Special Report

How Everyone in Their 20s and 30s Can Save Up to $1 Million

Published:

Last Updated:

The current bull market may be into its ninth year, but many people still have not started taking their financial future seriously, or have been scared to invest after the Great Recession. Whether you are saving for retirement, or just saving for a rainy day, it is important to build up a strong financial nest egg for your future.

Everyone wants to retire comfortably, but few actually invest enough to be able to do so.

Or perhaps you are thinking about your more immediate future? Many Americans worry about their jobs being replaced by robots or other types of automation. If you lose your job — to a robot or for any other reason — chances are you will need a nest egg to fall back on.

What if you could save $1 million over the years? By following several simple rules compiled by 24/7 Wall St., it shouldn’t be that hard for people in their 20s and 30s to save $1 million by the time retirement comes along, or at least to have considerable savings in case they lose their jobs along the way. Most people think the retirement age for Social Security is 65, but for those of us born in 1960 and after, the retirement age is really 67. There has also been talk for years about pushing the retirement age up to 70.

If there is one takeaway from the following piece it is to start saving as much money as early as possible.

Saving $1 million over 25 years or more may seem very hard. You might think that those pesky student loans or car or house payments will get in the way, or maybe you just need money to enjoy life. However, it is not as hard as you may think — as long as your money is compounded and invested wisely.

The government may have Social Security for you in your golden years, but it is probably not going to be anywhere near enough to live off. It is important to understand that you are on your own when it comes to planning for your future.

Investors who do not save through 401(k) plans, IRA structures, and other retirement strategies are going to find out that taxes on gains, interest, and dividends can slow down the effects of compounding. With compounding, investments grow exponentially as gains and interest earned are added to your principal, forming a larger base for future gains. Still, the reality is many of us, particularly if we did not start saving early enough, are going to have to invest outside of retirement plans if we even hope to get close to $1 million in the years ahead.

We have identified major pitfalls that can wreck retirement plans, and we have also targeted strategies that investors can use to avoid getting distracted along the way. Now it is time to see how easy it is for investors to save $1 million over a lifetime if they are disciplined.

Before getting into some basic calculations, let us consider asset allocations and diversification. If you just invest in one or two stocks, chances are very high your money is too concentrated and you are taking on too much risk. If you only invest in medium- term notes and longer-term bonds from the U.S. Treasury or government agencies, then you are likely not getting enough interest through time to build up enough wealth.

As of 2017, many investors have become spoiled as the stock market recovered more than 200% from the March 2009 panic-selling lows. No reputable financial adviser will tell you to expect the same returns and market performance in the years ahead.

It is imperative to manage expectations and budget for realistic returns. Many investors used to think 8% to 10% gains per year were reasonable to expect. As of late 2017, long-term Treasury yields are close to 3%, and the average Dow Jones Industrial Average dividend yield is almost 2.50%. With a mix of stocks and bonds, and with some more moderate appreciation in the market ahead, investors should probably budget for conservative gains of 5% to 6% per year.

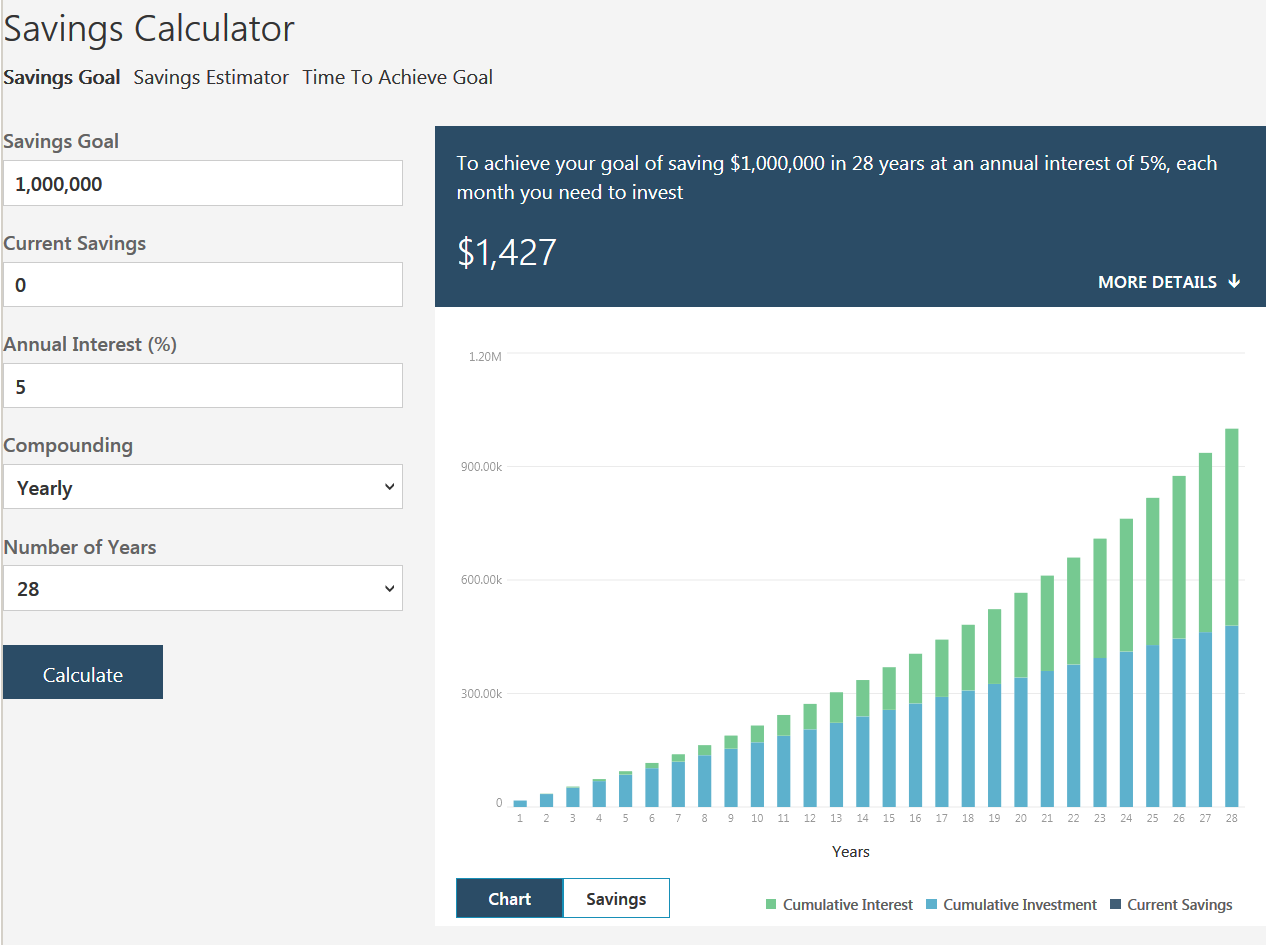

A way to start thinking about how to build a $1 million nest egg is to use a compounding interest calculator. MSN Money, Moneychimp, and many other online trading and money management sites offer this tool. Such calculators can help you compute your investment’s future value assuming certain savings and interest rates. It can also help you determine how much you need to save.

Some additional considerations include age and taxes. As you get older, you are likely to come by more money. This could come from higher earnings, but it could also come from an outside source such as selling a house, inheriting money, company stock options or profit sharing, or even a gift.

Also, the IRS knows it is hard to save enough to retire, so the government allows people who are 50 and older to have a “catch up” period until retirement in which they can save an additional $6,000 per year in 401(k) plans and another $1,000 per year in IRA plans. These allowances benefit older savers tremendously.

Here are several paths that will help you start saving up to that goal of $1 million if you get started in your 20s or 30s. It is still possible to hit the $1 million mark if you wait until your 40s or 50s to start saving — however, it will be considerably more difficult.

In order to be conservative with the numbers, we are using 5% returns as a base, and we are using annual compounding calculations (vs. monthly or quarterly) on the MSN Money savings calculator or the Moneychimp compound interest calculator. Each calculator will yield different results depending on whether your compounding is quarterly or annualized, when the additions are made (monthly or annual), and so on.

Click here to see the scenarios that will save you $1 million.

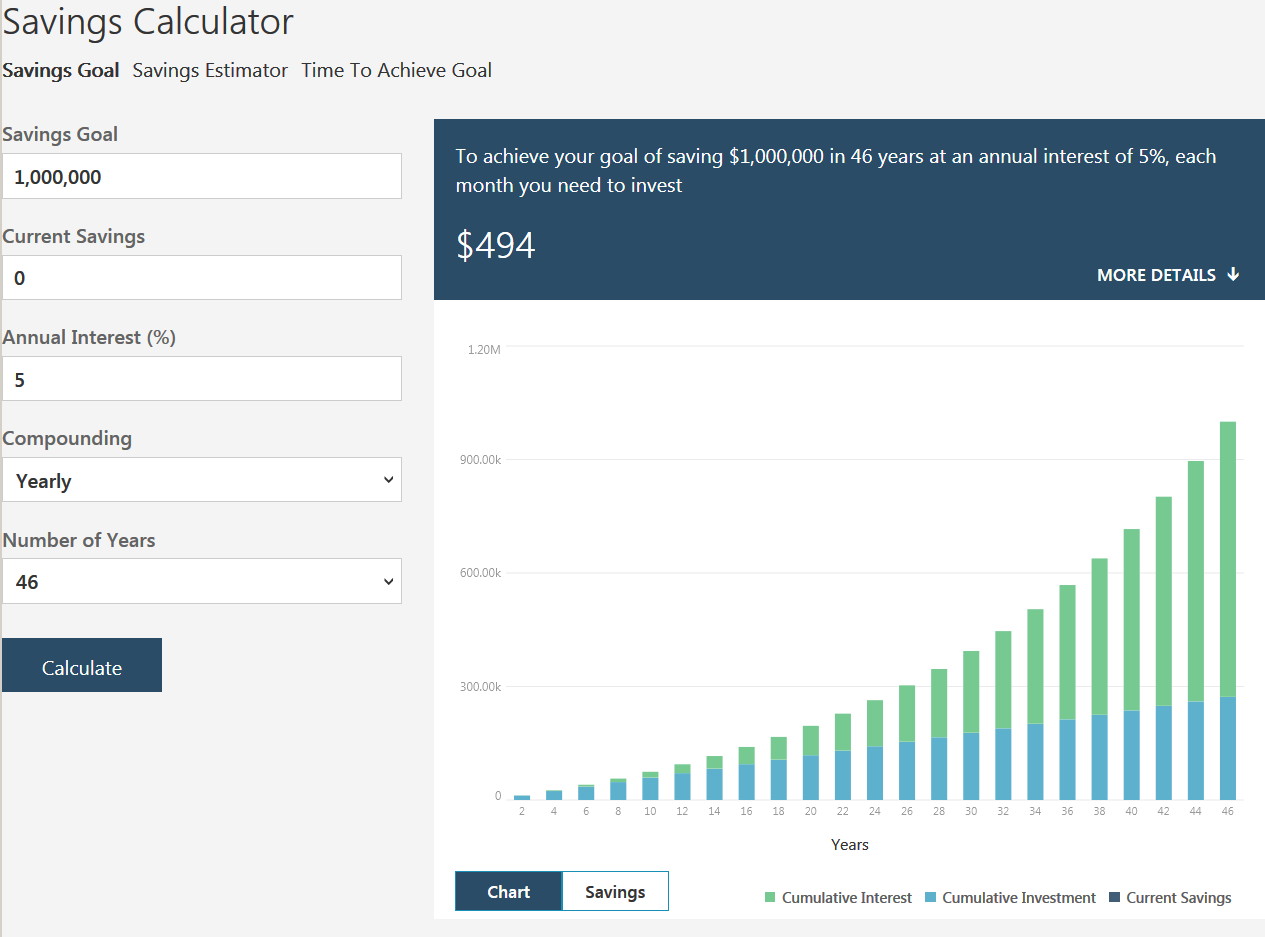

Scenario 1

You are 21 years old and did not go to or did not finish college. Many workers without college degrees earn less than $30,000 a year at the start of their careers, but their wages can rise over time. Working 35 hours a week at $15 per hour amounts to earnings of about $2,100 per month or about $25,000 a year.

At this rate, saving about $200 a month is a serious start if you consider that you have 46 years until your official Social Security age. Saving $200 per month for 46 years will come to more than $400,000, but saving more as wages increase with time will help you get to the goal. To generate $1 million after 46 years you will need to save $494 per month.

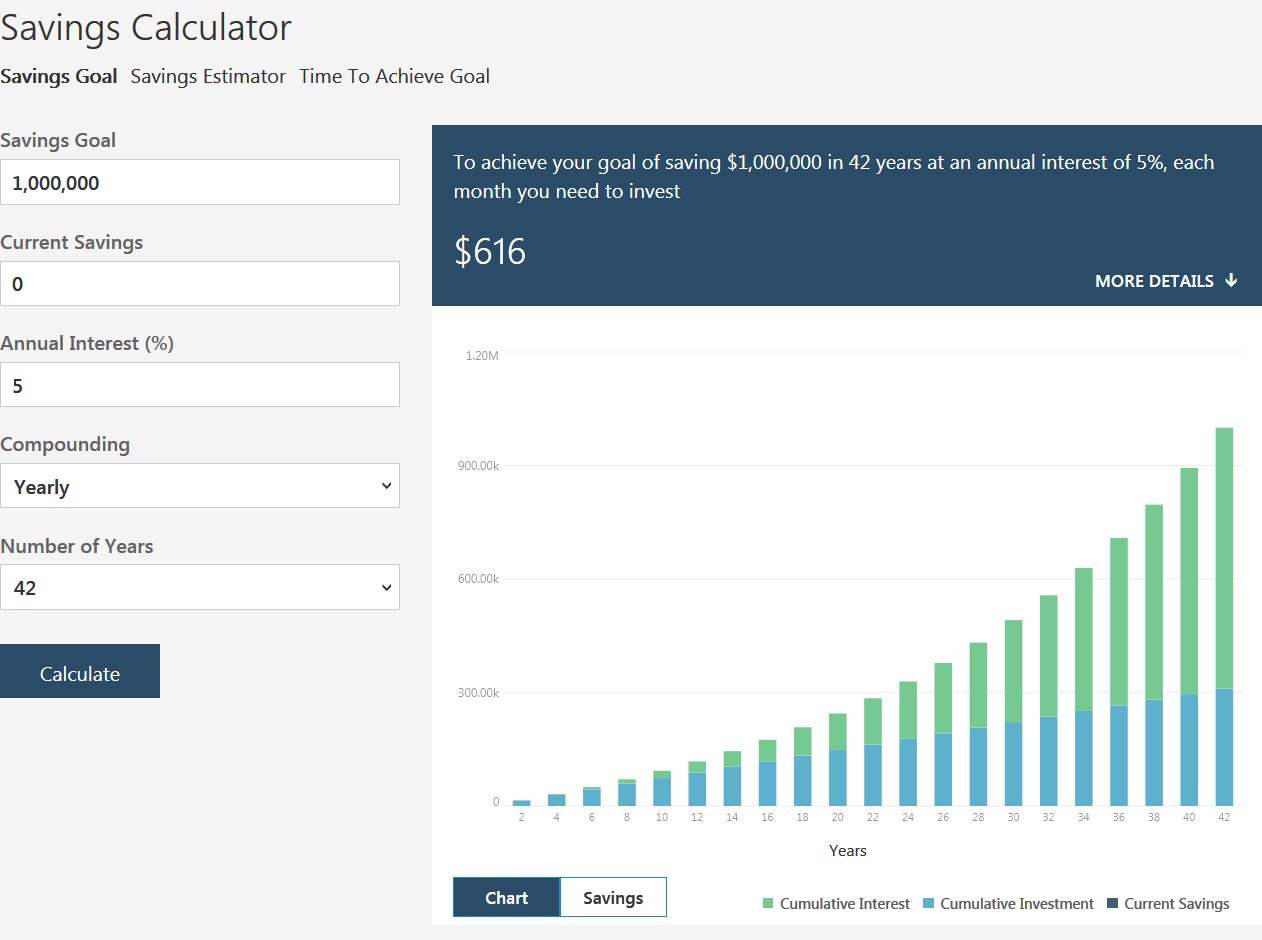

Scenario 2

You are 25 years old, have a college degree, and your salary is $35,000 a year. Thinking that you will see annual raises of 2% in the years ahead is not unrealistic. Saving $500 per month ($6,000 per year) is reasonable, but after 42 years at 5% the savings will only grow to $811,000 or so.

To hit that $1 million savings goal, you are going to have to commit to $616 per month at a 5% annual compounding. If the markets are better than the 5% base, then $500 per month at 5.5% turns into $924,000. And at a rate of 6% compounded, your savings will reach $1,055,000 after 42 years.

[in-text-ad]

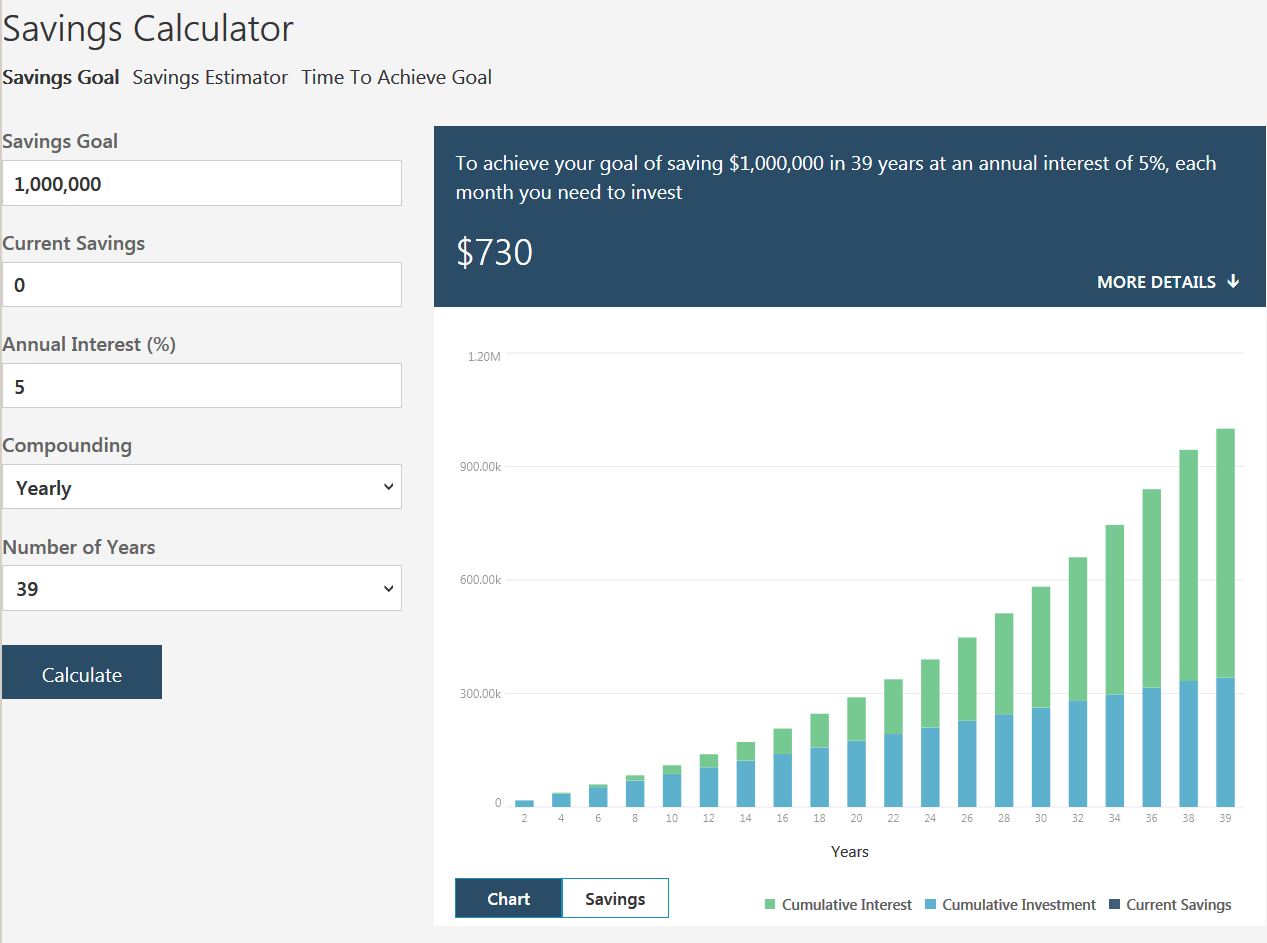

Scenario 3

Now imagine you are 28 years old and getting a slower start to saving for retirement. If you are making the same $35,000 salary with the same 2% raise expectations, you have 39 years until retirement age. Saving $500 per month will feel harder because you haven’t been doing it, but at 5% compounded only grows to $684,000 after 39 years.

With a compounded rate of 5.5% on that $500 per month the savings will be worth $771,000 by the time you’re 67, and with compounded return of 6% the savings will grow to about $870,000. To hit $1 million with no prior savings and 5% compounded is going to require a monthly contribution of $730, or about $8,760 per year.

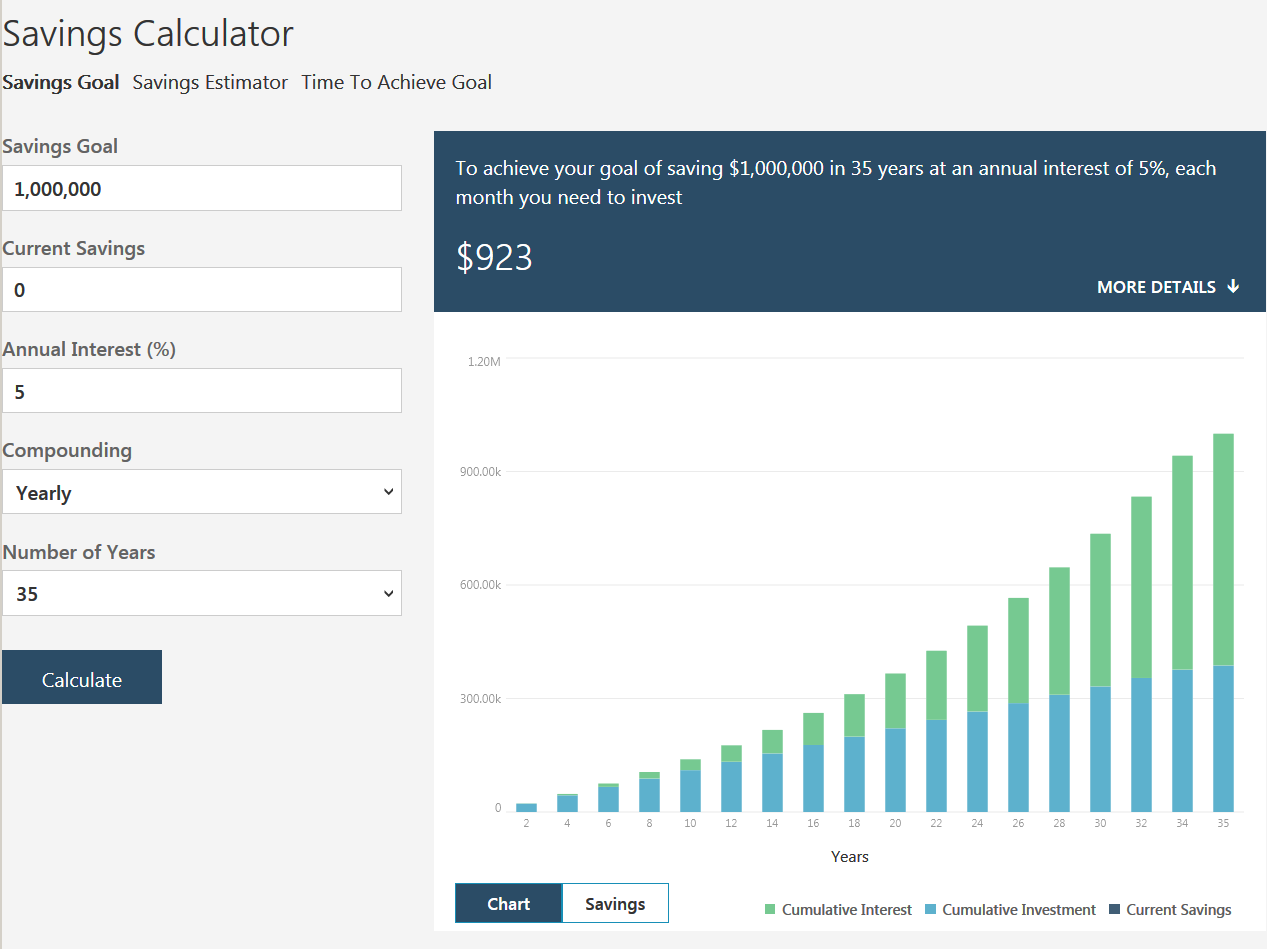

Scenario 4

You have waited until you are 32 years old to start saving and you still have 67 in your head as the retirement age. That means 35 years of compounding, but investing $500 per month at 5% will generate only about $542,000 by the time you hit 67.

To hit the $1 million mark with a 5% compounding, you are going to have to jump all the way up to saving $923 per month ($11,076 per year). If you get lucky and the average compounding is 6% per year, then you would only have to save $748 per month ($8,976 per year).

Scenario 5

You have reached 39 years of age and knocking on the door of 40. Somehow you have ignored the endless demands to start saving for retirement. You now have just 28 years to save $1 million. Saving $500 per month is going to only grow to $350,000 at 5% compounding or $411,000 if you are lucky and get 6% in returns. Here is where reality sets in if you start saving later in life. If you stick with a 5% expectation for compounding over 28 years, it’s going to require savings of $1,427 per month (or $17,124 per year), and that gets you right up to the IRS maximum annual contribution of a 401(k).

[in-text-ad]

Hopefully we have managed to demonstrate how crucial it is to start saving as early as you can and to start saving as much as you can. Life takes many turns, and there are some additional considerations.

First and foremost, financial markets and your investments probably will not grow at the same rate every year. It is also unrealistic to expect that the returns will be positive every year. You may have to consider along the way that you might need to adjust your savings higher as your income rises.

When you start at zero dollars saved without a conservative retirement plan, you have to contribute a lot more. If you come across money from inheritance, gifts, or stock options, these funds can obviously benefit your savings if you invest some of them along the way.

Many companies that offer 401(k) plans also have plans that will match 50% to 100% of your contribution up to a certain percentage of your income. You may consider saving less because of these matching funds, or you can treat them as an enhancement to your savings that can ramp up your post-career savings goal.

As you get older, your investing goals are going to change. Even if you are less aggressive, you should still consider using those IRS catch-up rules to enhance your retirement expectations.

If you are in your 20s or 30s, you might want to stay on top of legislative changes. Those statutory limits can change over the years, depending on the political winds.

Getting to $1 million may sound impossible, but now you see that it isn’t. However, you are going to need serious discipline. And don’t forget — by 2050, $1 million is probably going to sound and feel like a lot less than it does today.

Credit card companies are handing out rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.