Special Report

The Best CEOs of 2016

Published:

Last Updated:

Many factors influence a company’s performance — some within the control of corporate leadership and some outside out of it. Anything from government regulations, economic conditions, the price of oil, and unpredictable events can change a company’s bottom line.

It is largely the responsibility of CEOs to manage the risks of doing business. In addition, top management is expected to have impeccable knowledge of the industry and its customers. Taken together, CEOs make strategic decisions to steer the company in the right direction. For these reasons, investors watch CEOs very closely.

24/7 Wall St. reviewed various data for S&P 500 companies, including historical share prices, CEO tenures, and other performance metrics to identify some of the best CEOs in the nation. Jen-Hsun Huang of Nvidia is the leader as shares of the company he heads shot up 550% over the last three years. Martin Anstice of Lam Research Group rounds out the list in 15th place as LRCX shares nearly doubled in value in a three year period.

Click here to see the best CEOs of 2016.

The exact manner in which a CEO’s performance affects a company is difficult to pin down. In addition to providing a vision and long-term path for a company, a CEO participates in high-stakes negotiations for such deals as mergers, which can dramatically alter — for better or worse — the course of a company.

Despite opposition from the federal government, managed care company Humana and pharmaceutical giant Aetna are widely expected to complete a shareholder-approved merger due to the cooperation of corporate leadership. Facebook CEO Mark Zuckerberg’s decision to acquire Instagram for $1 billion in 2012 — considered ludicrous at the time, but a steal today — is another example. Similarly, the profits garnered from the massive consolidation in the airline industry would not be possible without the vision, cooperation, and negotiations performed by each company’s top executives.

To determine the best CEOs in America, 24/7 Wall St. reviewed the three-year stock price change through December 29, 2016 for all S&P 500 companies. To be considered, a company’s stock price needed to have significantly outperformed the S&P 500 index over the past three years as well as over the past 12 months, and — to ensure company performance can reasonably be attributed to current leadership — a CEO’s tenure needed to be at least three years. There are 15 companies on the S&P 500 that meet these criteria. Financial data for each company was obtained from the most recent financial documents filed with the federal government.

These are America’s best CEOs.

15. Martin Anstice

> Company: Lam Research Group

> 3-yr stock price change: 96%

> 1-yr stock price change: 33%

> CEO since: January 2012

Martin Anstice joined semiconductor maker Lam Research Corporation in 2001. Over the following decade, he swiftly rose through the ranks, holding various roles, including chief financial officer and executive vice president. He assumed the role of chief executive officer in 2012. Prior to working at Lam Research, Anstice held various positions at major corporations, including Raychem Corporation and its eventual parent, electronic sensors distributor Tyco International. Under Anstice’s leadership, Lam Research Group posted revenue growth of 24.7% from 2014 through 2015, the largest among major semiconductor manufacturers.

14. Bruce Broussard

> Company: Humana

> 3-yr stock price change: 100%

> 1-yr stock price change: 14%

> CEO since: January 2013

The value of Kentucky-based managed care company Humana shares has doubled over the last three years, outperforming the S&P 500 by a wide margin. Humana posted 2015 revenue of $54.29 billion, up from $48.50 billion in 2014 and $41.31 billion in 2013. Profits remained stable at over $1.1 billion in each of the past three fiscal years. In addition to overseeing Humana’s financial success, CEO Bruce Broussard appears to be managing merger and acquisition opportunities relatively well.

In the fall of 2015, Humana stockholders approved a merger agreement between Humana and fellow health care giant Aetna. The merger’s legality is currently being scrutinized by the Justice Department and a ruling will likely be made in early 2017, but the merger’s prospects are reportedly good. The two companies have already agreed to sell assets identified as problematic.

13. Wes Bush

> Company: Northrop Grumman

> 3-yr stock price change: 105%

> 1-yr stock price change: 23%

> CEO since: January 2010

After serving as corporate vice president, chief financial officer, and president of the company’s space technology division, Wes Bush was appointed Northrop Grumman CEO in January 2010. Under his leadership, Northrop Grumman’s stock price has more than doubled over the past three years — outperforming the S&P 500 index considerably. Despite the defense company’s strong performance on Wall Street, Bush’s compensation has fallen in recent years due in part to the company’s failure to win as many defense contracts as it had targeted. The lack of new contracts is likely the result of cuts to the U.S. defense budget that are affecting companies throughout the defense industry. While Northrop Grumman’s revenue from U.S. government contracts has fallen over the past three years, the company has managed to increase sales from international and other clients. In each of the last four quarters, Northrop Grumman has exceeded earnings estimates.

12. Tom Rutledge

> Company: Charter Communications

> 3-yr stock price change: 118%

> 1-yr stock price change: 44%

> CEO since: February 2012

Charter Communications is a telephone, internet, and television service provider, with operations in 41 states. Headed by Tom Rutledge since 2012, the company has done well for its shareholders in recent years. Now trading at over $290 a share, the company’s stock price has climbed by more than 400% since Rutledge took over. Investor confidence has likely been stoked by increasing revenues in each of the last two years. In addition, under Rutledge’s direction, Charter Communications acquired rival Time Warner Cable in a $56.7 billion deal last year. The deal turned Charter into the country’s second largest cable operator.

Rutledge has a long history in the cable television service industry. Over his nearly four-decade career in the industry, he has served in many high profile positions, including president of Time Warner Cable and COO of Cablevision Systems Corporation.

11. Scott Farmer

> Company: Cintas

> 3-yr stock price change: 97%

> 1-yr stock price change: 26%

> CEO since: July 2003

Headquartered in Cincinnati, Ohio, Cintas specializes in services for businesses such as manufacturing corporate uniforms, providing promotional products, and offering first aid and other services. Scott Farmer joined Cintas in 1981. He held a variety of executive positions until he was elected CEO in July 2003. Over the past three years, the price of Cintas stock has nearly doubled. While the company’s uniform segment contributed more than three-fourths of total sales in fiscal 2016, the first aid and safety segment posted the fastest growth. Sales of first aid and safety products and services grew 41.4% to $461.8 million, while sales of uniforms grew 6.7% to $3.8 billion.

In recent years, Cintas has been slimming down through divestitures of its non-core operations. Cintas completed in October 2015 the sale of its stake in the document management company Shred-It to waste management firm Stericycle. Cintas announced the sale of its document storage and imaging businesses in November 2014.

10. Stephen Smith

> Company: Equinix

> 3-yr stock price change: 120%

> 1-yr stock price change: 17%

> CEO since: April 2007

Stephen Smith has been at the helm of Equinix, a data center company, for nearly a decade. Over his tenure, Equinix has remained a strong performer on Wall Street. Since Smith took over in April 2007, the company’s share price has climbed by over 300%, due in part to the success of some strategic acquisitions. Many analysts predict the company will continue to outperform the S&P 500 index. Earlier this month, Equinix bought 24 Verizon data centers for $3.6 billion. The company believes the acquisition will bring in $450 million in revenue within the first year after the deal closes.

Smith spent the first eight years of his career in the military as a special assistant to the commanding officer of U.S. troops stationed in the Pacific. Since leaving the military, Smith has spent nearly two decades working at tech and software businesses, including as senior VP at Hewlett-Packard’s global services division before taking the top job at Equinix.

9. Mark Zuckerberg

> Company: Facebook

> 3-yr stock price change: 118%

> 1-yr stock price change: 10%

> CEO since: February 2004

Facebook CEO and co-founder Mark Zuckerberg is one of the most highly regarded corporate leaders in the world. Famous for being one of history’s youngest billionaires, Zuckerberg relentlessly works at growing his company. Facebook’s user base reportedly surpassed 1 billion in 2012 and continues to grow. As of last year, the total number of daily, monthly, and mobile users also surpassed 1 billion, and each metric had increased from the previous year. Under Zuckerberg’s guidance, Facebook posted revenue of $17.92 billion in 2015, up from $12.47 billion in 2014 and $7.87 billion in 2013. Profits rose proportionately, at $3.67 billion in 2015, up from $2.93 billion in 2014 and $1.49 billion the year before.

Zuckerberg has recently taken on projects with global reach. For instance, he initiated in 2014 a partnership between major technology companies called Internet.org with the stated intention of providing internet access to every human being.

8. Stephen Hemsley

> Company: UnitedHealth

> 3-yr stock price change: 116%

> 1-yr stock price change: 36%

> CEO since: November 2006

Stephen Hemsley joined UnitedHealth Group in June 1997. After serving as president and chief operating officer, Hemsley was named CEO in November 2006. In the decade of Hemsley’s tenure, UnitedHealth Group’s stock has steadily risen. In the past three years, the stock price has more than doubled.

UnitedHealth has managed to outperform most of its fellow health insurers, while the industry suffers from profit losses related to the Affordable Care Act. An unexpectedly high number of claims from ACA patients have hurt health insurers. Partially as a result, UnitedHealth has stopped selling ACA plans in a number of state markets. UnitedHealth managed to offset the losses, however, by the strong performance by its health services segment, Optum. The company beat earnings estimates in each of the last four consecutive quarters.

7. C. Howard Nye

> Company: Martin Marietta Materials

> 3-yr stock price change: 126%

> 1-yr stock price change: 65%

> CEO since: January 2010

Martin Marietta Materials sells a variety of construction materials, including asphalt, concrete, cement, and aggregates. Like many other companies in the industry, Martin Marietta has benefitted considerably from the recent rebound in the U.S. housing market. In addition to favorable market conditions, the company and its shareholders have also benefitted from the leadership of CEO Ward Nye.

Nye has nearly two decades of experience in the building materials and aggregates industry. Currently trading at near all-time highs, the company’s share price has appreciated by about 150% over the course of Nye’s tenure. Under Nye’s leadership, Martin Marietta boosted the company’s value on Wall Street to the point that it entered the S&P 500. Since then, the company acquired concrete and cement producer Texas Industries, and started the largest capital construction project in company history.

6. Brad Tilden

> Company: Alaska Air

> 3-yr stock price change: 145%

> 1-yr stock price change: 8%

> CEO since: May 2012

Chief executive officers are instrumental in merger and acquisitions, which are often major milestones in a company’s financial history. Shareholders watch these negotiations closely and evaluate CEO performance accordingly. Under Brad Tilden, Alaska Air completed a $2.6 billion takeover of Virgin America. Both airlines have posted above-average profits in recent years, and the deal — completed this year — created the nation’s fifth largest carrier in terms of revenue. Tilden will serve as CEO of the combined company.

Under Tilden, Alaska Air Group reported net income growth over the last three fiscal years. Tilden joined Alaska Air in 1991. Prior to his role as CEO, he filled various executive positions including controller, vice president of finance, and executive vice president.

5. Gary Kelly

> Company: Southwest Airlines

> 3-yr stock price change: 166%

> 1-yr stock price change: 16%

> CEO since: July 2004

CEO Gary Kelly can certainly be credited for a significant portion of Southwest Airlines’ ongoing favorable financial results, although the company was doing well long before Kelly took the reins in 2004. Southwest Airlines reported $2.2 billion in net income in its most recent fiscal year, the 43rd consecutive year of profitable results. It is also important to note that like other companies, but to a greater degree, financial performance of airlines such as Southwest is partially dependent on the status of government regulation as well as the price of oil. The U.S. airline industry benefited considerably from the drop in fuel prices in recent years, for example. However, Kelly has likely helped Southwest stand out even among airlines. In public statements, he has attributed Southwest’s ongoing success to customer service policies that he introduced and better than expected gains in developing markets.

4. Mary Dillon

> Company: Ulta Beauty

> 3-yr stock price change: 173%

> 1-yr stock price change: 39%

> CEO since: July 2013

Ulta, the largest beauty retailer in the United States, is one of the top performers in the S&P 500 index. While any given company’s performance on Wall Street is subject to any number of factors, Ulta shareholders have CEO Mary Dillon to thank. In 2013, her first year as CEO, Dillon worked undercover on a six-hour sales-floor shift during the busy holiday shopping season. Her experience led her to change the company’s strategy from focusing on discounts and coupons to focusing on convenience and customer experience. The reprioritization appears to have paid off. Since Dillon took over, the company’s share price has more than doubled. Beating earnings estimates in each quarter of fiscal 2016, the company has outperformed the S&P 500 index by nearly 30 percentage points year to date.

3. Michael Mussallem

> Company: Edwards Lifesciences

> 3-yr stock price change: 185%

> 1-yr stock price change: 18%

> CEO since: March 2000

What is now Edwards Lifesciences can trace its roots back more than half a century, when Miles Edwards invented the world’s first artificial heart valve and successfully placed it in a patient. Today, the company designs and manufactures medical equipment related to cardiovascular health.

Headed by CEO Michael Mussallem, Edwards Lifesciences is now among the top performing companies on Wall Street. For much of his career leading up to his current role, Mussallem worked for health care company Baxter International, the former parent company of Edwards Lifesciences. Mussallem became CEO of Edwards Lifesciences in 2000, the same year the company broke away from Baxter International. In the last 10 years, Edwards Lifesciences stock has appreciated by over 600%. Under Mussallem’s leadership, Edwards Lifesciences has reported 11 consecutive years of increasing earnings.

2. Andrew Wilson

> Company: Electronic Arts

> 3-yr stock price change: 251%

> 1-yr stock price change: 15%

> CEO since: September 2013

Video game company Electronic Arts develops games, content, and services for consoles, personal computers, and mobile devices. The company’s portfolio includes some of the most popular and successful brands in the video game industry such as The Sims, Madden, and FIFA. Andrew Wilson joined Electronic Arts in 2000 and held a number of key executive and development positions before being appointed CEO in 2013. In the two years prior to Wilson’s CEO appointment, EA was named the “Worst Company in America” by consumer news site Consumerist. As CEO, however, Wilson spearheaded EA’s revival. The turnaround was partially fueled by a redevelopment of the then-faltering FIFA brand, which reemerged as the fastest-selling sports game ever and today accounts for roughly one-third of the company’s revenue. Under Wilson’s leadership, the company’s profits grew from $8 million in fiscal 2014 to $875 million in 2015 and $1.2 billion in 2016.

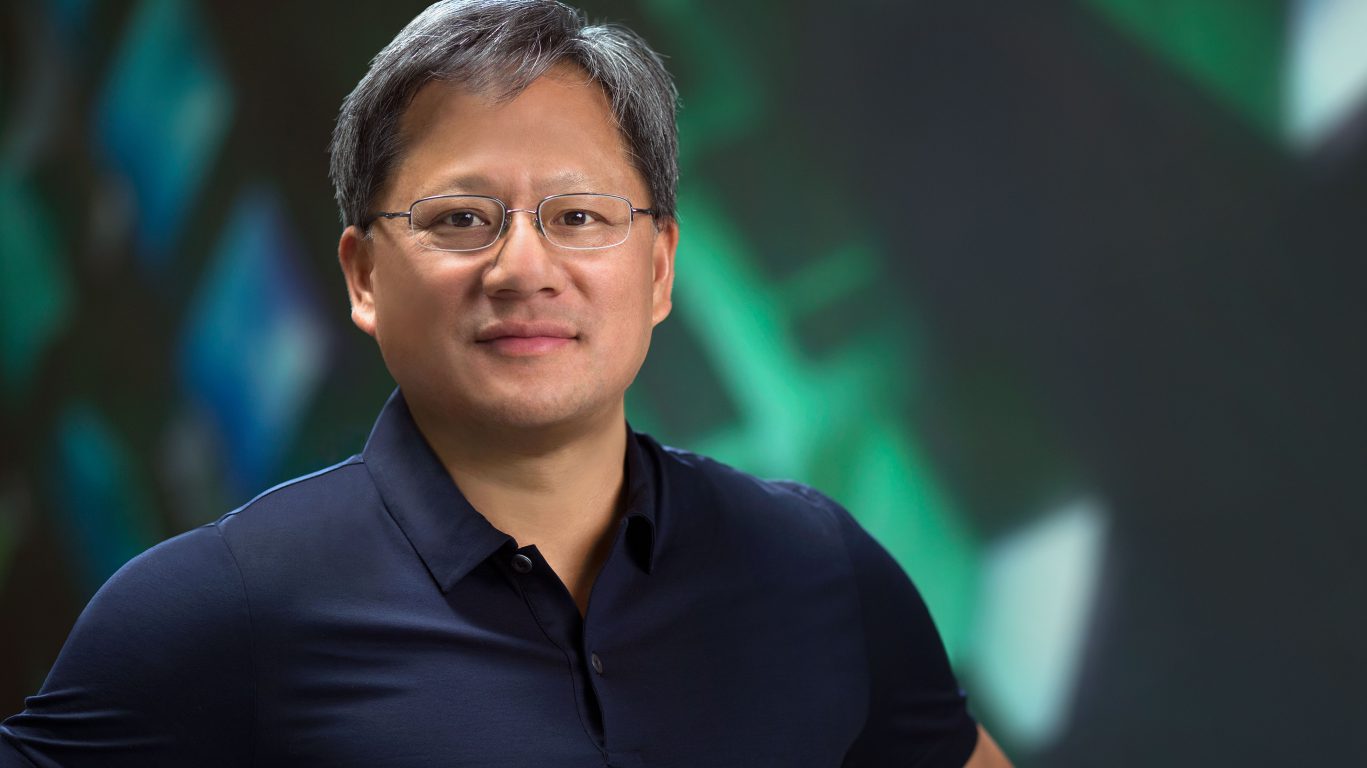

1. Jen-Hsun Huang

> Company: NVIDIA

> 3-yr stock price change: 555%

> 1-yr stock price change: 213%

> CEO since: April 1993

Semiconductor company Nvidia manufacturers chips for the gaming, professional visualization, data, mobile and automotive markets. The demand for the chips and components needed for these processes is widely expected to grow in coming years as graphics capabilities continue to improve, companies and individuals shift to cloud computing, and due to ongoing developments in the self-driving auto market from the likes of Google and Tesla. Shares of Nvidia increased in value by over 200% year to date and by more than 550% over the past three years — far and away the most of any S&P 500 company. The company reported $614 million in net income from operations in its most recent fiscal year, up from $440 million in 2014. Revenue grew to $5.01 billion, a record for the company.

Founder and CEO Jen-Hsun Huang can be given at least partial credit for keeping his company profitable. In public statements, Huang has touted the importance of both autonomous driving technology and cloud computing — Nvidia has profited immensely from developments in both these areas.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.