To be elected president, candidates must be able to convince the American people they can make life better for them. Yet, despite being successful in their presidential bids, some presidents are not as successful in their other endeavors — namely business and finance. In fact, several American presidents, at some point in their lives, became insolvent.

Whether it was in their early 20s or after their time in office, eight commanders in chief have been in serious financial trouble.

24/7 Wall St. reviewed historical records in order to determine which presidents have gone broke and identify the reasons for their money troubles.

Click here to see America’s 8 presidents who went broke.

The presidents that reached poverty or bankruptcy struggled to hold on to wealth for different reasons. Some, like Thomas Jefferson, were born extremely wealthy but could not manage that wealth. Jefferson acquired the debt of a number of family members and did not have the funds to pay off the debt of those family members as well as provide for himself..

Abraham Lincoln, on the other hand, was never wealthy, but he still struggled to get any financial stability early in his life. Lincoln’s first business venture, a general store, went into debt, and Lincoln had to sell his few possessions to appease his creditors.

Presidents going broke may be a thing of the past, as Harry S. Truman is the most recent entry on the list. These days, presidents can expect massive book deals once they leave the White House. Barack Obama and his wife, Michelle, received a reported $65 million for the rights to a book they will write together. That type of money should be enough to get anyone through retirement.

Ulysses S. Grant lived beyond his means and fell victim to a scam after his time in office. He had to sell his memoirs just before his death in order to provide his family with any inheritance at all.

24/7 Wall St. used historical sources to determine which presidents were ever in debt or impoverished during their adult lives. Presidents were ranked in order of their peak wealth. In the case of ties, presidents were ranked from most to least recent.

8. Harry S. Truman

> Term: 1945-1953 (33rd president)

> Source of wealth: Various jobs

> Peak net worth (in 2018 dollars): < $1 million

> Financial hardship: Business struggles

Harry S. Truman was unable to amass wealth at any point in his life and struggled with money until his death. Failed business ventures like a zinc mining operation and clothing store drove Truman into debt. Against the advice of those close to him, he declined to go into bankruptcy, opting instead to pay off his debts over time. Truman’s financial hardship prompted the doubling of the presidential salary. When Lyndon Baines Johnson signed the Medicare Act of 1965 into law, Truman became the first ever recipient of the new program.

[in-text-ad]

7. Ulysses Simpson Grant

> Term: 1869-1877 (18th president)

> Source of wealth: Military income

> Peak net worth (in 2018 dollars): < $1 million

> Financial hardship: Overspending / fraud

Outside of the office of the Presidency, Grant is best known for his military career, including his service during the Civil War. After fighting in the Mexican-American war, Grant tried his hand at civilian life. He worked in a real estate office for a time, and also tried farming on his wife’s family’s plantation. When the Civil War broke out, Grant quickly volunteered his services as an officer. Following his term as president, Grant and his wife traveled the world in luxury. While he had some money in savings, the former president invested in a fund in 1884 that would defraud Grant out of more than $100,000, leaving him penniless. Grant was able to finish his memoir shortly before his death, providing his family with some inheritance.

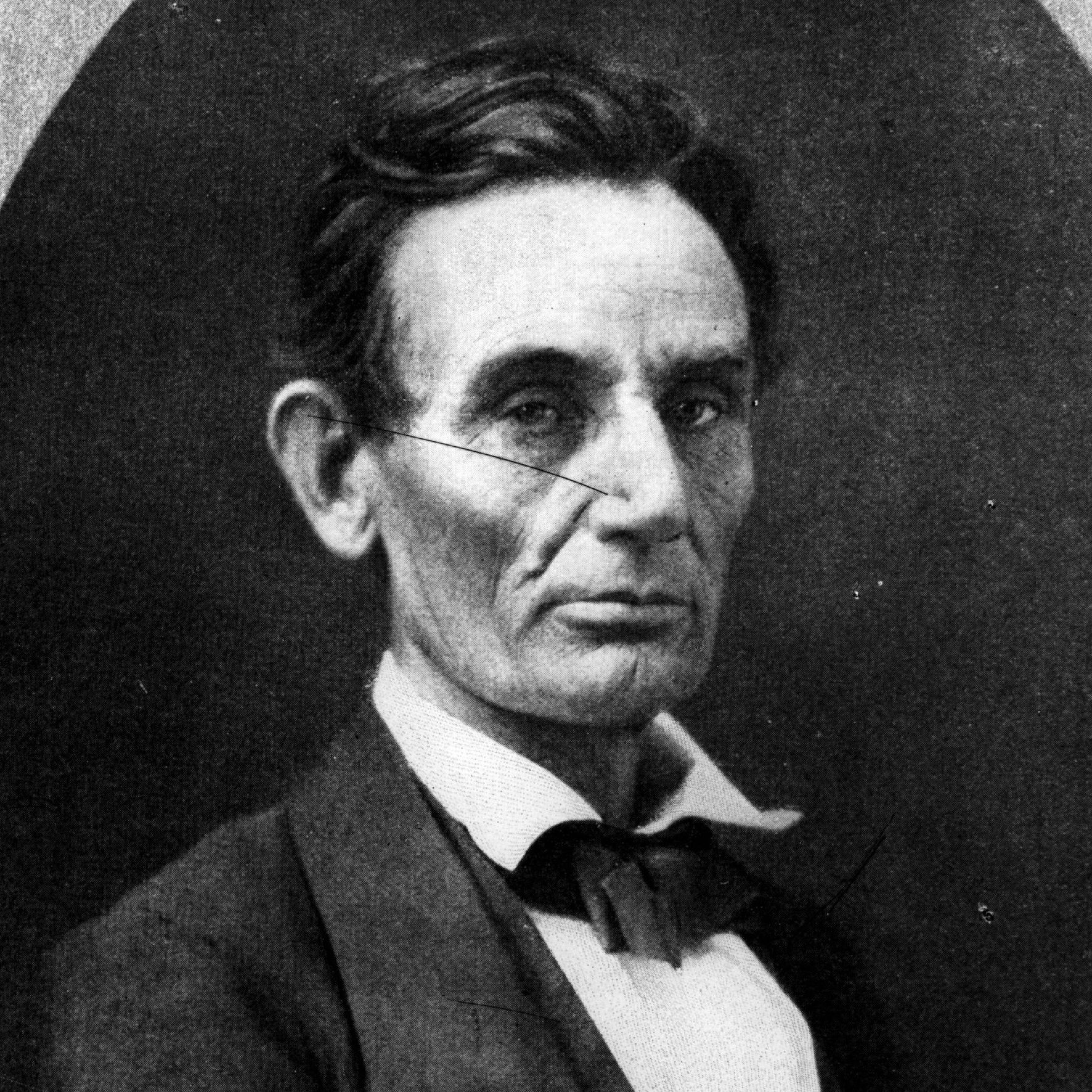

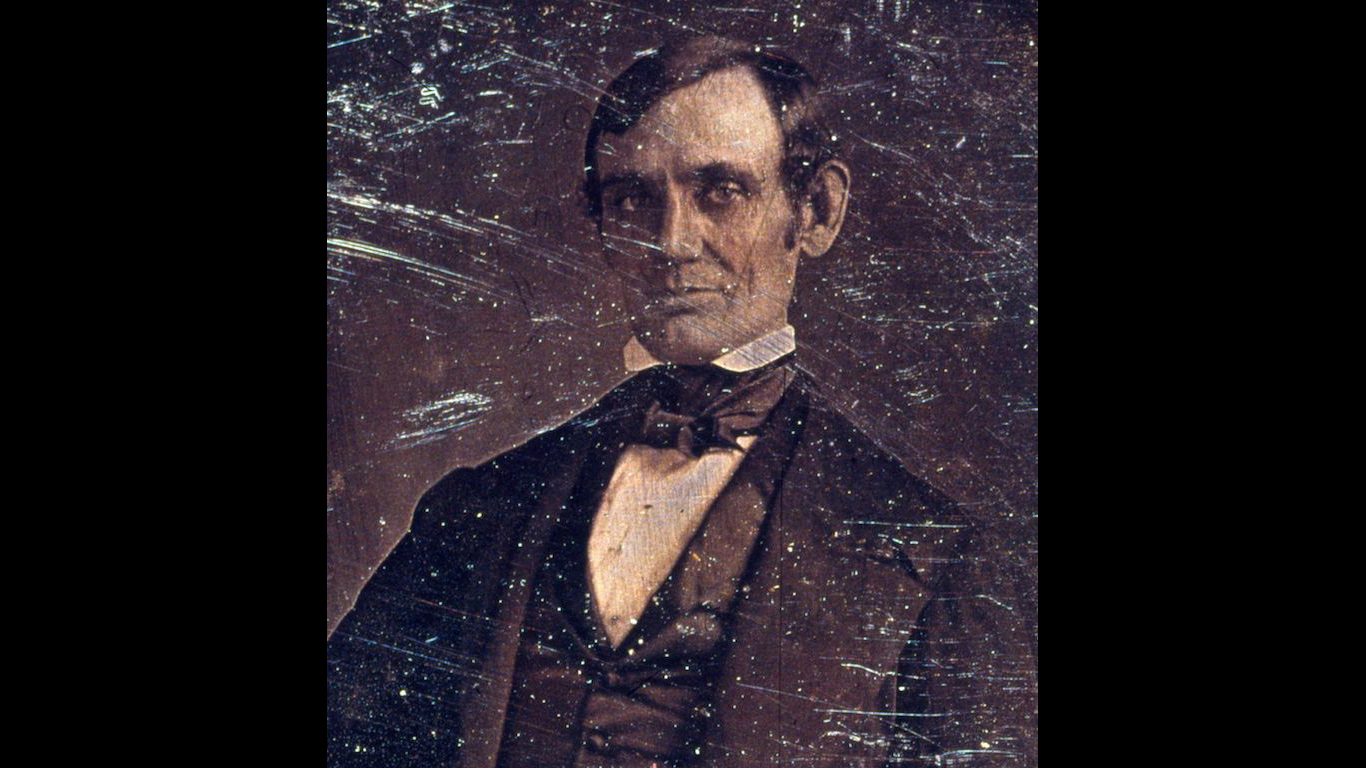

6. Abraham Lincoln

> Term: 1861-1865 (16th president)

> Source of wealth: Law practice

> Peak net worth (in 2018 dollars): < $1 million

> Financial hardship: Business struggles

Abraham Lincoln came from a humble background and struggled with his first business ventures. After making some money as a manual laborer, Lincoln and a friend together opened a general store in New Salem, Illinois. But the store went into debt, and though Lincoln sold much of his ownership of it, he was forced to absorb the debts after his partner died. To pay off creditors, Lincoln was at one point forced to sell his horse. Lincoln was finally able to pay back his debts and exit poverty through his law career.

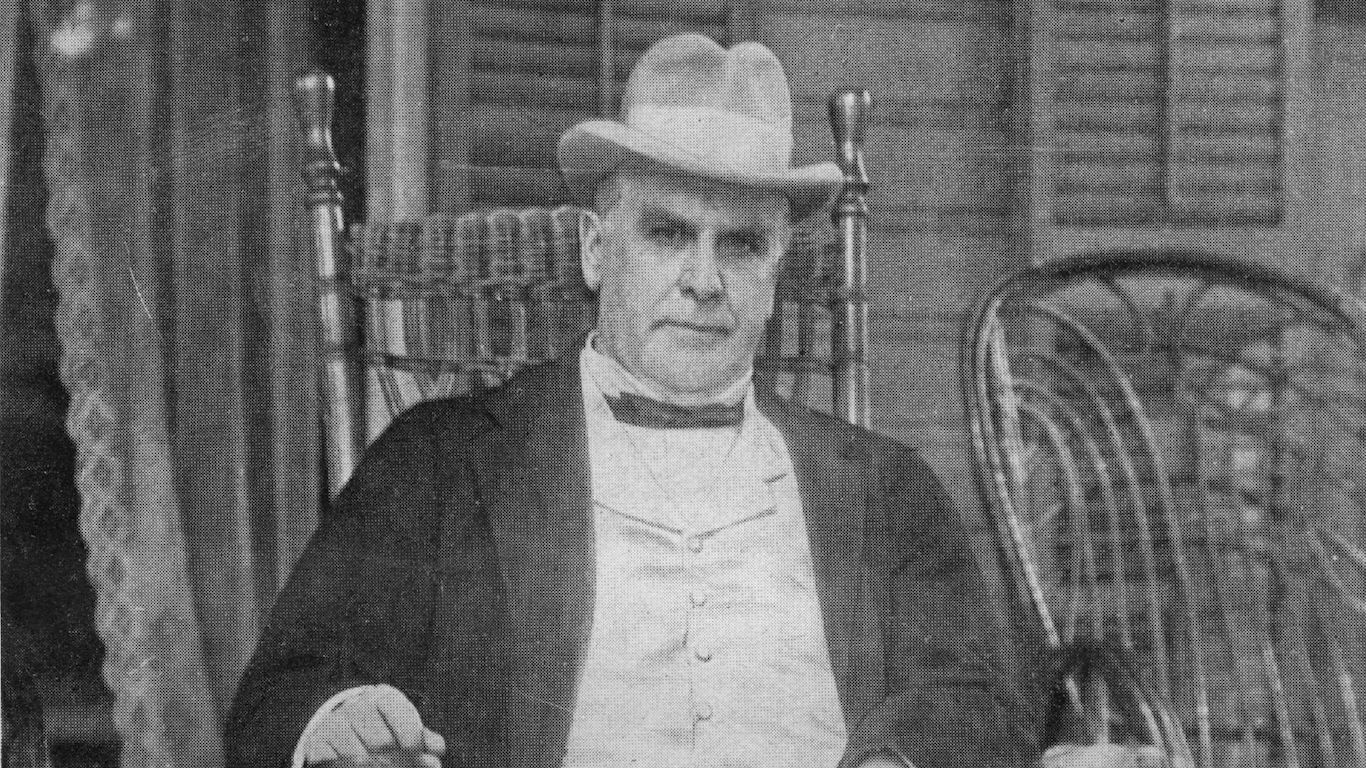

5. William McKinley

> Term: 1897-1901) (25th president)

> Source of wealth: Legal career

> Peak net worth (in 2018 dollars): $1.0 million

> Financial hardship: Business struggles / economic depression

William McKinley proves that not even people who become president are immune from a downturn in the economy. When the depression of 1893 hit, Mckinley’s friend defaulted on a loan the future president had co-signed. His resulting debt was estimated to be at least $100,000, and McKinley was forced to rely on his friends to pay off his debtors.

[in-text-ad-2]

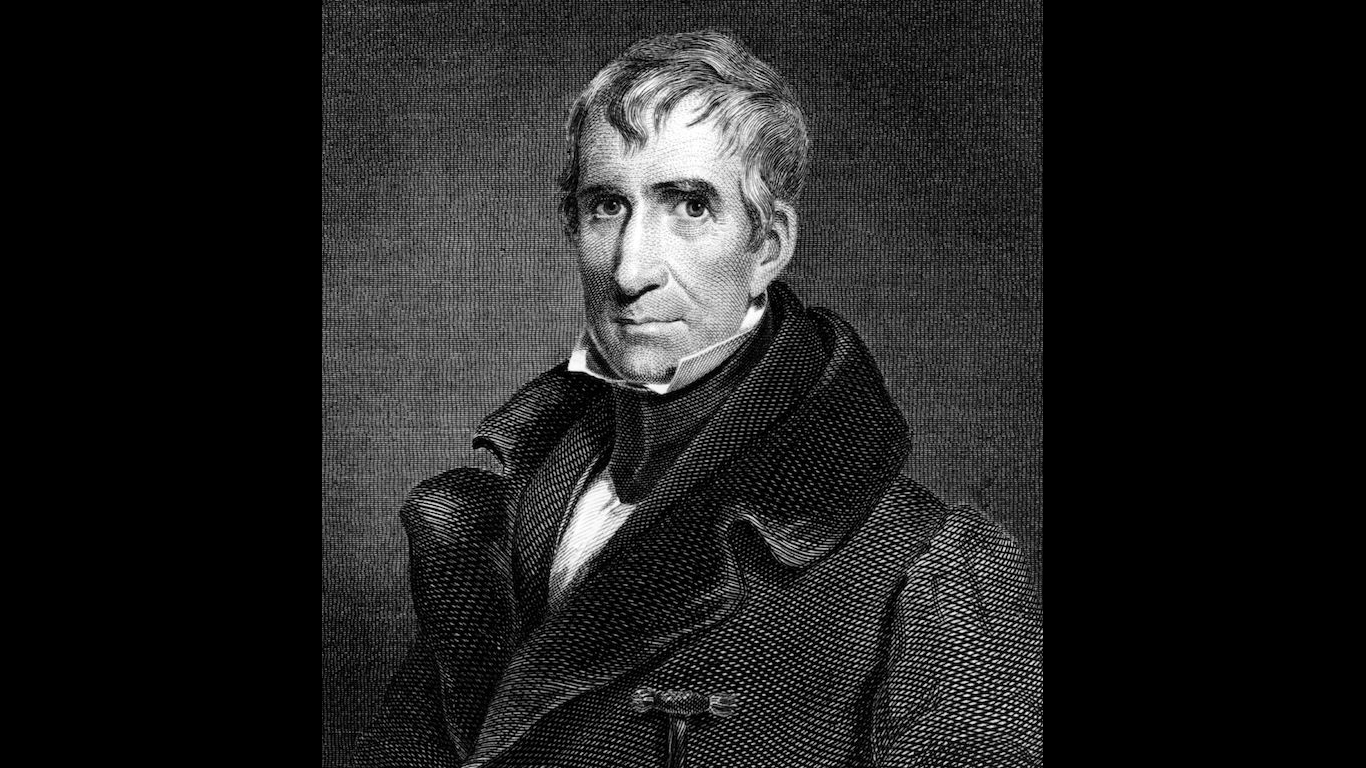

4. William Henry Harrison

> Term: 1841 (9th president)

> Source of wealth: Farming

> Peak net worth (in 2018 dollars): $6.1 million

> Financial hardship: Crop failure

For more than a decade in the early 1800’s William Henry Harrison owned a prosperous farm. But when he became the U.S. ambassador to Colombia in 1828, he left others to manage the business. Upon his return, Harrison discovered that bad weather had ruined his crop. With his primary source of income destroyed, he could not pay back his creditors and was forced to sell off much of his land. He was reportedly still in debt when he arrived to the White House in 1841, and when he died later that same year.

3. James Monroe

> Term: 1817-1825 (5th president)

> Source of wealth: Inheritance

> Peak net worth (in 2018 dollars): $30.4 million

> Financial hardship: Debt

In the early days of America, when agriculture was king, owning land was synonymous with wealth. Though James Monroe inherited a healthy family plantation, he neglected to maintain it while working in politics, and soon went into debt. mismanaged it and ran it into the ground. In debt, Monroe sold his 3,500 acre estate and a home in Paris. But Monroe’s financial troubles persisted, and he had to ask congress to relieve some of his debts. He received $30,000.

[in-text-ad]

2. James Madison

> Term: 1809-1817 (4th president)

> Source of wealth: Inheritance

> Peak net worth (in 2018 dollars): $113.3 million

> Financial hardship: Debt / business difficulties

James Madison occasionally had success with his agriculture businesses, but over time they drained his wealth. Adding to his troubles, Madison’s stepson had a gambling problem, and Madison was forced to foot the bill. Madison eventually sold half of his Montpelier plantation and many of his slaves, who he intended to free, to pay for the debts.

1. Thomas Jefferson

> Term: 1801-1809 (3rd president)

> Source of wealth: Inheritance

> Peak net worth (in 2018 dollars): $236.8 million

> Financial hardship: Debt

Thomas Jefferson was born into money as the son of wealthy landowners, but he had difficulties managing his fortune. Jefferson lived an extravagant lifestyle and loaned money to many people who were unable to pay him back. In addition, he inherited his father-in-law’s debt. The income from his Monticello estate began to dwindle, and Jefferson went into severe debt. He tried to sell his land, but the state of Virginia refused, and his daughter was forced to rely on charity.

Credit card companies are handing out rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.