Special Report

The County With the Least Expensive Housing Market in Every State

Published:

Last Updated:

Homeownership is a cornerstone of the American dream — but for many, realizing that dream is prohibitively expensive.

Today, the typical American home has a price tag of nearly a quarter of a million dollars, according to industry advocacy group the National Realtors Association. While not every budget can accommodate housing expenses that high, affordable real estate is available in nearly every state.

24/7 Wall St. reviewed home value data from NAR as of the third quarter of 2018 for 3,119 counties and county equivalents nationwide to identify the county with the least expensive housing market in every state. Counties in each state were ranked based on median home value. In 34 states, there is at least one county where more than 50% of homes cost less than $100,000. Hawaii and Rhode Island are the only states where no county has a median home value below the national median of $235,000.

Home values are typically a reflection of what area residents can afford, and as a result, the counties on this list tend to be low-income areas. Some even rank as the poorest county in their state. Windham County, Connecticut, is the only county on this list with a higher median annual household income than the national median of $57,652 — and every county on this list has a lower median household income than its home state.

Housing prices in many of the counties on this list are driven down by high regional vacancy rates — indicative of low demand — and lacking public works infrastructure. In the majority of these counties, the share of households that lack access to basic telephone service exceeds the 2.3% national share. In 42 of these counties, the share of vacant homes exceeds the 12.2% national vacancy rate. Homes in these counties are also far more likely than most to be older, built before 1939.

Click here to see the county with the least expensive housing market in each state.

Click here to read our methodology.

Alabama: Lowndes County

> Median home value: $62,908

> Median monthly housing costs w/ mortgage: $963

> Homes with no phone service access: 5.2%

> Vacant housing units: 16.5% of total

> Median household income: $29,785

[in-text-ad]

Alaska: Yukon-Koyukuk Census Area

> Median home value: $83,696

> Median monthly housing costs w/ mortgage: $1,080

> Homes with no phone service access: 8.9%

> Vacant housing units: 51.8% of total

> Median household income: $37,819

Arizona: Apache County

> Median home value: $51,798

> Median monthly housing costs w/ mortgage: $943

> Homes with no phone service access: 10.6%

> Vacant housing units: 40.4% of total

> Median household income: $32,360

Arkansas: Monroe County

> Median home value: $56,798

> Median monthly housing costs w/ mortgage: $817

> Homes with no phone service access: 8.0%

> Vacant housing units: 25.2% of total

> Median household income: $31,584

[in-text-ad-2]

California: Modoc County

> Median home value: $152,797

> Median monthly housing costs w/ mortgage: $1,007

> Homes with no phone service access: 1.3%

> Vacant housing units: 30.7% of total

> Median household income: $39,296

Colorado: Bent County

> Median home value: $86,780

> Median monthly housing costs w/ mortgage: $898

> Homes with no phone service access: 1.3%

> Vacant housing units: 21.8% of total

> Median household income: $32,500

[in-text-ad]

Connecticut: Windham County

> Median home value: $203,646

> Median monthly housing costs w/ mortgage: $1,668

> Homes with no phone service access: 1.2%

> Vacant housing units: 10.2% of total

> Median household income: $62,553

Delaware: Kent County

> Median home value: $230,026

> Median monthly housing costs w/ mortgage: $1,460

> Homes with no phone service access: 1.7%

> Vacant housing units: 8.8% of total

> Median household income: $57,647

Florida: Liberty County

> Median home value: $67,559

> Median monthly housing costs w/ mortgage: $843

> Homes with no phone service access: 1.5%

> Vacant housing units: 34.0% of total

> Median household income: $36,741

[in-text-ad-2]

Georgia: Wheeler County

> Median home value: $49,813

> Median monthly housing costs w/ mortgage: $879

> Homes with no phone service access: 20.0%

> Vacant housing units: 24.7% of total

> Median household income: $28,490

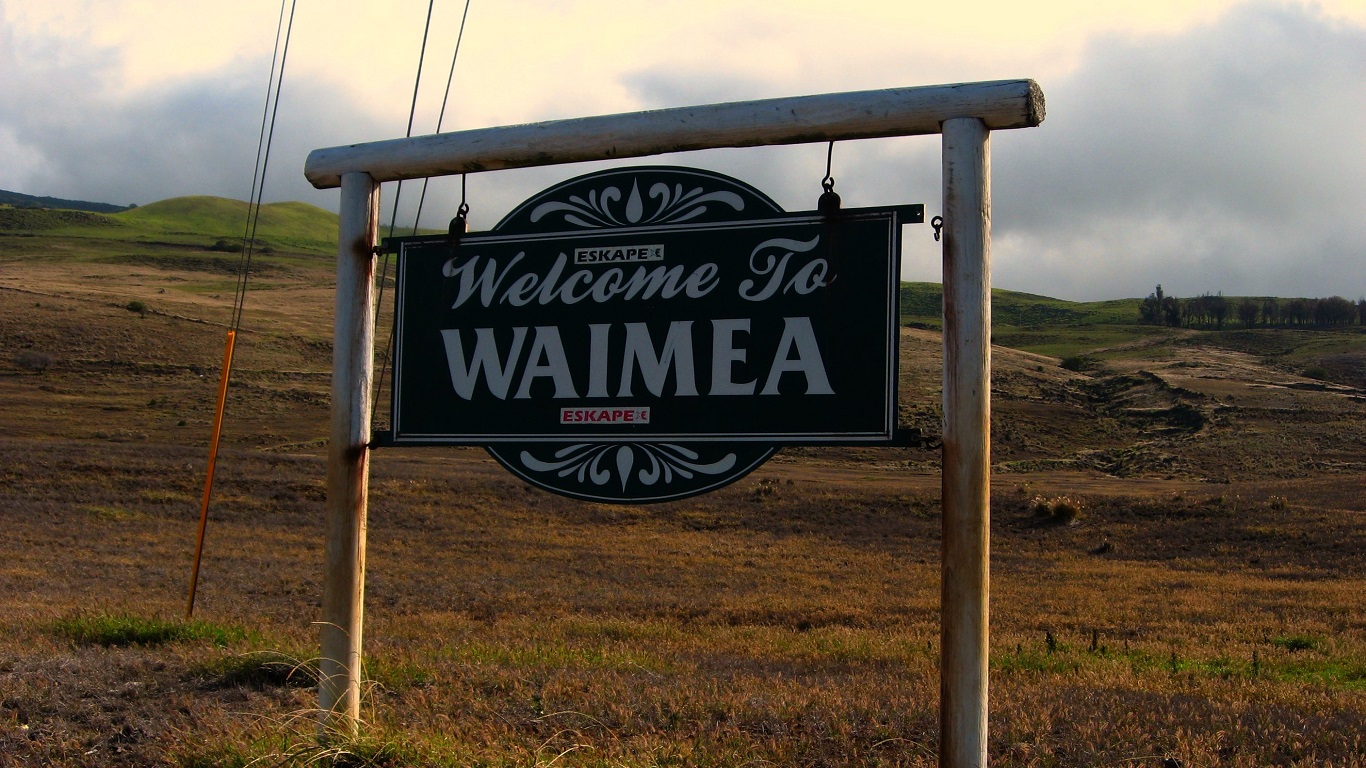

Hawaii: Hawaii County

> Median home value: $375,676

> Median monthly housing costs w/ mortgage: $1,605

> Homes with no phone service access: 2.0%

> Vacant housing units: 22.3% of total

> Median household income: $56,395

[in-text-ad]

Idaho: Clark County

> Median home value: $108,629

> Median monthly housing costs w/ mortgage: $884

> Homes with no phone service access: 0.0%

> Vacant housing units: 43.4% of total

> Median household income: $31,927

Illinois: Alexander County

> Median home value: $54,352

> Median monthly housing costs w/ mortgage: $880

> Homes with no phone service access: 2.4%

> Vacant housing units: 39.0% of total

> Median household income: $31,014

Indiana: Blackford County

> Median home value: $73,628

> Median monthly housing costs w/ mortgage: $843

> Homes with no phone service access: 1.7%

> Vacant housing units: 13.9% of total

> Median household income: $40,622

[in-text-ad-2]

Iowa: Audubon County

> Median home value: $72,664

> Median monthly housing costs w/ mortgage: $784

> Homes with no phone service access: 2.7%

> Vacant housing units: 10.9% of total

> Median household income: $48,750

Kansas: Elk County

> Median home value: $49,849

> Median monthly housing costs w/ mortgage: $960

> Homes with no phone service access: 2.7%

> Vacant housing units: 33.9% of total

> Median household income: $39,405

[in-text-ad]

Kentucky: Leslie County

> Median home value: $51,550

> Median monthly housing costs w/ mortgage: $772

> Homes with no phone service access: 6.4%

> Vacant housing units: 19.8% of total

> Median household income: $27,861

Louisiana: Tensas Parish

> Median home value: $64,341

> Median monthly housing costs w/ mortgage: $850

> Homes with no phone service access: 3.9%

> Vacant housing units: 43.2% of total

> Median household income: $21,906

Maine: Aroostook County

> Median home value: $104,510

> Median monthly housing costs w/ mortgage: $982

> Homes with no phone service access: 2.9%

> Vacant housing units: 25.0% of total

> Median household income: $39,021

[in-text-ad-2]

Maryland: Allegany County

> Median home value: $113,677

> Median monthly housing costs w/ mortgage: $1,060

> Homes with no phone service access: 1.6%

> Vacant housing units: 16.0% of total

> Median household income: $42,771

Massachusetts: Hampden County

> Median home value: $223,466

> Median monthly housing costs w/ mortgage: $1,531

> Homes with no phone service access: 2.1%

> Vacant housing units: 7.4% of total

> Median household income: $52,205

[in-text-ad]

Michigan: Ontonagon County

> Median home value: $75,085

> Median monthly housing costs w/ mortgage: $883

> Homes with no phone service access: 1.8%

> Vacant housing units: 48.1% of total

> Median household income: $36,073

Minnesota: Kittson County

> Median home value: $77,339

> Median monthly housing costs w/ mortgage: $1,058

> Homes with no phone service access: 0.9%

> Vacant housing units: 27.7% of total

> Median household income: $52,304

Mississippi: Issaquena County

> Median home value: $51,872

> Median monthly housing costs w/ mortgage: $1,098

> Homes with no phone service access: 5.5%

> Vacant housing units: 19.4% of total

> Median household income: $25,609

[in-text-ad-2]

Missouri: Worth County

> Median home value: $63,683

> Median monthly housing costs w/ mortgage: $904

> Homes with no phone service access: 1.7%

> Vacant housing units: 30.4% of total

> Median household income: $48,214

Montana: Blaine County

> Median home value: $94,014

> Median monthly housing costs w/ mortgage: $1,156

> Homes with no phone service access: 2.9%

> Vacant housing units: 18.8% of total

> Median household income: $35,506

[in-text-ad]

Nebraska: Grant County

> Median home value: $58,588

> Median monthly housing costs w/ mortgage: $1,102

> Homes with no phone service access: 1.8%

> Vacant housing units: 29.0% of total

> Median household income: $45,833

Nevada: Esmeralda County

> Median home value: $83,563

> Median monthly housing costs w/ mortgage: $850

> Homes with no phone service access: 0.8%

> Vacant housing units: 50.2% of total

> Median household income: $39,405

New Hampshire: Coos County

> Median home value: $132,002

> Median monthly housing costs w/ mortgage: $1,208

> Homes with no phone service access: 1.8%

> Vacant housing units: 35.4% of total

> Median household income: $45,386

[in-text-ad-2]

New Jersey: Cumberland County

> Median home value: $161,596

> Median monthly housing costs w/ mortgage: $1,589

> Homes with no phone service access: 2.7%

> Vacant housing units: 10.2% of total

> Median household income: $50,000

New Mexico: De Baca County

> Median home value: $69,412

> Median monthly housing costs w/ mortgage: $850

> Homes with no phone service access: 1.8%

> Vacant housing units: 41.7% of total

> Median household income: $31,439

[in-text-ad]

New York: Allegany County

> Median home value: $78,265

> Median monthly housing costs w/ mortgage: $987

> Homes with no phone service access: 4.6%

> Vacant housing units: 31.2% of total

> Median household income: $45,359

North Carolina: Robeson County

> Median home value: $82,505

> Median monthly housing costs w/ mortgage: $964

> Homes with no phone service access: 4.4%

> Vacant housing units: 12.9% of total

> Median household income: $32,407

North Dakota: Benson County

> Median home value: $70,141

> Median monthly housing costs w/ mortgage: $1,003

> Homes with no phone service access: 4.1%

> Vacant housing units: 24.4% of total

> Median household income: $44,500

[in-text-ad-2]

Ohio: Crawford County

> Median home value: $91,880

> Median monthly housing costs w/ mortgage: $939

> Homes with no phone service access: 2.2%

> Vacant housing units: 11.2% of total

> Median household income: $41,726

Oklahoma: Harmon County

> Median home value: $50,816

> Median monthly housing costs w/ mortgage: $659

> Homes with no phone service access: 7.6%

> Vacant housing units: 22.7% of total

> Median household income: $38,264

[in-text-ad]

Oregon: Gilliam County

> Median home value: $121,982

> Median monthly housing costs w/ mortgage: $989

> Homes with no phone service access: 2.6%

> Vacant housing units: 24.8% of total

> Median household income: $39,831

Pennsylvania: Cameron County

> Median home value: $76,958

> Median monthly housing costs w/ mortgage: $957

> Homes with no phone service access: 3.0%

> Vacant housing units: 50.4% of total

> Median household income: $40,402

Rhode Island: Providence County

> Median home value: $250,303

> Median monthly housing costs w/ mortgage: $1,730

> Homes with no phone service access: 1.9%

> Vacant housing units: 10.3% of total

> Median household income: $52,530

[in-text-ad-2]

South Carolina: Allendale County

> Median home value: $55,511

> Median monthly housing costs w/ mortgage: $791

> Homes with no phone service access: 4.1%

> Vacant housing units: 26.7% of total

> Median household income: $23,331

South Dakota: Todd County

> Median home value: $40,199

> Median monthly housing costs w/ mortgage: $709

> Homes with no phone service access: 10.1%

> Vacant housing units: 12.2% of total

> Median household income: $26,285

[in-text-ad]

Tennessee: Lake County

> Median home value: $81,761

> Median monthly housing costs w/ mortgage: $855

> Homes with no phone service access: 4.3%

> Vacant housing units: 17.0% of total

> Median household income: $31,993

Texas: Cochran County

> Median home value: $35,767

> Median monthly housing costs w/ mortgage: $802

> Homes with no phone service access: 2.0%

> Vacant housing units: 26.4% of total

> Median household income: $37,500

Utah: Carbon County

> Median home value: $142,387

> Median monthly housing costs w/ mortgage: $987

> Homes with no phone service access: 2.3%

> Vacant housing units: 19.7% of total

> Median household income: $46,994

[in-text-ad-2]

Vermont: Essex County

> Median home value: $134,687

> Median monthly housing costs w/ mortgage: $1,137

> Homes with no phone service access: 3.3%

> Vacant housing units: 46.9% of total

> Median household income: $38,767

Virginia: Buchanan County

> Median home value: $73,552

> Median monthly housing costs w/ mortgage: $946

> Homes with no phone service access: 2.5%

> Vacant housing units: 22.1% of total

> Median household income: $30,828

[in-text-ad]

Washington: Garfield County

> Median home value: $160,790

> Median monthly housing costs w/ mortgage: $1,059

> Homes with no phone service access: 3.2%

> Vacant housing units: 19.7% of total

> Median household income: $51,399

West Virginia: McDowell County

> Median home value: $35,932

> Median monthly housing costs w/ mortgage: $730

> Homes with no phone service access: 9.8%

> Vacant housing units: 31.4% of total

> Median household income: $25,595

Wisconsin: Menominee County

> Median home value: $91,657

> Median monthly housing costs w/ mortgage: $1,056

> Homes with no phone service access: 2.6%

> Vacant housing units: 41.9% of total

> Median household income: $38,080

[in-text-ad-2]

Wyoming: Hot Springs County

> Median home value: $154,348

> Median monthly housing costs w/ mortgage: $1,181

> Homes with no phone service access: 3.4%

> Vacant housing units: 13.2% of total

> Median household income: $48,403

Methodology

To determine the county with the least expensive housing market in every state, 24/7 Wall St. reviewed median home prices in the 3,119 county and county-equivalents as aggregated by the National Association of Realtors for the third quarter of 2018. We also considered median household incomes, median monthly housing costs for mortgage holders, the share of occupied homes with no access to telephone service, and housing vacancy rates — all five-year estimates from the from the U.S. Census Bureau’s 2017 American Community Survey.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.