Currently, 20 cities in the United States and Canada — narrowed down from an original list of 238 — are waiting for Amazon CEO Jeff Bezos to announce the location of his company’s new headquarters. Anticipation of the announcement is well warranted. The facility is expected to bring 50,000 new jobs to the chosen home city.

A healthy job market is the backbone of any thriving city. Across a population, a strong labor market can create a virtuous economic cycle, reducing financial hardship, fueling consumer spending, and attracting new residents.

The United States is in the midst of unprecedented employment growth. The U.S. economy added 134,000 new jobs in September 2018, marking the 96th consecutive month of job growth. In the last five years alone, the number of Americans with a job climbed by 11.2 million, or 7.8%.

While steady employment gains are breaking records on a national level, there are parts of the country where employment is growing even more rapidly — in some cases double the U.S. job growth rate.

24/7 Wall St. reviewed five-year changes in employment — the number of people employed — at the metro area level to identify the cities adding the most jobs. Over the past half decade, overall employment rose anywhere from 15.0% to 28.3% in the 31 cities on this list. These cities are almost entirely concentrated in the Southern and Western United States.

Click here to see the cities adding the most jobs.

Click here to read our detailed findings and methodology.

31. Albany, OR

> 5 yr. employment increase: 15.0% (+7,257 jobs)

> Highest growth industry: Education and health services (+2,100 jobs)

> August unemployment: 4.5%

> Median household income: $51,541

More cities in the West are adding jobs at a faster rate than in any other region in the United States. Oregon is home to five of those cities, more than any other state. In Albany, Oregon, total employment climbed 15.0% in the past five years alone, more than in all but 30 other U.S. metro areas and nearly double the national employment growth rate over the same period of 7.8%. The city’s education and health services sector contributed most to employment growth in Albany since 2013, accounting for 2,100 of the 7,257 total new jobs.

[in-text-ad]

30. Portland-Vancouver-Hillsboro, OR-WA

> 5 yr. employment increase: 15.0% (+165,512 jobs)

> Highest growth industry: Education and health services (+33,300 jobs)

> August unemployment: 3.8%

> Median household income: $71,931

Total employment climbed 15.0% in the Portland metro area in the past half decade, an increase of more than 165,000. The metro area’s unemployment rate plummeted over the same period, from 7.0% in August 2013 to just 3.8% in August 2018. The city’s declining unemployment rate closely mirrored that of the nation as a whole over the same period. However, the fall in unemployment is all the more impressive in Portland as the labor force increased by 11.1% over that period. Nationwide, the number of people working or looking for work remained flat.

Rapid population growth in the Portland metro area partially explains the spike in total employment and the area’s expanding workforce. Portland metro area’s population is currently 2.4 million, up 7.1% from five years ago.

29. Prescott, AZ

> 5 yr. employment increase: 15.1% (+12,860 jobs)

> Highest growth industry: Leisure and hospitality (+2,300 jobs)

> August unemployment: 4.8%

> Median household income: $50,041

Prescott, Arizona, added 12,860 jobs in the last five years, a 15.1% increase. To compare, total employment climbed by 7.8% nationwide over the same period. Despite the improvement, unemployment remains relatively high in Prescott. As of August, 4.8% of the metro area’s labor force were out of work, well above the comparable 3.9% U.S. unemployment rate.

The metro area’s relatively high unemployment rate is due in part to a surge in the number of people looking for work. Prescott’s labor force now totals over 103,000 workers, 11.2% more than in August 2013, when 92,600 metro area residents were working or looking for work.

28. Medford, OR

> 5 yr. employment increase: 15.4% (+13,372 jobs)

> Highest growth industry: Education and health services (+3,700 jobs)

> August unemployment: 4.7%

> Median household income: $51,409

Medford is one of several rapidly growing cities in Oregon adding jobs at a faster pace than almost anywhere else in the country. Due in large part to the metro area’s education and health services industry, there are over 13,000 more jobs in Medford today than there were in 2013, a 15.4% increase. Growth in education and health services is often driven by population growth, and in the last half decade, Medford’s population grew by 5.4%, outpacing the U.S. population growth rate of 3.8%.

Job growth in Medford far outpaced labor force growth in the past five years as the city’s unemployment rate was cut in half, from 9.4% in 2013 to 4.7% in 2018.

[in-text-ad-2]

27. Colorado Springs, CO

> 5 yr. employment increase: 15.5% (+45,706 jobs)

> Highest growth industry: Leisure and hospitality (+8,700 jobs)

> August unemployment: 4.1%

> Median household income: $65,593

Colorado Springs has added jobs in each of the past five years. The metro area’s total employment stands at just over 341,000, a 15.5% increase from 2013. Despite the steady increase in jobs, the metro area’s unemployment rate spiked in the past year, from 3.2% in August 2017 to 4.1% in August 2018.

Located along the Front Range region of the Rocky Mountains, Colorado Springs is a mecca for outdoor types and a popular tourist destination — and tourism has driven job growth in the city in recent years. Leisure and hospitality accounts for 8,700 of the 45,700 new jobs in the city in the past five years, the most of any industry.

26. Lake Havasu City-Kingman, AZ

> 5 yr. employment increase: 15.6% (+10,750 jobs)

> Highest growth industry: Leisure and hospitality (+2,500 jobs)

> August unemployment: 6.0%

> Median household income: $42,311

Lake Havasu is one of three metro areas in Arizona to rank among the U.S. cities adding jobs the fastest. In the past half decade, employment in the metro area grew 15.6%, double the comparable 7.8% national job growth.

Boasting 400 miles of coastline and sunshine almost year round, Lake Havasu is a popular tourist destination. In addition to boating, fishing, golfing, and hiking, the city is home to the London Bridge, which was relocated from the Thames to the Colorado River beginning in 1968 through 1971. The bridge is the second largest tourist draw in the state, trailing only the Grand Canyon. Tourism has been a boon for the local job market as Lake Havasu’s leisure and hospitality industry added 2,500 job in the past five years.

[in-text-ad]

25. Denver-Aurora-Lakewood, CO

> 5 yr. employment increase: 15.6% (+214,831 jobs)

> Highest growth industry: Professional and business services (+36,400 jobs)

> August unemployment: 3.3%

> Median household income: $76,643

Few U.S. metro areas have a faster growing labor force than Denver. In the past five years, the number of people in Denver either working or looking for work increased by 12.1%. For reference, the total U.S. labor force remained effectively flat over that period. Job growth in Denver, however, has kept pace with the city’s growing labor force, as total employment was up 15.6% over the same period.

Industries in Denver that each added over 30,000 jobs in the past five years include, professional business services, leisure and hospitality, trade, transportation, and utilities. No industries in the metro area around Colorado’s capital city shed jobs in the past half decade.

24. North Port-Sarasota-Bradenton, FL

> 5 yr. employment increase: 15.9% (+48,037 jobs)

> Highest growth industry: Professional and business services (+12,400 jobs)

> August unemployment: 3.6%

> Median household income: $56,817

There are now 48,000 more people working in the North Port-Sarasota-Bradenton metro area than there were five years ago. Overall employment climbed the most in the professional and business services industry, which added 12,400 jobs. The metro area’s leisure and hospitality industry and education and health services also grew substantially, netting a total of 9,500 and 8,500 new jobs, respectively.

The area’s rapid job growth outpaced the growth in the number of people looking for jobs in the metro area, and as a result, unemployment fell considerably. Just 3.6% of workers in North Port-Sarasota-Bradenton are out of a job, compared to the area’s 7.0% unemployment rate in August 2013.

23. Atlanta-Sandy Springs-Roswell, GA

> 5 yr. employment increase: 16.0% (+410,162 jobs)

> Highest growth industry: Trade, transportation, and utilities (+73,400 jobs)

> August unemployment: 3.6%

> Median household income: $65,381

The largest metro area by population on this list, employment in the Atlanta metro increased by 410,000 in the past five years. The metro area added 73,400 new jobs in its trade, transportation, and utilities sector alone, more than the total number of new jobs across all industries in the majority of metro areas on this list. Over the same period, Atlanta’s unemployment rate fell from 7.8% to 3.6% — currently one of the lowest of any major American city.

Atlanta’s low jobless rate partially explains the relatively high incomes in the city. The typical metro area household earns $65,381 a year, about $5,000 more than the income of the typical household nationwide.

[in-text-ad-2]

22. Wenatchee, WA

> 5 yr. employment increase: 16.1% (+9,365 jobs)

> Highest growth industry: Leisure and hospitality (+1,400 jobs)

> August unemployment: 4.0%

> Median household income: $58,990

Wenatchee is the only metro area in Washington state to rank on this list. Although the area’s employment dropped slightly in the past year, Wenatchee has added nearly 9,400 jobs in the past half decade — a 16.1% growth. The metro area’s leisure and hospitality, mining, logging, and construction, as well as its education and health services industries each added over 1,000 jobs in the past five years.

Like most other cities on this list, Wenatchee’s population is growing fast. In the last five years, the metro area’s population grew by 4.8%, outpacing the comparable national population growth rate of 3.8%.

21. Coeur d’Alene, ID

> 5 yr. employment increase: 16.2% (+10,622 jobs)

> Highest growth industry: Mining, logging, and construction (+2,100 jobs)

> August unemployment: 2.6%

> Median household income: $57,219

Total employment in Coeur d’Alene, Idaho, is up 16.2% in the past half decade. The number of people working in the metro area has grown in each of the past five years. Over the same period, unemployment in Coeur d’Alene fell from 6.1% to just 2.6% — one of the lowest unemployment rates in the country.

The area’s job growth has been driven by the mining, logging, and construction industry, which added 2,100 of all the new jobs over the past half decade. However, not all industries contributed to growth. There are 300 fewer people working in Coeur d’Alene’s manufacturing sector today than there were in 2013.

[in-text-ad]

20. Las Vegas-Henderson-Paradise, NV

> 5 yr. employment increase: 16.6% (+150,153 jobs)

> Highest growth industry: Professional and business services (+31,700 jobs)

> August unemployment: 4.9%

> Median household income: $57,189

There are over 150,000 more people working in the Las Vegas metro area today than there were five years ago. There were 905,000 people working in and around Sin City in 2013 compared to well over a million today. The professional and business services industry drove job growth, followed by the mining, logging, and construction industry.

Las Vegas’s job market was hit particularly hard by the recession, and as recently as 2013, nearly one in every 10 workers in the metro area were out of work. Due largely to rapid job growth, unemployment has improved substantially since — but at 4.9%, the metro area’s jobless rate remains higher than the August 3.9% national rate.

19. Orlando-Kissimmee-Sanford, FL

> 5 yr. employment increase: 17.0% (+189,131 jobs)

> Highest growth industry: Professional and business services (+54,000 jobs)

> August unemployment: 3.4%

> Median household income: $55,089

There are now 189,000 more people working in the Orlando-Kissimmee-Sanford, Florida, metro area than there were five years ago. The metro area’s professional and business services industry alone accounted for well over a quarter of that growth, adding to employment by 54,000.

Home to Walt Disney World Resort, the Orlando metro area is a popular tourist destination. Annual attendance at Magic Kingdom alone climbed from about 18.5 million in 2013 to about 20.5 million in 2017. Over roughly the same period, employment in the metro area’s leisure and hospitality industry climbed 23%, accounting for about 50,000 new jobs.

18. Grants Pass, OR

> 5 yr. employment increase: 17.6% (+5,066 jobs)

> Highest growth industry: Education and health services (+1,700 jobs)

> August unemployment: 5.3%

> Median household income: $44,426

There are now over 5,000 more people working in Grants Pass, Oregon, than there were five years ago, a 17.6% increase. Job growth was driven by the education and health services industry, which added 1,700 new jobs.

Not all industries in Grants Pass contributed to growth as the metro area’s government sector shed some 500 positions. Still, the metro area’s job market is much improved from five years ago. Just 5.3% of workers in Grants Pass were out of a job as of August 2018 compared to 10.7% in August 2013.

[in-text-ad-2]

17. Raleigh, NC

> 5 yr. employment increase: 17.6% (+103,395 jobs)

> Highest growth industry: Trade, transportation, and utilities (+19,700 jobs)

> August unemployment: 3.4%

> Median household income: $72,576

Raleigh, North Carolina, metro area’s population is one of the fastest growing in the United States. In the last five years, the city’s population grew by 12.3%, more than three times the 3.8% national population growth. Over the same period, the metro area’s labor force grew by 14.2%. Still, job growth more than kept pace. There are now over 100,000 more people working in Raleigh than there were in 2013, a 17.6% increase. In the past half decade, the unemployment rate in Raleigh fell from 6.3% to 3.4%.

Total employment grew in every sector in Raleigh in the past five years. The trade, transportation, and utilities industry alone added 19,700 new jobs.

16. Nashville-Davidson–Murfreesboro–Franklin, TN

> 5 yr. employment increase: 17.7% (+149,494 jobs)

> Highest growth industry: Professional and business services (+41,100 jobs)

> August unemployment: 3.1%

> Median household income: $63,939

The Nashville metro area is growing rapidly, and until recently, job growth has kept pace with the growing number of people looking for work. In the past five years, Nashville’s labor force grew by 13.7%. Over the same period, overall employment climbed 17.7%. The metro area’s unemployment rate fell from 6.3% in August 2013 to 2.9% in August 2017. However, job growth slowed slightly in the past year and did not keep pace with labor force growth. As a result, Nashville’s unemployment rate climbed slightly from 2.9% in August 2017 to 3.1% in August 2018.

Job growth in the Nashville metro area over the past half decade was driven largely by the professional and business services industry. The industry alone added 41,100 new workers, more than the total employment growth in many smaller cities on this list.

[in-text-ad]

15. Phoenix-Mesa-Scottsdale, AZ

> 5 yr. employment increase: 17.7% (+337,497 jobs)

> Highest growth industry: Education and health services (+57,800 jobs)

> August unemployment: 4.5%

> Median household income: $61,506

Of the three Arizona metro areas on this list, none has added jobs at a faster pace than Phoenix-Mesa-Scottsdale. There are now over 337,000 more people working in the metro area than there were five years ago, a 17.7% increase. Every industry contributed to the five-year job growth in the Phoenix metro area, with the education and health services industry and the professional and business services industry each adding over 50,000 new workers.

The labor force in Phoenix has also spiked since 2013, and as a result the metro area’s unemployment rate is higher than typical. In August 2013, the area’s unemployment rate was 7.2% — in line with the U.S. unemployment rate. As of August 2018, unemployment in the area stood at 4.5%, slightly higher than the 3.9% U.S. rate.

14. Cape Coral-Fort Myers, FL

> 5 yr. employment increase: 17.8% (+48,729 jobs)

> Highest growth industry: Mining, logging, and construction (+10,900 jobs)

> August unemployment: 3.7%

> Median household income: $53,928

Overall employment in the Cape Coral-Fort Myers metro area climbed 17.8% over the past five years. There are now 48,729 more people working in the metro area than there were in 2013. The rapid job growth has reduced unemployment at faster than typical rate. The unemployment rate in Cape Coral-Fort Myers stood at 7.5% in August 2013, higher than the 7.2% national rate. As of August 2018, unemployment in Cape Coral-Fort Myers was 3.7%, lower than the comparable 3.9% national rate.

The metro area’s mining, logging, and construction lead job growth in Cape Coral-Fort Myers, adding 10,900 new jobs in the past half decade.

13. Charlotte-Concord-Gastonia, NC-SC

> 5 yr. employment increase: 17.9% (+194,322 jobs)

> Highest growth industry: Professional and business services (+44,500 jobs)

> August unemployment: 3.7%

> Median household income: $61,156

Charlotte-Concord-Gastonia reported faster five-year employment growth than any other metro area in North Carolina. From 2013 through 2018, the number of people working in the metro area climbed by over 194,000, a 17.9% increase. The metro area’s professional and business services industry contributed most to growth, adding 44,500 jobs in the past half decade, more than total employment growth in many smaller cities on this list.

Charlotte is one of the fastest growing metro areas by population in the United States. The metro area population climbed 37.9%, from 1.8 million in 2012 to 2.5 million in 2017. Still, Charlotte’s job market more than kept pace with population growth, and from August 2013 to August 2018, unemployment in the metro area fell from 7.8% to 3.7%.

[in-text-ad-2]

12. Reno, NV

> 5 yr. employment increase: 18.0% (+36,792 jobs)

> Highest growth industry: Trade, transportation, and utilities (+10,300 jobs)

> August unemployment: 3.7%

> Median household income: $61,360

Every industry in Reno, Nevada, added jobs in the past five years. The strongest growth was in the trade, transportation, and utilities industry and in manufacturing, which together, accounted for about half of total employment growth in the metro area since 2013.

Because of the rapid job growth, Reno’s unemployment rate improved more than nearly every other U.S. metro area in the past five years. In August 2013, Reno’s 9.0% unemployment rate was well above U.S. unemployment rate of 7.2%. As of August 2018, the area’s unemployment rate was just 3.7%, lower than the comparable 3.9% national rate.

11. Fort Collins, CO

> 5 yr. employment increase: 18.3% (+30,546 jobs)

> Highest growth industry: Trade, transportation, and utilities (+4,800 jobs)

> August unemployment: 3.0%

> Median household income: $69,102

Fort Collins, Colorado reported a larger increase in overall employment in the past five years than just 10 other U.S. metro areas. There are now over 30,500 more people working in the metro area than there were in 2013, an 18.3% increase. To compare, overall employment climbed by 7.8% nationwide over the same period.

In Fort Collins, employment grew in every industry in the past five years. The trade, transportation, and utilities industry; the leisure and hospitality industry; as well as government, added over 4,000 jobs each. Despite climbing slightly in the past year, Fort Collins’ unemployment rate of 3.0% is well below the August U.S. unemployment rate of 3.9%.

[in-text-ad]

10. Austin-Round Rock, TX

> 5 yr. employment increase: 18.4% (+177,408 jobs)

> Highest growth industry: Professional and business services (+45,200 jobs)

> August unemployment: 3.0%

> Median household income: $73,800

Few U.S. metro areas are growing in population as rapidly as Austin, Texas. In the last five years, the metro area’s population climbed 15.3%, from 1.8 million in 2012 to 2.1 million in 2017. There are now more than 1.1 million people working in the Austin metro area, compared to 966,000 in 2013, an 18.4% increase.

The metro area’s professional and business services industry added 45,200 jobs since 2013, the largest employment increase of any industry. Some of the largest employers in Austin, including Apple, Dell, and IBM, are also in the metro area’s fastest growing industry.

9. Boise City, ID

> 5 yr. employment increase: 18.6% (+54,582 jobs)

> Highest growth industry: Trade, transportation, and utilities (+8,400 jobs)

> August unemployment: 2.3%

> Median household income: $55,324

Every major industry in Idaho state capital metro area employs more workers than it did five years ago. Overall, there are 54,582 more people working in Boise today than half a decade ago. The metro area’s trade, transportation, and utilities industry grew the most, adding 8,400 jobs, followed by the professional and business services industry, which added 8,000 jobs.

As the state capital, Boise has a relatively large government sector. In the past five years, the number of workers employed in government jobs in the metro area increased by 4,600.

8. Fayetteville-Springdale-Rogers, AR-MO

> 5 yr. employment increase: 20.0% (+44,583 jobs)

> Highest growth industry: Professional and business services (+9,200 jobs)

> August unemployment: 2.5%

> Median household income: $56,038

Overall employment has increased by 20% in the Fayetteville-Springdale-Rogers metro area over the past five years. Largely due to growth in the professional and business services industry and the trade, transportation, and utilities industry, there are now 44,583 more people working in and around Fayetteville than there were five years ago.

Due in part to near nation leading job growth, the metro area’s 2.5% unemployment rate is the lowest in Arkansas or Missouri and well below the 3.9% U.S. August unemployment rate.

[in-text-ad-2]

7. Gainesville, GA

> 5 yr. employment increase: 20.9% (+17,423 jobs)

> Highest growth industry: Trade, transportation, and utilities (+2,800 jobs)

> August unemployment: 3.0%

> Median household income: $61,977

Employment has grown faster in Gainesville, Georgia, than in any other city in the Southeast in the past five years. There are now 17,423 more people working in the metro area than there were in 2013, a 20.9% increase. Local manufacturers Kubota and Mars Wrigley Confectionery have each grown recently. Additionally, due in part to recent hiring by the distribution company Tatsumi Intermodal, the metro area’s trade, transportation, and utilities industry added 2,800 new jobs since 2013, the most of any industry in Gainesville.

As of August 2018, Gainesville’s unemployment rate was 3.0%, well below the comparable 3.9% national rate.

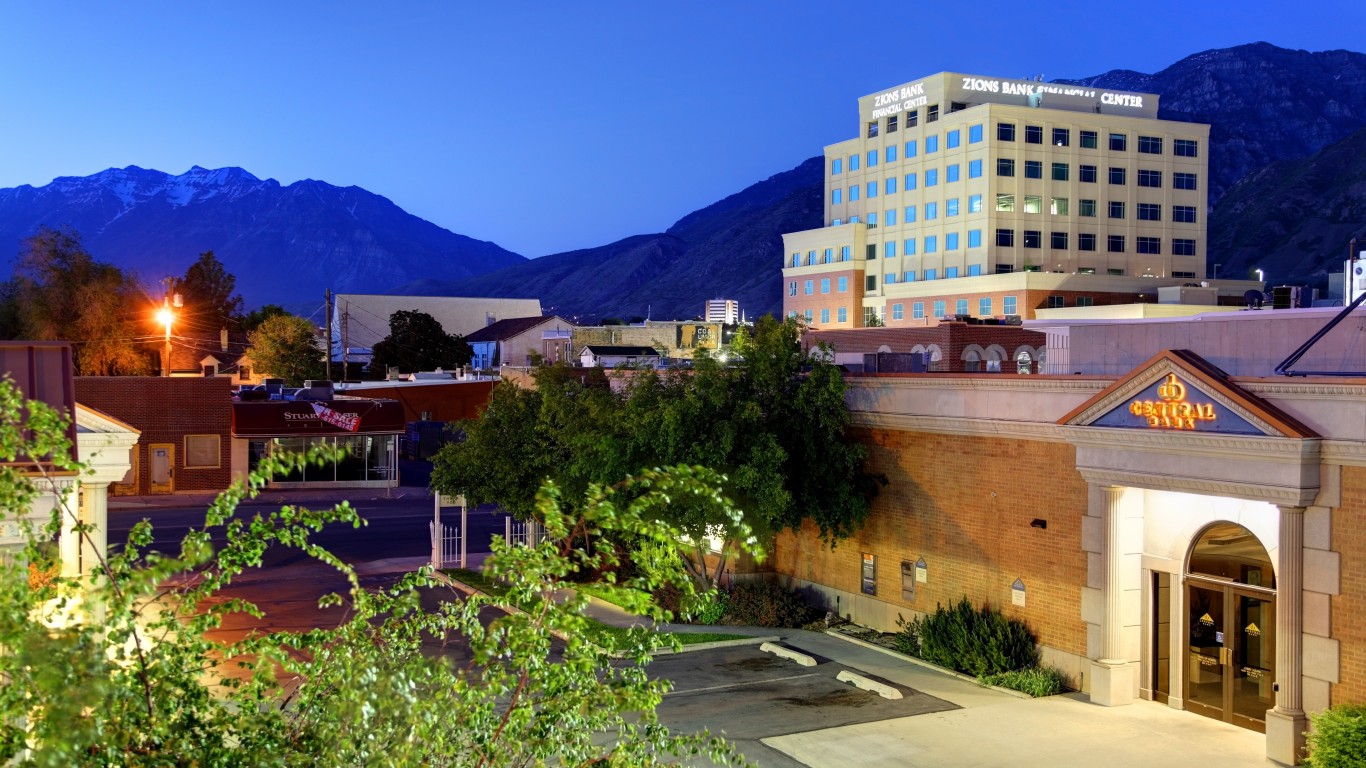

6. Provo-Orem, UT

> 5 yr. employment increase: 20.9% (+51,005 jobs)

> Highest growth industry: Trade, transportation, and utilities (+12,400 jobs)

> August unemployment: 3.2%

> Median household income: $70,196

Overall, there are approximately 51,000 more people working in Provo-Orem now than in 2013 — making the metro area one of only seven nationwide with over 20% five-year employment growth. While every major industry in the Provo-Orem metro area employs more workers now than it did five years ago, job growth was concentrated in the trade, transportation, and utilities industry and the mining, logging, and construction industry. Together, the two industries accounted for nearly half of the area’s employment growth in the past half decade.

Relatively low in 2013, the unemployment rate did not improve in Provo-Orem as much as it did in most other metro areas on this list. In August 2013, just 4.4% of the metro area’s labor force was out of a job compared to the 7.2% national unemployment rate at the time. As of August 2018, the unemployment rate in Provo-Orem stood at 3.2% compared to the 3.9% national rate.

[in-text-ad]

5. Greeley, CO

> 5 yr. employment increase: 21.1% (+27,758 jobs)

> Highest growth industry: Mining, logging, and construction (+5,100 jobs)

> August unemployment: 3.2%

> Median household income: $68,884

Employment climbed faster in Greeley in the past five years than in every other Colorado metro area and all but four other U.S. metro areas. Due largely to hiring in the mining, logging, and construction industry; the trade, transportation, and warehousing industry; and the leisure and hospitality industry, there are now nearly 27,800 more people working in the metro area than there were five years ago, a 21.1% increase.

Unemployment fell every year in the metro area between August 2013, when 6.1% of workers in Greeley were out of a job, to August 2017, when the unemployment rate stood at 2.6%. Despite inching up slightly in the past year due to faster than typical labor force growth, Greeley’s current 3.2% unemployment rate remains below the 3.9% national rate.

4. St. George, UT

> 5 yr. employment increase: 23.4% (+13,447 jobs)

> Highest growth industry: Trade, transportation, and utilities (+3,400 jobs)

> August unemployment: 4.0%

> Median household income: $54,842

Each of the five metro areas in Utah has added jobs faster than the 7.2% nationwide five-year employment growth. In the St. George metro area, five-year employment growth hit 23.4%, a statewide high.

St. George is one of the rare U.S. metro areas where despite the near nation-leading job growth, unemployment remains above the national rate. As of August 2018, 4.0% of the metro area’s labor force was out of a job compared to 3.9% of American workers. This is due in part to rapid labor force growth. The number of people working or looking for work in St. George climbed 21.7% in the past five years, and by 2.7% in the past year. Nationwide, the size of the labor force dipped by 0.1% in the past five years, and inched up just 0.7% last year.

3. Elkhart-Goshen, IN

> 5 yr. employment increase: 24.0% (+22,399 jobs)

> Highest growth industry: Manufacturing (+18,600 jobs)

> August unemployment: 2.9%

> Median household income: $58,960

Employment climbed by 24% in the Elkhart-Goshen, Indiana, metro area in the past five years, more than triple comparable employment growth nationwide. In many metro areas with similar job growth, hiring across multiple industries drove overall employment gains. In Elkhart-Goshen, manufacturing alone accounted for over 80% of job growth.

The metro area’s booming manufacturing sector is due in part to the growing popularity of RVs. About half of all RVs on the road were made in Elkhart County, and demand for RVs has been increasing for years. Total RV shipments have climbed every year since 2013, from 321,100 to 504,600 in 2017.

[in-text-ad-2]

2. Bend-Redmond, OR

> 5 yr. employment increase: 26.6% (+19,621 jobs)

> Highest growth industry: Mining, logging, and construction (+3,700 jobs)

> August unemployment: 3.6%

> Median household income: $66,273

Adding some 19,600 jobs since 2013, Bend-Redmond, Oregon, reported a 26.6% five-year employment growth, the fastest growth of any metro area in the western United States and second fastest nationwide.

Not including government, every industry in the Bend-Redmond metro area grew by total employment in the past five years. Mining, logging, and construction; leisure and hospitality; and education and health services each added over 3,000 jobs since 2013. Partially as a result, unemployment has dropped considerably in recent years. In the summer of 2013, the unemployment rate in Bend-Redmond was 8.5%, higher than the comparable 7.2% national rate. As of August 2018, unemployment in the metro area stood at 3.6%, below the 3.9% national rate.

1. Lake Charles, LA

> 5 yr. employment increase: 28.3% (+24,482 jobs)

> Highest growth industry: Mining, logging, and construction (+15,700 jobs)

> August unemployment: 4.2%

> Median household income: $52,314

Overall employment climbed by 28.3% in Lake Charles, Louisiana, in the past five years, the greatest gain of any U.S. metro area and nearly quadruple the 7.2% national employment growth. Over half of the 24,482 newly employed residents in the metro area found work in the mining, logging, and construction industry. Employment surges in the industry are partially attributable to several major industrial construction projects tied to the city’s booming natural gas industry. The projects have spillover effects, boosting employment in other supporting industries, like manufacturing.

As a whole, Louisiana’s economy is struggling, only recently emerging from a year and a half-long recession. Of the nine metro areas in the state, Lake Charles is the only one with an unemployment rate below 5.0%.

Detailed Findings

Nationwide, the education and health services sector has added more jobs than any other in the past five years — followed closely by the professional and business services and leisure and hospitality sectors.

The industries that drove growth in the metro areas on this list vary and include manufacturing; mining, logging and construction; and trade, transportation, and utilities in addition to the previously mentioned industries that drove national employment growth. Less than half of the cities adding the most jobs have an industry that is smaller now by total employment than it was five years ago.

Perhaps not surprisingly, the populations of most of the 31 cities adding the most jobs are also growing relatively fast. Only two cities on this list had slower population growth than the U.S. growth of 3.8% from 2012 to 2017. Overall, five-year population growth ranges from 1.9% in Lake Havasu City-Kingman, Arizona, to 37.9% in Charlotte, North Carolina.

Depending on the city, rapid population growth can be both a cause and a product of job growth. A growing population drives up demand for such services as education and health, ultimately driving employment growth. Similarly, new business growth and corporate expansions can spur hiring surges and draw job seekers to a city, ultimately leading to population spikes.

Just as the population of the cities on this list has grown in the past five years, so, too, has the number of people either working or looking for work, that is, the labor force. In the past five years, the labor force in the cities on this list has grown anywhere from 9.1% to nearly 25%. Over the same period, the size of the U.S. labor force remained effectively flat.

Job growth outpaced the influx of workers in every city on this list, as evidenced by the declines in unemployment rates. Grants Pass, Oregon, had the largest drop in unemployment, a 5.4 percentage point improvement from 10.7% in August 2013 to 5.3% in August 2018. Nationwide, unemployment dipped 3.3 percentage points over the same period.

Methodology

To identify the American cities adding the most jobs, 24/7 Wall St. reviewed percent change in total employment over the five years from August 2013 to August 2018 in U.S. metro areas. Employment (the number of people employed), the total size of the labor force (those working and looking for work), and the number of unemployed workers are all from the Bureau of Labor Statistics. The unemployment rate is also from the BLS and is as of August 2018. Employment by industry at the super sector level is also from the BLS and five-year changes were calculated from August 2013 to August 2018. Five-year population change was calculated from 2012 to 2017 and is from the U.S. Census Bureau’s American Community Survey. Median household income is for 2017 and is also from the ACS.

Are You Ahead, or Behind on Retirement?

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention. Many people have worked their whole lives preparing to retire without ever knowing the answer to the most important question: am I ahead, or behind on my goals?

Don’t make the same mistake. It’s an easy question to answer. A quick conversation with a financial advisor can help you unpack your savings, spending, and goals for your money. With Zoe Financial’s free matching tool, you can connect with trusted financial advisors in minutes.

Why wait? Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.