Special Report

US Industries Being Devastated by the Coronavirus

Published:

Last Updated:

As the United States continues its fight against the coronavirus pandemic, the nation faces an economic crisis — 22 million Americans filed for unemployment from mid-March through mid-April. More will likely have to do so soon as the federal government’s $349 billion small business lending program ran out of money on April 16, less than two weeks after it started. Virtually every sector of the economy has been affected, but some are facing near-total shutdowns.

24/7 Wall St. reviewed industry publications and data from the Bureau of Labor Statistics to determine the U.S. industries being devastated most by the outbreak.

Many of the Americans who lost their jobs recently worked in the leisure and hospitality sector. New unemployment claims in states that rely on tourism, like Nevada, or that have a relatively high concentration of bars and restaurants, like New York, are skyrocketing. These are every state’s unemployment claims since COVID-19 shut the economy down.

Industries involving large gatherings or travel are facing near-total shutdowns, as 42 states have instituted stay-at-home orders, and certain businesses have been ordered to close. This is every state’s rules for staying at home and social distancing.

Click here to see the U.S. industries being devastated by the coronavirus.

Gambling

Much of the nation’s $261 billion casino gaming industry has been shuttered because of measures taken to contain the spread of the coronavirus. Casinos in Las Vegas, Atlantic City, and other major gaming destinations have been closed, and staff members have been furloughed or laid off.

Similarly, with every major American sport league canceled for the foreseeable future, the $500 million-per month sports betting industry has essentially dried up. The coronavirus also hit the U.S. just before the beginning of one of the industry’s biggest events — the NCAA Men’s Basketball Tournament. During the 2019 tournament, Americans wagered an estimated $8.5 billion on games.

[in-text-ad]

Airlines

The airline industry is being hit especially hard by the pandemic as demand for domestic and international flights has all but vanished. Major carriers like United, Delta, and American Airlines have all announced plans to cut capacity by more than two-thirds in the coming months.

As of January there were 747,000 people working for U.S. airlines. Their jobs are at risk, though the government is stepping in to help. On April 15, 10 top U.S. airlines agreed to a package that will net them $22.7 billion-worth of wage grants, in addition to a previous $60 billion in grants and loans through a coronavirus relief bill.

Hotels

As the pandemic has curbed travel, demand for hotels has declined sharply. The hotel industry is projected to lose just over half of its revenue per room in 2020 compared to the year before, according to hospitality sector data company STR. Since mid-February, hotels have reportedly lost over $13 billion in room revenue.

The U.S. hotel industry employed over 1.6 million Americans before the pandemic — the ninth-largest sector in the U.S. in terms of total workers. An estimated 70% of hotel employees have either been laid off or furloughed, according to the American Hotels and Lodging Association. Concerned the CARES Act will only help hotels meet their payroll obligations for a maximum of eight weeks, hotel owners are lobbying congress for additional aid.

Movie theaters

Since social distancing guidelines were announced, movie theaters had to close their doors. Through February, theaters grossed well over $100 million per week, and sometimes even $200 million. By the week of March 13, weekly box office gross fell to $54 million. In the weeks since, theaters grossed just over $17,000 combined. Major theater chains such as AMC and Regal closed all U.S. theaters, leaving thousands of employees without work.

The impact of the pandemic on movie theaters could last even after social distancing guidelines are lifted. While some movies were released straight to video on demand, the releases of blockbusters like “Mulan,” “A Quiet Place Part II,” “Fast 9,” and the latest James Bond film, “No Time to Die,” which were slated for the coming weeks, were pushed back. Dozens of other films, however, had to halt their production, meaning there could be a long period when no new movies are coming out.

[in-text-ad-2]

Live sports

The postponement or suspension of sports leagues like the NBA, NHL, and more has created a huge vacuum for the leagues, players, the estimated 300 staff workers in a given arena, and surrounding businesses that rely on fans for their income. Statistical analysis site FiveThirtyEight estimates that the NBA stands to lose $350 million-$450 million from unsold tickets for the remaining of the regular season, as well as $200 million in non-ticket revenue from sources like parking, concessions, merchandise, and more — and that does not include lost playoff revenues.

The only option for sports to resume in 2020 may be to play without fans. Dr. Anthony Fauci of the National Institute of Allergy and Infectious Diseases said sports will likely not be able to return unless leagues are willing to play in empty stadiums and keep athletes isolated and test them regularly.

The MLB is weighing such a plan that would relocate all games to Arizona, potentially beginning as early as May. The NBA commissioner said a mid-June return to action would be a best-case scenario. The NHL is targeting a similar return date. The XFL, in its first season after reforming, folded.

Cruises

After Carnival’s Diamond Princess ship in February became one of the first large outbreak clusters outside China, the cruise industry has taken a huge hit. The CDC issued a No Sail Order for 100 days on April 9, but Carnival and Royal Caribbean have said they will begin offering cruises sooner.

Shares of the three major cruise companies — Royal Caribbean, Carnival Corp., and Norwegian Cruise Line Holdings — dropped by over 67% since mid-February. Unlike many industries that have been especially hard hit by the pandemic, the cruise sector was not included in the $2 trillion stimulus package. Though industry leaders asked for assistance, the largest companies were excluded because they are incorporated outside the U.S. Despite the rough economic conditions, cruise companies expect to stay afloat, and Carnival’s CEO said the cruise line already had substantial bookings for 2021.

[in-text-ad]

Shipping

A supply management survey found that three out of every four American businesses experienced a disruption to some part of their supply line due to the irregularities in the shipping industry stemming from the coronavirus pandemic. China is one of the world’s foremost shipping hubs, but COVID-19 has forced the country to close ports and send factory workers home for months. As Chinese ports reopened, American ones began to idle operations. The International Chamber of Shipping said the pandemic has cost the worldwide shipping industry around $350 million per week.

The outbreak has affected everyone in this highly globalized industry, and Americans are no exception. The average daily freight rate for large ships is reportedly less than half of break even level, and these rates are not expected to recover for months. Shipping companies are also not included in the government’s bailout funds as they operate out of many different countries.

Film production

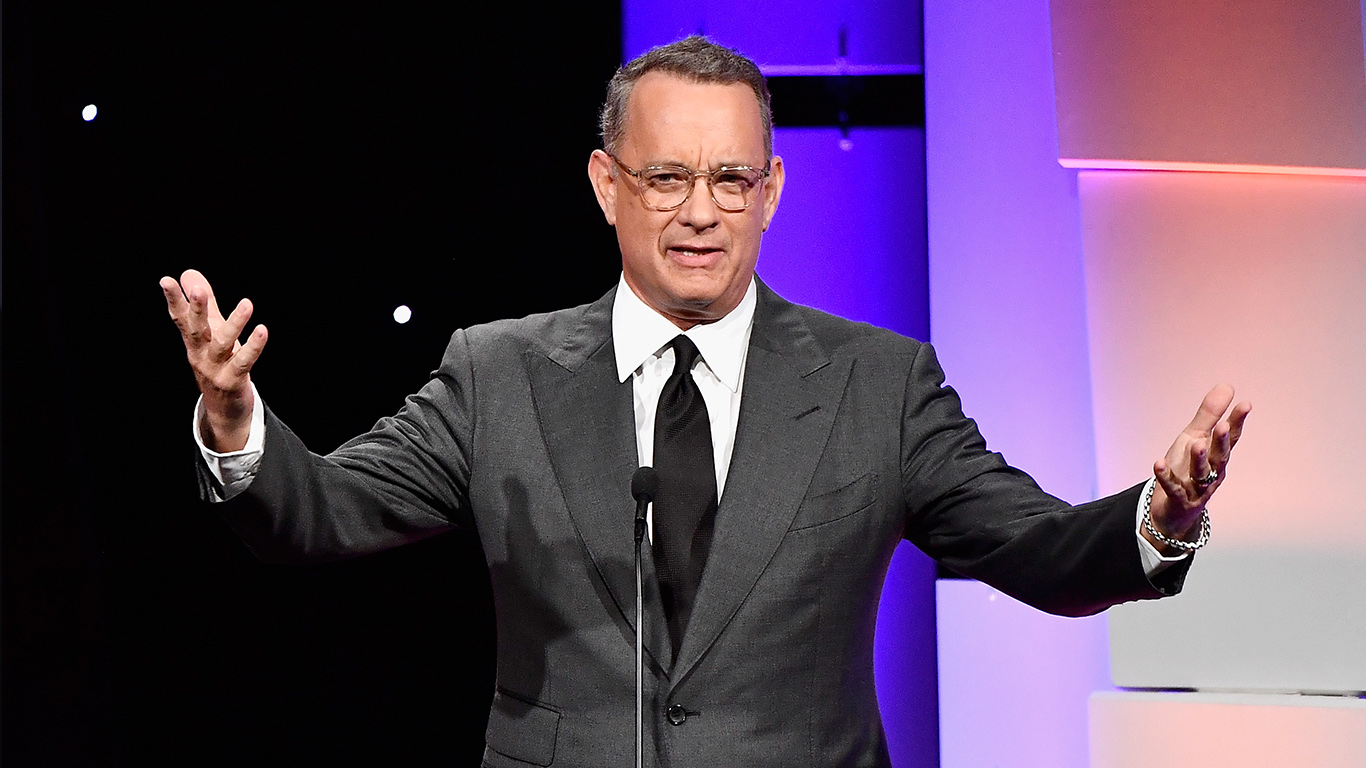

Oscar-winning actor Tom Hanks announced on March 12 that he tested positive for the coronavirus. Consequently, production of the film he was shooting at the time was shut down. While Hanks has since recovered, his film was one of a dozens of films and TV shows that halted production — either out of caution or because a cast or crew member had symptoms, tested positive, or came into contact with someone who did. These films would likely have contributed billions of dollars to the U.S. box office and economy in other ways.

Each time a production shuts down, it puts hundreds of crew members and cast out of work. Movies often have well over 500 crew members, including drivers, lighting technicians, directors, production assistants, camera operators, and more. Some of the larger films that have extensive visual effects have thousands of people credited. Over 220,000 Americans were working in the film production industry as of 2018.

Automakers

As the COVID-19 pandemic lingers, the demand for cars is decreasing. As Americans have become increasingly concerned about job security and try to save their money for emergencies they have been less likely to buy a car. Through the three weeks ending April 12, auto sales were less than half of what J.D. Power had projected they would be. Total vehicle sales in 2019 were 17.1 million and the new projection for 2020 sales was adjusted down from 16.7 to as low as 14 million. In addition to jeopardizing jobs at manufacturing plants, this also jeopardizes the jobs of the 1.1 million Americans who work in new and used car dealerships.

Previously, automakers also faced serious supply chain disruptions as parts imports from China became harder to get. Four out of every five cars made in the world rely on parts manufactured in China.

[in-text-ad-2]

Oil and gas

As people continue to work from home and avoid travel, the demand for oil and gas has plummeted. The International Energy Agency projects a decline in demand of 29 million barrels per day in April 2020 as compared to April 2019. The price of oil has been in an unprecedented freefall, selling for under $20 per barrel as of April 15.

Prior to the pandemic, the IEA projected an increase in demand for oil of over 800,000 barrels. The effects on the oil industry have been especially dire because China, the world’s top energy consumer, was the first to be hit as the source of the outbreak.

Retail

The U.S. retail industry has been devastated by the coronavirus pandemic, and a number of stores have had to close their doors. Retail sales fell by more than 6% in March 2020 as compared to March of the previous year. Many retailers were already struggling before the pandemic, and now they are trying desperately to avoid closing permanently.

Retailers like T.J. Maxx, Macy’s, Gap, Urban Outfitters, and more have announced they will furlough hundreds of thousands of workers. One Jefferies analyst told CNBC, “With stores accounting for 75% of sales for most retailers, we anticipate massive EPS (earnings per share) declines for 1Q, especially as most retailers appear to be paying employees during the 2 week closures.”

[in-text-ad]

Conventions

As mass gatherings of people have been declared unsafe, many of the massive conventions that draw thousands of attendees from across the globe have been canceled. The cancellations of tech conferences like E3, SXSW, and more have likely cost local economies over $1.1 billion, according to data company PredictHQ. In 2019 alone, SXSW’s full-time and seasonal workers had an economic impact of over $350 million on the Austin, Texas, economy, according to consulting firm Greyhill Advisors and SXSW.

The cancellation of the E3 conference has also cost the video game industry its biggest week of the year. New games and consoles are often unveiled at the event, which usually hosts over 65,000 guests. Facebook and Google also had to scrap their own conventions. This moratorium on large gatherings could devastate the 55,000-person industry of convention and trade show organizers in the U.S.

Food service

Between full- and limited-service restaurants, caterers, buffets, and more, well over 10 million Americans work in the food service industry. States have ordered restaurants to offer only takeout, drive-thru, and delivery options as a preventive measure, which has cut into restaurants revenues and profits and could jeopardize jobs in the food service field, which is largely made up of hourly workers.

Of the 701,000 Americans who lost their job in March, 417,000 worked in bars, restaurants, or other food service occupations. This may only get worse as the National Restaurant Association expects 5 million – 7 million Americans in the hospitality sector will be out of work by the end of June.

Theme parks

Large theme parks have stopped welcoming guests in the wake of the coronavirus pandemic, closing the massive industry for the foreseeable future. Disney is by far the largest theme park operator in the world, with six parks — all of which were shuttered as the outbreak spread. Disney reported over $26.2 billion in revenue from its parks in fiscal 2019. Dividing this evenly throughout the year would mean the company could lose revenue of around $500 million per week of parks closure, assuming the same revenue this year.

Other prominent parks have been affected as well. All SeaWorld parks are closed; Six Flags temporarily closed 10 of its parks; and Universal Studios closed its Orlando and Hollywood parks through the end of May. Nationwide, there are nearly 200,000 people who work at theme parks, many of whom could be out of work throughout the worst of the coronavirus outbreak.

[in-text-ad-2]

Gyms

Gyms were already facing challenges from home exercise companies like Peloton, and social distancing recommendations and the fear of the spread of the coronavirus have further added to the challenges large gyms and group fitness classes face.

In every state, gyms have been either ordered to shut down or were forced to because of bans on large gatherings. Prior to the pandemic, gyms and boutique fitness classes ballooned into a $94 billion industry that is now in jeopardy.

Construction

As the coronavirus devastates the U.S. economy, companies will likely have to pull back on expansion, leaving a huge gap in the construction industry. Housing starts dropped to 1.2 million in March from 1.6 million in February, a more than 22% decline. The drop was larger than the expected drop to 1.3 million starts.

Smaller construction companies may have to lay off workers as their supply of equipment and parts from China is disrupted. An estimated 7.6 million Americans are working in the construction sector and could be affected by these changes.

[in-text-ad]

Transportation

With Americans working from home and staying in instead of going to work and visiting bars and restaurants, ride sharing companies like Uber and Lyft are seeing their potential ridership dissipate. According to a Business Insider survey Uber and Lyft drivers said their earnings dropped by 50%-80% throughout March, if they were even still driving at all. Many stopped offering rides over safety concerns.

Both companies announced they would stop letting different users share the same car. Uber has pledged financial assistance to drivers who are quarantined and not able to work, though this would likely not impact most of the estimated 900,000 U.S. drivers. Nearly 5,000 Americans in the transportation and warehousing sector lost their jobs in March, making it one of the most impacted industries in that regard.

Real estate

With nearly every state instituting stay-at-home orders, Americans are largely unable to go out and find and buy a new home. The impact of COVID-19 on real estate varies widely between major areas. In New York City, one of the hardest hit areas, new home listings fell around 70%. The real estate industry as a whole is suffering, with weekly mortgage applications falling by nearly 18% in April’s first week, compared to the previous week, indicating less house sales transactions.

The impact could stretch for months after social distancing guidelines are lifted as there could be fewer houses available. The number of housing starts fell from 1.56 million in February to 1.2 million in March, though this may be more in line with an anticipated decrease in demand. With 22 million Americans filing for unemployment between March 14 and April 11 and many more facing reduced earnings, there will likely be fewer Americans in the market for a new house.

Health care

While some hospitals in coronavirus hot spots like Queens, New York, have been stretched to their limits by an influx of patients, other hospitals are struggling — especially those in rural areas. As facilities have had to suspend nonemergency treatment, their revenue has greatly declined. Becker’s Hospital Review found that well over 100 American hospitals had to furlough or lay off workers, costing thousands of health care workers their income. This applies to doctors offices, dental offices, physical therapy, yearly physicals, preventive care and more.

Other health care-related facilities have seen sharp declines in business, as well. Quest Diagnostics performed hundreds of thousands of COVID-19 tests, nearly 40% of all coronavirus testing by commercial labs. The demand for its other services, however, declined significantly, and the company furloughed over 4,000 employees due to the lost business.

[in-text-ad-2]

Steel mills

Mills that would normally produce millions of tons of steel have been shut down across America due to the coronavirus. Companies like U.S. Steel, ArcelorMittal, and Gerdau have idled their operations due to a lack of demand, largely from automakers that are no longer manufacturing vehicles. Credit Suisse predicts that the auto industry’s demand for steel will decline 70%-90% in the second quarter of 2020.

Steel mills were allowed to continue operations as an essential industry. More than 83,000 Americans work in these mills.

Manufacturing

An estimated 18,000 Americans working in manufacturing lost their jobs in March, one of just six industries to shed that many workers that month. While some manufacturing jobs, like those associated with food and drinks, have been busier in recent weeks, industry-wide orders have declined dramatically. New orders for goods from factories sank to their lowest level in over a decade.

In addition to demand issues and the strain added by social distancing rules, factories have also faced problems with supply. With supply lines from China disrupted as early as January, factories had to burn through stockpiled parts to make cell phones, cars, and other goods.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.