Special Report

The 8 Poorest US Presidents

Published:

Last Updated:

Based on campaign finance reports, Sen. Bernie Sanders and Sen. Marco Rubio, who at one point were among the leading candidates for the nation’s highest office, are each likely worth less than $500,000. Should either candidate have been elected, it would have been a departure from the recent trend. Each of the last five presidents have had net worths of at least $1 million. The current president, Donald Trump, is likely worth billions, and is the wealthiest president of all time.

Sanders and Rubio’s net worth does not match the wealth of former President Obama, whose estate we price at $7 million, or the $75 million combined estate of former president Bill Clinton and current presidential hopeful Hillary Clinton. However, they have by no means experienced the financial destitution some of our nation’s leaders have faced.

24/7 Wall St. examined the finances of all 43 presidents and found eight that became insolvent at one time or another during their adult lifetimes. Jefferson had a passion for expensive homes, land, and personal property. Madison was a poor judge of real estate values and gambled that his plantations would produce outsized crop production. William Henry Harrison had bad luck with the weather which destroyed his wheat and corn.

Click here to see the 8 poorest U.S. presidents.

Click here to see the 10 richest U.S. presidents.

By the middle of the 19th century, land ownership went from being common to unusual. Lincoln lost everything when the general store he owned with a partner failed. An associate of Grant’s son ran through the former Union general’s entire fortune. The depression of 1893 ruined the value of McKinley’s investment in a tin plate company. Truman lost the clothing store that he owned with a partner.

As we observed in the Net Worth of the American Presidents, the nation’s chief executives were men of their times, at least financially. What is striking is the extent to which many were gamblers. Some, like Hoover, bet and won. He became wealthy in the mining business. LBJ made money as a cattle rancher, a risky business depending on the national appetite for beef and, to some extent the weather.

It could be argued that men who are willing to lead the nation into war, annex millions of square miles of territory or drop the atomic bomb to end a war were by their nature risk takers. Whether that is a better trait for managing personal wealth or the nation’s fortunes is for history to decide.

These are America’s poorest presidents.

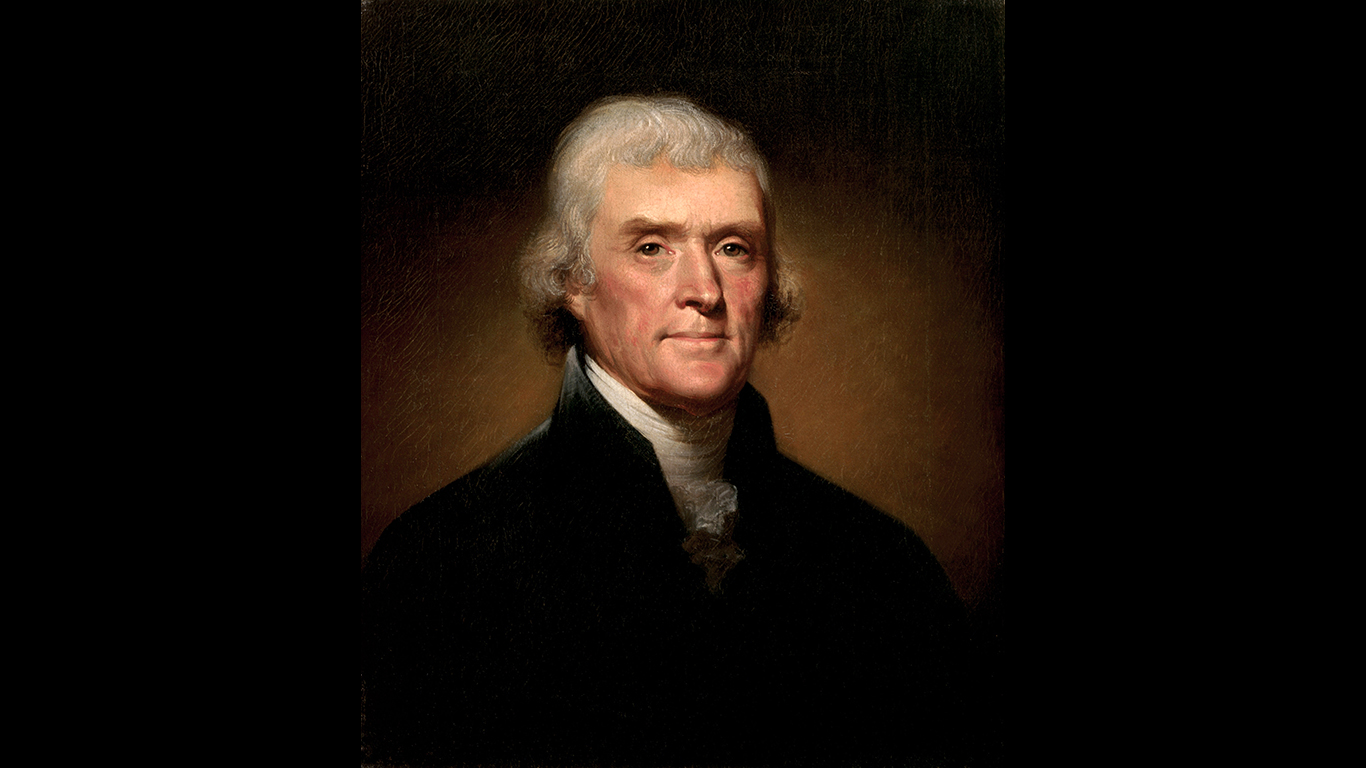

8. Thomas Jefferson

Despite an ostentatious lifestyle – or perhaps because of it – Jefferson owed money to various creditors throughout his life. He inherited debt from his father-in-law as a result of unusual estate planning and was a creditor to many unreliable debtors. His main source of income, “Monticello,” proved inadequate to cover his debts. Poor management of his estate and price fluctuations of commodities cost Jefferson dearly. Towards the end of his life, he was so severely in debt that he petitioned the state of Virginia to auction off his land; the state refused. After he died, his estate was was auctioned off, and his surviving daughter was forced to rely on charity.

[in-text-ad]

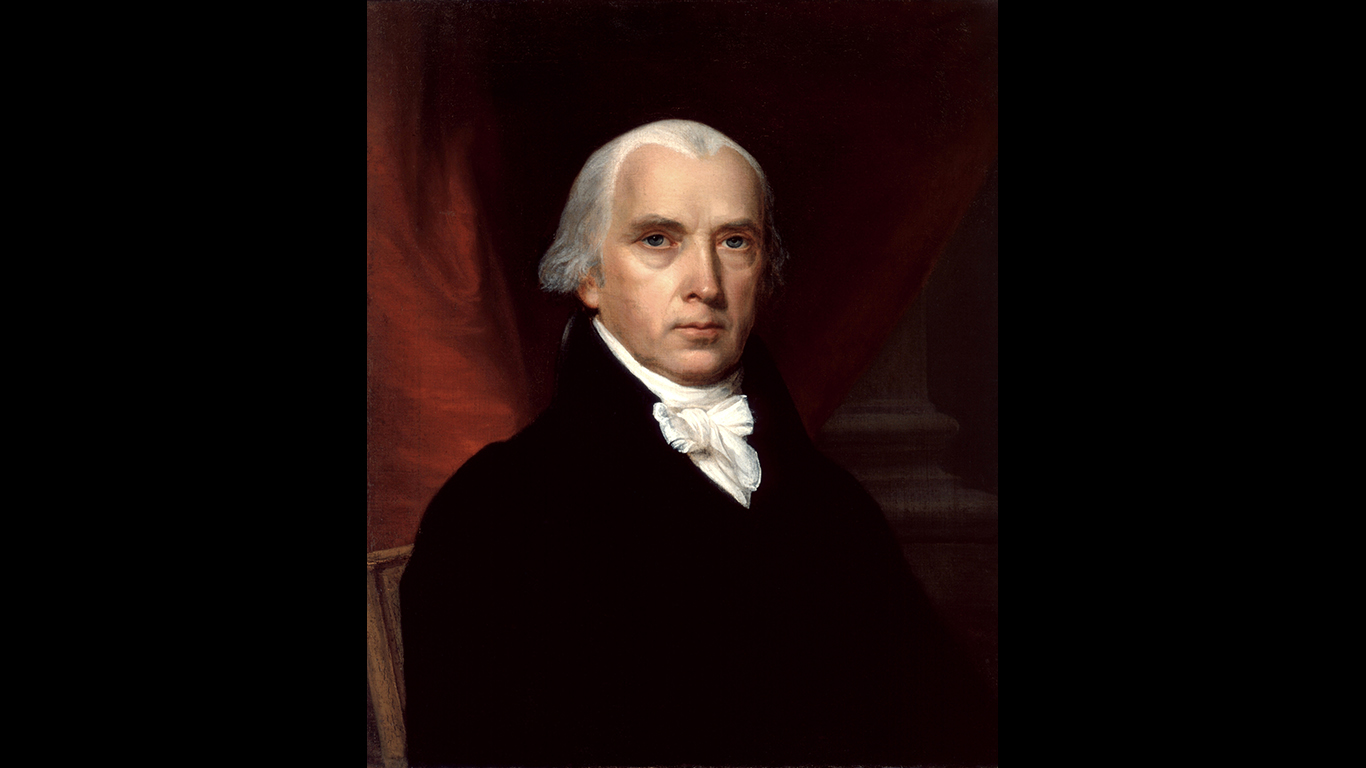

7. James Madison

At his “Montpelier” plantation, Madison suffered similar difficulties to Jefferson. While his various agriculture businesses were occasionally profitable, in the end they lost him money. His stepson, a gambler, racked up debts. Madison absorbed these obligations and was forced to sell half of Montpelier to pay them off. Although he may have wanted to free his slaves, his financial troubles prevented him from doing so, and he was forced to sell some of them to pay off debts. Some historians suggest that he had his memoirs published posthumously in order to better provide for his family.

6. James Monroe

Monroe ran his plantation into the ground. At the end of his life, he petitioned Congress to relieve some of his family’s debt and was granted $30,000. It turned out to be insufficient and he was forced to sell his home in Paris and his 3,500 acre “Ash Lawn” estate. On Monroe’s misfortune, John Quincy Adams wrote “Mr. Monroe is a very remarkable instance of a man whose life has been a continued series of the most extraordinary good fortune, who has never met with any known disaster, has gone through a splendid career of public service, has received more pecuniary reward from the public than any other man since the existence of the nation, and is now dying, at the age of seventy-two, in wretchedness and beggary.”

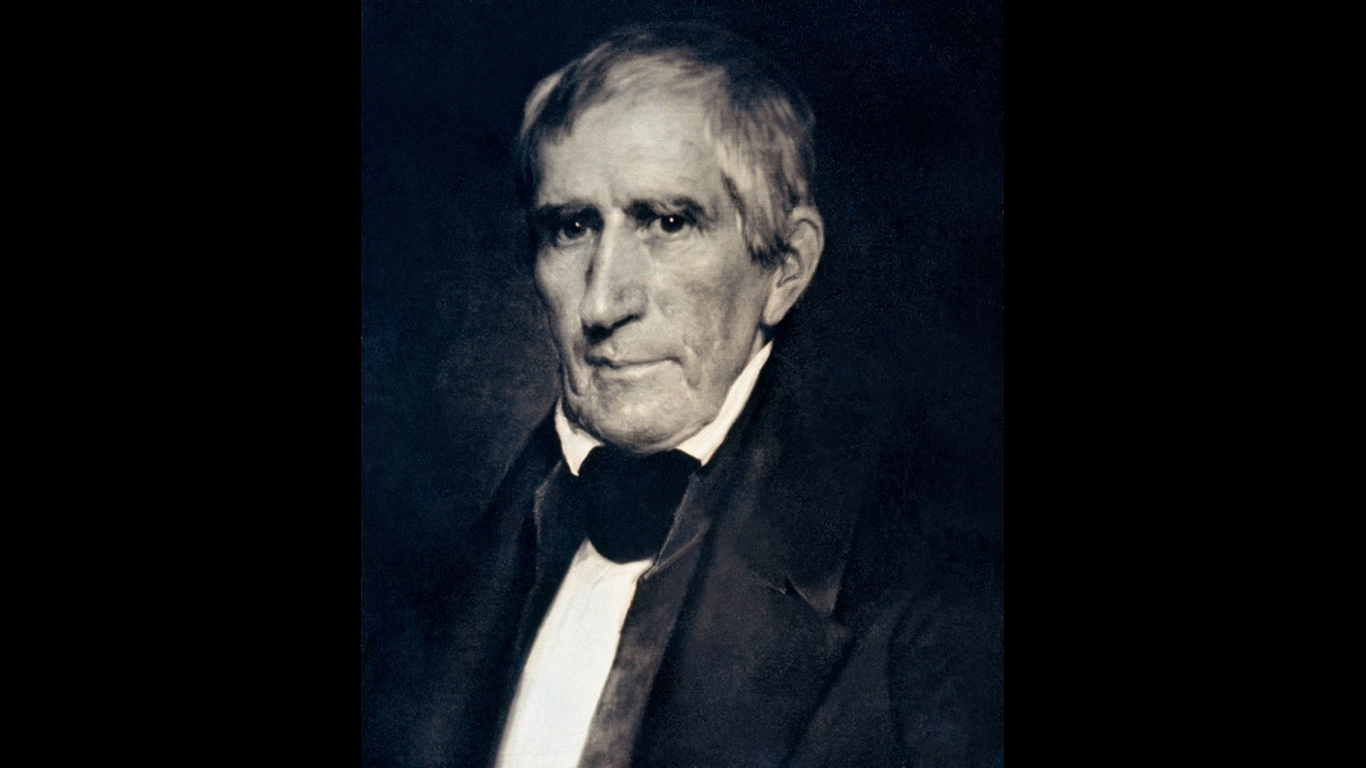

5. William Henry Harrison

While serving as the Ambassador to Colombia in 1829-1830, Harrison was forced to manage his farm from abroad. When he returned to the states, he discovered that bad weather had destroyed his crops. At the same time, his creditors were all demanding payment. On top of his own heavy obligations, his sons also owed substantial amounts. Harrison spent much of the time after his return to America trying to get his finances in order, and was forced to sell off most of his land. By the time he reached the White House, he was still reportedly in debt. His untimely death, only one month after entering office, may have been the only thing that prevented him from reaching total insolvency.

[in-text-ad]

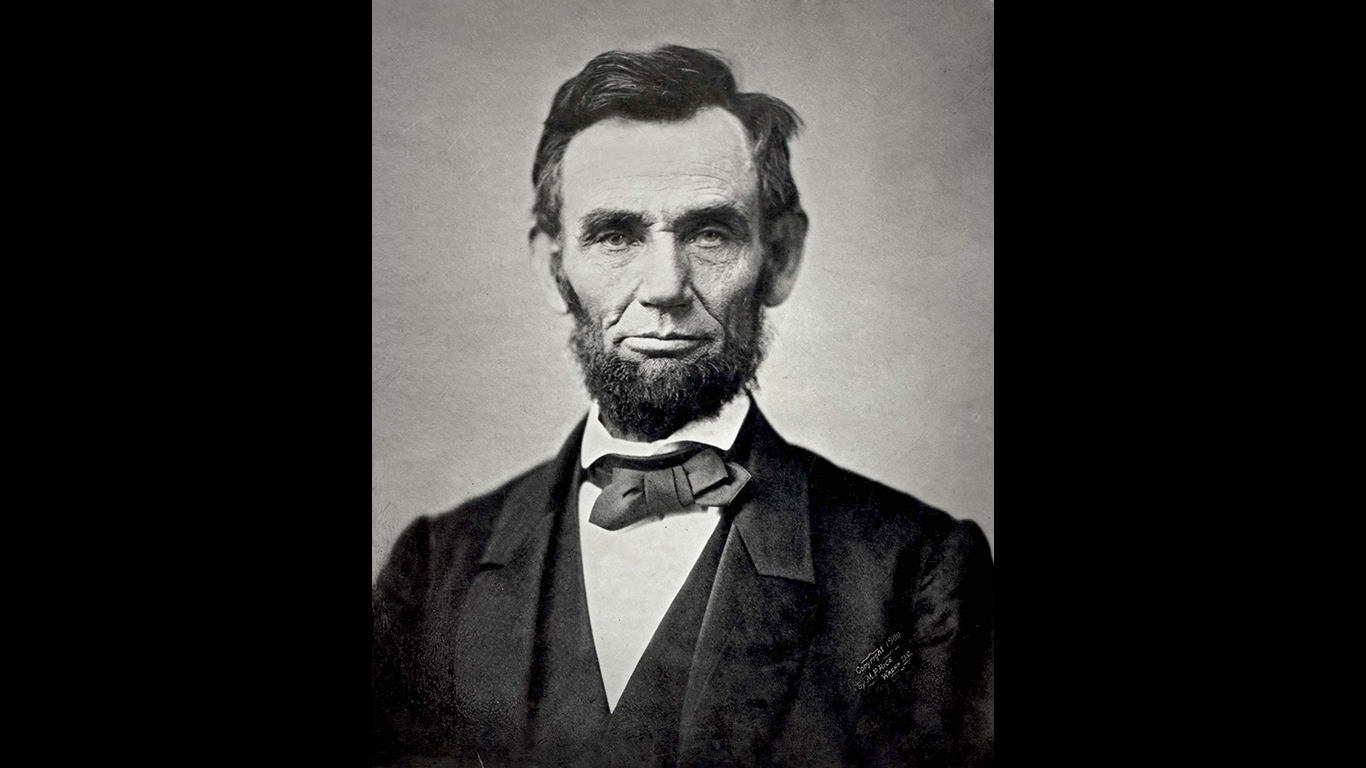

4. Abraham Lincoln

An ambitious but poor young man, Lincoln’s early life left him in financial ruin. When he was in his 20’s he bought a general store with a friend and business associate – an investment he would later regret. Before the store went bankrupt Lincoln sold his share in the venture. However, his partner died shortly afterwards and Lincoln was forced to absorb his debts. He was taken to court by the store’s creditors and lost ownership of his only remaining assets: a horse and some surveying equipment. His later career as an attorney eventually brought Lincoln out of complete poverty.

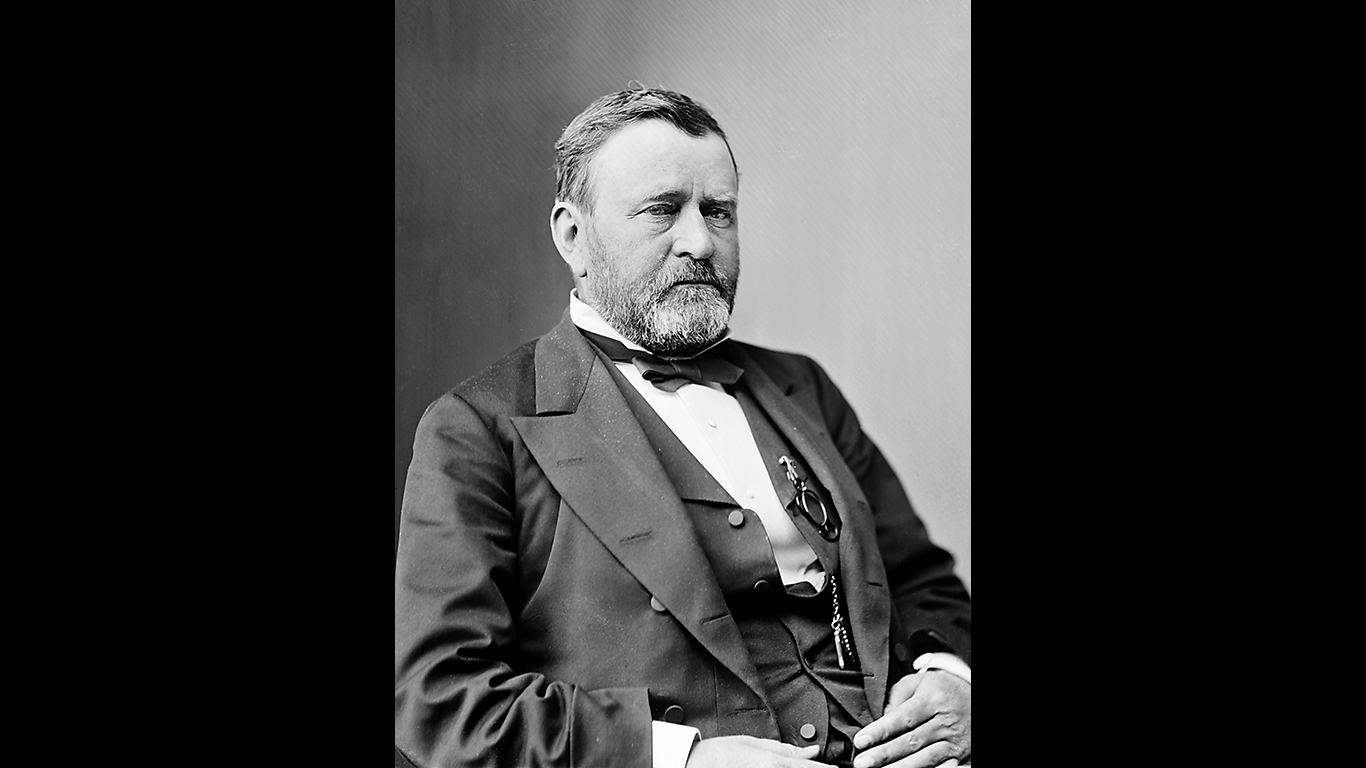

3. Ulysses Simpson Grant

His brief, illustrious career as our nation’s highest-ranking general notwithstanding, Grant never earned a great deal of money and often lived well beyond his means. This was especially the case after his presidency, when he and his wife traveled the world, dining with foreign dignitaries and staying in expensive hotels. In 1881, Grant’s son, Buck, convinced his father to enter an investment partnership with an associate of his, Ferdinand Ward, for $100,000. Ward mismanaged and embezzled Grant’s assets, and when the firm of Ward and Grant went bankrupt, the former was sent to prison, and Grant was left with hundreds of thousands in debt. He went bankrupt, and was only able to save his family further financial hardships by selling his civil war memoirs for nearly half a million dollars – published shortly after his death.

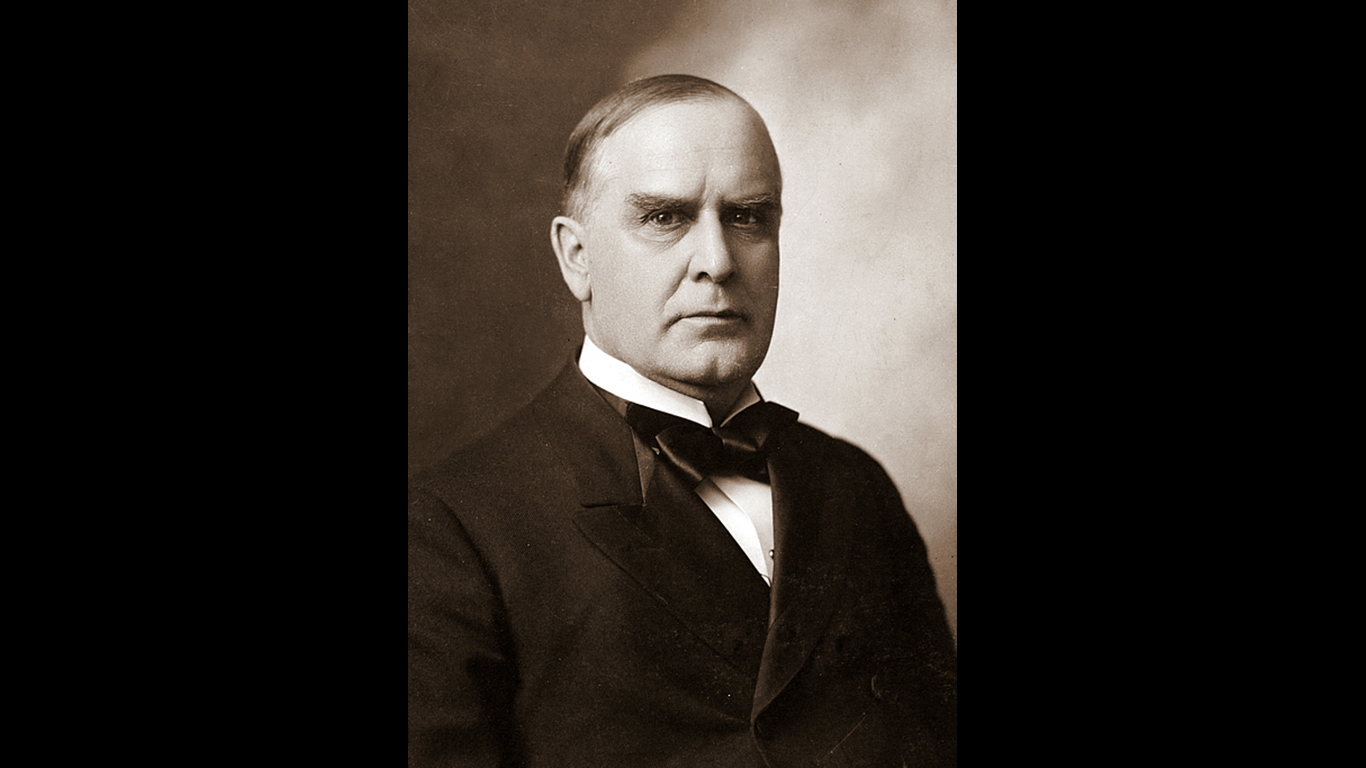

2. William McKinley

While McKinley spent most of his life in relative financial stability, the depression of 1893 bankrupted an investment he had made with a friend in a tin plate company. His final debts reached an estimated $130,000 and McKinley was forced to file for bankruptcy. In order to pay off his debts, McKinley solicited some of his friends to help him manage his estate and sell off his property. Instead, his friends exercised various connections and raised the sum of money on their own, much to McKinley’s perpetual shame.

[in-text-ad]

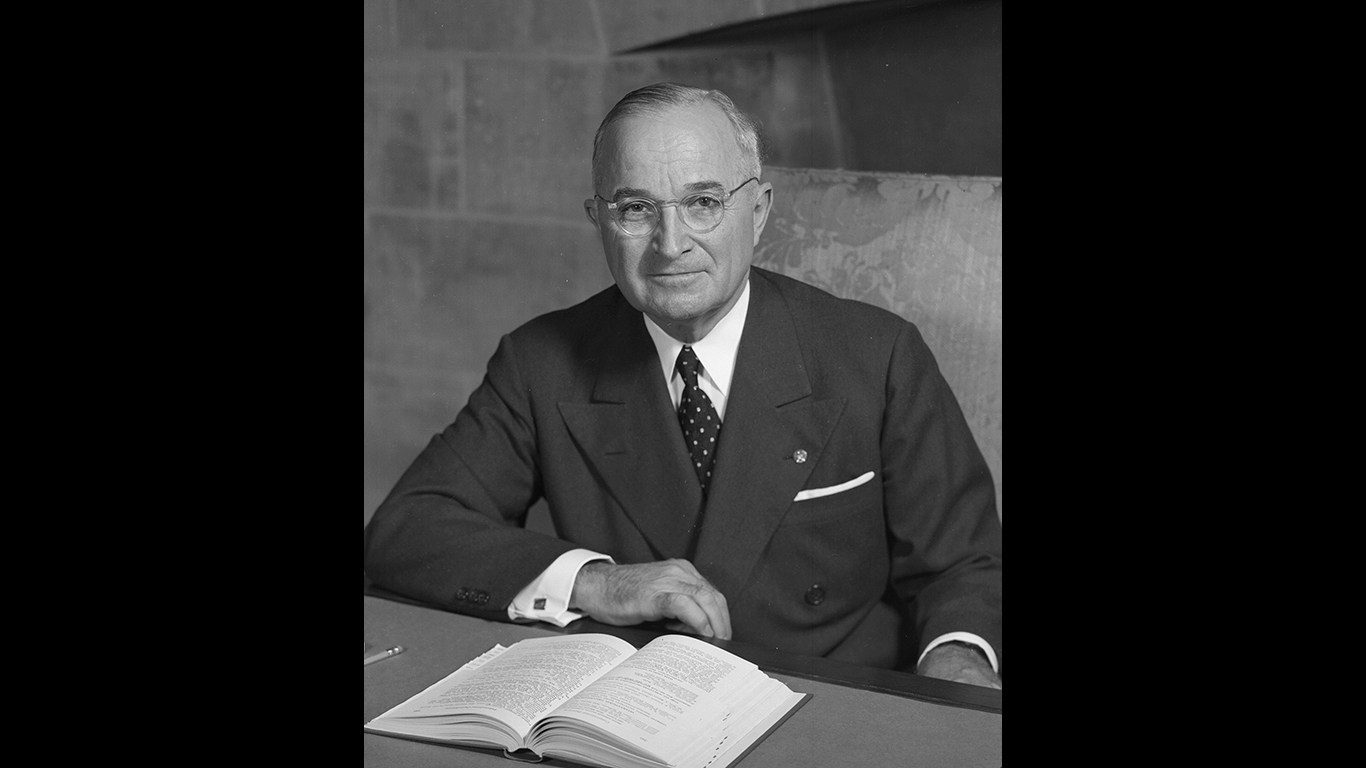

1. Harry S. Truman

One of the saddest cases of presidential hardship, Truman, was relatively poor throughout his life. He borrowed against his meager future inheritance and invested in a zinc mining operation, which failed and lost him most of his investment. Truman later performed various menial jobs, which barely kept his family afloat. However, the real financial disaster occurred when the clothing store he owned with a friend went bankrupt in the wake of extreme deflation. Truman lost his $30,000 investment, but never declared bankruptcy, despite urgings from friends and family to do so. Truman continued to pay debts throughout his early career, and was still thousands of dollars in debt when he began his tenure as a senator. It was Truman’s sad financial state that inspired the doubling of the presidential salary, which he received after the fact. Truman and his wife were the first two official recipients of Medicare when Lyndon Johnson signed the program into law.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.