The COVID-19 pandemic is one of the most devastating health emergencies in American history. Health officials have confirmed more than 2.3 million cases, with over 122,000 of them fatal. As people were told to stay home and avoid going out and nonessential businesses were ordered to close, the American economy has been left devastated.

Some businesses were able to weather the economic fallout, but many were not. A May study from the National Bureau of Economic Research estimated that because of the pandemic over 100,000 small businesses permanently closed. Larger businesses were not immune to the effects, either. Some major American companies with hundreds of locations across the country have also struggled.

While small businesses may have to close their doors, larger businesses often decide to seek bankruptcy protection in the hopes of restructuring their debt and turning their companies around. While some succeed and exit bankruptcy better-positioned to compete in their industry, others do not and are liquidated. 24/7 Wall St. reviewed major companies that have filed, or are likely to file, for bankruptcy.

Companies in certain industries have been especially vulnerable to the economic effects of the pandemic: oil and gas companies had to contend with plunging oil prices as a result of both a lack of demand as people traveled less and a price war between Saudi Arabia and Russia; retailers were among the many nonessential businesses ordered to close; and as business travel and vacations were canceled, car rental businesses had few customers if any. These are the U.S. industries being devastated by the coronavirus.

As businesses had to contend with a lack of income, many were forced to furlough employees or permanently lay them off. The U.S. is now facing an unprecedented economic crisis, with over 45 million Americans filing for unemployment benefits since mid-March. Some states that are especially reliant on hard-hit industries were hit much harder than others, leading to much higher unemployment rates in these states. These are every state’s unemployment claims since COVID-19 shut the economy down.

Click here to see American businesses that might not survive coronavirus.

1. JCPenney

> Industry: Retail

JCPenney’s multi-billion dollar debt load, combined with the chain closing most of its stores nationwide because of COVID-19-imposed restrictions, have cast the company’s future into doubt. The department store chain filed for bankruptcy in May, and in June, it announced it would close nearly 150 of its 846 stores. Company CEO Jill Soltau blamed the pandemic for the closures, saying, “Until this pandemic struck, we had made significant progress rebuilding our company” under a reorganization plan.

[in-text-ad]

2. 24 Hour Fitness

> Industry: Fitness

Gyms around the country, including 24 Hour Fitness, were shuttered as a result of COVID-19. The company filed for bankruptcy on June 15, blaming the filing on the pandemic. The fitness chain permanently shuttered over 130 of its locations, leaving around 300 gyms. Most remaining locations are expected to be open by the end of June. The pandemic only served to add to the challenges chains like 24 Hour Fitness were already facing as Americans switched to cheaper gyms, boutique fitness options like spin or barre classes, or home fitness options like Peloton.

3. J. Crew

> Industry: Apparel

Weeks after closing its doors on March 16, clothing retailer J. Crew filed for Chapter 11 bankruptcy. The company also said it reached an agreement with its lenders to convert more than $1.6 billion of the company’s debt into equity. J. Crew also secured a $400 million loan, though it may be increasingly difficult for the company to pay it back as its credit rating has been downgraded twice by credit rating agency Moody’s Investors Service during the pandemic. As of mid-June, the company had reopened two-thirds of its roughly 500 stores.

4. Hertz

> Industry: Car rental

With more than $25.8 billion in assets, car rental company Hertz became the largest business to declare bankruptcy in the fallout of COVID-19 when it filed for Chapter 11 bankruptcy protection in May. With nonessential travel all but canceled, Hertz has been struggling with a lack of revenue.

After the bankrupt company’s recent attempt to raise money through a secondary share offering failed, Morgan Stanley analysts raised alarms that Hertz’s shares might soon become worth virtually nothing. Analysts also said Hertz is at risk of being delisted from the New York Stock Exchange and may not have enough cash to operate by the end of the year.

[in-text-ad-2]

5. Chesapeake Energy

> Industry: Energy

According to a Reuters report, oil and gas company Chesapeake Energy is looking to file for bankruptcy as early as late June. It is reportedly seeking Chapter 11 protection as it struggles with over $9 billion in debt. The global oil industry was devastated by a historic plunge in oil prices stemming from a lack of demand during the global shutdown and a price war between Russia and Saudi Arabia. In April, the price of West Texas Intermediate oil futures set for May fell below zero for the first time. While prices have rebounded, they remain low, hovering under $40 per barrel throughout June. Prices had been above $50 throughout 2019.

6. Lord & Taylor

> Industry: Retail

While many companies use their time in bankruptcy protection as an opportunity to lower debt and streamline operations, Lord & Taylor may be shutting down for good. Reuters reported the department store planned to liquidate its inventory in all remaining 38 stores once all locations reopened. So far, only select stores have welcomed shoppers back.

Lord & Taylor, which opened in 1826, was considered the oldest department store in the country. The store suffered from the same issues many department stores were facing even before the pandemic, experiencing declining revenue and lower foot traffic as online shopping became more common. Lord & Taylor was sold to an investment firm in 2006 for $1.2 billion. In 2019, fashion rental company Le Tote bought it for around $71 million.

[in-text-ad]

7. Pier 1 Imports

> Industry: Retail

Home-decor retailer Pier 1 Imports was struggling before the coronavirus affected the U.S., filing for bankruptcy in February and planning to close about half of its stores. CEO Robert Riesbeck hoped the retailer could find a buyer, but once the pandemic hit, any interest evaporated. Pier 1 asked a bankruptcy court to approve its plan to shut down all stores and liquidate all assets as soon as stores can reopen. It has more than 500 locations across the country.

8. Le Pain Quotidien

> Industry: Restaurant

French-themed bakery and cafe chain Le Pain Quotidien declared bankruptcy in late May. As COVID-19 spread, the business closed all locations and laid off the majority of its employees. Le Pain Quotidien has decided to sell off its American sites.

9. Neiman Marcus

> Industry: Luxury

Luxury department store chain Neiman Marcus filed for Chapter 11 bankruptcy protection on May 7 in an attempt to restructure debt and survive the harsh economic conditions created by the coronavirus pandemic. The company had been saddled with $4 billion in debt since its 2013 sale to a private equity firm. Women’s Wear Daily reported in June that Neiman Marcus is trying to vacate its location in Manhattan’s Hudson Yards complex.

Issues at the luxury retailer had been compounded by the recent precipitous drop in sales of luxury goods, which were likely some of the first purchases postponed during the pandemic. Neiman Marcus is in the process of reopening all of its physical locations, with more than 90% in at least partial operation as of June 22.

[in-text-ad-2]

10. Advantage Rent A Car

> Industry: Car rental

After leisure and business travel ground to a halt, car rental companies were left with lots full of cars but no one to drive them. Advantage Rent A Car filed for bankruptcy on May 26, just a few days after car rental competitor Hertz. Advantage had also filed for bankruptcy protection in 2008 and 2013. The company is reportedly struggling with a debt load of around $500 million.

11. Sur La Table

> Industry: Retail

In May, Bloomberg reported that luxury kitchen goods retailer Sur La Table was preparing to declare bankruptcy and was looking for a buyer, though a representative from Sur La Table’s parent company declined to comment. Sur La Table was especially vulnerable to the pandemic compared to other brick-and-mortar retailers as the store is known for its in-house cooking classes. Two of Sur La Table’s creditors have expressed doubt that the business would be able to repay $31 million in senior debt, and their valuation of that debt was dropped by more than a third.

[in-text-ad]

12. Gold’s Gym

> Industry: Fitness

Bans on crowds of more than 10 people across the nation spelled disaster for large gym chains like Gold’s Gym. The company filed for bankruptcy on May 4 and had to permanently close 30 company-owned locations amid the pandemic.

Some Gold’s Gym locations have begun reopening, with enhanced safety measures in place, such as requiring members to wear masks to enter. As part of its bankruptcy exit plan, CEO Adam Zeitsiff said the company would focus on getting smaller locations in cities and spread to smaller communities.

13. True Religion

> Industry: Apparel

Clothing brand True Religion filed for bankruptcy in mid-April — the second time in just four years. While COVID-19 all but ended foot traffic, True Religion struggled going into the pandemic, largely due to the rise in popularity of athleisure-style clothes replacing jeans as a casual clothing option. True Religion has around 140 stores in America, though its products are available in hundreds more retailers like Nordstrom and Bloomingdales.

14. Diamond Offshore Drilling

> Industry: Energy

Houston-based contract drilling business Diamond Offshore Drilling was forced to file for bankruptcy after many of the largest oil companies in the world pulled back on spending as oil prices collapsed. Worldwide, total spending on oilfield equipment and services is predicted to drop to its lowest level in 15 years, with companies like Diamond Offshore Drilling experiencing the fallout.

[in-text-ad-2]

15. CMX Cinemas

> Industry: Theaters

CMX Cinemas owns 41 movie theaters that also serve food in major cities like New York, Chicago, Miami, and more. The eighth-largest theater operator in the U.S., CMX declared bankruptcy in April and had to pull out of a deal that would have expanded its footprint into Texas. As movie distributors pushed the release of spring blockbusters to later in the year and theaters were required to close because of COVID-19 concerns, total movie sales in the U.S. diminished to just a few thousand dollars throughout April and have yet to surpass $750,000 in a single week since. For context the lowest weekly box office this year before March was $112.2 million.

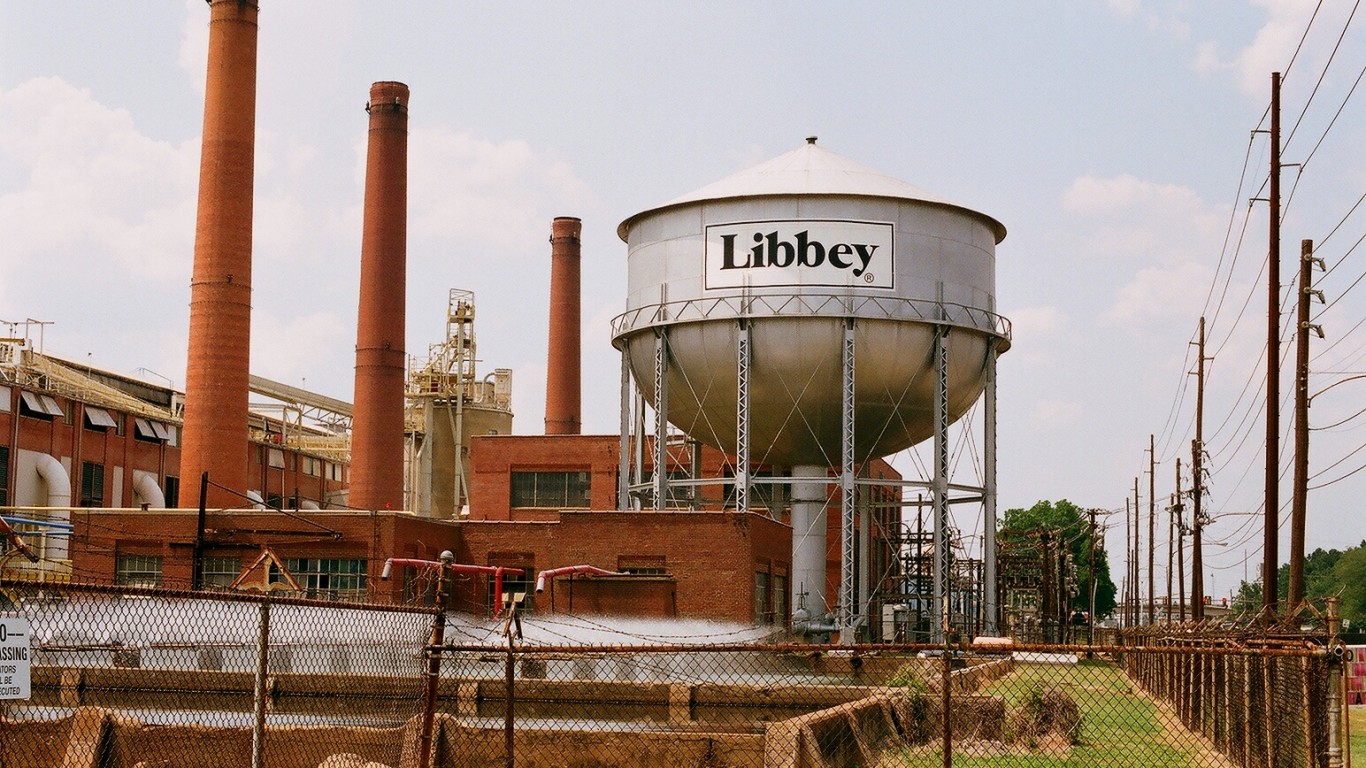

16. Libbey

> Industry: Manufacturing

Libbey may not be a household name, but chances are you are familiar with its products. The Toledo-based company is one of the leading providers of glassware to bars and restaurants, with sales of $782.4 million last year. As dining establishments closed, however, they had no need for new glassware and sales at Libbey suffered. After sales dropped from about $10 million per week before the pandemic to less than half of that throughout much of March, the company declared bankruptcy.

[in-text-ad]

17. Whiting Petroleum

> Industry: Energy

Whiting Petroleum became the first major shale company to file for bankruptcy protection when it did so on April 1. This came in the wake of oil prices collapsing because of decreased demand due to COVID-19 and a Saudi-Russian price war. The company was criticized after CEO Bradley Holly received a $6.4 million bonus after filing.

18. Tuesday Morning

> Industry: Retail

Retailer Tuesday Morning filed for bankruptcy on May 27. The discount homeware brand has over 687 stores in nearly 40 states, though as part of its filing, the company said it would close around 230 of those locations. As a nonessential business, Tuesday Morning closed all of its stores in March, furloughing around 9,000 employees, most of whom have since returned to work.

19. Apex Parks Groups

> Industry: Amusement parks

Apex Parks Groups operates 10 amusement and water parks in California, New Jersey, and Florida, though it recently closed a park in New York. While other amusement companies have been able to survive the shutdown brought on by COVID-19, Apex was already struggling to stay afloat. The company assets are worth between $50 million and $100 million, but its liabilities are between $100 million and $500 million.

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.