: $52,163 (13th lowest)

> Avg. debt as share of median household income: 34.9% (5th highest)

An estimated 71% of Idaho students leave college with some amount of loan debt, a larger share than in any state other than Pennsylvania and New Hampshire. While a large share of Idaho students take student loans, higher education in the state is among the least expensive in the country. Tuition and fees at the average four-year public school in the state is just $7,010, roughly $2,600 less than the national average. Like most of the country, however, tuition in Idaho is rising. The average cost to attend the University of Idaho, one of the largest universities in the state, rose by 15.9% in the five years since the 2011-2012 school year.

[in-text-ad]

14. Iowa

> Avg. debt at graduation: $19,064

> Pct. of adults with at least a bachelor’s degree: 26.8% (17th lowest)

> Median household income, ages 25-44: $60,791 (22nd highest)

> Avg. debt as share of median household income: 31.4% (14th highest)

The average cost of attending a public four-year university in Iowa is $8,270 annually, roughly $1,400 less expensive than the average cost nationwide. Despite the low tuition and fees, nearly two-thirds of Iowa graduates leave school in debt, one of the highest shares of any state. To help curb the large share of indebted students in Iowa, the state’s Board of Regents consecutively voted to freeze tuition starting at the 2012-13 school year until spring 2016. In the last five years, tuition in the state’s public four-year universities has risen just 2.7%, less than one-third increase in tuition nationwide. The board recently voted to unfreeze tuition, however, and may vote to increase the cost of attendance in the near future. The average debt per recent graduate debt of $19,064 is currently higher than in most states — and may continue to rise.

13. New Jersey

> Avg. debt at graduation: $19,242

> Pct. of adults with at least a bachelor’s degree: 37.6% (5th highest)

> Median household income, ages 25-44: $77,039 (4th highest)

> Avg. debt as share of median household income: 25.0% (20th lowest)

The average cost of tuition and fees at a public four-year university for in-state students in New Jersey is $13,280, higher than in any state other than Pennsylvania, Vermont, and New Hampshire. The high price of higher education in the state may explain the large share of students taking on debt, which at 66% of the class of 2015 is one of the largest in the country.

Costly tuition likely deters many of New Jersey’s college-bound seniors from attending school in the state. With a net loss of more than 27,000 students who left the state to go to school in other parts of the country in the most recent Fall semester, New Jersey has the largest outbound migration of college students in the country. To prevent the brain drain, both universities and state lawmakers are making efforts to make college more affordable. The state’s largest school, Rutgers University, instituted a program that provides free tuition to students from low income families. Enrollment at the school has risen 12% over the past five years.

12. New York

> Avg. debt at graduation: $19,317

> Pct. of adults with at least a bachelor’s degree: 35.0% (9th highest)

> Median household income, ages 25-44: $67,199 (14th highest)

> Avg. debt as share of median household income: 28.7% (24th highest)

Upon graduation, New York students owe $19,317, on average, in college loans. The state’s public schools, which include the substantial State University of New York network of colleges and universities, do not appear to be driving the high average debt in state. The average New York native attending a public four-year school in the state pays just $7,710 in tuition and fees, about $2,000 lower than the average tuition of $9,650 nationwide.

In 12 of the 15 states with the most college debt, at least 66% of students graduate with some amount of debt. In New York, however, just 59% graduate with debt. Some of New York’s expensive private schools may be driving up the state’s average. Columbia University in New York City, which has about 6,100 undergraduates enrolled, costs an average of $55,056 in tuition and fees. The state is home to another dozen or so colleges and universities with average annual tuition and fees of at least $50,000.

11. Illinois

> Avg. debt at graduation: $19,374

> Pct. of adults with at least a bachelor’s degree: 32.9% (12th highest)

> Median household income, ages 25-44: $64,062 (18th highest)

> Avg. debt as share of median household income: 30.2% (17th highest)

The average Illinois college student has more than $19,000 in debt upon graduation. Nearly 75% of Illinois’ postsecondary students are state natives, one of the highest such shares of all states.

Despite the relatively many local students and the discounts for in-state students, Illinois natives still spend more on average than local students do in most states. The average four-year public school Illinois native pays $13,280 annually in tuition and fees, the fifth most of any state. The average tuition at the state’s largest public university, The University of Illinois at Urbana-Champaign, is $15,698 for in-state students, among the most for major state schools.

10. Ohio

> Avg. debt at graduation: $19,495

> Pct. of adults with at least a bachelor’s degree: 26.8% (17th lowest)

> Median household income, ages 25-44: $56,786 (21st lowest)

> Avg. debt as share of median household income: 34.3% (7th highest)

At an average of nearly $20,000 per student, the typical debt for students graduating from colleges and universities in Ohio is 10th highest of all states. Because debt per student includes all students, including those who did not take loans, the relatively high proportion of recent state graduates who needed to borrow largely explains the high per-student debt. And the average debt among only those students who borrowed is even higher. Approximately two-thirds of college students in Ohio graduated with debt, in the top 10 compared with other states. The typical debt at graduation among only students who borrowed is $30,239, ninth highest in the nation.

[in-text-ad]

9. West Virginia

> Avg. debt at graduation: $19,520

> Pct. of adults with at least a bachelor’s degree: 19.6% (2nd lowest)

> Median household income, ages 25-44: $49,624 (6th lowest)

> Avg. debt as share of median household income: 39.3% (2nd highest)

Students in West Virginia graduate college with $19,520 in debt on average, more than in most states. West Virginia is also one of the poorest states in the country, and the average student debt load amounts to 39% of the median household income of working-age adults between the ages of 25 and 44, a larger share than in any state other than Mississippi. For many students in the state, post-college earnings are not enough to offset the financial burden brought on by student loans. An estimated 16.2% of graduates with outstanding student loans in West Virginia default on their debt within two years of leaving school, the second largest share of any state.

8. Massachusetts

> Avg. debt at graduation: $19,854

> Pct. of adults with at least a bachelor’s degree: 41.5% (the highest)

> Median household income, ages 25-44: $80,184 (the highest)

> Avg. debt as share of median household income: 24.8% (18th lowest)

The average Massachusetts college student leaves school with roughly $20,000 in student debt, among the most of any state. One partial explanation may be the high cost of tuition in the state. According to the College Board, tuition at an average four-year public university in the state is $12,280, the eighth highest in the country.

While Massachusetts has some of the more expensive colleges in the country, it is a worthwhile investment for many students. Graduates of Harvard University and the Massachusetts Institute of Technology earn more on average than graduates of nearly any other school in the country. The median household income for those ages 25 to 44 in Massachusetts of $80,184 is the second highest of any state. Just 6.1% of indebted graduates in the state default on their student loans within two years of leaving school, the smallest share nationwide.

7. Wisconsin

> Avg. debt at graduation: $19,881

> Pct. of adults with at least a bachelor’s degree: 28.4% (24th lowest)

> Median household income, ages 25-44: $61,669 (21st highest)

> Avg. debt as share of median household income: 32.2% (11th highest)

Students of private universities tend to graduate with substantially more debt than students of public colleges. Nine of the 10 Wisconsin colleges and universities where students graduate with the most debt are private institutions. The average graduate of the University of Wisconsin-Oshkosh, a public school, has $26,960 in student debt, well above the national average. Students of the University of Wisconsin at River Falls, Stevens Point, Eau Claire, La Crosse, and Madison, on the other hand, all tend to have relatively small student loans at graduation.

Tuition and fees at public four-year universities in Wisconsin rose by 2.3% over the past five years, one of the lowest increases compared with other states. By contrast, tuition and fees grew by an average of 9.4% nationwide over that period.

6. Rhode Island

> Avg. debt at graduation: $20,334

> Pct. of adults with at least a bachelor’s degree: 32.7% (13th highest)

> Median household income, ages 25-44: $64,614 (17th highest)

> Avg. debt as share of median household income: 31.5% (13th highest)

Due to several reasons, including discounts for in-state students and the ease of travel, in most states the majority of students are from the state. Rhode Island, which has among the highest average per-student debt in the country, is a notable exception. Less than one in four Rhode Island enrollees in fall 2014 were state natives.

The lower share of local students may explain the high debt burden of Rhode Island college graduates. Out-of-state students attending public universities in the small state pay $15,450 on average more than locals attending these schools.

5. South Dakota

> Avg. debt at graduation: $21,298

> Pct. of adults with at least a bachelor’s degree: 27.5% (18th lowest)

> Median household income, ages 25-44: $59,249 (25th highest)

> Avg. debt as share of median household income: 35.9% (4th highest)

State college and university systems tend to be less expensive than private postsecondary institutions, and this is no different in South Dakota. The typical four-year private school in the state charges $8,140 for in-state students. The system also has the smallest premiums for our-of-state students. Undergraduate enrollees at a University of South Dakota school from outside of the state only pay an average of $11,470, a difference of $3,330. In contrast, out-of-state students nationwide spend $15,280 more on average than in-state students.

[in-text-ad]

Even with relatively inexpensive public schools, students across the state are more likely to have debt, and those with debt tend to have more of it than most states. Of those who graduated from a South Dakota school in 2015, 73% had debt, the second highest share in the country.

4. Minnesota

> Avg. debt at graduation: $21,744

> Pct. of adults with at least a bachelor’s degree: 34.7% (10th highest)

> Median household income, ages 25-44: $71,122 (9th highest)

> Avg. debt as share of median household income: 30.6% (16th highest)

Those who graduate from college or university in Minnesota have an average of $21,744 in debt, more than in all but a handful of states. When excluding the students with zero debt upon graduation, the average debt is nearly $10,000 higher. Not only is the average per-student debt higher, but more students in the state are likely to have debt. Seven in 10 students who completed school in 2015 had debt, the fifth highest share of any state.

However, while Minnesota’s students tend to graduate with a large amount of debt, most are able to pay it off without getting into financial trouble. Just 8.8% of Minnesota’s class of 2013 who had debt defaulted on their student loans within the first three years, less than the 11.3% of all U.S. students with debt who did.

3. Connecticut

> Avg. debt at graduation: $21,805

> Pct. of adults with at least a bachelor’s degree: 38.3% (4th highest)

> Median household income, ages 25-44: $73,328 (7th highest)

> Avg. debt as share of median household income: 29.7% (19th highest)

The premium paid by out-of-state students in Connecticut, who make up a relatively high share of all students compared with other states, helps explain the state’s third highest average debt at graduation. For state residents attending a four-year public university in the state the average tuition of $11,730 is just slightly higher than the national average in-state tuition of $9,650. For out-of-state students, however, the comparable tuition is $31,580, the third highest of all states.

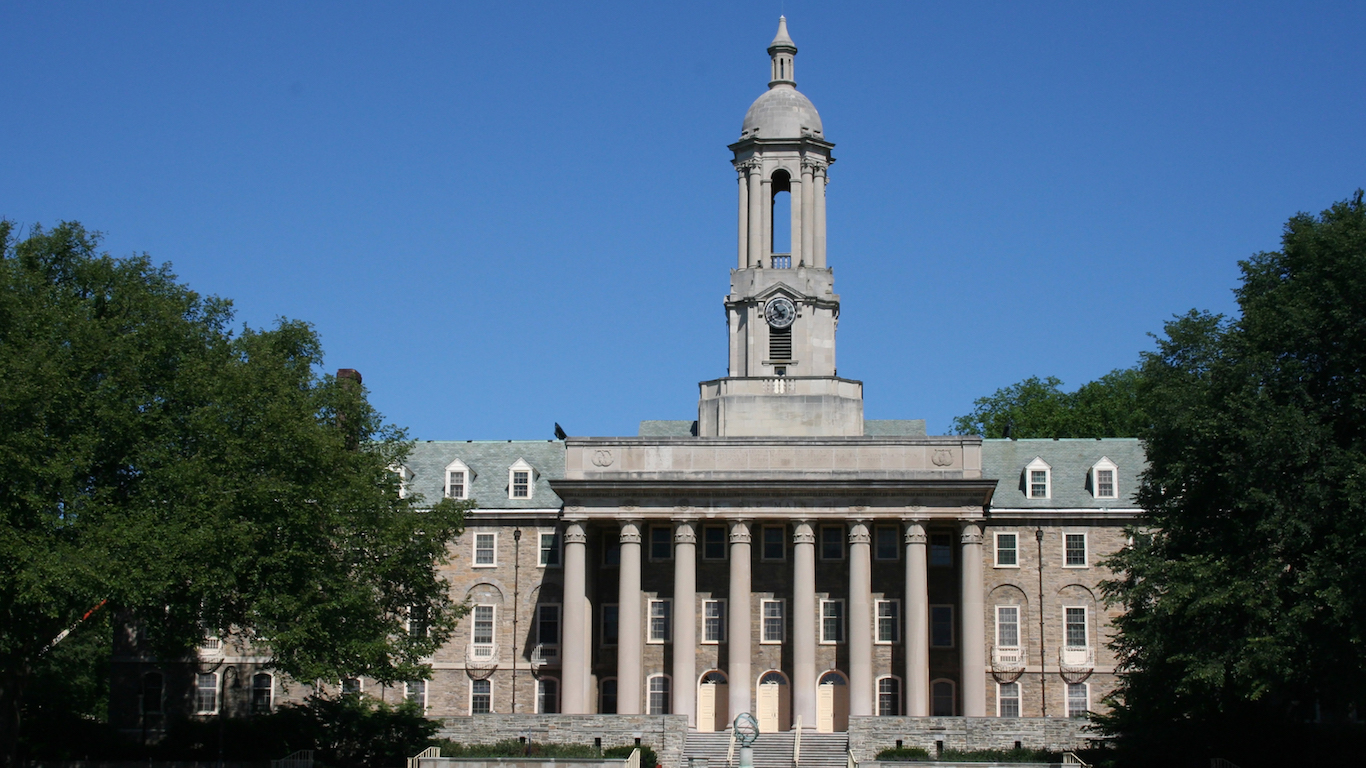

2. Pennsylvania

> Avg. debt at graduation: $24,172

> Pct. of adults with at least a bachelor’s degree: 29.7% (23rd highest)

> Median household income, ages 25-44: $63,547 (20th highest)

> Avg. debt as share of median household income: 38.0% (3rd highest)

The near-nation leading average per-student debt in Pennsylvania could be partially due to relatively high tuitions at state universities. The average in-state tuition for a student at a four-year state public college is $13,880, the third highest in-state tuition of all states. The high proportion of students who take on student debt, at 71%, also drives up the average debt load across all graduates.

Not all graduates of Pennsylvania’s university system tend to have large student debt. Graduates of the University of Pennsylvania, Swarthmore College, and Haverford College, for example, leave with less than $10,000 in debt on average. However, of the nearly 100 postsecondary institutions reviewed in Pennsylvania, these institutions are unusual.

1. New Hampshire

> Avg. debt at graduation: $25,740

> Pct. of adults with at least a bachelor’s degree: 35.7% (8th highest)

> Median household income, ages 25-44: $77,046 (3rd highest)

> Avg. debt as share of median household income: 33.4% (9th highest)

Students who graduate from college in New Hampshire tend to have more debt than their peers in every other state. The average debt at graduation of $25,740 is well above the national average of $16,929 per student. Students of New Hampshire’s university system are also the most likely in the nation to borrow money for their education. More than three in every four students had loan debt at graduation. While this certainly drives up the average per-student debt, the average debt among only those students who borrowed, at $36,101, is also the highest in the country. This means that compared to other states, not only are students in New Hampshire more likely to borrow, but also they tend to borrow more.

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.