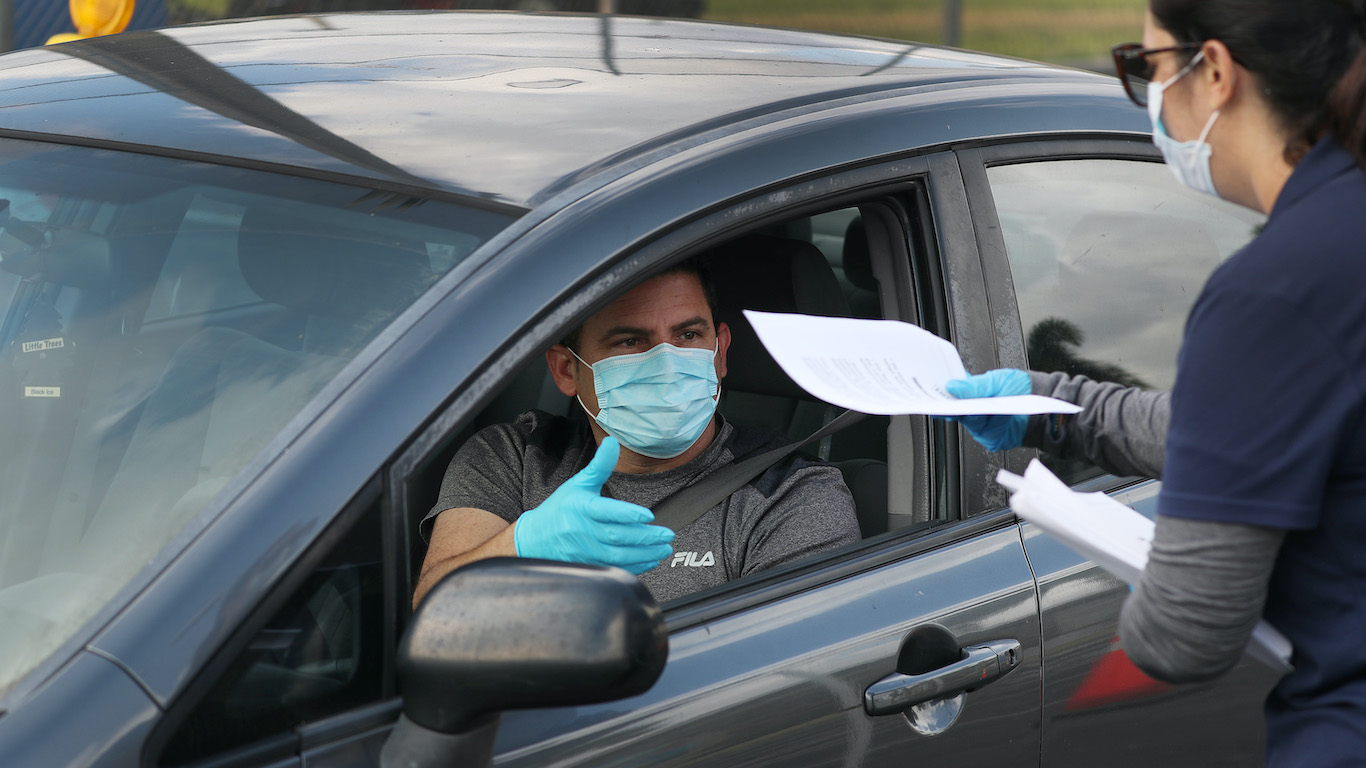

The nationwide effort to contain the spread of COVID-19 has taken a considerable economic toll. In recent weeks, travel has all but ground to a halt, and nonessential businesses have shuttered, causing mass layoffs and a historic unemployment crisis. The crunch has arrived at a time when many Americans are already facing financial strain — tax season.

Exactly how much of a financial burden taxes impose can depend on where one lives. While every American is subject to the same federal tax code, state and local tax laws vary dramatically by region. As a result, in some parts of the country, state and local taxes account for a larger portion of a typical resident’s income than in others.

Using data from the U.S. Census Bureau’s 2017 Census of Governments, 24/7 Wall St. reviewed the total state and local tax collections as a share of income on a per capita basis to identify the states with the lowest and highest tax burden. Federal taxes were not included in the calculation.

Every state levies some combination of property, income, and sales taxes. All told, Americans pay just over $5,000 a year in state and local taxes, equal to 9.8% of their estimated annual income. State by state, however, this share varies from as little as 7.2% of annual income to as much as 13.8%. Typically, property taxes are the largest driver of the overall tax burden within a state. These are the states with the highest (and lowest) property taxes.

In light of the COVID-19 crisis, nearly every state has taken measures to ease the financial pressure of tax season. For example, the IRS has pushed the deadline for filing federal income taxes from April 15 to July 15, 2020, and most states have followed suit. This is why April 15 is usually the last day to file your taxes.

Click here to see the states where taxes are adding to the financial strain of COVID-19

Click here to read our methodology

50. Alaska

> Taxes paid as pct. of income: 7.2%

> Income per capita: $56,794 (9th highest)

> Income tax collections per capita: $0 (tied – the lowest)

> Property tax collections per capita: $2,120 (10th highest)

> General sales tax collections per capita: $316 (5th lowest)

> COVID-19 income tax deadline: N/A

Unlike nearly every other state, Alaska has not had to revise due dates for income tax filings, as it is one of only a handful of states that does not levy a personal income tax. Partially as a result, Alaska has the lowest tax burden of any state, with residents spending the equivalent of just 7.2% of their annual income on state and local taxes, considerably less than the comparable nationwide figure of 9.8%.

Because Alaska is a resource-rich state, its tax revenue comes large from taxes on oil production.

[in-text-ad]

49. Tennessee

> Taxes paid as pct. of income: 7.6%

> Income per capita: $44,950 (15th lowest)

> Income tax collections per capita: $37 (8th lowest)

> Property tax collections per capita: $876 (6th lowest)

> General sales tax collections per capita: $1,393 (12th highest)

> COVID-19 income tax deadline: July 15, 2020

Tennessee residents pay an average of just 7.6% of their annual income in taxes, second lowest of any state. The state’s low tax burden is largely because the only income tax Tennessee levies is on investment earnings — and as is the case in most states, the filing deadline for those taxes has been pushed from April 15 to July 15 in the face of the coronavirus.

48. Florida

> Taxes paid as pct. of income: 7.6%

> Income per capita: $47,869 (24th lowest)

> Income tax collections per capita: $0 (tied – the lowest)

> Property tax collections per capita: $1,330 (22nd lowest)

> General sales tax collections per capita: $1,323 (16th highest)

> COVID-19 income tax deadline: N/A

Florida has one of the lowest tax burdens of any state, with the typical resident paying just 7.6% of his or her annual income in taxes. Florida is able to fund government operations without levying a personal income tax largely because of revenue it gets from sales tax, as the state is a popular tourist destination. However, as nonessential travel grinds to halt in an attempt to contain the spread of COVID-19, Florida’s budget will likely take a hit.

47. Oklahoma

> Taxes paid as pct. of income: 8.1%

> Income per capita: $43,634 (10th lowest)

> Income tax collections per capita: $794 (16th lowest)

> Property tax collections per capita: $730 (2nd lowest)

> General sales tax collections per capita: $1,185 (18th highest)

Oklahoma ranks among the top five oil-producing states, and the state funds much of its operations through taxes on resource extraction. Partially as a result, the state has one of the lowest tax burdens in the country, with residents paying just 8.1% of their annual income in taxes on average. However, as oil and gas revenues have fallen in conjunction with the onset of COVID-19, lawmakers recently shifted $500 million from the state’s rainy day fund to fill a budget shortfall.

[in-text-ad-2]

46. Arizona

> Taxes paid as pct. of income: 8.2%

> Income per capita: $42,505 (9th lowest)

> Income tax collections per capita: $489 (11th lowest)

> Property tax collections per capita: $1,099 (17th lowest)

> General sales tax collections per capita: $1,371 (13th highest)

With lower property and income tax collections per capita than most states, Arizona’s overall effective tax rate of just 8.2% is the fifth lowest among states. Like most states, the income tax deadline in Arizona was pushed from April 15 to July 15 in recognition of the disruptions caused by the coronavirus. As COVID-19 is straining state financial resources, lawmakers anticipate a budget shortfall in fiscal 2021 as high as $1.6 billion.

45. Alabama

> Taxes paid as pct. of income: 8.3%

> Income per capita: $40,467 (4th lowest)

> Income tax collections per capita: $769 (15th lowest)

> Property tax collections per capita: $582 (the lowest)

> General sales tax collections per capita: $1,039 (20th lowest)

Arkansas collects the lowest property tax per capita of any state and lower income and sales taxes per capita than most states. Partially as a result, Alabama residents pay less as a share of their annual income than residents of most states. Alabama is one of nearly 40 states following the IRS lead in extending the income tax filing deadline for residents until July 15.

[in-text-ad]

44. Wyoming

> Taxes paid as pct. of income: 8.3%

> Income per capita: $56,377 (10th highest)

> Income tax collections per capita: $0 (tied – the lowest)

> Property tax collections per capita: $2,089 (11th highest)

> General sales tax collections per capita: $1,116 (25th highest)

Wyoming residents pay just 8.3% of their annual income in taxes per year on average, less than in the vast majority of states. A resource-rich state, Wyoming draws significant revenue from oil extraction and does not levy a personal income tax. However, as oil prices have plummeted in recent months, the state’s structural deficit will not likely improve any time soon. Lawmakers in Wyoming agreed earlier this year to a 5% tax hike on lodging services.

43. Missouri

> Taxes paid as pct. of income: 8.4%

> Income per capita: $45,744 (18th lowest)

> Income tax collections per capita: $1,073 (25th highest)

> Property tax collections per capita: $1,039 (15th lowest)

> General sales tax collections per capita: $1,048 (21st lowest)

The typical Missouri resident pays just $3,821 in state and local taxes annually, well below the national average of $5,073. Per capita state and local tax collections in the state amount to just 8.4% of the income per capita among state residents, also considerably less than the comparable nationwide figure of 9.8%.

42. South Carolina

> Taxes paid as pct. of income: 8.4%

> Income per capita: $42,081 (7th lowest)

> Income tax collections per capita: $825 (18th lowest)

> Property tax collections per capita: $1,201 (19th lowest)

> General sales tax collections per capita: $760 (9th lowest)

> COVID-19 income tax deadline: July 15, 2020

South Carolina is one of several states in the South to rank among the 10 states with the lowest effective tax rates. The state moved quickly to provide residents with a deadline extension for filing income taxes, pushing the date to June 1. However, when the federal government moved its own deadline to July 15, South Carolina adopted the new national deadline.

[in-text-ad-2]

41. New Hampshire

> Taxes paid as pct. of income: 8.4%

> Income per capita: $58,397 (8th highest)

> Income tax collections per capita: $49 (9th lowest)

> Property tax collections per capita: $3,307 (the highest)

> General sales tax collections per capita: $0 (tied – the lowest)

> COVID-19 income tax deadline: June 15, 2020

With no sales tax and an income tax that applies only to interest and dividends, New Hampshire has an 8.4% effective tax rate. It is the only state in the Northeast to rank among the 10 states where residents pay the smallest share of their income in state and local taxes.

Still, property taxes are high in the state. Per capita property tax collections in New Hampshire amount to $3,307 annually, more than in every other state.

40. Georgia

> Taxes paid as pct. of income: 8.4%

> Income per capita: $44,536 (14th lowest)

> Income tax collections per capita: $1,054 (25th lowest)

> Property tax collections per capita: $1,161 (18th lowest)

> General sales tax collections per capita: $892 (12th lowest)

The typical Georgia resident pays just $3,739 in state and local taxes annually, well below the $5,073 national average. This amounts to just 8.4% of the per capita income in the state, also considerably less than the comparable nationwide figure of 9.8%.

The low tax burden on residents means Georgia has less revenue to work with — and as sales tax revenue dries up as a result of COVID-19 containment efforts, the state is facing a budget crisis going into the end of its fiscal year.

[in-text-ad]

39. Montana

> Taxes paid as pct. of income: 8.6%

> Income per capita: $45,312 (17th lowest)

> Income tax collections per capita: $1,119 (24th highest)

> Property tax collections per capita: $1,567 (22nd highest)

> General sales tax collections per capita: $0 (tied – the lowest)

The effective state and local government tax rate in Montana is just 8.6% — below the 9.8% average rate across all states. The low tax burden is largely because the state does not levy a sales tax. As is the case in much of the country, tax payers in Montana have until July 15 to file their income tax returns.

38. South Dakota

> Taxes paid as pct. of income: 8.6%

> Income per capita: $49,554 (22nd highest)

> Income tax collections per capita: $0 (tied – the lowest)

> Property tax collections per capita: $1,621 (19th highest)

> General sales tax collections per capita: $1,648 (5th highest)

> COVID-19 income tax deadline: N/A

Though South Dakota has higher property tax collections per capita than most states and higher sales tax collections per capita than all but four states, it still has one of the lowest tax burdens in the country. South Dakota residents pay just 8.6% of their annual income in state and local taxes, compared to the 9.8% average across all states. This is largely because South Dakota is one of only a handful of states to not levy a personal income tax.

37. Indiana

> Taxes paid as pct. of income: 8.6%

> Income per capita: $45,225 (16th lowest)

> Income tax collections per capita: $909 (19th lowest)

> Property tax collections per capita: $1,041 (16th lowest)

> General sales tax collections per capita: $1,135 (22nd highest)

With lower income, property, and sales tax collections per capita than most states, Indiana has one of the lowest effective tax rates of any state. Residents pay an average of about 8.6% of the income per capita in the state of $45,225 in state and local taxes annually.

[in-text-ad-2]

36. Virginia

> Taxes paid as pct. of income: 8.7%

> Income per capita: $55,306 (12th highest)

> Income tax collections per capita: $1,542 (9th highest)

> Property tax collections per capita: $1,652 (16th highest)

> General sales tax collections per capita: $642 (7th lowest)

The typical Virginia resident pays 8.7% of his or her annual income in state and local taxes — a lower tax burden than in most states. However, that may soon change as Virginia’s General Assembly recently passed a budget that will increase spending and raise taxes.

Unlike most states, Virginia does not follow the April 15 federal tax deadline. Rather, state residents must file by May 1 — a deadline that has not changed due to the coronavirus. The state, however, has extended the deadline for payments until June 1.

35. Texas

> Taxes paid as pct. of income: 8.7%

> Income per capita: $47,929 (25th lowest)

> Income tax collections per capita: $0 (tied – the lowest)

> Property tax collections per capita: $1,872 (13th highest)

> General sales tax collections per capita: $1,426 (11th highest)

> COVID-19 income tax deadline: N/A

Texas leads the United States in oil production, and like many resource-rich states, it does not levy a tax on personal income — meaning state residents have a smaller tax burden. Texas generated $3.9 billion in tax revenue from oil production in fiscal 2019. Sales taxes account the largest share of tax revenue in the state at 57%.

[in-text-ad]

34. Idaho

> Taxes paid as pct. of income: 8.8%

> Income per capita: $42,094 (8th lowest)

> Income tax collections per capita: $966 (21st lowest)

> Property tax collections per capita: $1,018 (13th lowest)

> General sales tax collections per capita: $963 (17th lowest)

The effective state and local government tax rate in Idaho is just 8.8% — below the average of 9.8% across all states. And soon, it could be even lower. Before Idaho’s legislature adjourned amid concerns over the coronavirus, it had been considering cuts to sales tax on groceries as well as reductions in property taxes.

Idaho has pushed the deadline for residents to file their income tax returns to June 15. The extension is a month shorter than the federal deadline extension to July 15.

33. Colorado

> Taxes paid as pct. of income: 8.8%

> Income per capita: $55,335 (11th highest)

> Income tax collections per capita: $1,209 (15th highest)

> Property tax collections per capita: $1,542 (24th highest)

> General sales tax collections per capita: $1,339 (14th highest)

Though income and sales tax collections are higher in Colorado on a per capita basis than they are in most states, residents still generally pay a smaller than typical share of their annual income in state and local taxes. This is largely explained by the higher than average incomes in the state, as the typical Colorado resident earns $55,335 a year, about $3,500 more than the income per capita across the U.S. as a whole.

32. North Carolina

> Taxes paid as pct. of income: 9.0%

> Income per capita: $44,180 (13th lowest)

> Income tax collections per capita: $1,177 (19th highest)

> Property tax collections per capita: $974 (10th lowest)

> General sales tax collections per capita: $1,026 (19th lowest)

> COVID-19 income tax deadline: July 15, 2020

North Carolina residents pay 9.0% of their annual income in state and local taxes, a smaller share than in most other states. The state has a lower tax burden despite higher per capita income tax collections than most other states. Like most states, North Carolina has pushed its deadline to file income tax to July 15. However, interest will accrue between April 15 and the date of payment.

[in-text-ad-2]

31. Michigan

> Taxes paid as pct. of income: 9.1%

> Income per capita: $46,258 (19th lowest)

> Income tax collections per capita: $1,005 (23rd lowest)

> Property tax collections per capita: $1,416 (23rd lowest)

> General sales tax collections per capita: $925 (15th lowest)

Michigan has a 9.1% effective tax burden, lower than that of most states. One of the hardest hit states by the coronavirus so far, Michigan is taking measures to reduce tax-related hardships during the COVID-19 crisis. Gov. Gretchen Whitmer (D) issued an executive order that extends the delay of any tax foreclosures on delinquent properties from March 31 to May 29. Also, like most states, Michigan extended the deadline for filing income tax from April 15 to July 15.

30. Washington

> Taxes paid as pct. of income: 9.1%

> Income per capita: $58,550 (7th highest)

> Income tax collections per capita: $0 (tied – the lowest)

> Property tax collections per capita: $1,498 (25th lowest)

> General sales tax collections per capita: $2,476 (the highest)

Washington state residents pay more per capita in sales tax than residents of every other state. However, Washington is one of a handful of states that does not levy an income tax, and partially as a result, the overall tax burden in the state is lower than it is in most states. Filing deadlines in the state for business tax and interest and dividends tax had been pushed to June 15.

[in-text-ad]

29. Utah

> Taxes paid as pct. of income: 9.2%

> Income per capita: $44,002 (12th lowest)

> Income tax collections per capita: $1,167 (21st highest)

> Property tax collections per capita: $1,037 (14th lowest)

> General sales tax collections per capita: $1,071 (22nd lowest)

The typical Utah resident pays just $4,063 in state and local taxes annually, well below the national average of $5,073. These payments are equal to 9.2% of income per capita in the state, slightly less than the comparable 9.8% figure nationwide.

28. Kentucky

> Taxes paid as pct. of income: 9.5%

> Income per capita: $40,999 (5th lowest)

> Income tax collections per capita: $1,313 (13th highest)

> Property tax collections per capita: $831 (5th lowest)

> General sales tax collections per capita: $784 (11th lowest)

Kentucky has a 9.5% effective tax burden — lower than that of just over half of states. While state residents may benefit from having a lower tax burden, state finances are in bad shape. Kentucky has one of the worst funded pension systems and one of the smallest rainy day funds among states. To address unforeseen financial burdens associated with COVID-19, Kentucky lawmakers cut previously planned spending on the latest budget proposal. They also proposed a bill that will tax vape products.

27. Kansas

> Taxes paid as pct. of income: 9.5%

> Income per capita: $48,869 (24th highest)

> Income tax collections per capita: $800 (17th lowest)

> Property tax collections per capita: $1,552 (23rd highest)

> General sales tax collections per capita: $1,477 (9th highest)

Tax payers in Kansas spend about 9.5% of their annual income on average in state and local taxes, slightly below the average 9.8% state and local tax burden nationwide. Kansas is also taking measures to ease some of the financial pressures of tax season during the COVID-19 crisis. Like most states, it has pushed the deadline to file income tax returns until July 15, and it is giving residents until October 15 to apply for homestead and property tax relief.

[in-text-ad-2]

26. Nevada

> Taxes paid as pct. of income: 9.6%

> Income per capita: $46,914 (22nd lowest)

> Income tax collections per capita: $0 (tied – the lowest)

> Property tax collections per capita: $1,012 (11th lowest)

> General sales tax collections per capita: $1,846 (4th highest)

> COVID-19 income tax deadline: N/A

Nevada is one of only a handful of states that does not levy an income tax and instead relies heavily on sales tax revenue. Though the high sales tax collections per capita contribute to Nevada’s 9.6% effective tax rate, much of that tax is paid by visitors and tourists. An estimated 42.5 million people visited Las Vegas alone in 2019, and sales and gaming taxes account for nearly half of the state’s general revenue.

25. Massachusetts

> Taxes paid as pct. of income: 9.6%

> Income per capita: $68,233 (2nd highest)

> Income tax collections per capita: $2,145 (4th highest)

> Property tax collections per capita: $2,434 (6th highest)

> General sales tax collections per capita: $909 (14th lowest)

Residents of Northeastern states typically have a higher than average state and local tax burden. Massachusetts, however, is an exception. Though income, sales, and property tax collections per capita in Massachusetts are among the highest of all states, residents still generally pay a smaller share of their annual income in state and local taxes than the nationwide average. This is largely explained by higher than average incomes. The annual income per capita in Massachusetts is $68,233, about $16,000 more than income per capita across the U.S. as a whole.

[in-text-ad]

24. Arkansas

> Taxes paid as pct. of income: 9.6%

> Income per capita: $41,520 (6th lowest)

> Income tax collections per capita: $922 (20th lowest)

> Property tax collections per capita: $740 (3rd lowest)

> General sales tax collections per capita: $1,511 (8th highest)

Arkansas collects $740 per capita in property taxes, the third lowest figure among states. However, the sales tax collections per capita figure in the state is higher than in most states. Overall, the state’s 9.6% average state and local tax burden is just under the average of 9.8% across all states.

23. Delaware

> Taxes paid as pct. of income: 9.7%

> Income per capita: $50,350 (21st highest)

> Income tax collections per capita: $1,297 (14th highest)

> Property tax collections per capita: $923 (8th lowest)

> General sales tax collections per capita: $0 (tied – the lowest)

The 9.7% effective state and local tax rate across Delaware is in line with the national average. Though the state has a higher than average effective income tax rate, residents are not charged state or local sales taxes. Delaware has extended the income tax filings deadline for residents, pushing the deadline from April 30 to July 15.

22. Pennsylvania

> Taxes paid as pct. of income: 9.7%

> Income per capita: $53,144 (16th highest)

> Income tax collections per capita: $1,339 (12th highest)

> Property tax collections per capita: $1,528 (25th highest)

> General sales tax collections per capita: $894 (13th lowest)

The typical Pennsylvania resident spends 9.7% of his or her annual income on state and local taxes, in line with the 9.8% national average. Pennsylvania’s income tax collections per capita of $1,339 annually is higher than in most states. As is the case in most states, the deadline for filing state income tax returns in Pennsylvania has been pushed to July 15.

[in-text-ad-2]

21. Oregon

> Taxes paid as pct. of income: 9.8%

> Income per capita: $48,372 (25th highest)

> Income tax collections per capita: $2,021 (6th highest)

> Property tax collections per capita: $1,487 (24th lowest)

> General sales tax collections per capita: $0 (tied – the lowest)

Oregon is one of only a handful of states that does not levy a sales tax. Still, the per capita income tax collections in Oregon is higher than in all but five other states. The higher taxes pose a larger than average burden on residents as incomes in the state are lower than average. The average Oregon resident earns $48,372 a year, about $3,500 less than the comparable national average.

20. Louisiana

> Taxes paid as pct. of income: 9.9%

> Income per capita: $43,938 (11th lowest)

> Income tax collections per capita: $632 (13th lowest)

> Property tax collections per capita: $901 (7th lowest)

> General sales tax collections per capita: $1,851 (3rd highest)

Income per capita in Louisiana is about $44,000 a year, nearly $8,000 less than annual income per capita across the U.S. as a whole. As a result, taxes pose a greater than typical financial burden on many Louisiana residents. Though the state property and income tax collections per capita are lower than in most states, the overall state and local tax burden of 9.9% in Louisiana is higher than in most other states.

[in-text-ad]

19. Wisconsin

> Taxes paid as pct. of income: 9.9%

> Income per capita: $49,290 (23rd highest)

> Income tax collections per capita: $1,345 (11th highest)

> Property tax collections per capita: $1,655 (14th highest)

> General sales tax collections per capita: $969 (18th lowest)

Though per capita sales tax collections are lower in Wisconsin than in most other states, per capita property and income tax collections are higher than in most states. All told, Wisconsin residents spend 9.9% of their income on state and local taxes, slightly higher than the 9.8% national average.

Wisconsin lawmakers have moved to provide taxpayers with some relief during the coronavirus pandemic, considering legislation that would waive late payment penalties for property taxes through October. As is the case in most states, state income taxes are not due until mid-July in Wisconsin.

18. Ohio

> Taxes paid as pct. of income: 10.0%

> Income per capita: $46,651 (21st lowest)

> Income tax collections per capita: $1,207 (16th highest)

> Property tax collections per capita: $1,316 (21st lowest)

> General sales tax collections per capita: $1,337 (15th highest)

Ohio has a 10.0% effective tax burden — higher than that of most states. Like many states where taxes levied at the state and local level pose a greater than average burden on residents, incomes are relatively low in Ohio. Per capita income in the state is $46,651 a year, $5,200 less than the national average.

17. Nebraska

> Taxes paid as pct. of income: 10.1%

> Income per capita: $50,663 (20th highest)

> Income tax collections per capita: $1,162 (22nd highest)

> Property tax collections per capita: $1,957 (12th highest)

> General sales tax collections per capita: $1,167 (21st highest)

In Nebraska, income, property, and sales tax collections per capita are all higher than they are in most states. Partially as a result, the effective state and local property tax burden amounts to 10.1% of per capita income in Nebraska.

Gov. Pete Ricketts (R) has taken steps to reduce the burden of state and local taxes on state residents — many of whom are strained financially by efforts to contain the coronavirus. Ricketts has waived penalties for late payments for excise taxes and pushed the deadline to file income tax returns until July 15.

[in-text-ad-2]

16. Mississippi

> Taxes paid as pct. of income: 10.1%

> Income per capita: $36,375 (the lowest)

> Income tax collections per capita: $614 (12th lowest)

> Property tax collections per capita: $1,017 (12th lowest)

> General sales tax collections per capita: $1,180 (20th highest)

The typical Mississippi resident earns about $36,375 a year, $15,510 less than annual income per capita across the U.S. as a whole. As a result, taxes pose a greater than average financial burden on many Mississippi residents. Though the state collects less in property and income taxes per capita than most states do, the overall state and local tax burden of 10.1% in Mississippi is higher than in most other states.

Due to legal budget requirements in Mississippi state law, the deadline for income tax return filings cannot be pushed past May 15.

15. West Virginia

> Taxes paid as pct. of income: 10.2%

> Income per capita: $38,644 (2nd lowest)

> Income tax collections per capita: $998 (22nd lowest)

> Property tax collections per capita: $948 (9th lowest)

> General sales tax collections per capita: $758 (8th lowest)

> COVID-19 income tax deadline: July 15, 2020

Despite having lower per capita sales, property, and income tax collections than most states, West Virginia has a higher than average state and local tax burden. This is largely due to lower than average incomes. Annual per capita income in West Virginia is just $38,644, more than $13,000 below the comparable national figure.

[in-text-ad]

14. California

> Taxes paid as pct. of income: 10.3%

> Income per capita: $60,156 (6th highest)

> Income tax collections per capita: $2,137 (5th highest)

> Property tax collections per capita: $1,607 (20th highest)

> General sales tax collections per capita: $1,246 (17th highest)

Taxpayers in California spend 10.3% of their annual income on state and local taxes, a larger share than in most states. Like most states, California has extended its 2020 income tax filing deadline in consideration of the financial constraint many residents may be under as a result of COVID-19. In addition, Gov. Gavin Newsom (D) extended various tax deadlines for small businesses until the end of July.

13. Maryland

> Taxes paid as pct. of income: 10.4%

> Income per capita: $60,512 (5th highest)

> Income tax collections per capita: $2,390 (2nd highest)

> Property tax collections per capita: $1,623 (18th highest)

> General sales tax collections per capita: $765 (10th lowest)

Taxes are generally less of a burden in higher income areas as they are less likely to account for a large share of annual spending. The annual income per capita of $60,512 in Maryland is nearly $9,000 above the comparable national figure. Still, the state has nearly the highest per capita income tax collections of any state, and as a result, Maryland has a 10.4% effective tax rate, higher than the 9.8% national average.

12. New Mexico

> Taxes paid as pct. of income: 10.4%

> Income per capita: $39,521 (3rd lowest)

> Income tax collections per capita: $640 (14th lowest)

> Property tax collections per capita: $792 (4th lowest)

> General sales tax collections per capita: $1,604 (6th highest)

> COVID-19 income tax deadline: July 15, 2020

The typical New Mexico resident earns about $39,521 a year, about $12,400 less than annual income per capita across the U.S. as a whole. As a result, taxes pose a greater than average financial burden on many New Mexico residents. Though the state collects less per capita in property and income taxes than most states, the overall state and local tax burden of 10.4% in New Mexico is higher than in most states and higher than the 9.8% national average.

[in-text-ad-2]

11. Iowa

> Taxes paid as pct. of income: 10.5%

> Income per capita: $47,458 (23rd lowest)

> Income tax collections per capita: $1,196 (17th highest)

> Property tax collections per capita: $1,632 (17th highest)

> General sales tax collections per capita: $1,128 (23rd highest)

The amount paid in state and local taxes per capita in Iowa is equal to about 10.5% of income per capita — a higher tax burden than in most states. Still, Iowa is doing more than many other states to lessen the potential negative financial impact of paying taxes during the COVID-19 crisis. The state has pushed the deadline to file income tax returns to the end of July and has suspended interest and other penalties for late property tax payments.

10. Connecticut

> Taxes paid as pct. of income: 10.6%

> Income per capita: $72,213 (the highest)

> Income tax collections per capita: $2,227 (3rd highest)

> Property tax collections per capita: $3,020 (3rd highest)

> General sales tax collections per capita: $1,185 (19th highest)

Connecticut is one six Northeastern states to rank among the 10 states with the highest effective tax rates. Despite having the highest annual income per capita of any state, at $72,213, state and local taxes still account for a larger than typical share of income — 10.6% compared to 9.8% nationwide. Connecticut has the third highest income and third highest property tax collections per capita of any state.

[in-text-ad]

9. Rhode Island

> Taxes paid as pct. of income: 10.6%

> Income per capita: $52,379 (18th highest)

> Income tax collections per capita: $1,173 (20th highest)

> Property tax collections per capita: $2,407 (7th highest)

> General sales tax collections per capita: $943 (16th lowest)

Taxpayers in Rhode Island spend 10.6% of their annual income on state and local taxes, a larger share than in most states. Like most states, Rhode Island is giving residents a three month extension on the income tax filing deadline. Lawmakers in the state are currently looking for ways to compensate for the delay in revenue.

8. Illinois

> Taxes paid as pct. of income: 10.7%

> Income per capita: $53,943 (14th highest)

> Income tax collections per capita: $1,037 (24th lowest)

> Property tax collections per capita: $2,239 (8th highest)

> General sales tax collections per capita: $1,127 (24th highest)

The 10.7% effective state and local tax rate in Illinois is the third highest in the Midwest and eighth highest among all states nationwide. Despite higher revenue on a per capita basis, Illinois is facing a budget crisis that will be exacerbated by the coronavirus crisis. By some estimates, the state could suffer revenue losses as high as $8 billion in the coming years.

7. New Jersey

> Taxes paid as pct. of income: 10.7%

> Income per capita: $64,924 (4th highest)

> Income tax collections per capita: $1,570 (8th highest)

> Property tax collections per capita: $3,276 (2nd highest)

> General sales tax collections per capita: $1,079 (23rd lowest)

> COVID-19 income tax deadline: July 15, 2020

New Jersey collects $3,276 per capita annually in property taxes, more than any state. Nationwide, state and local property tax collections amount to $1,617 per capita. The high property taxes, in addition to higher than average income taxes, largely explain the state’s 10.7% effective tax rate — which is well above the 9.8% national average.

[in-text-ad-2]

6. Minnesota

> Taxes paid as pct. of income: 11.2%

> Income per capita: $54,919 (13th highest)

> Income tax collections per capita: $1,968 (7th highest)

> Property tax collections per capita: $1,599 (21st highest)

> General sales tax collections per capita: $1,097 (25th lowest)

Minnesota is one of only six states with an effective tax rate above 11%. The relatively high tax burden in the state is mostly attributable to higher than average income and property tax collections per capita. As is the case in most states, Minnesota residents will have until July 15 to file their income tax returns in an attempt to alleviate unforeseen financial strain many may face in the COVID-19 crisis.

5. Maine

> Taxes paid as pct. of income: 11.4%

> Income per capita: $46,570 (20th lowest)

> Income tax collections per capita: $1,150 (23rd highest)

> Property tax collections per capita: $2,138 (9th highest)

> General sales tax collections per capita: $1,080 (24th lowest)

Northeastern states typically have higher taxes than much of the rest of the country, and in Maine, residents face the additional financial strain of lower than average incomes. Per capita income in the state is $46,570 per year, compared to per capita income of $51,885 nationwide. Coupled with higher income and property tax collections on a per capita basis than most other states, Maine’s 11.4% effective tax rate is fifth highest nationwide.

[in-text-ad]

4. Vermont

> Taxes paid as pct. of income: 11.6%

> Income per capita: $51,976 (19th highest)

> Income tax collections per capita: $1,191 (18th highest)

> Property tax collections per capita: $2,670 (5th highest)

> General sales tax collections per capita: $627 (6th lowest)

Despite having one of the lowest sales tax collections per capita among states, Vermont has a far higher than average overall tax burden, due largely to high income and property tax collections per capita. Vermonters typically pay about 11.6% of their annual income in state and local taxes, well above the 9.8% national average.

As the COVID-19 crisis is putting undue financial strain on many in the state, Vermont extended the deadline to file income tax returns to July 15 and has waived late penalties and interest for certain business taxes.

3. Hawaii

> Taxes paid as pct. of income: 12.5%

> Income per capita: $53,145 (15th highest)

> Income tax collections per capita: $1,471 (10th highest)

> Property tax collections per capita: $1,236 (20th lowest)

> General sales tax collections per capita: $2,431 (2nd highest)

Hawaii’s third-highest effective tax rate of 12.5% is driven in large part by sales tax. State and local governments collect $2,431 in sales taxes per capita annually, more than every state except for Washington and more than double the national average of $1,196. Much of that sales tax comes from non-state residents, however. As a popular tourist destination, Hawaii draws in millions of tourists annually. In 2018 alone, visitor spending topped $17.6 billion.

2. North Dakota

> Taxes paid as pct. of income: 12.7%

> Income per capita: $52,669 (17th highest)

> Income tax collections per capita: $423 (10th lowest)

> Property tax collections per capita: $1,654 (15th highest)

> General sales tax collections per capita: $1,476 (10th highest)

> COVID-19 income tax deadline: July 15, 2020

Income tax collections per capita in North Dakota are among the lowest in the country. The state collects just $423 per capita annually, less than half the average of $1,181 across all states. Still, largely because of high property and sales tax per capita, North Dakota has a 12.7% effective state and local tax rate, second highest among states.

[in-text-ad-2]

1. New York

> Taxes paid as pct. of income: 13.8%

> Income per capita: $65,644 (3rd highest)

> Income tax collections per capita: $2,877 (the highest)

> Property tax collections per capita: $2,902 (4th highest)

> General sales tax collections per capita: $1,551 (7th highest)

> COVID-19 income tax deadline: July 15, 2020

New York state has the highest tax burden of any state, with residents spending the equivalent of 13.8% of their annual income on state and local taxes. The high overall tax burden is driven by the state’s nation-leading per capita income tax collections, which at $2,877 are nearly $1,700 higher than the national average.

In order to compensate for revenue shortfalls resulting from the coronavirus containment efforts, lawmakers cut about $10 billion in initially planned spending from the state’s fiscal 2021 budget. To give taxpayers a break, New York extended the deadline to file income tax returns until July 15 and will not penalize late sales tax payments.

Methodology

To determine the states where Americans have the highest state and local tax burden, 24/7 Wall St. calculated state and local tax collections as a percentage of personal income for all 50 states.

Data on state and local tax collections, including data on individual income, property, and general sales tax collections, came from the U.S. Census Bureau’s 2017 Census of Governments. Data on personal income and population, which were used to calculate tax collection per capita, came from the Bureau of Economic Analysis and are for 2017.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.