This November, in addition to the presidential election, 11 U.S. states as well as two territories will hold elections for governor. Governors are the highest-ranking public official in a state government, effectively serving as chief executives. While the general job description is the same across the 50 states, the details can vary considerably by state. Key differences include state-specific policy priorities and legislative hurdles, populations, and of course, compensation.

The power wielded by state governors has been evident in 2020, as each state, under the direction of its governor, has adopted its own approach to combating the coronavirus. Some governors have chosen to ignore federal guidelines, while others have responded with even stricter measures.

Unlike senators, who are also elected on a state-by-state basis, there is no set salary for governors. While senators earn an annual salary of $174,000, governors’ salaries vary by state — from as little as $70,000 to more than $200,000.

24/7 Wall St. reviewed 2019 salary information from The Council on State Governments, a policy database, to identify how much America’s governors are paid in every state.

Despite their status as the highest-ranking public officials in state governments, governors are usually not the highest paid state employees. Reasons for this vary from state to state. Often, various state departments pay their leadership larger salaries in order to compete with the private sector for top talent. In politically divided states, a pay raise for the governor may lack the necessary legislative support. Also, importantly, governors do not typically run for office for the paycheck.

While there is no hard and fast rule, generally, states that collect more taxes on a per capita basis tend to pay their governors more than states that collect less taxes. Here is a look at how much Americans are paying in taxes on a state-by-state basis.

Click here to see America’s highest paid governors.

Click here to read our detailed methodology.

50. Maine: Janet Mills (D)

> Salary: $70,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,295 per capita (13th highest)

> Statewide cost of living (2018): equal to the nat’l avg.

[in-text-ad]

49. Colorado: Jared Polis (D)

> Salary: $90,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,599 per capita (16th lowest)

> Statewide cost of living (2018): 1.9% more expensive than nat’l avg.

48. Arizona: Doug Ducey (R)

> Salary: $95,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,272 per capita (11th lowest)

> Statewide cost of living (2018): 3.5% less expensive than nat’l avg.

47. Oregon: Kate Brown (D)

> Salary: $98,600

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,017 per capita (24th highest)

> Statewide cost of living (2018): 1.1% more expensive than nat’l avg.

[in-text-ad-2]

46. Kansas: Laura Kelly (D)

> Salary: $99,636

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,279 per capita (15th highest)

> Statewide cost of living (2018): 10.0% less expensive than nat’l avg.

44 (tie). Nebraska: Pete Ricketts (R)

> Salary: $105,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,795 per capita (24th lowest)

> Statewide cost of living (2018): 10.5% less expensive than nat’l avg.

[in-text-ad]

44 (tie). Wyoming: Mark Gordon (R)

> Salary: $105,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,180 per capita (19th highest)

> Statewide cost of living (2018): 7.3% less expensive than nat’l avg.

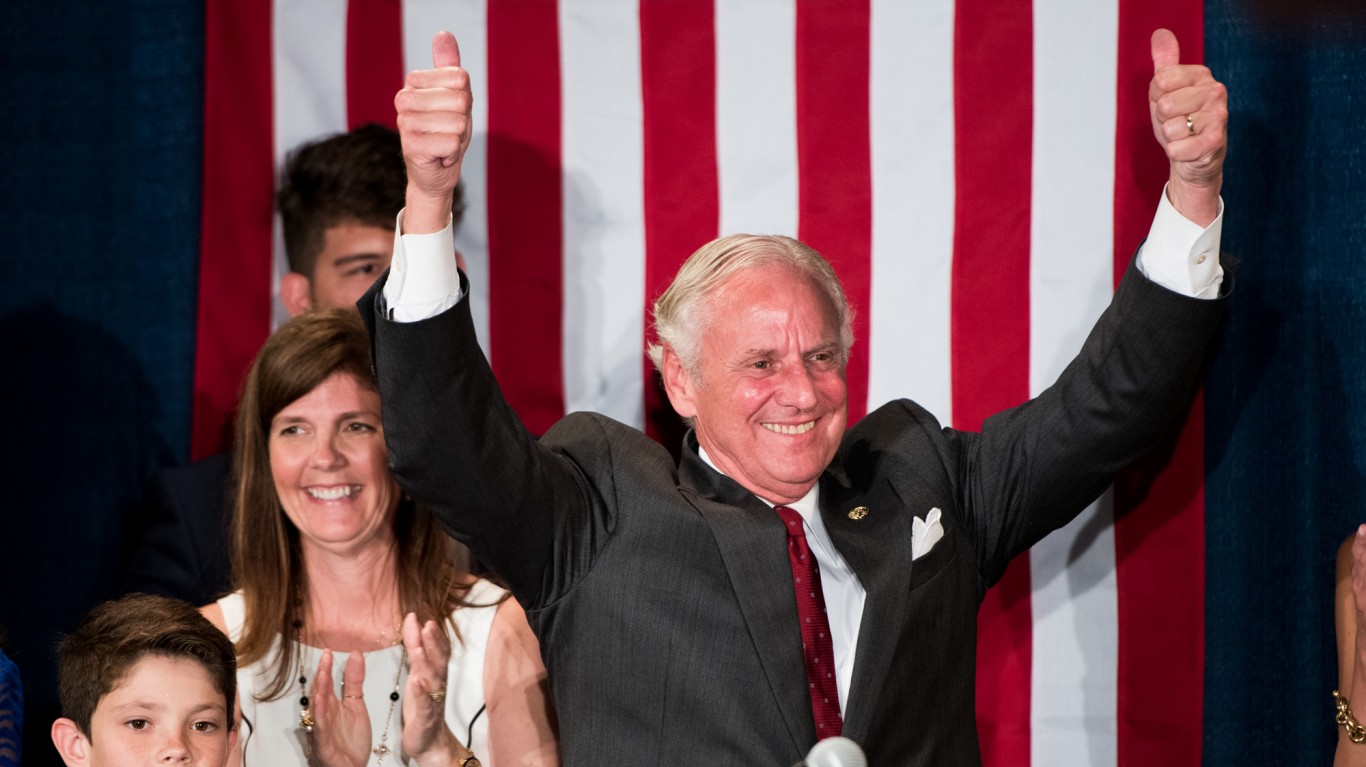

43. South Carolina: Henry McMaster (R)

> Salary: $106,078

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,075 per capita (the lowest)

> Statewide cost of living (2018): 8.9% less expensive than nat’l avg.

42. New Mexico: Michelle Lujan Grisham (D)

> Salary: $110,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,707 per capita (20th lowest)

> Statewide cost of living (2018): 8.9% less expensive than nat’l avg.

[in-text-ad-2]

41. South Dakota: Kristi Noem (R)

> Salary: $113,961

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,174 per capita (7th lowest)

> Statewide cost of living (2018): 12.1% less expensive than nat’l avg.

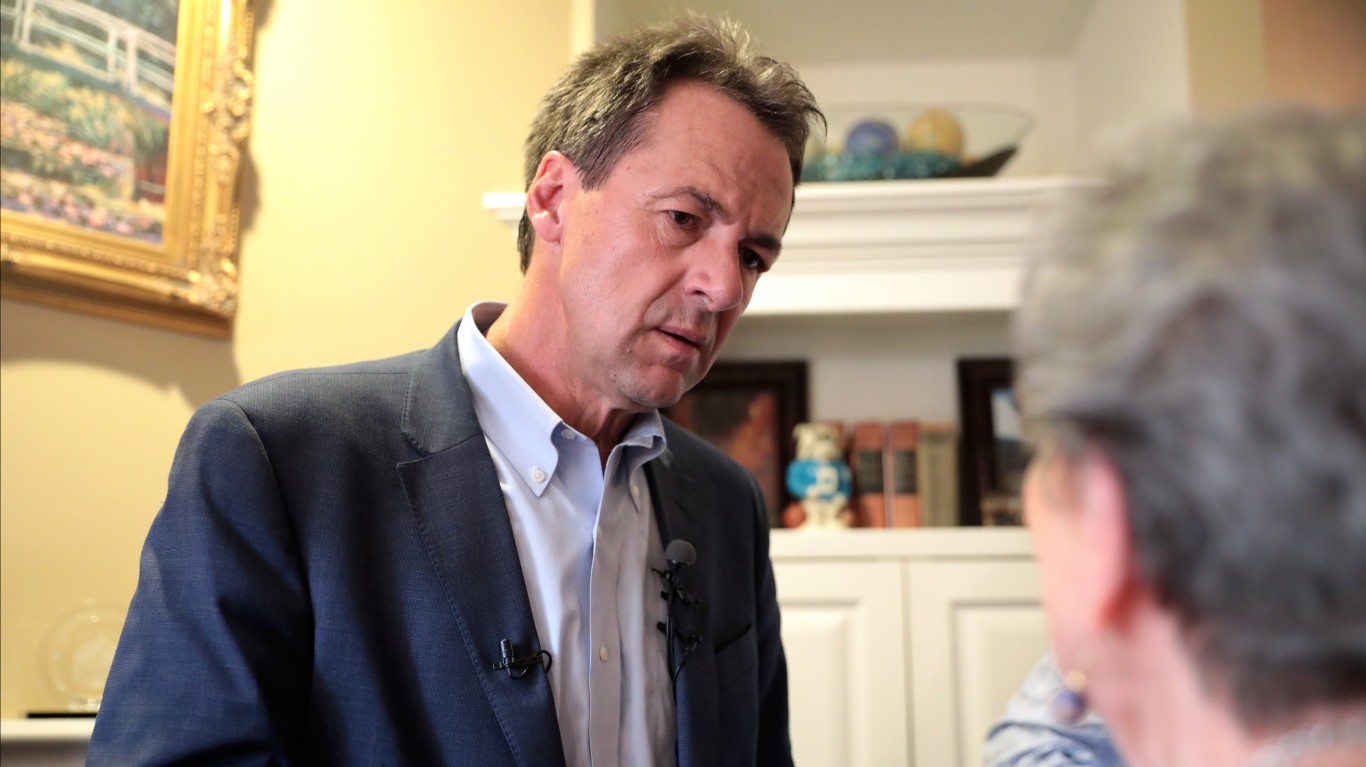

40. Montana: Steve Bullock (D)

> Salary: $115,505

> Present term: Jan 2017 – Jan 2021

> State tax collections (2018): $2,772 per capita (23rd lowest)

> Statewide cost of living (2018): 6.7% less expensive than nat’l avg.

[in-text-ad]

39. Alabama: Kay Ivey (R)

> Salary: $120,395

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,262 per capita (10th lowest)

> Statewide cost of living (2018): 13.6% less expensive than nat’l avg.

38. Indiana: Eric Holcomb (R)

> Salary: $121,331

> Present term: Jan 2017 – Jan 2021

> State tax collections (2018): $2,899 per capita (25th lowest)

> Statewide cost of living (2018): 10.7% less expensive than nat’l avg.

37. Mississippi: Tate Reeves (R)

> Salary: $122,160

> Present term: Jan 2020 – Jan 2024

> State tax collections (2018): $2,642 per capita (17th lowest)

> Statewide cost of living (2018): 14.0% less expensive than nat’l avg.

[in-text-ad-2]

36. Minnesota: Tim Walz (D)

> Salary: $127,629

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $4,758 per capita (5th highest)

> Statewide cost of living (2018): 2.5% less expensive than nat’l avg.

35. North Dakota: Doug Burgum (R)

> Salary: $129,096

> Present term: Dec 2016 – Dec 2020

> State tax collections (2018): $5,533 per capita (the highest)

> Statewide cost of living (2018): 9.4% less expensive than nat’l avg.

[in-text-ad]

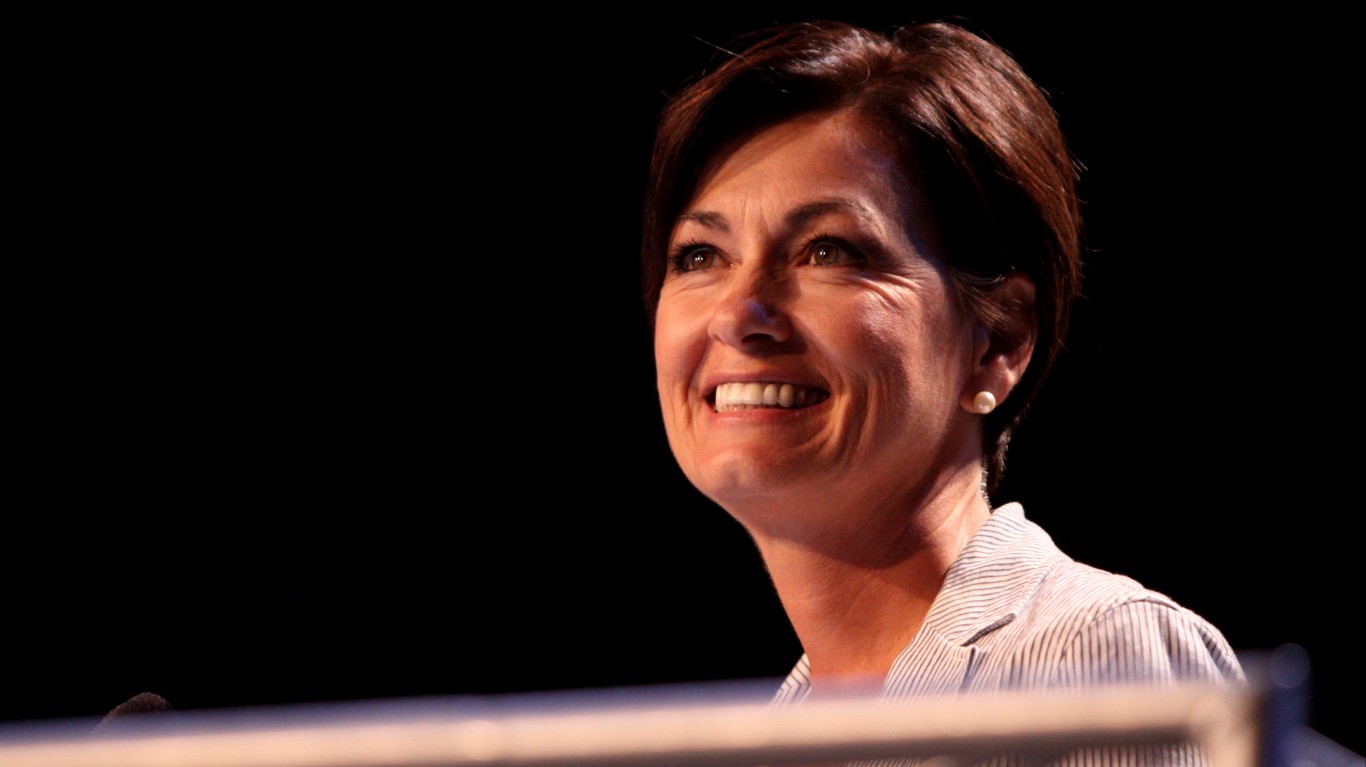

33 (tie). Iowa: Kim Reynolds (R)

> Salary: $130,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,196 per capita (18th highest)

> Statewide cost of living (2018): 10.8% less expensive than nat’l avg.

33 (tie). Louisiana: John Bel Edwards (D)

> Salary: $130,000

> Present term: Jan 2016 – Jan 2020

> State tax collections (2018): $2,437 per capita (13th lowest)

> Statewide cost of living (2018): 10.9% less expensive than nat’l avg.

32. Florida: Ron DeSantis (R)

> Salary: $130,273

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,158 per capita (6th lowest)

> Statewide cost of living (2018): 0.6% more expensive than nat’l avg.

[in-text-ad-2]

31. Missouri: Mike Parson (R)

> Salary: $133,821

> Present term: June 2018 – Jan 2021

> State tax collections (2018): $2,126 per capita (4th lowest)

> Statewide cost of living (2018): 11.2% less expensive than nat’l avg.

30. New Hampshire: Chris Sununu (R)

> Salary: $134,581

> Present term: Jan 2019 – Jan 2021

> State tax collections (2018): $2,153 per capita (5th lowest)

> Statewide cost of living (2018): 6.0%more expensive than nat’l avg.

[in-text-ad]

29. Idaho: Brad Little (R)

> Salary: $138,302

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,764 per capita (22nd lowest)

> Statewide cost of living (2018): 7.5% less expensive than nat’l avg.

28. North Carolina: Roy Cooper (D)

> Salary: $144,349

> Present term: Jan 2017 – Jan 2021

> State tax collections (2018): $2,683 per capita (18th lowest)

> Statewide cost of living (2018): 8.2% less expensive than nat’l avg.

27. Alaska: Mike Dunleavy (R)

> Salary: $145,000

> Present term: Dec 2018 – Dec 2022

> State tax collections (2018): $2,226 per capita (8th lowest)

> Statewide cost of living (2018): 4.8% more expensive than nat’l avg.

[in-text-ad-2]

26. Rhode Island: Gina Raimondo (D)

> Salary: $145,755

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,294 per capita (14th highest)

> Statewide cost of living (2018): 0.7% less expensive than nat’l avg.

25. Oklahoma: Kevin Stitt (R)

> Salary: $147,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,425 per capita (12th lowest)

> Statewide cost of living (2018): 11.6% less expensive than nat’l avg.

[in-text-ad]

24. Arkansas: Asa Hutchinson (R)

> Salary: $148,134

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,266 per capita (16th highest)

> Statewide cost of living (2018): 14.7% less expensive than nat’l avg.

23. Kentucky: Andy Beshear (D)

> Salary: $148,781

> Present term: Dec 2019 – Dec 2023

> State tax collections (2018): $2,699 per capita (19th lowest)

> Statewide cost of living (2018): 12.2% less expensive than nat’l avg.

22. Nevada: Steve Sisolak (D)

> Salary: $149,573

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,018 per capita (23rd highest)

> Statewide cost of living (2018): 2.5% less expensive than nat’l avg.

[in-text-ad-2]

19 (tie). Connecticut: Ned Lamont (D)

> Salary: $150,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $5,341 per capita (3rd highest)

> Statewide cost of living (2018): 6.1% more expensive than nat’l avg.

19 (tie). Utah: Gary Herbert (R)

> Salary: $150,000

> Present term: Jan 2017 – Jan 2021

> State tax collections (2018): $2,543 per capita (15th lowest)

> Statewide cost of living (2018): 3.4% less expensive than nat’l avg.

[in-text-ad]

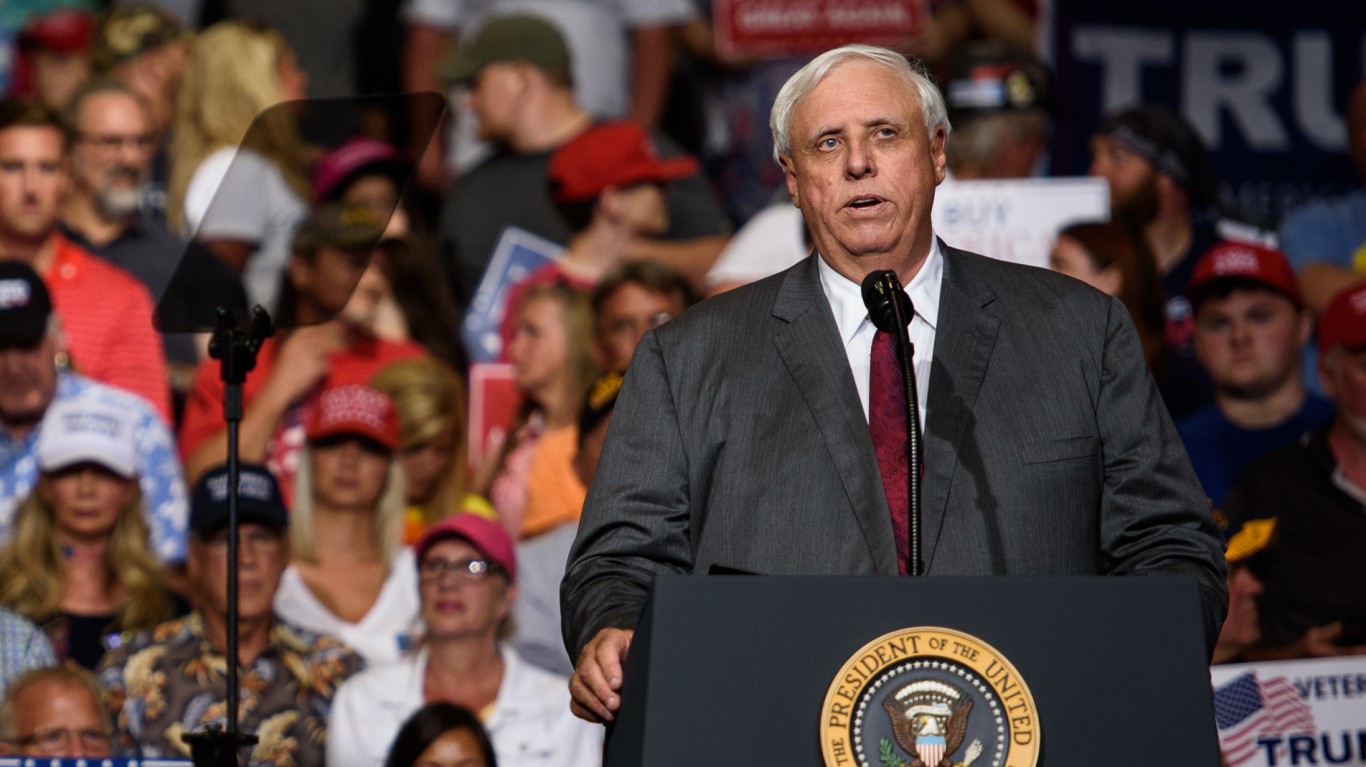

19 (tie). West Virginia: Jim Justice (R)

> Salary: $150,000

> Present term: Jan 2017 – Jan 2021

> State tax collections (2018): $3,000 per capita (25th highest)

> Statewide cost of living (2018): 12.2% less expensive than nat’l avg.

18. Wisconsin: Tony Evers (D)

> Salary: $152,756

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,224 per capita (17th highest)

> Statewide cost of living (2018): 8.1% less expensive than nat’l avg.

17. Ohio: Richard Michael DeWine (R)

> Salary: $153,650

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,492 per capita (14th lowest)

> Statewide cost of living (2018): 11.6% less expensive than nat’l avg.

[in-text-ad-2]

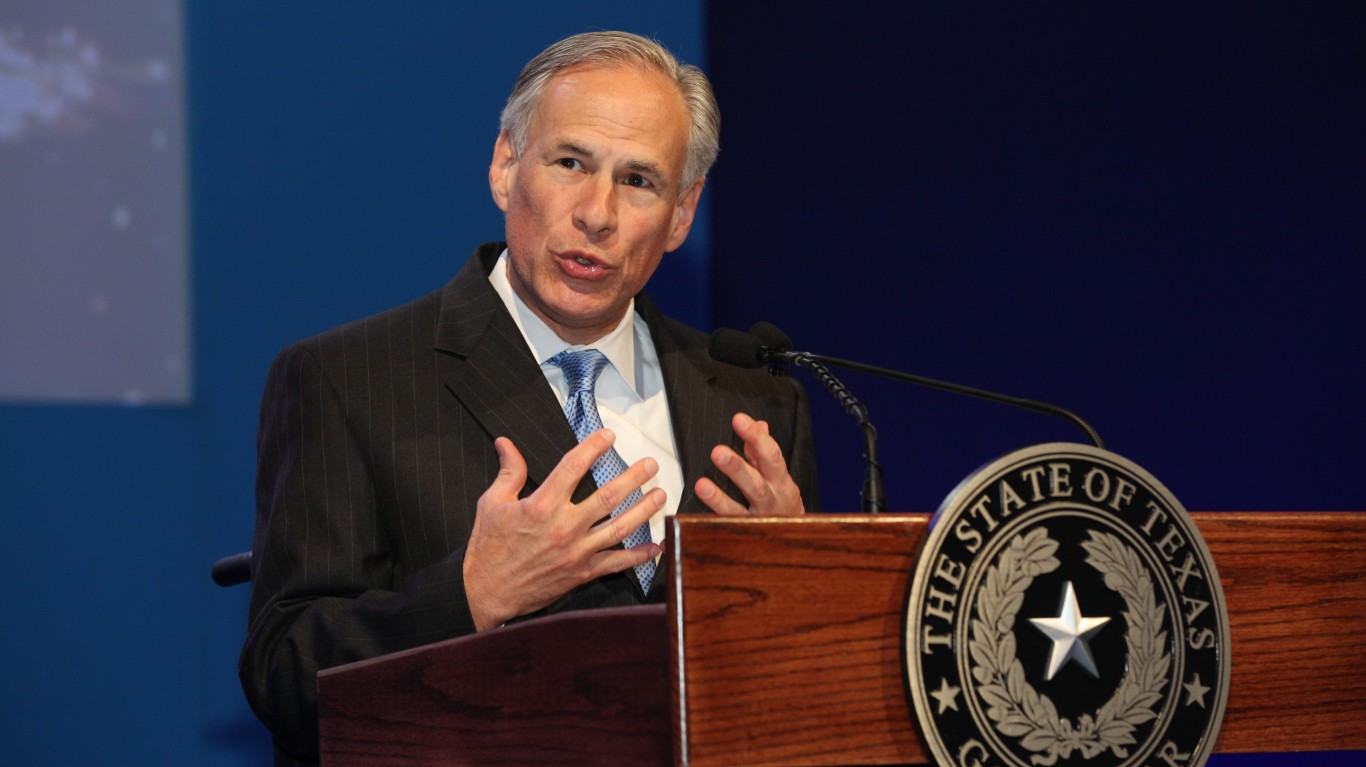

16. Texas: Greg Abbott (R)

> Salary: $153,750

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,102 per capita (2nd lowest)

> Statewide cost of living (2018): 3.2% less expensive than nat’l avg.

15. Hawaii: David Ige (D)

> Salary: $158,700

> Present term: Dec 2018 – Dec 2022

> State tax collections (2018): $5,431 per capita (2nd highest)

> Statewide cost of living (2018): 18.1% more expensive than nat’l avg.

[in-text-ad]

14. Michigan: Gretchen Whitmer (D)

> Salary: $159,300

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,052 per capita (22nd highest)

> Statewide cost of living (2018): 7.6% less expensive than nat’l avg.

13. Maryland: Larry Hogan (R)

> Salary: $170,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,711 per capita (11th highest)

> Statewide cost of living (2018): 8.4% more expensive than nat’l avg.

12. Delaware: John Carney (D)

> Salary: $171,000

> Present term: Jan 2017 – Jan 2021

> State tax collections (2018): $4,363 per capita (8th highest)

> Statewide cost of living (2018): 1.2% less expensive than nat’l avg.

[in-text-ad-2]

9 (tie). Georgia: Brian Kemp (R)

> Salary: $175,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,244 per capita (9th lowest)

> Statewide cost of living (2018): 7.0% less expensive than nat’l avg.

9 (tie). New Jersey: Phil Murphy (D)

> Salary: $175,000

> Present term: Jan 2018 – Jan 2022

> State tax collections (2018): $3,970 per capita (10th highest)

> Statewide cost of living (2018): 15.2% more expensive than nat’l avg.

[in-text-ad]

9 (tie). Virginia: Ralph Northam (D)

> Salary: $175,000

> Present term: Jan 2018 – Jan 2022

> State tax collections (2018): $2,758 per capita (21st lowest)

> Statewide cost of living (2018): 2.0%more expensive than nat’l avg.

8. Illinois: JB Pritzker (D)

> Salary: $177,412

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,128 per capita (21st highest)

> Statewide cost of living (2018): 1.9% less expensive than nat’l avg.

7. Vermont: Phil Scott (R)

> Salary: $178,274

> Present term: Jan 2019 – Jan 2021

> State tax collections (2018): $5,244 per capita (4th highest)

> Statewide cost of living (2018): 3.0%more expensive than nat’l avg.

[in-text-ad-2]

6. Washington: Jay Inslee (D)

> Salary: $183,072

> Present term: Jan 2017 – Jan 2021

> State tax collections (2018): $3,527 per capita (12th highest)

> Statewide cost of living (2018): 7.8% more expensive than nat’l avg.

5. Massachusetts: Charlie Baker (R)

> Salary: $185,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $4,296 per capita (9th highest)

> Statewide cost of living (2018): 9.7% more expensive than nat’l avg.

[in-text-ad]

4. Tennessee: Bill Lee (R)

> Salary: $194,112

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $2,108 per capita (3rd lowest)

> Statewide cost of living (2018): 10.1% less expensive than nat’l avg.

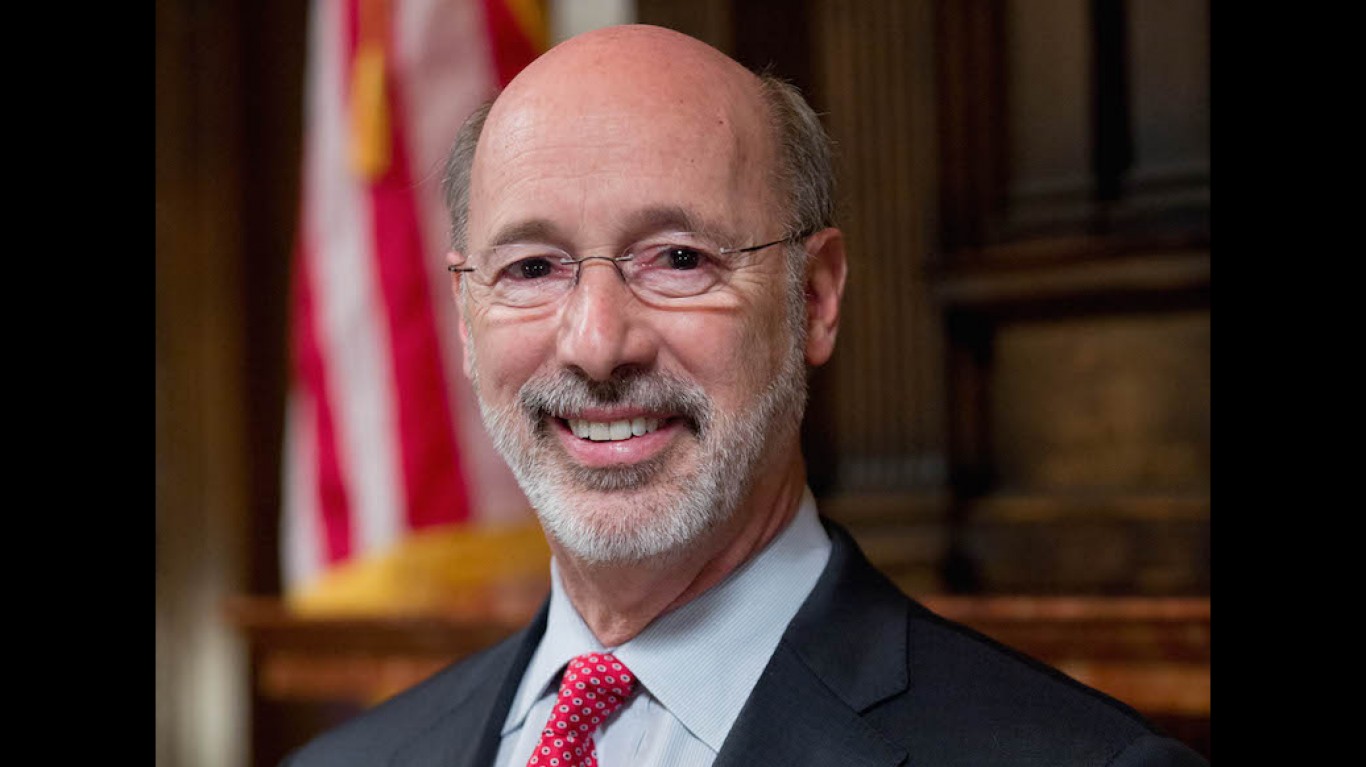

3. Pennsylvania: Tom Wolf (D)

> Salary: $194,850

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $3,179 per capita (20th highest)

> Statewide cost of living (2018): 2.5% less expensive than nat’l avg.

2. New York: Andrew Cuomo (D)

> Salary: $200,000

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $4,531 per capita (6th highest)

> Statewide cost of living (2018): 16.4% more expensive than nat’l avg.

[in-text-ad-2]

1. California: Gavin Newsom (D)

> Salary: $201,680

> Present term: Jan 2019 – Jan 2023

> State tax collections (2018): $4,424 per capita (7th highest)

> Statewide cost of living (2018): 15.4% more expensive than nat’l avg.

Methodology

To identify America’s highest paid governors, 24/7 Wall St. consulted the most recent governor compensation data in the Book of the States 2019 chapter on the state executive branch, originally published by The Council of State Governments.

Each governor’s present term in office and party affiliation are also from the Council of State Governments.

State tax collections per capita for fiscal year 2018 are from tax policy advocacy group Tax Foundation’s Facts and Figures 2020. Regional price parity figures — a cost of living measure — by state for 2018 are from the Bureau of Economic Analysis.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.