Special Report

The County With the Most Expensive Housing Market in Every State

Published:

Last Updated:

Home prices are higher today than they were before the housing bubble. Because incomes have increased at a slower pace than housing prices, however, housing affordability has actually declined.

Housing prices also vary considerably within states. To determine the county with the most expensive housing market in every state, 24/7 Wall St. reviewed median home prices as of the fourth quarter of 2016 from the National Association of Realtors. The typical home nationwide costs $235,000. Of the 3,119 counties measured, San Francisco County, California is the most expensive housing market. The typical home there sells for over $1 million.

The counties with the most expensive housing markets are frequently within large metropolitan areas. In fact, 38 of the counties on this list are near urban centers.

Click here to see the county with the most expensive housing market in every state.

Large cities are often home to specialized jobs in some of the nation’s highest paying industries. The nation’s three most expensive housing markets are all counties in the San Francisco area, within commuting distance to the high paying technology jobs of Silicon Valley. Many other expensive housing markets are in the Northeast, near the urban centers of New York, Boston, and the District of Columbia.

While relatively expensive, these markets are not necessarily unaffordable. Of the 50 counties with the most expensive housing markets in their state, 22 also report the state’s highest incomes. Further, the homeownership rate in the most expensive county in 33 states is greater than the comparable state rate.

Yet there are some notable exceptions as a few of these markets are far from affordable for the typical resident. For example, the median household income in San Francisco County is one of the highest in the country, at over $81,000. The area’s seven-figure median home price, however, means relatively few residents have the option of owning their homes. San Francisco County’s homeownership rate of 36.4% is well below both the state and national rates of 54.3% and 63.9%, respectively.

The extremely expensive homes in the San Francisco area mirrors a regional pattern. Nationwide, housing prices increased by nearly 6% between the fourth quarters of 2015 and 2016. In the Western United States, already the most expensive region in the country, housing prices grew by nearly 8%.

To determine the county with the most expensive housing market in every state, 24/7 Wall St. reviewed median home prices in the 3,199 county and county-equivalents as aggregated by the National Association of Realtors for the fourth quarter of 2016. Monthly payments for the median home price for the same time period are also from the NAR and assume a fixed 30-year mortgage with a 4.2% interest rate and a 10% down payment. Median household incomes for each county come from the U.S. Census Bureau’s 2015 American Consumer Survey.

Here is the county with the most expensive housing market in every state.

1. Alabama

> County: Shelby

> Median sale: $207,684

> Monthly payment: $914

> Median household income: $70,187

> Surrounding metro area: Birmingham-Hoover, AL

[in-text-ad]

2. Alaska

> County: Sitka City and Borough

> Median sale: $372,064

> Monthly payment: $1,638

> Median household income: $70,376

> Surrounding metro area: N/A

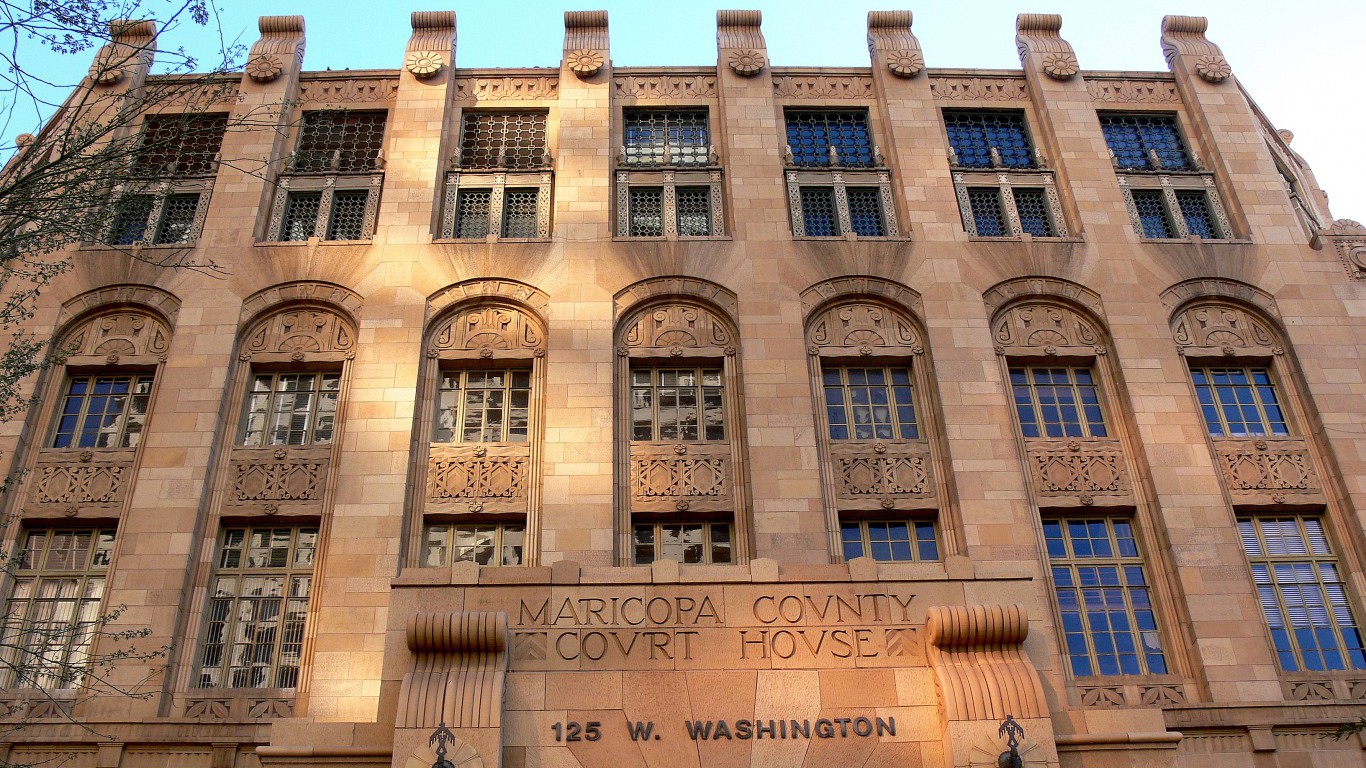

3. Arizona

> County: Maricopa

> Median sale: $251,691

> Monthly payment: $1,108

> Median household income: $54,229

> Surrounding metro area: Phoenix-Mesa-Scottsdale, AZ

4. Arkansas

> County: Benton

> Median sale: $180,437

> Monthly payment: $794

> Median household income: $56,239

> Surrounding metro area: Fayetteville-Springdale-Rogers, AR-MO

[in-text-ad-2]

5. California

> County: San Francisco

> Median sale: $1,048,166

> Monthly payment: $4,613

> Median household income: $81,294

> Surrounding metro area: San Francisco-Oakland-Hayward, CA

6. Colorado

> County: Pitkin

> Median sale: $727,422

> Monthly payment: $3,201

> Median household income: $71,196

> Surrounding metro area: N/A

[in-text-ad]

7. Connecticut

> County: Fairfield

> Median sale: $427,907

> Monthly payment: $1,883

> Median household income: $84,233

> Surrounding metro area: Bridgeport-Stamford-Norwalk, CT

8. Delaware

> County: New Castle

> Median sale: $265,141

> Monthly payment: $1,167

> Median household income: $65,476

> Surrounding metro area: Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

9. Florida

> County: Monroe

> Median sale: $449,807

> Monthly payment: $1,980

> Median household income: $57,290

> Surrounding metro area: N/A

[in-text-ad-2]

10. Georgia

> County: Forsyth

> Median sale: $329,054

> Monthly payment: $1,448

> Median household income: $88,816

> Surrounding metro area: Atlanta-Sandy Springs-Roswell, GA

11. Hawaii

> County: Honolulu

> Median sale: $687,898

> Monthly payment: $3,028

> Median household income: $74,460

> Surrounding metro area: Urban Honolulu, HI

[in-text-ad]

12. Idaho

> County: Blaine

> Median sale: $436,048

> Monthly payment: $1,919

> Median household income: $60,088

> Surrounding metro area: N/A

13. Illinois

> County: DuPage

> Median sale: $308,372

> Monthly payment: $1,357

> Median household income: $79,658

> Surrounding metro area: Chicago-Naperville-Elgin, IL-IN-WI

14. Indiana

> County: Hamilton

> Median sale: $248,642

> Monthly payment: $1,094

> Median household income: $86,222

> Surrounding metro area: Indianapolis-Carmel-Anderson, IN

[in-text-ad-2]

15. Iowa

> County: Dallas

> Median sale: $218,155

> Monthly payment: $960

> Median household income: $76,320

> Surrounding metro area: Des Moines-West Des Moines, IA

16. Kansas

> County: Johnson

> Median sale: $250,294

> Monthly payment: $1,102

> Median household income: $76,113

> Surrounding metro area: Kansas City, MO-KS

[in-text-ad]

17. Kentucky

> County: Oldham

> Median sale: $279,080

> Monthly payment: $1,228

> Median household income: $85,452

> Surrounding metro area: Louisville/Jefferson County, KY-IN

18. Louisiana

> County: Orleans

> Median sale: $233,045

> Monthly payment: $1,026

> Median household income: $36,792

> Surrounding metro area: New Orleans-Metairie, LA

19. Maine

> County: Cumberland

> Median sale: $278,449

> Monthly payment: $1,225

> Median household income: $60,051

> Surrounding metro area: Portland-South Portland, ME

[in-text-ad-2]

20. Maryland

> County: Montgomery

> Median sale: $500,559

> Monthly payment: $2,203

> Median household income: $99,435

> Surrounding metro area: Washington-Arlington-Alexandria, DC-VA-MD-WV

21. Massachusetts

> County: Nantucket

> Median sale: $983,597

> Monthly payment: $4,329

> Median household income: $84,057

> Surrounding metro area: N/A

[in-text-ad]

22. Michigan

> County: Leelanau

> Median sale: $273,287

> Monthly payment: $1,203

> Median household income: $56,189

> Surrounding metro area: N/A

23. Minnesota

> County: Carver

> Median sale: $311,835

> Monthly payment: $1,372

> Median household income: $86,323

> Surrounding metro area: Minneapolis-St. Paul-Bloomington, MN-WI

24. Mississippi

> County: Madison

> Median sale: $218,793

> Monthly payment: $963

> Median household income: $64,376

> Surrounding metro area: Jackson, MS

[in-text-ad-2]

25. Missouri

> County: Platte

> Median sale: $213,655

> Monthly payment: $940

> Median household income: $68,254

> Surrounding metro area: Kansas City, MO-KS

26. Montana

> County: Gallatin

> Median sale: $312,571

> Monthly payment: $1,376

> Median household income: $55,553

> Surrounding metro area: N/A

[in-text-ad]

27. Nebraska

> County: Washington

> Median sale: $196,813

> Monthly payment: $866

> Median household income: $65,370

> Surrounding metro area: Omaha-Council Bluffs, NE-IA

28. Nevada

> County: Douglas

> Median sale: $354,045

> Monthly payment: $1,558

> Median household income: $58,535

> Surrounding metro area: N/A

29. New Hampshire

> County: Rockingham

> Median sale: $316,836

> Monthly payment: $1,394

> Median household income: $81,198

> Surrounding metro area: Boston-Cambridge-Newton, MA-NH

[in-text-ad-2]

30. New Jersey

> County: Bergen

> Median sale: $474,771

> Monthly payment: $2,090

> Median household income: $85,806

> Surrounding metro area: New York-Newark-Jersey City, NY-NJ-PA

31. New Mexico

> County: Santa Fe

> Median sale: $314,482

> Monthly payment: $1,384

> Median household income: $54,315

> Surrounding metro area: Santa Fe, NM

[in-text-ad]

32. New York

> County: New York

> Median sale: $913,126

> Monthly payment: $4,019

> Median household income: $72,871

> Surrounding metro area: New York-Newark-Jersey City, NY-NJ-PA

33. North Carolina

> County: Dare

> Median sale: $302,242

> Monthly payment: $1,330

> Median household income: $54,496

> Surrounding metro area: N/A

34. North Dakota

> County: Burleigh

> Median sale: $250,798

> Monthly payment: $1,104

> Median household income: $65,254

> Surrounding metro area: Bismarck, ND

[in-text-ad-2]

35. Ohio

> County: Delaware

> Median sale: $308,212

> Monthly payment: $1,356

> Median household income: $91,955

> Surrounding metro area: Columbus, OH

36. Oklahoma

> County: McClain

> Median sale: $172,150

> Monthly payment: $758

> Median household income: $56,088

> Surrounding metro area: Oklahoma City, OK

[in-text-ad]

37. Oregon

> County: Clackamas

> Median sale: $391,547

> Monthly payment: $1,723

> Median household income: $65,965

> Surrounding metro area: Portland-Vancouver-Hillsboro, OR-WA

38. Pennsylvania

> County: Chester

> Median sale: $351,935

> Monthly payment: $1,549

> Median household income: $85,976

> Surrounding metro area: Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

39. Rhode Island

> County: Newport

> Median sale: $393,194

> Monthly payment: $1,731

> Median household income: $69,526

> Surrounding metro area: Providence-Warwick, RI-MA

[in-text-ad-2]

40. South Carolina

> County: Charleston

> Median sale: $311,137

> Monthly payment: $1,369

> Median household income: $53,437

> Surrounding metro area: Charleston-North Charleston, SC

41. South Dakota

> County: Custer

> Median sale: $237,842

> Monthly payment: $1,047

> Median household income: $52,218

> Surrounding metro area: Rapid City, SD

[in-text-ad]

42. Tennessee

> County: Williamson

> Median sale: $428,366

> Monthly payment: $1,885

> Median household income: $96,565

> Surrounding metro area: Nashville-Davidson–Murfreesboro–Franklin, TN

43. Texas

> County: Kendall

> Median sale: $339,324

> Monthly payment: $1,493

> Median household income: $73,240

> Surrounding metro area: San Antonio-New Braunfels, TX

44. Utah

> County: Summit

> Median sale: $615,010

> Monthly payment: $2,707

> Median household income: $91,773

> Surrounding metro area: N/A

[in-text-ad-2]

45. Vermont

> County: Chittenden

> Median sale: $289,228

> Monthly payment: $1,273

> Median household income: $65,350

> Surrounding metro area: Burlington-South Burlington, VT

46. Virginia

> County: Falls Church city

> Median sale: $824,637

> Monthly payment: $3,629

> Median household income: $120,522

> Surrounding metro area: Washington-Arlington-Alexandria, DC-VA-MD-WV

[in-text-ad]

47. Washington

> County: San Juan

> Median sale: $545,588

> Monthly payment: $2,401

> Median household income: $55,960

> Surrounding metro area: N/A

48. West Virginia

> County: Jefferson

> Median sale: $237,790

> Monthly payment: $1,047

> Median household income: $66,677

> Surrounding metro area: Washington-Arlington-Alexandria, DC-VA-MD-WV

49. Wisconsin

> County: Waukesha

> Median sale: $275,022

> Monthly payment: $1,210

> Median household income: $76,545

> Surrounding metro area: Milwaukee-Waukesha-West Allis, WI

[in-text-ad-2]

50. Wyoming

> County: Teton

> Median sale: $748,600

> Monthly payment: $3,295

> Median household income: $75,325

> Surrounding metro area: N/A

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4% today, and inflation is much higher. Checking accounts are even worse.

Every day you don’t move to a high-yield savings account that beats inflation, you lose more and more value.

But there is good news. To win qualified customers, some accounts are paying 9-10x this national average. That’s an incredible way to keep your money safe, and get paid at the same time. Our top pick for high yield savings accounts includes other one time cash bonuses, and is FDIC insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes and your money could be working for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.