There are hundreds of major, publicly traded companies in the United States with annual revenues of $1 billion or more. At the helm of each of these corporations is a well-compensated chief executive. The typical CEO of such a company earns $11 million a year — nearly 200 times the $57,617 the typical American household earns a year.

The stark difference in compensation only appears to be growing wider. CEO pay increased by 6% in 2016, compared to a 3% increase in earnings for the typical American household. While many working Americans might receive an annual cost of living salary bump, CEOs are used to far bigger raises. Even some of those that rank among the highest paid more than doubled their earnings in 2016 compared to the previous year.

24/7 Wall St. reviewed CEO compensation for the 200 largest publicly traded U.S. companies by revenue to identify the highest paid chief executive officers. Compensation figures, which include salaries, bonuses, incentives, and stock options, came from Equilar, an executive compensation data firm.

Few would disagree that CEOs — particularly those at the helm of large publicly traded companies that employ thousands of Americans — shoulder more responsibility and face greater pressures than the average worker. Accountable to their employees, shareholders, and customers, CEOs could be held culpable for low worker morale, falling returns on Wall Street, and poor customer experiences — among countless other issues.

Whether or not such pressures warrant eight-figure paychecks is a matter for debate. Still, for many of those with the top job at some of America’s largest companies, $11 million is a pittance. Dozens of large U.S. companies compensate their chief executives well in excess of $20 million per year.

Click here to see the highest paid CEOs.

Click here to see our detailed findings and methodology.

25. Laurence D. Fink

> Company: BlackRock (BLK)

> Annual compensation: $25.5 million

> Year-over-year compensation change: -1%

> Revenue: $11.0 billion

[in-text-ad]

24. John D. Wren

> Company: Omnicom Group (OMC)

> Annual compensation: $26.0 million

> Year-over-year compensation change: +10%

> Revenue: $15.4 billion

23. Brian D. Jellison

> Company: Roper Technologies (ROP)

> Annual compensation: $26.3 million

> Year-over-year compensation change: +13%

> Revenue: $3.8 billion

22. Kenneth W. Lowe

> Company: Scripps Networks Interactive (SNI)

> Annual compensation: $26.8 million

> Year-over-year compensation change: +234%

> Revenue: $3.4 billion

[in-text-ad-2]

21. James Dimon

> Company: JPMorgan Chase (JPM)

> Annual compensation: $27.2 million

> Year-over-year compensation change: +49%

> Revenue: $90.3 billion

20. James J. Peterson

> Company: Microsemi (MSCC)

> Annual compensation: $28.0 million

> Year-over-year compensation change: +277%

> Revenue: $1.8 billion

[in-text-ad]

19. Dion J. Weisler

> Company: HP (HPQ)

> Annual compensation: $28.2 million

> Year-over-year compensation change: N/A

> Revenue: $52.1 billion

18. Stephen A. Wynn

> Company: Wynn Resorts (WYNN)

> Annual compensation: $28.2 million

> Year-over-year compensation change: +36%

> Revenue: $4.5 billion

17. John J. Haley

> Company: Willis Towers Watson (WLTW)

> Annual compensation: $28.2 million

> Year-over-year compensation change: N/A

> Revenue: $7.9 billion

[in-text-ad-2]

16. Leonard S. Schleifer

> Company: Regeneron Pharmaceuticals (REGN)

> Annual compensation: $28.3 million

> Year-over-year compensation change: -40%

> Revenue: $4.9 billion

15. Brian L. Roberts

> Company: Comcast (CMCSA)

> Annual compensation: $28.6 million

> Year-over-year compensation change: +4%

> Revenue: $80.4 billion

[in-text-ad]

14. Gregory B. Maffei

> Company: Liberty Media & Liberty Interactive (LMCA & QVCA)

> Annual compensation: $29.8 million

> Year-over-year compensation change: +11%

> Revenue: $5.3 billion

13. Joshua W. Sapan

> Company: AMC Networks (AMCX)

> Annual compensation: $30.5 million

> Year-over-year compensation change: +72%

> Revenue: $2.8 billion

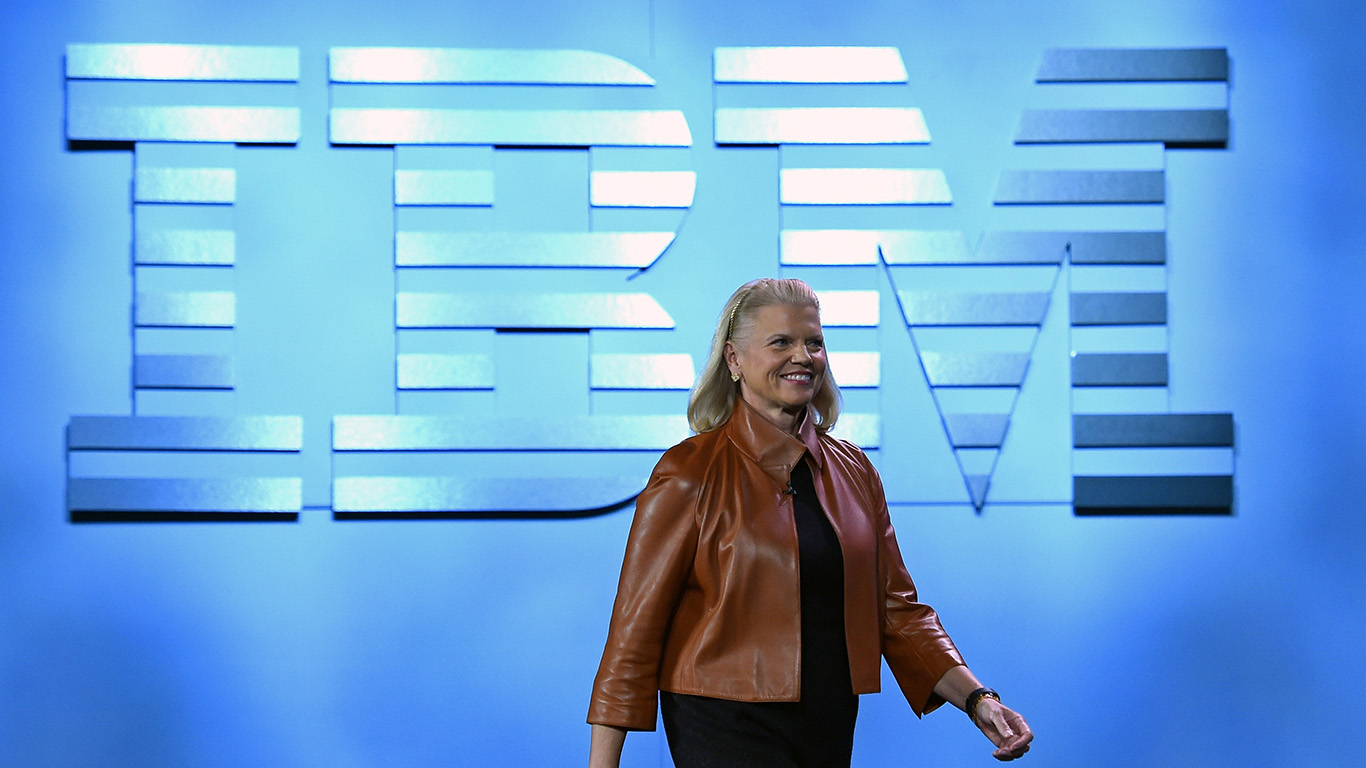

12. Virginia M. Rometty

> Company: International Business Machines (IBM)

> Annual compensation: $32.3 million

> Year-over-year compensation change: +63%

> Revenue: $79.9 billion

[in-text-ad-2]

11. Jeffrey L. Bewkes

> Company: Time Warner (TWX)

> Annual compensation: $32.6 million

> Year-over-year compensation change: +3%

> Revenue: $29.3 billion

10. Margaret C. Whitman

> Company: Hewlett Packard Enterprise (HPE)

> Annual compensation: $32.9 million

> Year-over-year compensation change: +93%

> Revenue: $28.9 billion

[in-text-ad]

9. Robert A. Kotick

> Company: Activision Blizzard (ATVI)

> Annual compensation: $33.1 million

> Year-over-year compensation change: +358%

> Revenue: $6.6 billion

8. David M. Zaslav

> Company: Discovery Communications (DISCA)

> Annual compensation: $37.2 million

> Year-over-year compensation change: +15%

> Revenue: $6.5 billion

7. Safra A. Catz

> Company: Oracle (ORCL)

> Annual compensation: $40.9 million

> Year-over-year compensation change: N/A

> Revenue: $37.7 billion

[in-text-ad-2]

6. Robert A. Iger

> Company: Walt Disney (DIS)

> Annual compensation: $41.0 million

> Year-over-year compensation change: -6%

> Revenue: $55.1 billion

5. Mark V. Hurd

> Company: Oracle (ORCL)

> Annual compensation: $41.1 million

> Year-over-year compensation change: N/A

> Revenue: $37.7 billion

[in-text-ad]

4. Mark G. Parker

> Company: Nike (NKE)

> Annual compensation: $47.6 million

> Year-over-year compensation change: +183%

> Revenue: $34.4 billion

3. Fabrizio Freda

> Company: Estee Lauder (EL)

> Annual compensation: $47.7 million

> Year-over-year compensation change: +196%

> Revenue: $11.8 billion

2. Leslie Moonves

> Company: CBS (CBS)

> Annual compensation: $68.6 million

> Year-over-year compensation change: +22%

> Revenue: $13.2 billion

[in-text-ad-2]

1. Thomas M. Rutledge

> Company: Charter Communications (CHTR)

> Annual compensation: $98.0 million

> Year-over-year compensation change: +499%

> Revenue: $29.0 billion

Detailed findings & methodology

For most working Americans, wages and salaries account for the vast majority of total income in a given year. For CEOs, base salary typically comprises only a small fraction of annual compensation. For example, Thomas Rutledge, chairman and CEO of Charter Communications, earned a $2 million salary in 2016 and nearly $90 million in stocks and options. All told, Rutledge’s base salary accounted for only about 2% of his total annual compensation.

While Rutledge earned more in 2016 than any other public CEO in the United States, he is not an outlier. Base salary accounted for a small fraction of total compensation for every chief executive on this list.

It is no accident that such a small share of total compensation comes from salary. According to analysis provided by Equilar, CEO compensation is increasingly designed to be performance based — rising and falling with certain metrics such as revenue. For example, Charter Communications’ revenue climbed by nearly 200% in 2016 — the largest gain among the 200 largest publicly traded U.S. companies. Likely heavily tied to corporate performance, Rutledge’s compensation soared by about 500% over the same period.

To identify the highest paid CEOs, 24/7 Wall St. reviewed total compensation packages for CEOs at the 200 largest public companies by revenue in the United States that filed proxy statements covering 2016 before May 1, 2017 from executive-level data collector Equilar. Year-over-year changes in compensation also came from Equilar.

Total compensation is defined as salary, bonus, stock and options valued at grant date, and other compensation as disclosed in the summary compensation table of company proxy statements and excludes pension and deferred compensation values. Annual revenue figures are for the latest available fiscal year and come from financial reports filed with the Securities and Exchange Commission.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.