Special Report

Cost of Living in San Francisco, California

Published:

Last Updated:

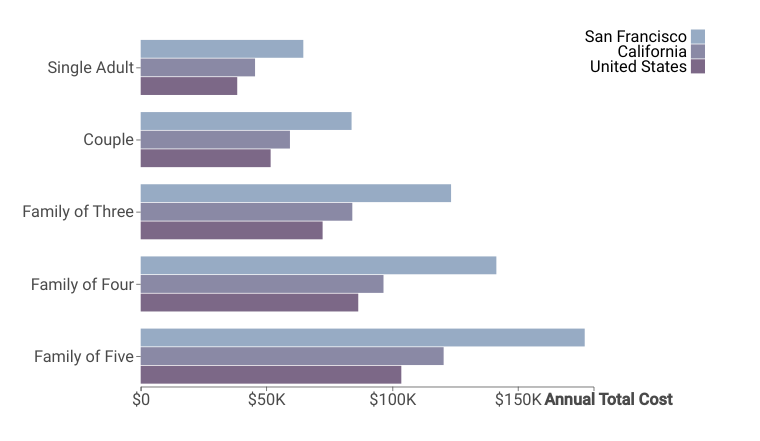

San Francisco is a city in California with a population of 870,044. The total cost of housing, food, child care, transportation, health care, taxes, and other necessities for a single adult in San Francisco is $64,666 a year — greater than the annual cost of living for California of $45,534 and greater than the national figure of $38,433.

Using cost of living data from the nonprofift think tank Economic Policy Institute, 24/7 Wall St. estimated the cost of living in San Francisco and over 29,000 other cities and towns in the US.

Housing is one of the largest components of cost of living. In San Francisco, the median home value is $1,009,500, greater than the national median home value of $204,900. The median price of a home built in 1939 or earlier is $1,138,800, while the median value of a home built in 2014 or later is $1,244,200.

Renting is a sometimes lower cost alternative to homeownership. In San Francisco, some 62.40% of occupied homes are rented, greater than the 36.2% national renter rate. The typical renter in San Francisco spends $1,805 a month on housing, greater than the $1,023 national median monthly rent.

In addition to home value, one of the largest determinants of housing affordability is area income. While nationwide the price of a typical U.S. home is 3.4 times the $60,293 U.S. median household income, housing affordability ratios range from approximately 1.0 in the least expensive cities to more than 10.0 in the country’s most expensive markets. In San Francisco, the median household income is $104,552, 9.7 times the median home value.

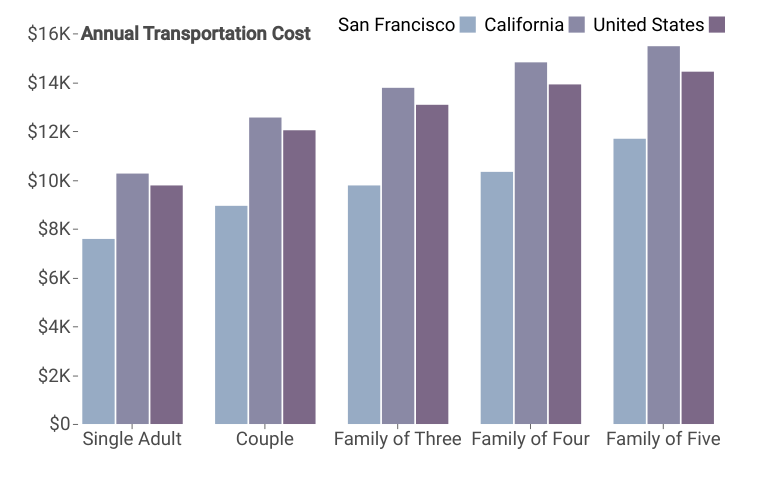

Transportation can also be a significant component of cost of living. In San Francisco, 40.20% of commuters drive to work, compared to 85.5% of commuters nationwide. An estimated 23.60% of workers commute to jobs outside of San Francisco, a smaller share than the 43.7% share of commuters nationwide who live and work in different cities. The average commute in San Francisco is 33.3 minutes long, compared to the 26.6-minute average commute nationwide. Taking into account the cost of gas, as well as public transit and car maintenance, the EPI estimates that a single person in San Francisco spends $7,569 a year on transportation, less than the national average of $9,760.

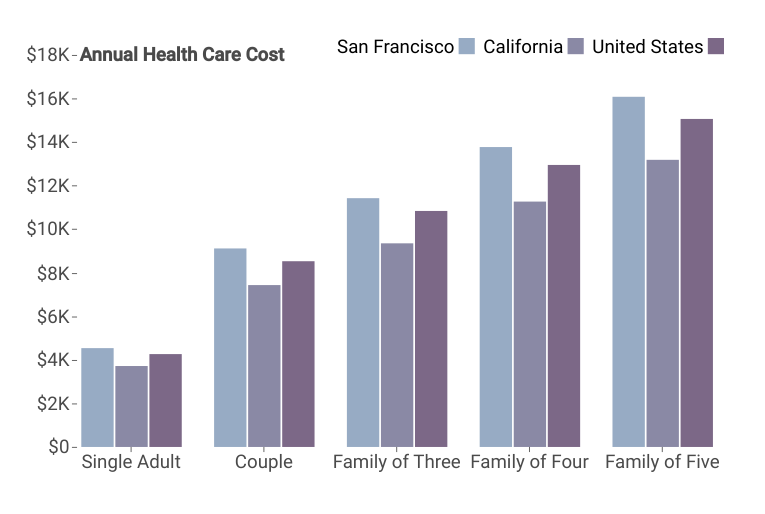

Out-of-pocket health care costs and insurance premiums — assuming at least a basic level of health insurance coverage — are slightly higher than they are on average nationwide in San Francisco and also well above what they are across California as a whole.

For a single adult living in the area, average health care costs come out to $4,550 per year, compared to an average of $3,711 across California and $4,266 nationwide.

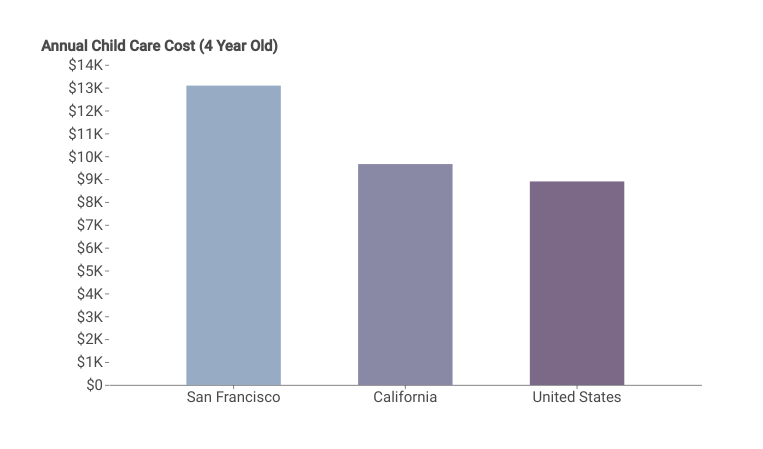

For families with children, child care adds thousands of dollars to overall annual spending. In San Francisco, the average annual cost of child care for two children — one 4 year old and one 8 year old — is $20,066, about $5,200 more than the comparable average of $14,822 across all of California. Meanwhile, across the U.S. as a whole, childcare expenses for two children averages $15,853 per year.

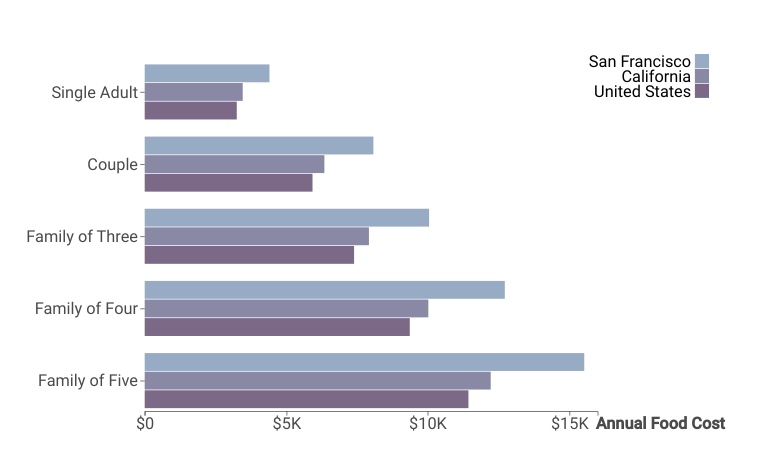

Food is another every day expense that has a significant impact on overall cost of living. Data from the U.S. Department of Agriculture shows that the cost of food varies from city to city and town to town.

In San Francisco, a single adult spends an average of $4,404 on food annually, and a family of four spends $12,720 on average. For context, average annual food expenditure across California and the U.S., respectively, are $3,468 and $3,240 for a single adult, and $10,016 and $9,354 for a family of four. These estimates are calculated for a nutritionally adequate diet of food purchased at a grocery store for at-home preparation.

Few expenses vary as much from city to city and town to town as taxes. Accounting for state and federal income taxes, as well as Social Security contributions and Medicare payroll taxes, the average adult working in San Francisco, California pays $13,931 annually — a relatively high sum compared to the the statewide average of $8,248.

It is important to note that these calculations do not include other common taxes such as property, sales, and excise taxes. Accounting for these taxes, while excluding taxes levied at the federal level, San Francisco residents live in a state with a high average tax burden. Per capita state tax collections in California total $4,424 per year, compared to the $3,151 average across all states.

To estimate the cost of housing, food, transportation, health care, child care, taxes, and other necessities, 24/7 Wall St. assigned county-level Economic Policy Institute data to cities, towns, villages and Census-designated places based on boundary definitions from the U.S. Census Bureau. For places that span multiple counties, data was aggregated based on the percentage of boundary overlap.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.