An estimated 141.9 million people are working in the United States, up 4.8% from 10 years ago. While the economy as a whole grew at a healthy pace, workforce growth was far from uniform. A handful of industries more than doubled in size, while others shed more than half of their workforce.

Nearly every industry is the U.S. economy is subject to the powerful and often unpredictable forces of the free market. In recent years, globalization and technological advancements have fundamentally changed the U.S. economic landscape. For better or worse, industries that at one time seemed unassailable now appear to be hanging by a thread.

24/7 Wall St. reviewed annual employment data from the Bureau of Labor Statistics from 2007 to 2016 to identify the fastest dying industries. Industries on this list shed between 42% of workers on the lower end and as many as nearly 90% in the fastest dying industry.

Click here to see America’s 24 dying industries.

Click here to see our detailed findings and methodology.

24. Office supplies, except paper, manufacturing

> Employment change 2007-2016: -42.1%

> Employment total: 11,597

> Wage growth 2007-2016: 12.2%

> Avg. annual wage: $47,222

Office supplies manufacturing is one of many industries in the United States negatively affected by the increasing digitization of the workplace. According to a recent survey by cloud management company RightScale, 94% of technology-focused businesses are either planning to adopt cloud technology or are currently using cloud-based applications. The increasing ability to store documents and other data virtually has rendered fax machines and photo copiers less necessary and reduced demand for office supplies manufacturing. Employment in the industry has fallen by 42.1% since 2007, among the most of any sector.

[in-text-ad]

23. Stationery product manufacturing

> Employment change 2007-2016: -42.2%

> Employment total: 18,365

> Wage growth 2007-2016: 19.4%

> Avg. annual wage: $51,272

Stationery product manufacturing is one of many industries hurt by the proliferation of digital communication platforms such as email and electronic invitation websites. As demand for traditional stationary products declined over the past decade, employment in the industry fell from 31,758 U.S. workers to 18,365 — a 42.2% drop. American Greetings — one of the largest greeting card producers in the world — has closed dozens of retail stores in recent years, and after more than 40 years on the stock market, was taken private in 2013. In total, the number of U.S. stationery manufacturing establishments in the United States fell from 645 in 2007 to 488 in 2016.

22. Bookstores and news dealers

> Employment change 2007-2016: -42.9%

> Employment total: 86,521

> Wage growth 2007-2016: 15.6%

> Avg. annual wage: $20,133

Over the past decade, traditional book stores and news dealers have struggled to compete with the rise of digital media and e-commerce retailers. Borders, at one time the second largest bookstore chain the United States, closed all of its locations by 2011. The number of bookstores nationwide fell from 11,728 in 2007 to 7,889 in 2016 — a 32.7% decline. The number of bookstore and newsstand employees fell by 42.9% over the same period, one of the largest declines of any industry.

Amazon has been a major force in the demise of brick-and-mortar bookstores, today accounting for 41% of all book sales. While e-commerce has hurt brick-and-mortar bookstores, the low prices offered by Amazon has led to more book sales overall, creating more opportunities for writers and publishers. In the past 10 years, the number of independent artists and writers in United States rose 3.9%, more than a majority of industries.

21. Securities and commodity exchanges

> Employment change 2007-2016: -42.9%

> Employment total: 4,931

> Wage growth 2007-2016: 7.1%

> Avg. annual wage: $201,266

The securities and commodity exchange industry consists of establishments engaged in facilitating physical or electronic marketplaces for the buying and selling of stocks, stock options, bonds, and commodity contracts. As more open floor exchanges establish online trading platforms, fewer physical securities and commodity exchange locations are necessary. The number of security and commodity exchange establishments in the United States fell from 312 in 2007 to 189 in 2016, a 36.0% drop. Additionally, fewer employees are needed at each location. The number of securities and commodity exchange workers fell by 42.9% over the past 10 years, more than nearly any other industry.

[in-text-ad-2]

20. Sound recording studios

> Employment change 2007-2016: -42.9%

> Employment total: 4,657

> Wage growth 2007-2016: 10.5%

> Avg. annual wage: $52,679

Musical production practices have evolved with technology technology since the invention of sound recording in the 19th century. In recent years, advances in sound mixing technology have democratized the production and distribution of music, reducing the need for professional recording studios for many artists.

Sound City Studios, a recording studio in Los Angeles notable for its history with major musical acts such as Tom Petty, Johnny Cash, and Nirvana, closed its commercial operations in 2011. In total, the number of recording studios in the United States fell from 1,700 establishments in 2007 to 1,438 in 2016 — a 15.4% drop. Employment in the industry fell by 42.9% over the same period, one of the largest declines of any sector.

19. Textile and fabric finishing mills

> Employment change 2007-2016: -44.4%

> Employment total: 23,739

> Wage growth 2007-2016: 23.1%

> Avg. annual wage: $44,629

Textiles manufacturing is one of many industries negatively affected by increased competition from foreign cotton importers and the decline of the U.S. manufacturing sector. Employment at textile and fabric finishing mills fell by 44.4% from 2007 to 2016, more than nearly any other industry in the country. One factor that contributed to the decline of employment in textile was the phasing out of the 1974 Multifiber Arrangement, which had imposed quotas on how much the United States, Canada, and Europe could import from developing countries such as China and Bangladesh and was intended to preserve domestic textile production. Since the last import quota expired in 2004, Chinese textile and apparel imports to the United States have more than doubled.

[in-text-ad]

18. Other publishers

> Employment change 2007-2016: -44.7%

> Employment total: 14,942

> Wage growth 2007-2016: 29.3%

> Avg. annual wage: $65,699

The other publishers industry category includes establishments that publish works other than newspapers, magazines, books, directories, mailing lists, or music. Examples may include publishers of art prints, calendars, or greeting cards. Like the rest of the publishing industry, such niche publishers have struggled to compete against the growing number of digital media platforms. While employment across all sectors in the United States rose 4.8% between 2007 and 2016, the number of workers employed at alternative publishers fell by 44.7%, among the most of any industry.

17. Other depository credit intermediation

> Employment change 2007-2016: -45.3%

> Employment total: 11,374

> Wage growth 2007-2016: 19.6%

> Avg. annual wage: $72,701

Depository credit intermediation, or bank lending, declined substantially after the Great Recession, and has yet to fully recover. Depressed U.S. consumer confidence in the wake of the recession is likely one reason for the reduced demand for loans, as fewer Americans are seeking loans to start new businesses. Additionally, the four largest U.S. banks — Bank of America, Citigroup, JPMorgan Chase, and Wells Fargo — have been less willing to lend to small businesses. As of 2014, new loans from the top four banks had fallen to 50% of their 2006 levels. Other depository credit intermediation establishments — which includes industrial and private banks — are also feeling the pinch. Employment at other depository credit intermediation establishments has fallen 45.3% since 2007, more than nearly any other industry.

16. Curtain and linen mills

> Employment change 2007-2016: -45.6%

> Employment total: 20,605

> Wage growth 2007-2016: 24.3%

> Avg. annual wage: $36,548

Like the rest of the manufacturing sector, employment at curtain and linen mills in the United States has declined substantially over the past decade. Since the last of the international import quotas protecting the domestic textile sector were lifted in 2004, U.S. imports of Chinese textiles and apparel have more than doubled. As competition from Chinese manufacturing outfits increased over the past decade, many American textile manufacturers ceased commercial operations. The number of curtain and linen mills fell from 2,332 in 2007 to 1,493 in 2016, a 36.0% decline. Employment at curtain and linen mills fell by 45.6% over the same period.

[in-text-ad-2]

15. Savings institutions

> Employment change 2007-2016: -46.0%

> Employment total: 122,229

> Wage growth 2007-2016: 23.1%

> Avg. annual wage: $67,412

While employment across all sectors rose 4.8% between 2007 and 2016, employment at savings institutions, such as savings banks and savings and loan associations, fell by 46.0%. One reason for the steep decline may be reduced demand for banking services. Americans’ confidence in the U.S. banking system was eroded during the Great Recession and has yet to fully recover. According to a Gallup poll, just 27% of Americans are confident in the country’s banking system, compared to 53% in 2004. Additionally, the rise of online and mobile banking applications, which allow customers to deposit checks and perform other banking tasks online, has reduced the need for physical bank locations.

14. Formal wear and costume rental

> Employment change 2007-2016: -46.9%

> Employment total: 7,051

> Wage growth 2007-2016: 38.0%

> Avg. annual wage: $29,437

Since the start of the 21st century, the U.S. marriage rate fell from 8.2 marriages per 1,000 Americans in 2000 to 6.8 marriages per 1,000 Americans in 2013, the lowest in recorded history. With roughly 235,000 fewer marriages in 2013 than in 2000, there was significantly reduced demand for formal wear rental services. Additionally, increasing textile imports from China have reduced the price for formal wear in the United States, allowing many Americans to own tuxedos and formal dresses instead of renting. Since 2007, the number of formal wear and costume rental establishments fell from 1,937 to 1,078, a 44.3% decline. While the number of U.S. workers across all sectors rose by 4.8% over the same period, employment in formal wear and costume rental fell by 46.9%.

[in-text-ad]

13. Support activities for printing

> Employment change 2007-2016: -47.3%

> Employment total: 25,122

> Wage growth 2007-2016: 15.8%

> Avg. annual wage: $52,134

As the internet continues to expand and becomes the preferred platform for media consumption, demand for printed content, such as books, newspapers, and magazines is declining. The decline has precipitated considerable job losses in the support activities for printing industry, which includes establishments engaged in activities such as book binding, embossing, engraving. In the last decade, the number of Americans working in the industry fell from 47,700 to only about 25,100, a 47.3% decline.

The industry’s decline is not likely to reverse course. Consolidation in the industry is expected to continue in the coming years, along with a shrinking workforce.

12. Other telecommunications

> Employment change 2007-2016: -47.8%

> Employment total: 78,579

> Wage growth 2007-2016: 20.0%

> Avg. annual wage: $87,337

The other telecommunications industry category deals in specialized telecomm services like satellite tracking and radar station operations. In the past decade, the number of Americans working in the field has been nearly cut in half. Employment decline in the industry is likely attributable to technological advancement and increased automation.

Compared to most dying industries, other telecommunications workers are relatively well compensated. The average annual salary in the industry is $87,337, more than all but three other industries on this list.

11. Professional employer organizations

> Employment change 2007-2016: -48.1%

> Employment total: 356,883

> Wage growth 2007-2016: 29.9%

> Avg. annual wage: $42,545

Professional employer organizations manage a range of human resources-related needs for larger companies, including health care benefits, payroll, and 401(k) retirement plans. In the past decade, employment in the field fell by 48.1%.

A range of factors precipitated the job cuts in the industry. Mostly, the job cuts were the result of technological advances, which streamlined many of these processes making the industry more efficient and reducing the need for workers in the industry.

[in-text-ad-2]

10. Newspaper publishers

> Employment change 2007-2016: -49.3%

> Employment total: 176,628

> Wage growth 2007-2016: 16.4%

> Avg. annual wage: $49,461

Few industries have taken a bigger hit from the rise in digital media than print newspaper publishers. Once the preferred news medium, newspapers nationwide have been losing advertising and subscription revenue over the years as cable television and web-based news platforms have gained favor. As a result, dozens of publications across the United States have gone out of print or have dramatically reduced output over the past decade. The industry, which employed nearly 350,000 Americans as recently as 2007, now employs only about 177,000 people.

9. Telephone apparatus manufacturing

> Employment change 2007-2016: -51.6%

> Employment total: 18,317

> Wage growth 2007-2016: 22.0%

> Avg. annual wage: $120,904

Telephone apparati include a range of communications equipment like internet modems, routers, and answering machines. Competition from communication device makers abroad has forced American communication apparatus manufacturing companies to shed workers at a faster rate than nearly any other industry. The number of establishments engaged in telephone apparatus manufacturing in the United States declined from 583 to 448 over the past decade, a 23.2% drop. Over the same period, the number of Americans employed in the industry has been cut in half.

[in-text-ad]

8. Hosiery and sock mills

> Employment change 2007-2016: -55.9%

> Employment total: 8,094

> Wage growth 2007-2016: -15.1%

> Avg. annual wage: $29,409

Jobs in knitting and finishing hosiery and socks are largely disappearing from America’s industrial landscape. Over the decade since 2007, the number of jobs in the industry fell from over 18,400 to fewer than 8,100, a 56% drop. The number of mills operating in the United States also declined by 47%.

A microcosm of the broader industry trend, Fort Payne, Alabama, formerly known as the “Sock Capital of the World,” once was home to 125 hosiery and sock mills, and is now home to fewer than two dozen. Over the last several decades, the town has lost much of its once dominant industry. Companies like Gildan-Prewett have been shuttering operations in town and shifting them abroad, taking advantage of cheaper labor.

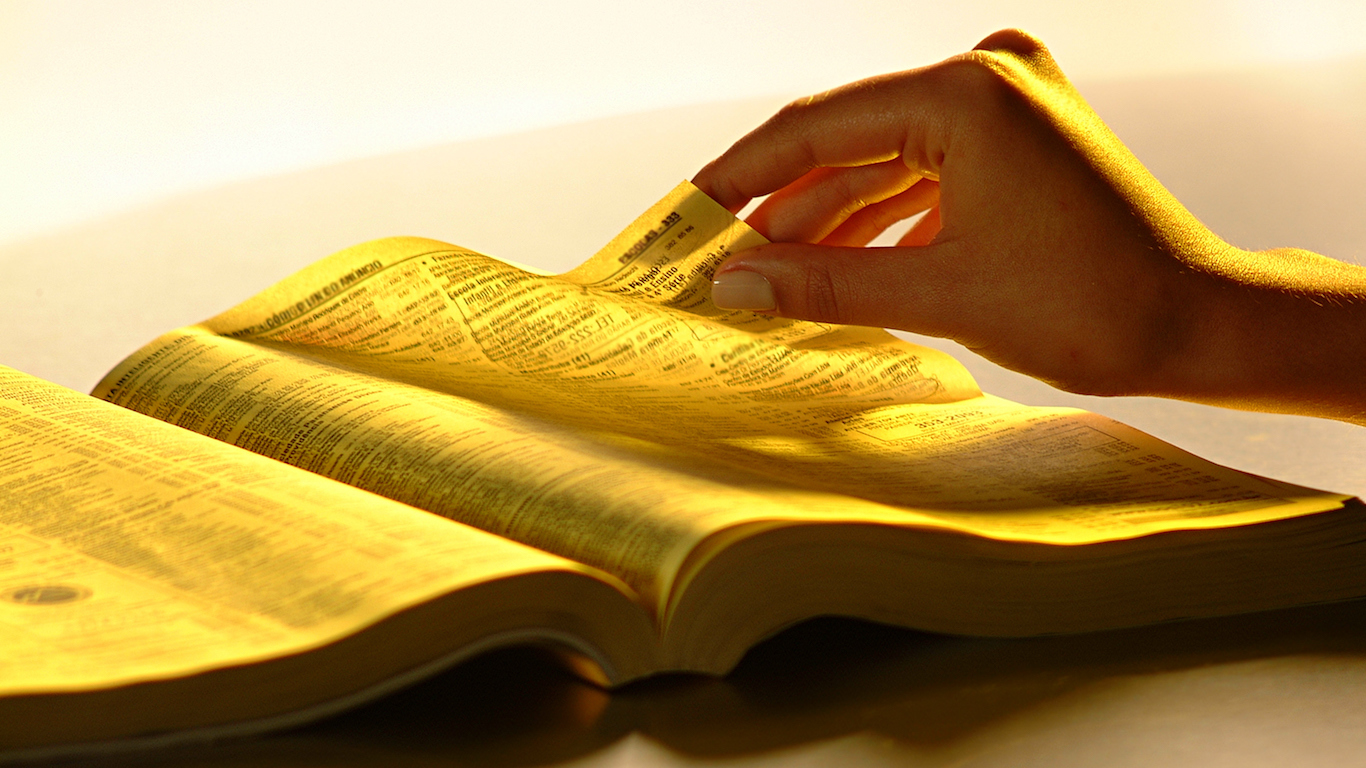

7. Directory and mailing list publishers

> Employment change 2007-2016: -56.0%

> Employment total: 20,290

> Wage growth 2007-2016: 16.7%

> Avg. annual wage: $76,451

As the industry name implies, directory and mailing list publishers collect and compile information like mailing addresses, telephone numbers, or any number of other public records. Historically, the industry has derived its revenue from advertising in printed publications. However, like many industries on this list, directory and mailing list publishers are shedding jobs as more and more Americans shift away from print in favor of digital publications. Less advertising revenue means fewer jobs, and over the past decade, the industry shed some 25,800 workers — 56% of its workforce in 2007 — and shuttered nearly 1,000 production establishments.

6. Land subdivision

> Employment change 2007-2016: -56.0%

> Employment total: 40,814

> Wage growth 2007-2016: 22.8%

> Avg. annual wage: $81,257

Land subdivision involves dividing a large segment of land into smaller parcels, largely for the purpose of new home construction. Due in large part to industry consolidation and integration, as well as reduced demand for real estate in the wake of the recession and housing crisis, the industry shed 56% of its jobs in the past decade.

While the U.S. housing market has been recovering in recent years, it has yet to return to its pre-crisis levels. There were only 1.2 million new housing starts in the United States in 2016, 13.4% less than the nearly 1.4 million housing starts in 2007.

[in-text-ad-2]

5. Port and harbor operations

> Employment change 2007-2016: -58.0%

> Employment total: 11,340

> Wage growth 2007-2016: 1.6%

> Avg. annual wage: $74,603

Jobs at ports and harbors typically involve cargo and ship handling and navigation — all jobs that are slowly being automated. While automation is killing jobs, it results in more efficient, precise, and profitable loading and unloading of ship cargo.

The industry is heavily dependent on global commerce — which is currently booming. While industry jobs may be disappearing, ports and harbors are not. As employment in the industry fell by 58.0% in the last 10 years, the number of U.S. ports and harbors increased by 2.2%.

4. Photofinishing

> Employment change 2007-2016: -59.2%

> Employment total: 9,703

> Wage growth 2007-2016: 63.3%

> Avg. annual wage: $55,433

Photofinishing is another prime example of an industry gutted by the rise of digital technology and media. An estimated 95% of Americans own a cell phone, the vast majority of which are equipped with a built-in digital camera. Photographs can now be taken and shared instantly through any number of social media applications, including Facebook, Instagram, and Snapchat.

At one time, most Americans did not need to look further than their local drug store for a photo developing service. Today, as film cameras lose favor to digital devices, finding an outfit that still develops film is not as easy. The number of Americans working in photofinishing fell by nearly 60% between 2007 and 2016.

[in-text-ad]

3. Magnetic media manufacturing and reproducing

> Employment change 2007-2016: -60.5%

> Employment total: 15,125

> Wage growth 2007-2016: 42.8%

> Avg. annual wage: $104,687

Employment in manufacturing of magnetic media, such as audio tapes and videotapes or floppy disks, is dying along with demand for such products. Now that media — both auditory and visual — can be streamed on demand through a number of web-based platforms, fewer and fewer Americans rely on physical copies of media for entertainment. Similarly, with technology like DVR and Tivo, most Americans have little reason to buy blank VHS tapes for the purpose of recording a TV show with a VCR.

Due largely to changes in how Americans consume information, music and movies, employment in magnetic media manufacturing and reproducing has declined by over 60% in the last decade.

2. Other apparel knitting mills

> Employment change 2007-2016: -65.1%

> Employment total: 4,065

> Wage growth 2007-2016: 33.6%

> Avg. annual wage: $37,529

The other apparel knitting mills industry classification includes knitting of outerwear, underwear, and nightwear. Like many other industries in the United States, cheaper labor abroad and improving technology are killing jobs in apparel knitting mills. In the past decade, total employment in the industry declined by 65%. Over the same period, the number knitting mills in the United States fell from 256 to 142. Declines in employment and output are projected to continue in the coming years.

Many companies in the industry not outsourcing labor are paying the price. American Apparel, for example, was forced to declare bankruptcy in 2015. Though there were multiple factors at play in American Apparel’s bankruptcy, the company pays factory workers more than most other companies in the industry, as it primarily manufactures its clothing in Los Angeles based mills.

1. Video tape and disc rental

> Employment change 2007-2016: -89.8%

> Employment total: 11,921

> Wage growth 2007-2016: 34.9%

> Avg. annual wage: $19,718

That video tape and DVD rentals shed the largest share of employees of any other industry in the last 10 years is likely not a surprise to anyone. Once a staple in nearly every American town, video rental stores are now about as rare as a home without a computer or internet access. About 86% of the 15,300 video rental stores that were open in 2007 are now shuttered.

The shift away from video rental has been ushered in by streaming services provided by companies like HBO, Amazon, and Netflix. In the last two years alone, Netflix’s revenue climbed 60% to over $8.8 billion.

Detailed Findings & Methodology

The types of industries shedding the most workers range broadly from telecommunications equipment manufacturing to newspaper publishers. While the types of jobs on this list often have little in common, their declines in recent years can often be traced to one of just two causes.

In an interview with 24/7 Wall St., Martin Kohli, chief regional economist at the Bureau of Labor Statistics, explained that two major technological changes have led to steep employment declines in many of the industries on this list.

The first of these is the expansion of internet use and access. “Because of the continued expansion of the internet, there have been big changes in how people get information and entertainment, and this has created some winners and some losers” Kohli said.

Instant streaming access through online platforms like Hulu, Amazon, and Netflix have decimated VHS manufacturing and video and disc rental businesses. Employment in those industries fell by 60.5% and 89.8%, respectively, in the past decade.

Meanwhile, online news platforms and photo sharing social media applications have played a considerable role in the the decline of newspaper publishing, photofinishing, and libraries and archives. In the past decade, the number of Americans working in each of these industries has been cut in half.

The second major technological trend is related to increasing automation in the workplace. “Because of changes in technology, productivity has gone up in a number of industries so you need fewer people to make the same amount of stuff,” Kohli said.

Increased efficiency attributable to technology disproportionately affects the manufacturing industry. Of the 25 jobs on this list, 10 are in the manufacturing sector.

Many industries on this list continue to suffer from the longer term trend of globalization. Inexpensive labor abroad, as well as foreign manufacturers competing with U.S. companies, have each contributed to the decline of the American manufacturing sector.

To identify America’s 25 dying industries, 24/7 Wall St. reviewed employment change from 2007 through last year for 712 U.S. industries in the fourth level of detail in the North American Industry Classification System (NAICS) by the Office of Management and Budget. All data, including the number of establishments within each industry, average weekly and annual wages, as well as breakouts of these data over government, private, and local levels were retrieved from the U.S. Bureau of Labor Statistics’ (BLS) Quarterly Census of Employment and Wages (QCEW). Several fourth tier industries from the 2007 data have been aggregated under 2012 codes. For example, “Tobacco Production Manufacturing” and “Tobacco Stemming and Redrying” are now aggregated under “Tobacco Manufacturing.” Data has been adjusted accordingly to ensure an accurate portrayal of 10-year employment change in these industries.

The BLS tracks industry employment by tallying the number of workers in establishments whose primary sources of revenue fall within a given industry. As a result, a given establishment along with all of its employees may be reclassified depending on business decisions and market performance. In 2013, the BLS reclassified workers employed in funds, trusts, and other financial vehicles, as well as employees of private households, into other industries. As a result, 2016 employment data for funds, trusts, and other financial vehicles, as well as private households, is uncomparable with 2007 data, and was not considered.

Correction: Due to Bureau of Labor Statistics data suppression, 24/7 Wall St. incorrectly identified libraries and archives as one of the industries losing the most workers. In fact, employment has remained stable.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.