Special Report

What America’s Governors Are Paid in Every State

Published:

Last Updated:

Governors are the highest-ranking public official in a state government, effectively serving as chief executives. While the general job description is the same across the 50 states, the details can vary considerably by state. Key differences include state-specific policy priorities and legislative hurdles, population size, and of course, compensation.

Unlike senators, who are also elected on a state by state basis, there is no set salary for governors. While senators earn an annual salary of $174,000 (though most senators are worth far more — this is how rich every U.S. senator is), governors’ salaries vary by state — from as little as $70,000 to more than $200,000.

24/7 Wall St. reviewed 2019 salary information from The Council on State Governments, a policy database, to identify how much America’s governors are paid in every state.

Despite their status as the highest-ranking public officials in state governments, governors are usually not the highest paid state employees. Reasons for this vary from state to state. Often, various state departments pay their leadership larger salaries in order to compete with the private sector for top talent. In politically divided states, a pay raise for the governor may lack the necessary legislative support. Also, importantly, governors do not typically run for office for the paycheck.

While there is no hard and fast rule, generally, states with larger populations have higher governor salaries. Similarly, states that collect more taxes on a per capita basis tend to pay their governors more than states that collect less taxes. Here is a look at how much Americans are paying in taxes on a state by state basis.

Click here to see what America’s governors are paid in every state

Click here to read our methodology

50. Maine: Janet Mills (D)

> Salary: $70,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $3,168 per capita (13th highest)

> Statewide cost of living: 1.6% less than nat’l avg.

> State population: 1,338,404 (9th lowest)

[in-text-ad]

49. Colorado: Jared Polis (D)

> Salary: $90,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,354 per capita (13th lowest)

> Statewide cost of living: 3.2% more than nat’l avg.

> State population: 5,695,564 (21st highest)

48. Arizona: Doug Ducey (R)

> Salary: $95,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $1,979 per capita (6th lowest)

> Statewide cost of living: 3.6% less than nat’l avg.

> State population: 7,171,646 (14th highest)

47. Oregon: Kate Brown (D)

> Salary: $98,600

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,876 per capita (21st highest)

> Statewide cost of living: 0.5% less than nat’l avg.

> State population: 4,190,713 (24th lowest)

[in-text-ad-2]

46. Kansas: Laura Kelly (D)

> Salary: $99,636

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,806 per capita (24th highest)

> Statewide cost of living: 10.0% less than nat’l avg.

> State population: 2,911,510 (16th lowest)

45. Nebraska: Pete Ricketts (R)

> Salary: $105,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,658 per capita (22nd lowest)

> Statewide cost of living: 10.4% less than nat’l avg.

> State population: 1,929,268 (14th lowest)

[in-text-ad]

44. Wyoming: Mark Gordon (R)

> Salary: $105,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,847 per capita (23rd highest)

> Statewide cost of living: 4.8% less than nat’l avg.

> State population: 577,737 (the lowest)

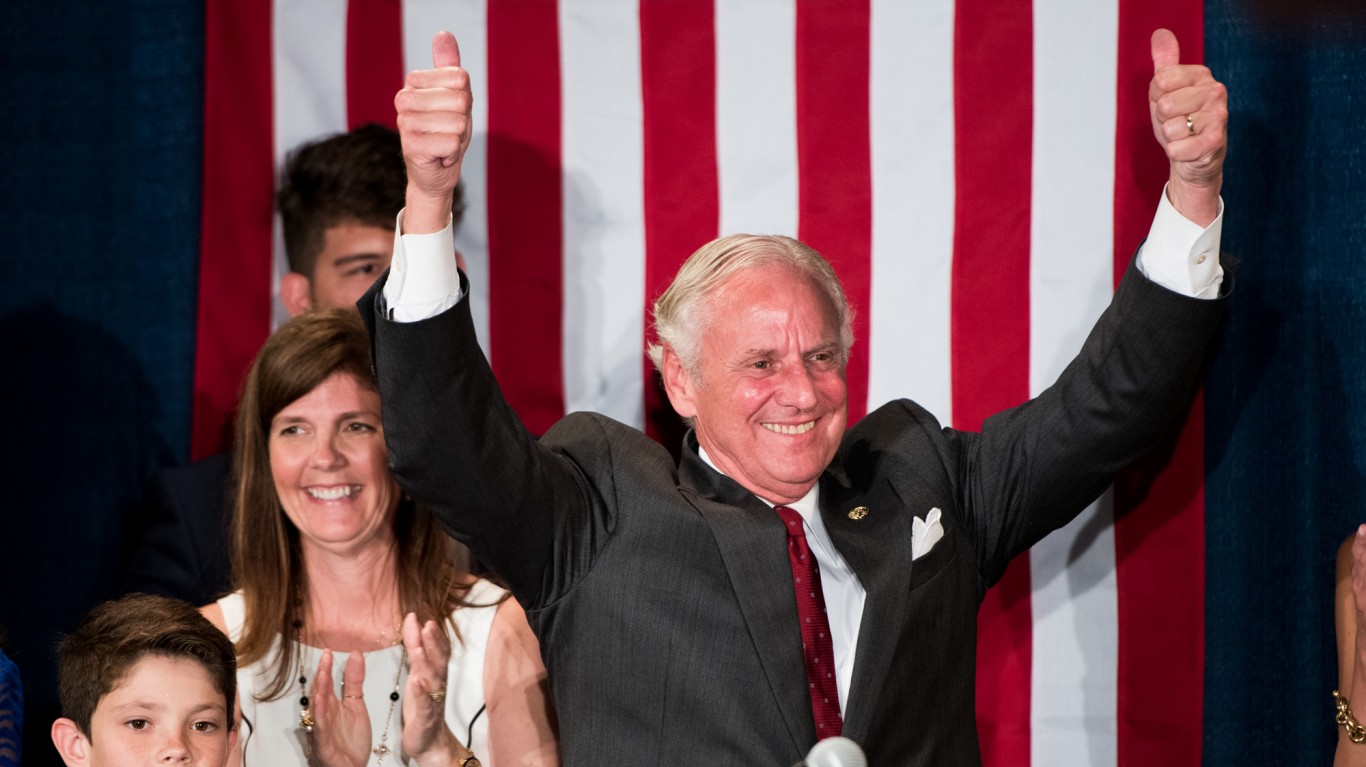

43. South Carolina: Henry McMaster (R)

> Salary: $106,078

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $1,956 per capita (5th lowest)

> Statewide cost of living: 9.6% less than nat’l avg.

> State population: 5,084,127 (23rd highest)

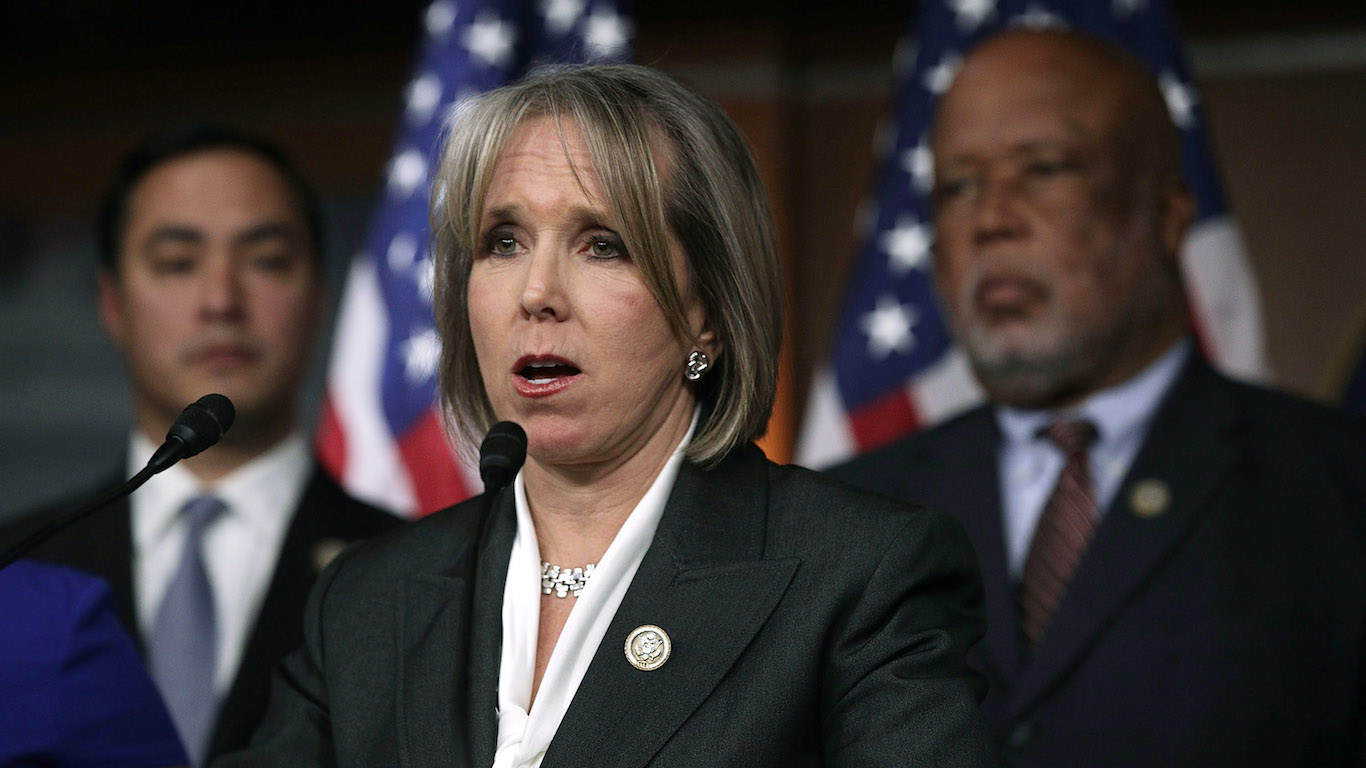

42. New Mexico: Lujan Grisham (D)

> Salary: $110,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,766 per capita (25th lowest)

> Statewide cost of living: 6.7% less than nat’l avg.

> State population: 2,095,428 (15th lowest)

[in-text-ad-2]

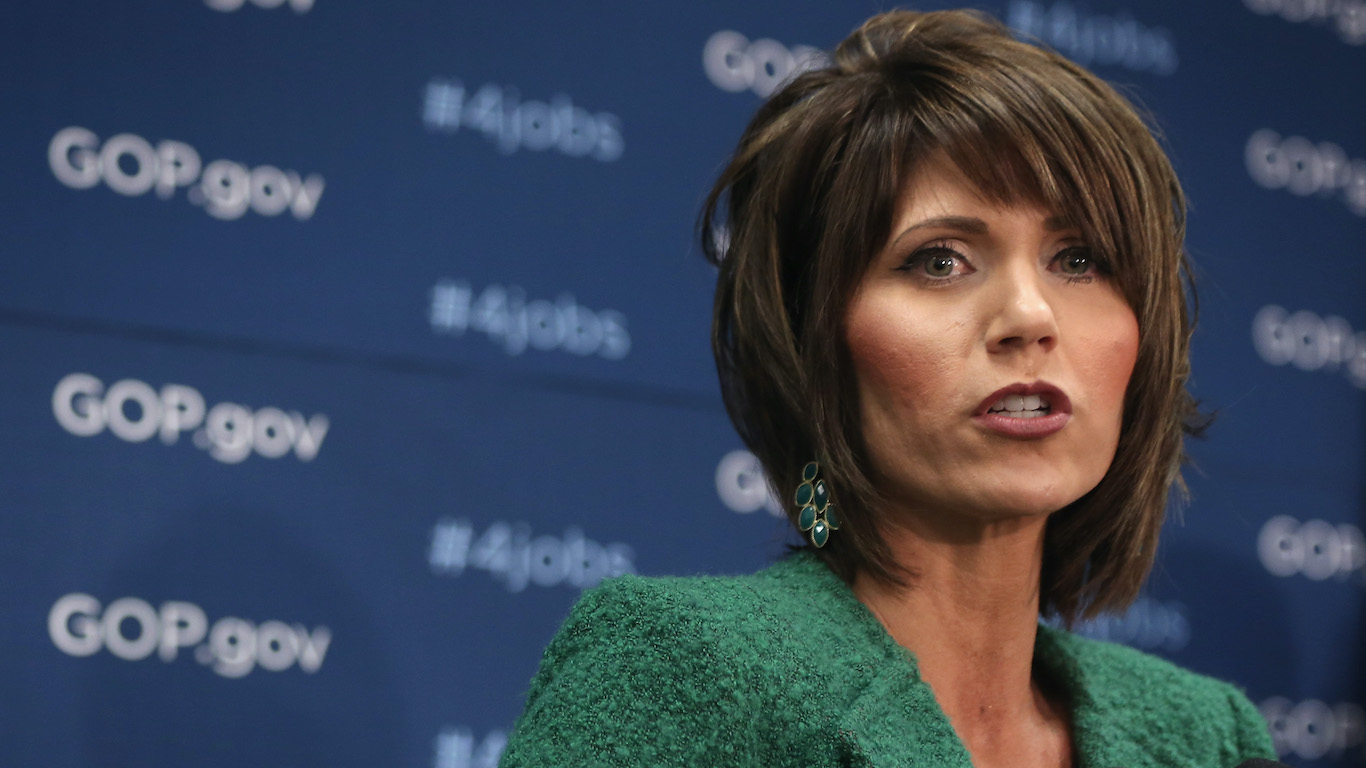

41. South Dakota: Kristi Noem (R)

> Salary: $113,961

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,103 per capita (9th lowest)

> Statewide cost of living: 11.8% less than nat’l avg.

> State population: 882,235 (5th lowest)

40. Montana: Steve Bullock (D)

> Salary: $115,505

> Present term: Jan. 2017 – Jan. 2021

> State tax collections: $2,527 per capita (16th lowest)

> Statewide cost of living: 5.4% less than nat’l avg.

> State population: 1,062,305 (8th lowest)

[in-text-ad]

39. Alabama: Kay Ivey (R)

> Salary: $120,395

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,137 per capita (10th lowest)

> Statewide cost of living: 13.3% less than nat’l avg.

> State population: 4,887,871 (24th highest)

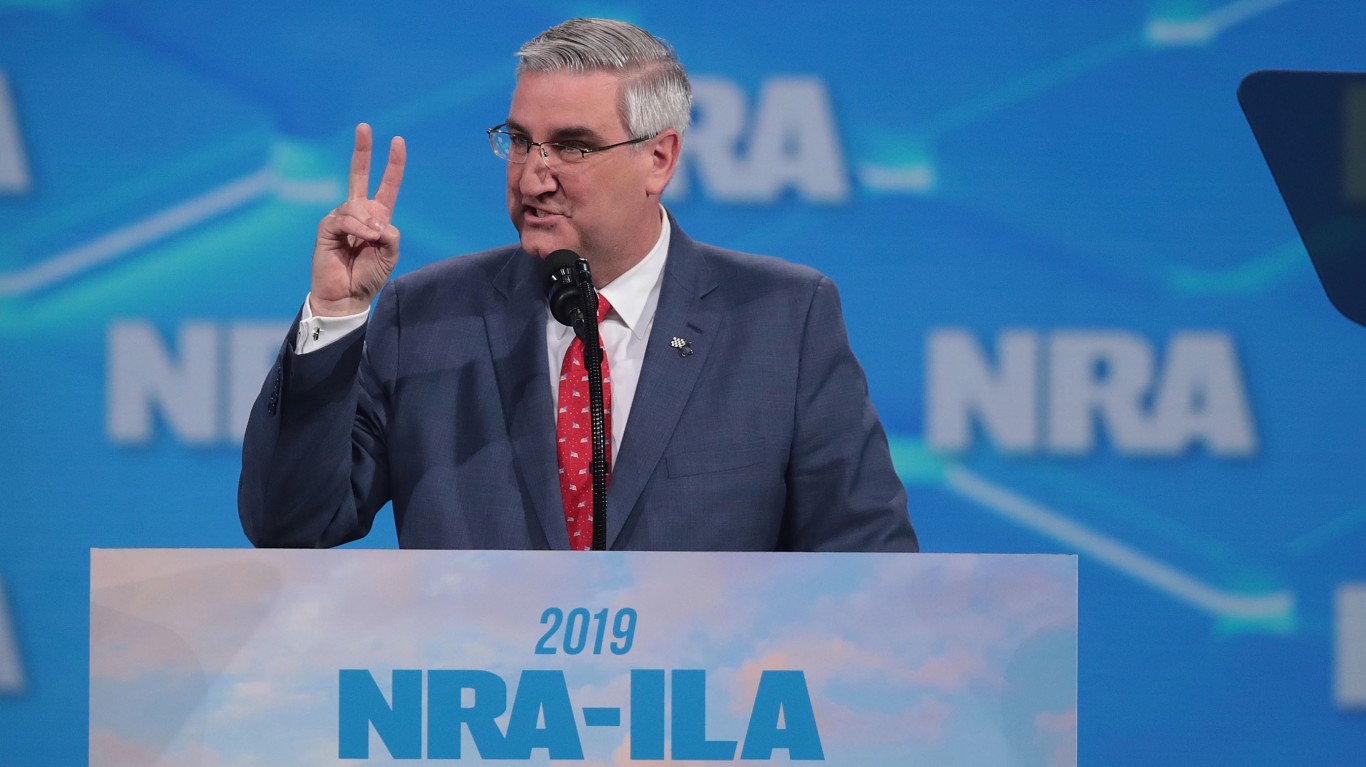

38. Indiana: Eric Holcomb (R)

> Salary: $121,331

> Present term: Jan. 2017 – Jan. 2021

> State tax collections: $2,708 per capita (24th lowest)

> Statewide cost of living: 10.2% less than nat’l avg.

> State population: 6,691,878 (17th highest)

37. Mississippi: Phil Bryant (R)

> Salary: $122,160

> Present term: Jan. 2016 – Jan. 2020

> State tax collections: $2,608 per capita (18th lowest)

> Statewide cost of living: 14.3% less than nat’l avg.

> State population: 2,986,530 (17th lowest)

[in-text-ad-2]

36. Minnesota: Tim Walz (D)

> Salary: $127,629

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $4,590 per capita (3rd highest)

> Statewide cost of living: 2.5% less than nat’l avg.

> State population: 5,611,179 (22nd highest)

35. North Dakota: Doug Burgum (R)

> Salary: $129,096

> Present term: Dec. 2016 – Dec. 2020

> State tax collections: $4,587 per capita (4th highest)

> Statewide cost of living: 9.9% less than nat’l avg.

> State population: 760,077 (4th lowest)

[in-text-ad]

34. Iowa: Kim Reynolds (R)

> Salary: $130,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $3,101 per capita (16th highest)

> Statewide cost of living: 10.2% less than nat’l avg.

> State population: 3,156,145 (20th lowest)

33. Louisiana: Bel Edwards (D)

> Salary: $130,000

> Present term: Jan. 2016 – Jan. 2020

> State tax collections: $2,371 per capita (14th lowest)

> Statewide cost of living: 9.9% less than nat’l avg.

> State population: 4,659,978 (25th highest)

32. Florida: Ron DeSantis (R)

> Salary: $130,273

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $1,917 per capita (4th lowest)

> Statewide cost of living: 0.1% less than nat’l avg.

> State population: 21,299,325 (3rd highest)

[in-text-ad-2]

31. Missouri: Mike Parson (R)

> Salary: $133,821

> Present term: June 2018 – Jan. 2021

> State tax collections: $2,044 per capita (7th lowest)

> Statewide cost of living: 10.5% less than nat’l avg.

> State population: 6,126,452 (18th highest)

30. New Hampshire: Chris Sununu (R)

> Salary: $134,581

> Present term: Jan. 2019 – Jan. 2021

> State tax collections: $1,859 per capita (2nd lowest)

> Statewide cost of living: 5.8% more than nat’l avg.

> State population: 1,356,458 (10th lowest)

[in-text-ad]

29. Idaho: Brad Little (R)

> Salary: $138,302

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,627 per capita (21st lowest)

> Statewide cost of living: 7.0% less than nat’l avg.

> State population: 1,754,208 (12th lowest)

28. North Carolina: Roy Cooper (D)

> Salary: $144,349

> Present term: Jan. 2017 – Jan. 2021

> State tax collections: $2,614 per capita (19th lowest)

> Statewide cost of living: 8.7% less than nat’l avg.

> State population: 10,383,620 (9th highest)

27. Alaska: Mike Dunleavy (R)

> Salary: $145,000

> Present term: Dec. 2018 – Dec. 2022

> State tax collections: $1,608 per capita (the lowest)

> Statewide cost of living: 4.4% more than nat’l avg.

> State population: 737,438 (3rd lowest)

[in-text-ad-2]

26. Rhode Island: Gina Raimondo (D)

> Salary: $145,755

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $3,083 per capita (17th highest)

> Statewide cost of living: 1.4% less than nat’l avg.

> State population: 1,057,315 (7th lowest)

25. Oklahoma: Kevin Stitt (R)

> Salary: $147,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,180 per capita (12th lowest)

> Statewide cost of living: 11.0% less than nat’l avg.

> State population: 3,943,079 (23rd lowest)

[in-text-ad]

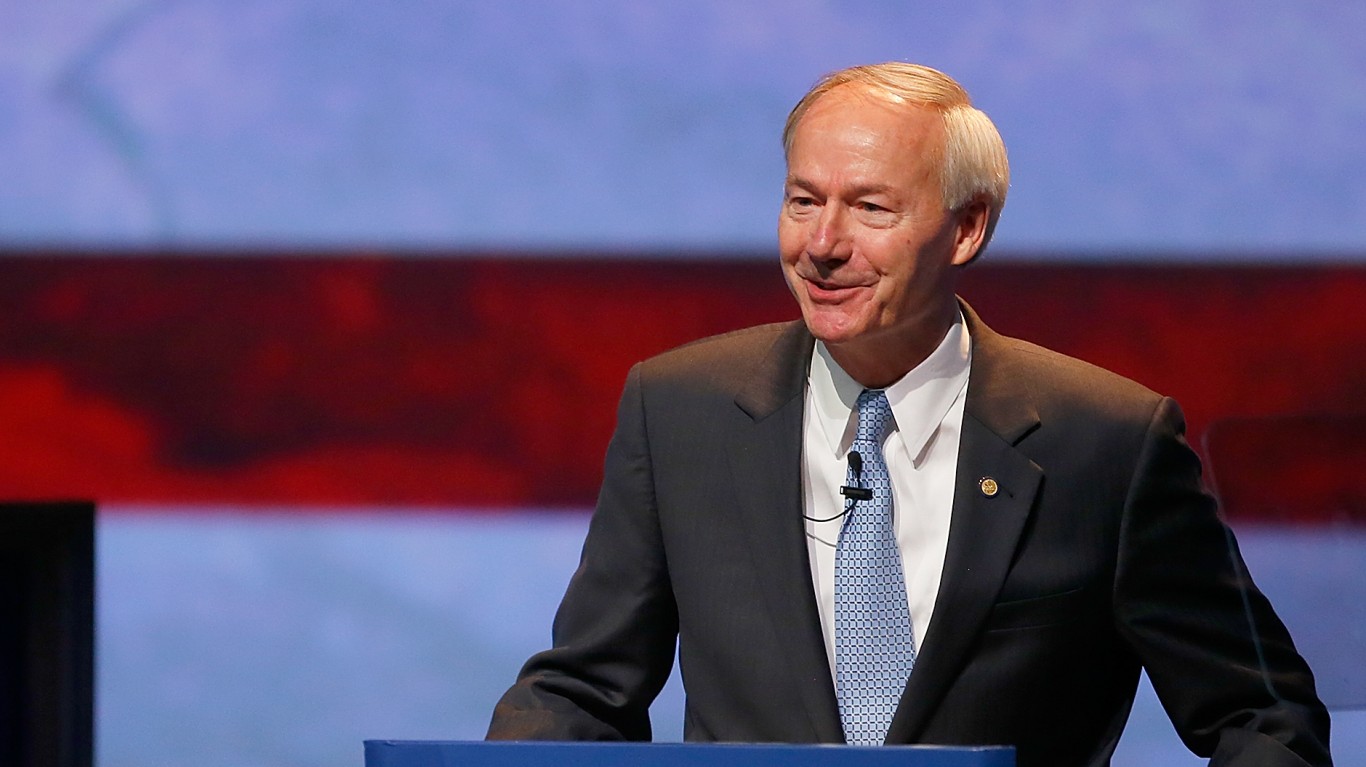

24. Arkansas: Asa Hutchinson (R)

> Salary: $148,134

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $3,168 per capita (14th highest)

> Statewide cost of living: 13.5% less than nat’l avg.

> State population: 3,013,825 (18th lowest)

23. Kentucky: Matt Bevin (R)

> Salary: $148,781

> Present term: Dec. 2015 – Dec. 2019

> State tax collections: $2,673 per capita (23rd lowest)

> Statewide cost of living: 12.1% less than nat’l avg.

> State population: 4,468,402 (25th lowest)

22. Nevada: Steve Sisolak (D)

> Salary: $149,573

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,877 per capita (20th highest)

> Statewide cost of living: 2.4% less than nat’l avg.

> State population: 3,034,392 (19th lowest)

[in-text-ad-2]

21. Connecticut: Ned Lamont (D)

> Salary: $150,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $4,555 per capita (5th highest)

> Statewide cost of living: 8.0% more than nat’l avg.

> State population: 3,572,665 (22nd lowest)

20. Utah: Gary R. Herbert (R)

> Salary: $150,000

> Present term: Jan. 2017 – Jan. 2021

> State tax collections: $2,525 per capita (15th lowest)

> Statewide cost of living: 3.0% less than nat’l avg.

> State population: 3,161,105 (21st lowest)

[in-text-ad]

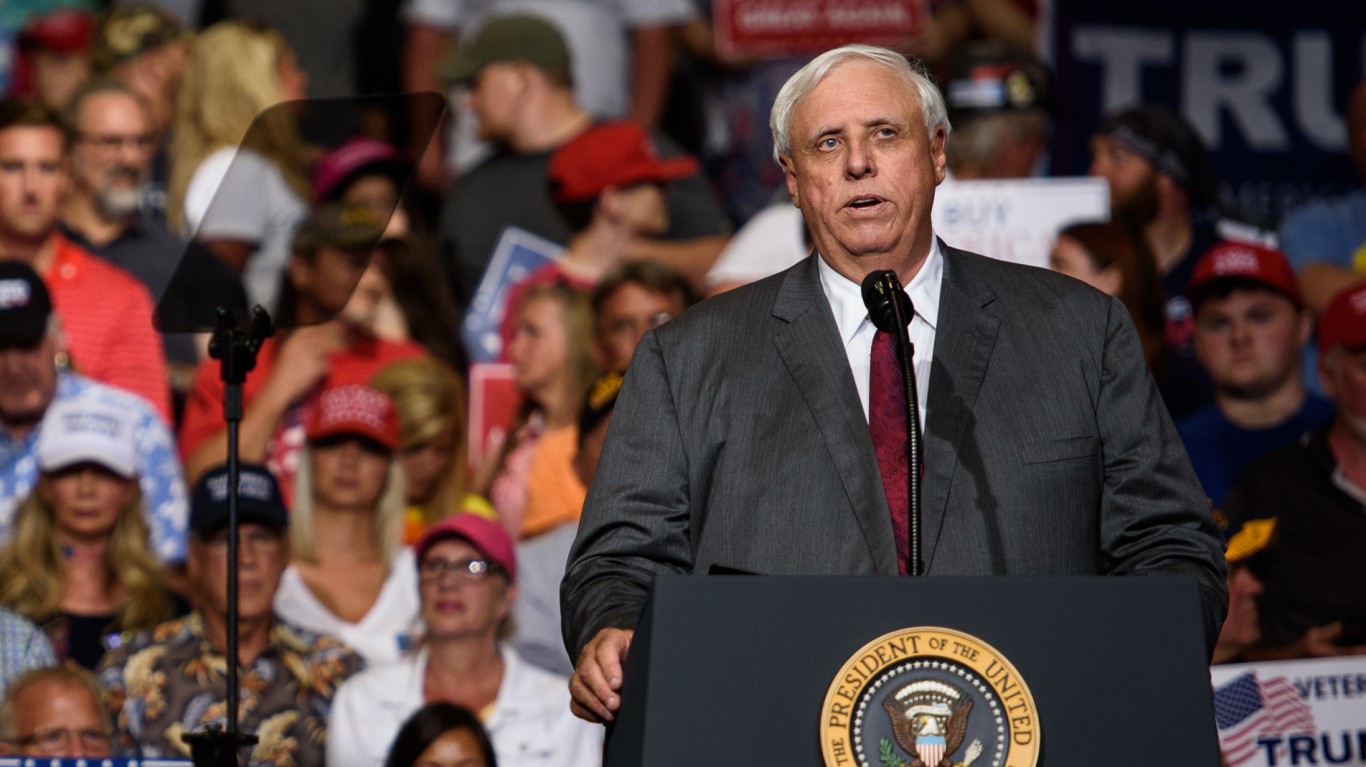

19. West Virginia: Jim Justice (R)

> Salary: $150,000

> Present term: Jan. 2017 – Jan. 2021

> State tax collections: $2,804 per capita (25th highest)

> Statewide cost of living: 13.0% less than nat’l avg.

> State population: 1,805,832 (13th lowest)

18. Wisconsin: Tony Evers (D)

> Salary: $152,756

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $3,129 per capita (15th highest)

> Statewide cost of living: 7.6% less than nat’l avg.

> State population: 5,813,568 (20th highest)

17. Ohio: Mike DeWine (R)

> Salary: $153,650

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,599 per capita (17th lowest)

> Statewide cost of living: 11.1% less than nat’l avg.

> State population: 11,689,442 (7th highest)

[in-text-ad-2]

16. Texas: Greg Abbott (R)

> Salary: $153,750

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $1,894 per capita (3rd lowest)

> Statewide cost of living: 3.0% less than nat’l avg.

> State population: 28,701,845 (2nd highest)

15. Hawaii: David Ige (D)

> Salary: $158,700

> Present term: Dec. 2018 – Dec. 2022

> State tax collections: $4,924 per capita (2nd highest)

> Statewide cost of living: 18.5% more than nat’l avg.

> State population: 1,420,491 (11th lowest)

[in-text-ad]

14. Michigan: Gretchen Whitmer (D)

> Salary: $159,300

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,874 per capita (22nd highest)

> Statewide cost of living: 7.0% less than nat’l avg.

> State population: 9,995,915 (10th highest)

13. Maryland: Larry Hogan (R)

> Salary: $170,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $3,569 per capita (11th highest)

> Statewide cost of living: 9.4% more than nat’l avg.

> State population: 6,042,718 (19th highest)

12. Delaware: John Carney (D)

> Salary: $171,000

> Present term: Jan. 2017 – Jan. 2021

> State tax collections: $3,731 per capita (9th highest)

> Statewide cost of living: 0.1% more than nat’l avg.

> State population: 967,171 (6th lowest)

[in-text-ad-2]

11. Georgia: Brian Kemp (R)

> Salary: $175,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,150 per capita (11th lowest)

> Statewide cost of living: 7.5% less than nat’l avg.

> State population: 10,519,475 (8th highest)

10. New Jersey: Phil Murphy (D)

> Salary: $175,000

> Present term: Jan. 2018 – Jan. 2022

> State tax collections: $3,590 per capita (10th highest)

> Statewide cost of living: 12.9% more than nat’l avg.

> State population: 8,908,520 (11th highest)

[in-text-ad]

9. Virginia: Ralph Northam (D)

> Salary: $175,000

> Present term: Jan. 2018 – Jan. 2022

> State tax collections: $2,623 per capita (20th lowest)

> Statewide cost of living: 2.1% more than nat’l avg.

> State population: 8,517,685 (12th highest)

8. Illinois: JB Pritzker (D)

> Salary: $177,412

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,967 per capita (18th highest)

> Statewide cost of living: 1.5% less than nat’l avg.

> State population: 12,741,080 (6th highest)

7. Vermont: Phil Scott (R)

> Salary: $178,274

> Present term: Jan. 2019 – Jan. 2021

> State tax collections: $5,015 per capita (the highest)

> Statewide cost of living: 2.5% more than nat’l avg.

> State population: 626,299 (2nd lowest)

[in-text-ad-2]

6. Washington: Jay Inslee (D)

> Salary: $183,072

> Present term: Jan. 2017 – Jan. 2021

> State tax collections: $3,240 per capita (12th highest)

> Statewide cost of living: 6.4% more than nat’l avg.

> State population: 7,535,591 (13th highest)

5. Massachusetts: Charlie Baker (R)

> Salary: $185,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $4,012 per capita (7th highest)

> Statewide cost of living: 7.9% more than nat’l avg.

> State population: 6,902,149 (15th highest)

[in-text-ad]

4. Tennessee: Bill Lee (R)

> Salary: $194,112

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,069 per capita (8th lowest)

> Statewide cost of living: 9.6% less than nat’l avg.

> State population: 6,770,010 (16th highest)

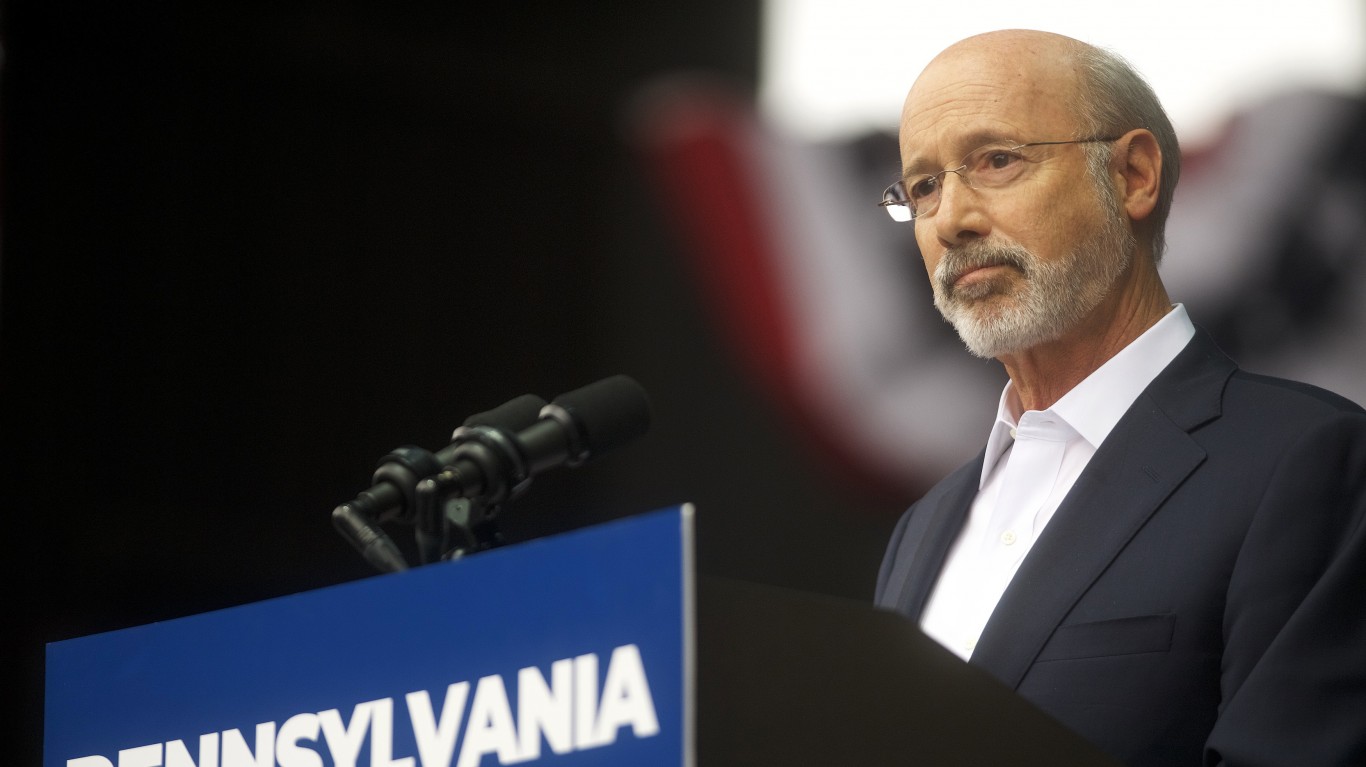

3. Pennsylvania: Tom Wolf (D)

> Salary: $194,850

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $2,956 per capita (19th highest)

> Statewide cost of living: 2.1% less than nat’l avg.

> State population: 12,807,060 (5th highest)

2. New York: Andrew Cuomo (D)

> Salary: $200,000

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $4,014 per capita (6th highest)

> Statewide cost of living: 15.8% more than nat’l avg.

> State population: 19,542,209 (4th highest)

[in-text-ad-2]

1. California: Gavin Newsom (D)

> Salary: $201,680

> Present term: Jan. 2019 – Jan. 2023

> State tax collections: $3,936 per capita (8th highest)

> Statewide cost of living: 14.8% more than nat’l avg.

> State population: 39,557,045 (the highest)

Methodology

To identify America’s highest paid governors, 24/7 Wall St. consulted the most recent governor compensation data in the 2019 Book of the States chapter on the state executive branch, originally published by The Council of State Governments.

Each governor’s present term in office and party affiliation is also from the Council of State Governments.

State tax collections per capita for fiscal year 2017 are from tax policy advocacy group Tax Foundation’s Facts and Figures 2019. Regional price parity figures by state for 2017 are from the Bureau of Economic Analysis. Total population figures are from the U.S. Census Bureau’s 2018 American Community Survey and are 1-year estimates.

The Average American Is Losing Momentum On Their Savings Every Day (Sponsor)

If you’re like many Americans and keep your money ‘safe’ in a checking or savings account, think again. The average yield on a savings account is a paltry .4%1 today. Checking accounts are even worse.

But there is good news. To win qualified customers, some accounts are paying more than 7x the national average. That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.