Special Report

50 Companies That Owe Their Employees a Raise

Published:

Last Updated:

The average CEO base salary at a S&P 500 company is over $10 million. With stock options and other benefits, that income nearly doubles. By contrast, an ordinary worker employed full-time in America earns approximately $45,550 annually.

And while CEO pay in the United States has seemingly continued to rise regardless of both economic conditions and company performance, wages for typical workers have remained relatively flat.

According to an analysis by think tank Economic Policy Institute of stock options, cash salaries, and other benefits, CEO compensation at the nation’s 350 largest companies rose by 17.6% between 2016 and 2017, and by over 1,000% between 1978 and 2017. For the average worker, wages remained effectively flat, inching up 0.3%, between 2016 and 2017, and rising a meager 11.2% since 1978.

Most of the nation’s CEOs would fall comfortably into the top 0.1% or 0.01% of earners. For most Americans, the amount of money a CEO earns in a year is outside the realm of comprehension. And yet, many such ordinary individuals are employed at the very companies run by the nation’s ultra-rich executives.

To identify the nation’s most unequal-paying companies, 24/7 Wall St. reviewed the ratio between annual CEO base pay and average worker salary at 168 large U.S. companies, using data from benefits and compensation information website Payscale. CEO names, cash and total compensation figures, as well as the median worker annual pay, came from Payscale. Data is as of 2016. We have indicated when a given CEO is no longer employed by the company.

Many of these companies are international conglomerates. We chose to focus on pay inequities across the U.S. workforce. If CEO compensation levels were compared to average wages worldwide, the CEO-to-average worker pay gaps would be considerably larger. No pay gap for a company on this list is greater than 500 to 1. Looking at CEO-to-world average wage ratios, pay gaps exceed 1,000 to 1 at 33 corporations in the Russell 3000.

45. Coca Cola

> CEO to typical worker wage ratio (cash): 114 to 1

> CEO: Muhtar Kent

> CEO pay, cash: $6,855,126

> CEO pay, total compensation: $14,590,571

> Median worker annual pay: $59,900

[in-text-ad]

44. Universal Health Services

> CEO to typical worker wage ratio (cash): 117 to 1

> CEO: Alan B. Miller

> CEO pay, cash: $6,373,857

> CEO pay, total compensation: $20,427,309

> Median worker annual pay: $54,600

43. Prudential Financial

> CEO to typical worker wage ratio (cash): 122 to 1

> CEO: John R. Strangfeld

> CEO pay, cash: $10,239,654

> CEO pay, total compensation: $16,668,942

> Median worker annual pay: $84,200

42. Caesars Entertainment

> CEO to typical worker wage ratio (cash): 124 to 1

> CEO: Mark Frissora

> CEO pay, cash: $5,498,830

> CEO pay, total compensation: $12,812,830

> Median worker annual pay: $44,300

[in-text-ad-2]

41. Deere & Co

> CEO to typical worker wage ratio (cash): 124 to 1

> CEO: Samuel R. Allen

> CEO pay, cash: $7,497,246

> CEO pay, total compensation: $15,770,056

> Median worker annual pay: $60,700

40. Lowe’s

> CEO to typical worker wage ratio (cash): 127 to 1

> CEO: Robert A. Niblock (resigned 03/2018)

> CEO pay, cash: $4,210,444

> CEO pay, total compensation: $13,155,164

> Median worker annual pay: $33,100

[in-text-ad]

39. Charter Communications

> CEO to typical worker wage ratio (cash): 129 to 1

> CEO: Thomas M. Rutledge

> CEO pay, cash: $6,362,036

> CEO pay, total compensation: $16,361,387

> Median worker annual pay: $49,300

38. Wells Fargo & Company

> CEO to typical worker wage ratio (cash): 130 to 1

> CEO: John G. Stumpf (resigned 10/2016)

> CEO pay, cash: $6,818,550

> CEO pay, total compensation: $19,318,604

> Median worker annual pay: $52,600

37. Aramark

> CEO to typical worker wage ratio (cash): 131 to 1

> CEO: Eric J. Foss

> CEO pay, cash: $5,546,823

> CEO pay, total compensation: $21,136,908

> Median worker annual pay: $42,300

[in-text-ad-2]

36. AT&T

> CEO to typical worker wage ratio (cash): 131 to 1

> CEO: Randall L. Stephenson

> CEO pay, cash: $7,794,762

> CEO pay, total compensation: $22,417,776

> Median worker annual pay: $59,400

35. Nike

> CEO to typical worker wage ratio (cash): 131 to 1

> CEO: Mark G. Parker

> CEO pay, cash: $10,527,902

> CEO pay, total compensation: $16,819,730

> Median worker annual pay: $80,100

[in-text-ad]

34. Morgan Stanley

> CEO to typical worker wage ratio (cash): 134 to 1

> CEO: James P. Gorman

> CEO pay, cash: $10,716,160

> CEO pay, total compensation: $21,966,480

> Median worker annual pay: $80,100

33. Halliburton

> CEO to typical worker wage ratio (cash): 134 to 1

> CEO: David J. Lesar

> CEO pay, cash: $9,601,126

> CEO pay, total compensation: $15,572,202

> Median worker annual pay: $71,500

32. Centene

> CEO to typical worker wage ratio (cash): 140 to 1

> CEO: Michael F. Neidorff

> CEO pay, cash: $8,423,903

> CEO pay, total compensation: $20,755,103

> Median worker annual pay: $60,100

[in-text-ad-2]

31. MGM Resorts International

> CEO to typical worker wage ratio (cash): 142 to 1

> CEO: James J. Murren

> CEO pay, cash: $7,021,948

> CEO pay, total compensation: $13,271,940

> Median worker annual pay: $49,600

30. Marathon Petroleum

> CEO to typical worker wage ratio (cash): 145 to 1

> CEO: Gary R. Heminger

> CEO pay, cash: $6,475,770

> CEO pay, total compensation: $17,351,260

> Median worker annual pay: $44,800

[in-text-ad]

29. Wyndham Worldwide

> CEO to typical worker wage ratio (cash): 146 to 1

> CEO: Stephen P. Holmes

> CEO pay, cash: $7,472,307

> CEO pay, total compensation: $14,972,307

> Median worker annual pay: $51,100

28. Lockheed Martin

> CEO to typical worker wage ratio (cash): 147 to 1

> CEO: Marillyn A. Hewson

> CEO pay, cash: $11,200,254

> CEO pay, total compensation: $20,163,169

> Median worker annual pay: $76,200

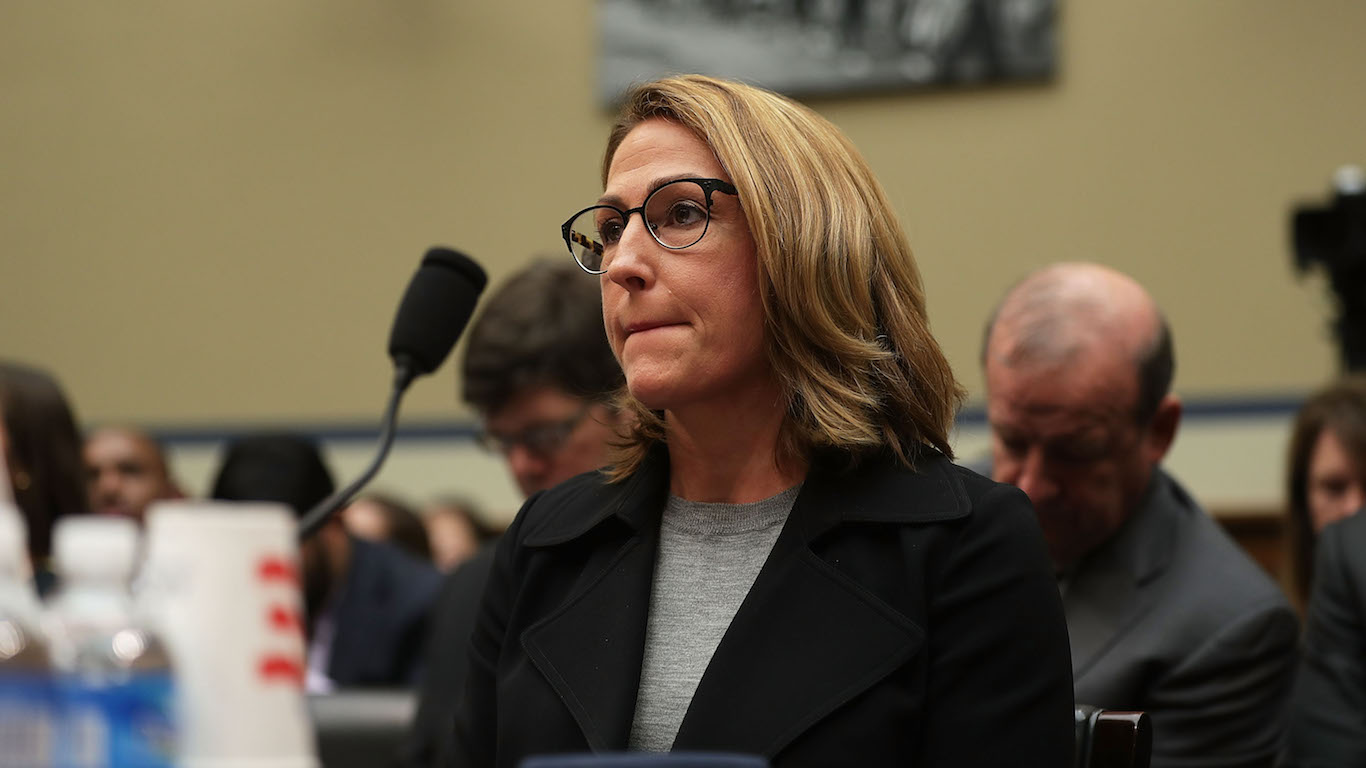

27. Mylan N.V.

> CEO to typical worker wage ratio (cash): 151 to 1

> CEO: Heather Bresch

> CEO pay, cash: $11,662,799

> CEO pay, total compensation: $18,162,852

> Median worker annual pay: $77,100

[in-text-ad-2]

26. Discovery Communications

> CEO to typical worker wage ratio (cash): 156 to 1

> CEO: David M. Zaslav

> CEO pay, cash: $10,614,934

> CEO pay, total compensation: $32,377,346

> Median worker annual pay: $68,100

25. Omnicom Group

> CEO to typical worker wage ratio (cash): 160 to 1

> CEO: John D. Wren

> CEO pay, cash: $13,496,047

> CEO pay, total compensation: $23,576,047

> Median worker annual pay: $84,300

[in-text-ad]

24. T-Mobile

> CEO to typical worker wage ratio (cash): 178 to 1

> CEO: John J. Legere

> CEO pay, cash: $10,782,502

> CEO pay, total compensation: $24,457,987

> Median worker annual pay: $60,700

23. Ameriprise Financial

> CEO to typical worker wage ratio (cash): 198 to 1

> CEO: James M. Cracchiolo

> CEO pay, cash: $9,901,300

> CEO pay, total compensation: $19,372,300

> Median worker annual pay: $50,100

22. Time Warner

> CEO to typical worker wage ratio (cash): 200 to 1

> CEO: Jeffrey L. Bewkes (resigned 06/2018)

> CEO pay, cash: $15,610,633

> CEO pay, total compensation: $31,493,211

> Median worker annual pay: $78,200

[in-text-ad-2]

21. General Electric

> CEO to typical worker wage ratio (cash): 202 to 1

> CEO: Jeffrey R. Immelt (resigned 12/2017)

> CEO pay, cash: $17,434,376

> CEO pay, total compensation: $26,637,142

> Median worker annual pay: $86,400

20. Amtrust Financial Services

> CEO to typical worker wage ratio (cash): 203 to 1

> CEO: Barry Zyskind

> CEO pay, cash: $10,942,190

> CEO pay, total compensation: $13,942,205

> Median worker annual pay: $53,800

[in-text-ad]

19. Starbucks

> CEO to typical worker wage ratio (cash): 204 to 1

> CEO: Howard Schultz (resigned 04/2017)

> CEO pay, cash: $5,722,076

> CEO pay, total compensation: $20,091,353

> Median worker annual pay: $28,000

18. Time Warner Cable

> CEO to typical worker wage ratio (cash): 207 to 1

> CEO: Robert D. Marcus (resigned 05/2016)

> CEO pay, cash: $10,699,868

> CEO pay, total compensation: $18,034,506

> Median worker annual pay: $51,700

17. Lennar

> CEO to typical worker wage ratio (cash): 208 to 1

> CEO: Stuart A. Miller (resigned 04/2018)

> CEO pay, cash: $12,813,693

> CEO pay, total compensation: $17,909,693

> Median worker annual pay: $61,700

[in-text-ad-2]

16. Wal Mart Stores

> CEO to typical worker wage ratio (cash): 209 to 1

> CEO: C. Douglas McMillon

> CEO pay, cash: $5,133,256

> CEO pay, total compensation: $19,404,042

> Median worker annual pay: $24,600

15. Liberty Media & Liberty Interactive

> CEO to typical worker wage ratio (cash): 214 to 1

> CEO: Gregory B. Maffei

> CEO pay, cash: $10,947,607

> CEO pay, total compensation: $26,868,931

> Median worker annual pay: $51,100

[in-text-ad]

14. Cablevision Systems

> CEO to typical worker wage ratio (cash): 220 to 1

> CEO: James L. Dolan (resigned 06/2016)

> CEO pay, cash: $13,649,028

> CEO pay, total compensation: $24,539,725

> Median worker annual pay: $62,000

13. Viacom

> CEO to typical worker wage ratio (cash): 230 to 1

> CEO: Philippe P. Dauman (resigned 08/2016)

> CEO pay, cash: $18,263,525

> CEO pay, total compensation: $54,140,509

> Median worker annual pay: $79,400

12. Allergan

> CEO to typical worker wage ratio (cash): 232 to 1

> CEO: Brenton L. Saunders

> CEO pay, cash: $21,565,325

> CEO pay, total compensation: $21,565,325

> Median worker annual pay: $92,900

[in-text-ad-2]

11. Goodyear Tire & Rubber Co

> CEO to typical worker wage ratio (cash): 234 to 1

> CEO: Richard J. Kramer

> CEO pay, cash: $12,779,784

> CEO pay, total compensation: $17,772,128

> Median worker annual pay: $54,700

10. Wynn Resorts

> CEO to typical worker wage ratio (cash): 238 to 1

> CEO: Stephen A. Wynn (resigned 02/2018)

> CEO pay, cash: $11,930,391

> CEO pay, total compensation: $20,680,391

> Median worker annual pay: $50,100

[in-text-ad]

9. Pepsico

> CEO to typical worker wage ratio (cash): 259 to 1

> CEO: Indra K. Nooyi (resigned 10/2018)

> CEO pay, cash: $15,937,828

> CEO pay, total compensation: $22,189,307

> Median worker annual pay: $61,500

8. Honeywell International

> CEO to typical worker wage ratio (cash): 279 to 1

> CEO: David M. Cote (resigned 03/2016)

> CEO pay, cash: $22,767,851

> CEO pay, total compensation: $33,105,851

> Median worker annual pay: $81,600

7. L Brands

> CEO to typical worker wage ratio (cash): 285 to 1

> CEO: Leslie H. Wexner

> CEO pay, cash: $9,665,925

> CEO pay, total compensation: $26,669,306

> Median worker annual pay: $33,900

[in-text-ad-2]

6. Comcast

> CEO to typical worker wage ratio (cash): 301 to 1

> CEO: Brian L. Roberts

> CEO pay, cash: $16,819,942

> CEO pay, total compensation: $27,520,744

> Median worker annual pay: $55,800

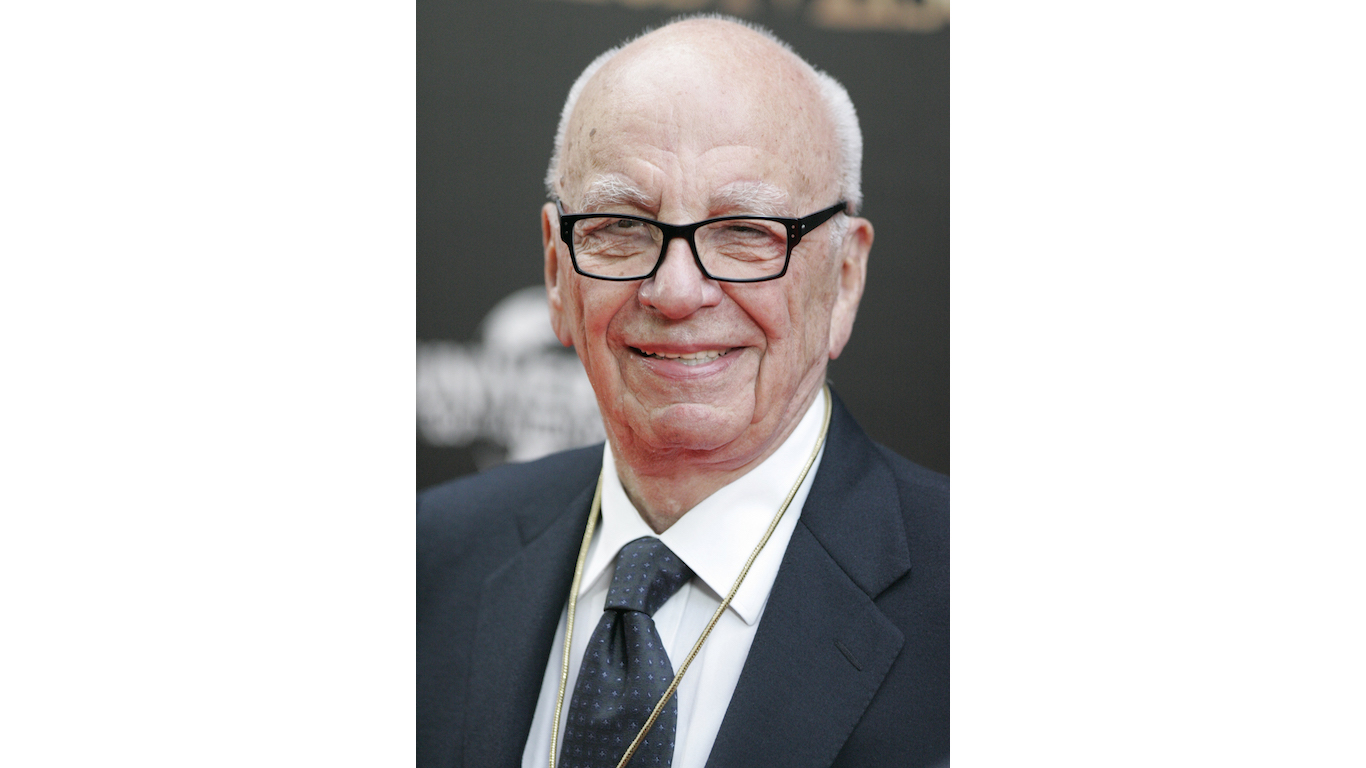

5. Twenty-First Century Fox

> CEO to typical worker wage ratio (cash): 311 to 1

> CEO: K. Rupert Murdoch (resigned 06/2015)

> CEO pay, cash: $17,047,636

> CEO pay, total compensation: $22,192,923

> Median worker annual pay: $54,800

[in-text-ad]

4. TJX Companies

> CEO to typical worker wage ratio (cash): 327 to 1

> CEO: Carol Meyrowitz

> CEO pay, cash: $7,330,584

> CEO pay, total compensation: $17,962,232

> Median worker annual pay: $22,400

3. Walt Disney

> CEO to typical worker wage ratio (cash): 367 to 1

> CEO: Robert A. Iger

> CEO pay, cash: $26,208,003

> CEO pay, total compensation: $43,490,567

> Median worker annual pay: $71,400

2. CBS

> CEO to typical worker wage ratio (cash): 395 to 1

> CEO: Leslie Moonves (resigned 09/2018)

> CEO pay, cash: $23,652,883

> CEO pay, total compensation: $56,352,801

> Median worker annual pay: $59,900

[in-text-ad-2]

1. CVS Health

> CEO to typical worker wage ratio (cash): 434 to 1

> CEO: Larry J. Merlo

> CEO pay, cash: $12,105,481

> CEO pay, total compensation: $22,855,374

> Median worker annual pay: $27,900

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.