The markets were notoriously unstable in the second half of 2018, and that already promises to be the case into 2019, with political drama, trade issues and worries about an economic slowdown.

As investors look at portfolio picks for this year, they should consider a mix of major growth stocks and safe harbor securities. Some growth stocks, like Microsoft, have not been beaten down by worries of regulation. Safe harbor stocks, which are very large companies with strong histories of dividends, are a good balance to volatile growth sectors.

24/7 Wall St. looked at the Standard & Poor’s 500 Index to find a mix that takes into account these factors.

Click here to see 20 stocks to own for 2019

1. Amazon

Amazon.com Inc. (NASDAQ: AMZN) has several moats that make it hard for competition to effectively attack it. Despite the tech sell-off, its shares remain recommended by most analysts who follow the company. With a market cap of $787 billion, it ranks first among U.S. public companies, ahead Alphabet and Microsoft.

Amazon is best known for its huge e-commerce operations. However, it also operates one of the world’s largest streaming media businesses through its Prime subscription service, and its consumer electronics products have become a critical part of its revenue base. Perhaps more important than any of these, Amazon leads the hot cloud computing market with its Amazon Web Service division.

[in-text-ad]

2. Verizon

Safe harbor stocks are defined by those of companies that have large market share, huge revenue and rock-solid balance sheets. Most investors add dividend payouts that are long-lived and create a large yield. Few stocks fit this role as well as Verizon Communications Inc. (NYSE: VZ). Verizon dominates the wireless market in the United States along with AT&T. Between them, they have little competition.

Last year, Verizon made $30 billion on $126 billion in revenue. Although neither of these figures are rising rapidly, the company has a $2.41 payout, which is a yield of 4.21%. Its $113 billion in debt is spread over a payment period that should not affect its margins.

3. McDonald’s

McDonald’s Corp. (NYSE: MCD) is another safe harbor stock. It’s 14,000-store footprint puts it at the lead among fast-food companies in America, and it has over 37,000 locations worldwide. In the most recent quarter, same-store sales worldwide jumped by a healthy 4.2%. McDonald’s has staked out a strong position in the breakfast market, a challenge to Starbucks and Dunkin’ Donuts. Many of its locations operate 24 hours a day.

McDonald’s is famous for share buybacks. In the three years that ended in 2016, its share repurchases totaled $20 billion. McDonald’s $4.64 dividend drives a yield of 2.58%.

4. Microsoft

Microsoft Corp. (NASDAQ: MSFT) currently ranks as America’s second most valuable company based on market cap. Its success in the cloud, hardware and traditional server and operating systems has driven a turnaround under CEO Satya Nadella, who took over the job in 2014. In the most recent quarter, revenue rose a strong 19% to $29.1 billion. Revenue in its Intelligent Cloud business was $8.6 billion, which was a 24% increase.

Microsoft also has put a huge sum into buybacks. In the most recent quarter, the buyback plus dividend commitments reached $6.1 billion. With a $1.84 dividend, Microsoft sports a 1.80% yield, unusual for a tech growth company

[in-text-ad-2]

5. Merck

Shares of Merck & Co. Inc. (NYSE: MRK) are up more than any other of the Dow Jones industrial average components this year, higher by 35%. The pharmaceutical giant posted strong third-quarter earnings. Sales were $10.8 billion, up from $10.3 billion in the year-before period. Net income results were much stronger. Merck made $2 billion, compared to a loss of $50 million.

The pipeline for its oncology drugs is highly promising. Merck reported sales of its Keytruda cancer treatment was the cornerstone of this improvement. Merck also announced a $10 billion share buyback and raised its dividend roughly 15% to $2.20 a share.

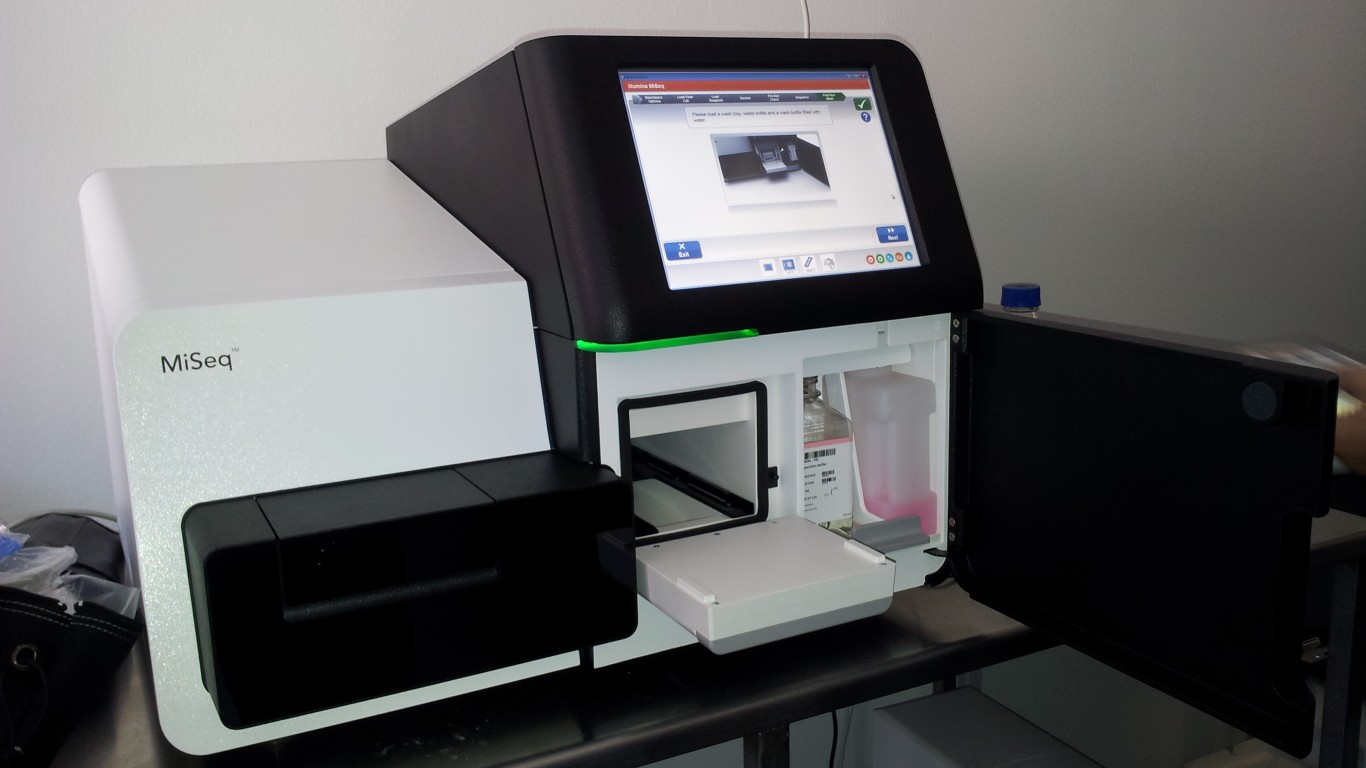

6. Illumina

Illumina Inc. (NASDAQ: ILMN) is the leader in genome sequencing and array-based solutions for genetic analysis. These tools have become critical to scientific advances in diagnosing and treating a large number of diseases. The company’s five-year revenue growth rate is 19% per year. In its most recently reported quarter, it had net income of $618 million on revenue of $2.47 billion, an indication of how high its margins have become. Illumina’s share price is up 135% in the past year.

[in-text-ad]

7. JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is widely considered the best-run bank is America, helmed by America’s most prominent banker, Jamie Dimon, who has held the CEO job since 2005. The bank’s biggest asset is its size and diversity. It is a major force in retail banking, both with branches and online. It maintains one of the largest corporate bank operations in the world and serves many of the world’s largest companies. It also has big trading and credit card businesses. JPMorgan boasts a yield of 3.18%

8. Walt Disney

Walt Disney Co. (NYSE: DIS) has been around since 1923, and management is making the biggest bet in its history as media consumption moves from theaters and the TV screen to streaming to homes and phones. At the same time, Disney has maintained growth in the most stable parts of its portfolio in its theme parks, which contributed $20 billion of its $59 billion in revenue last year. Its blockbuster buyout of most of 21st Century Fox cements its position as among the world’s largest media companies. The shares yield 1.59%.

9. Berkshire Hathaway

This conglomerate is run by Warren Buffett, often considered the greatest investor in history. Berkshire Hathaway Inc. (NYSE: BRK.B) is a combination of companies Buffett has bought outright and those in which he has invested. Among his largest holdings in public companies are Apple, JPMorgan and Coca-Cola. Among those Berkshire owns outright are Geico and NetJets.

Long-term investors in Berkshire Hathaway have been rewarded. Its shares are up 70% in the past five years, compared to 37% for the S&P 500. An investment in Berkshire Hathaway is essentially an investment in Buffett and his financial prowess.

[in-text-ad-2]

10. Alphabet

The parent of Google, the Waymo self-driving car company and the Android operating system has fallen out of favor with some investors. It has become a target in both the United States and European Union because of antitrust and privacy concerns. These could slow the company’s financial progress in the future.

However, Alphabet Inc. (NASDAQ: GOOGL) has become among the most diversified of the mega tech companies. Google owns the search engine business. Even if that is challenged by regulators, it is hard to imagine that its market share would be rolled back sharply. Android has such a large share of the portable device market that hardware companies would have to be forced to abandon it. This is hard to imagine, since there is no commercial alternative. Revenue continues to grow rapidly despite the company’s size. Last year’s revenue was $110 billion.

11. Procter & Gamble

No longer considered a pillar of American industry, Procter & Gamble Co. (NYSE: PG) is still one of the world’s largest consumer products companies. Its balance sheet and yield are a case for the attractiveness of the shares, particularly in a choppy market. Its yield is 3.12%. Because the company has a steady set of businesses, its shares do not gyrate like those of many growth companies.

Over the past year, the stock is flat while the S&P 500 is down 8%. P&G’s top line has dropped slightly over the past several years to $66.8 billion. Net income from operations has been steady at around $10 billion for the past three years in a row.

[in-text-ad]

12. Home Depot

Home Depot Inc. (NYSE: HD), the largest home improvement company in America, is proof that not all major retailers will be run out of business by Amazon. Its revenue in the past three years has gone from $88.5 billion to $94.6 billion, to $100.9 billion. It had record net income of $8.6 billion last year, which is extremely high net margin compared to other major national retailers. Home Depot also has a strong tailwind. Even if the housing market is slowing somewhat, it is still the healthiest it has been in over a decade. The stock carries a yield of 2.33%

13. GM

General Motors Co. (NYSE: GM) is a well-run company in an ugly industry. However, it continues to be the market share leader in the United States. It is also one of the largest auto companies in China, the world’s largest car market. China’s car sales have slowed, but that does not take away its strategic value.

One of the things Wall Street admires about GM is that its CEO Mary Barra is willing to make tough decisions in the interest of shareholders. She recently announced layoffs at facilities in the United States and Canada, despite political pressure. Ultimately, GM’s fate will be decided based on the strides it can make in the electric car and autonomous vehicle sectors. At this point, it is not considered either far ahead of or behind in the industry’s race. In the meantime, GM has a 4.43% yield.

14. Boeing

At this point, a bet on this stock is mostly a bet on relationships between China and the United States. Boeing Co. (NYSE: BA) expects China to be 18% of the global market for new commercial aircraft within 20 years. Tariffs on commercial aircraft could cripple Boeing’s earnings. There are two factors in Boeing’s favor.

The first is that there is only one alternative to Boeing aircraft and that is Airbus. Airbus almost certainly does not have the capacity to ramp up production to a level that would offset that of Boeing’s exports to China. The other factor is the likelihood that the trade war between the United States and China will be to painful for the parties to bear. That would put Boeing in the clear. Boeing has a 2.51% yield.

[in-text-ad-2]

15. Visa

Recent research shows that Visa Inc. (NYSE: V) controls half of all the credit card transactions globally. The company claims it operates in over 200 countries and has 3.3 billion cards in use. It is a level of market share no other company in the industry can possibly match. The company is expanding into related businesses, particularly mobile payments and checking. Last year, Visa’s revenue rose 12% to $20.6 billion. Net income rose 54% to $10.3 billion. Payment volume rose 12%. Visa’s yield is only 0.74%, but its shares are up 65% over the past two years.

16. Southwest Airlines

Southwest Airlines Co. (NYSE: LUV) has been in the headlines recently because of the death of founder and CEO Herb Kelleher. It was considered the best-run American airline when he ran the carrier. Many on Wall Street think it still is. A look at the stock chart of Southwest and all other major airlines for the past five years makes the point perfectly. Southwest shares are up 127%. No other U.S. carrier is even close.

Southwest has paid a dividend for 169 quarters, a near miracle in the bankruptcy-prone industry. Southwest’s revenue in the most recent quarter was $5.6 billion, up from $5.3 billion in the same quarter the year before. Net income was $615 million, up from $528 million. Southwest pays a modest 1.34%.

[in-text-ad]

17. New York Times

New York Times Co. (NYSE: NYT) has the most successful newspaper franchise in the United States. The primary reason for this is that it is one of the few papers for which large numbers of people will pay several hundred dollars a year to read online. While most newspapers have not been able to make up for huge drops in advertising revenue and traditional subscriptions, the Times has kept a large editorial staff and its reputation of one of the best papers in the English speaking world. It currently has over three million digital-only subscriptions.

While most newspaper company stocks have plunged in the past year, shares of New York Times are up 20%. Plus, the stock carries a 0.70% yield.

18. Costco

Costco Wholesale Corp. (NASDAQ: COST) is another of the very small group of national retailers that has not been damaged by the rise of e-commerce and, in specific, Amazon. Its business model is different from almost any other large retailer in the country. It charges membership fees for people and businesses who want to shop at any of its 768 locations, 533 of which are in the United States and Puerto Rico.

The fee, which is usually $60 a year, gives Costco a line of recurring revenue. This has helped contribute to total revenue which reached $35.1 billion in the most recent quarter, up from $31.8 billion in the same period a year ago. Net income rose to $767 million from $640 million. CostCo stores have a tremendous range of inventory which runs from groceries to office furniture. It also has its own bargain brand, Kirkland, for highly cost conscious customers. CostCo has a 1.10% yield. Its shares are up 27% in the last year.

19. T. Rowe Price

T. Rowe Price Group Inc. (NASDAQ: TROW) is to some extent a bet on the markets themselves. The investment management firm is known primarily for its mutual funds.The company has over $1 trillion in assets. In the most recent quarter, revenue rose 15% to $1.4 billion. Net income rose 49% to $583 millon. Since the quarter ended on September 30, some of the results were certainly due to the bull market.

As the market jump up and down, T. Rowe Price assets could drop, particularly if there is a long and sharp sell-off. Its stock is down more than the broader market over the past six months. T. Rowe Price is also in a competitive business, up against giants Fidelity and Vanguard. The stock has a very healthy yield of 3.04%.

[in-text-ad-2]

20. J.M. Smucker

J.M. Smucker Co. (NYSE: SJM) comes with some risks. Its pet food business is not growing as fast as Wall Street would like, which has hurt the stock, pushing it down 26% in the past year. Its consumer foods business, which includes famous brands like Jif peanut butter and Folgers coffee, is steady, but not exciting. The most recent quarterly result were not awful, just under expectations. Revenue rose 5% to just over $2 billion. Earnings dropped 4% to $1.66 per share. Smucker also dropped its guidance.

Some investors like stocks when they think all the bad news is out. This is likely one of those cases. The company has a high yield of 3.52%.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.