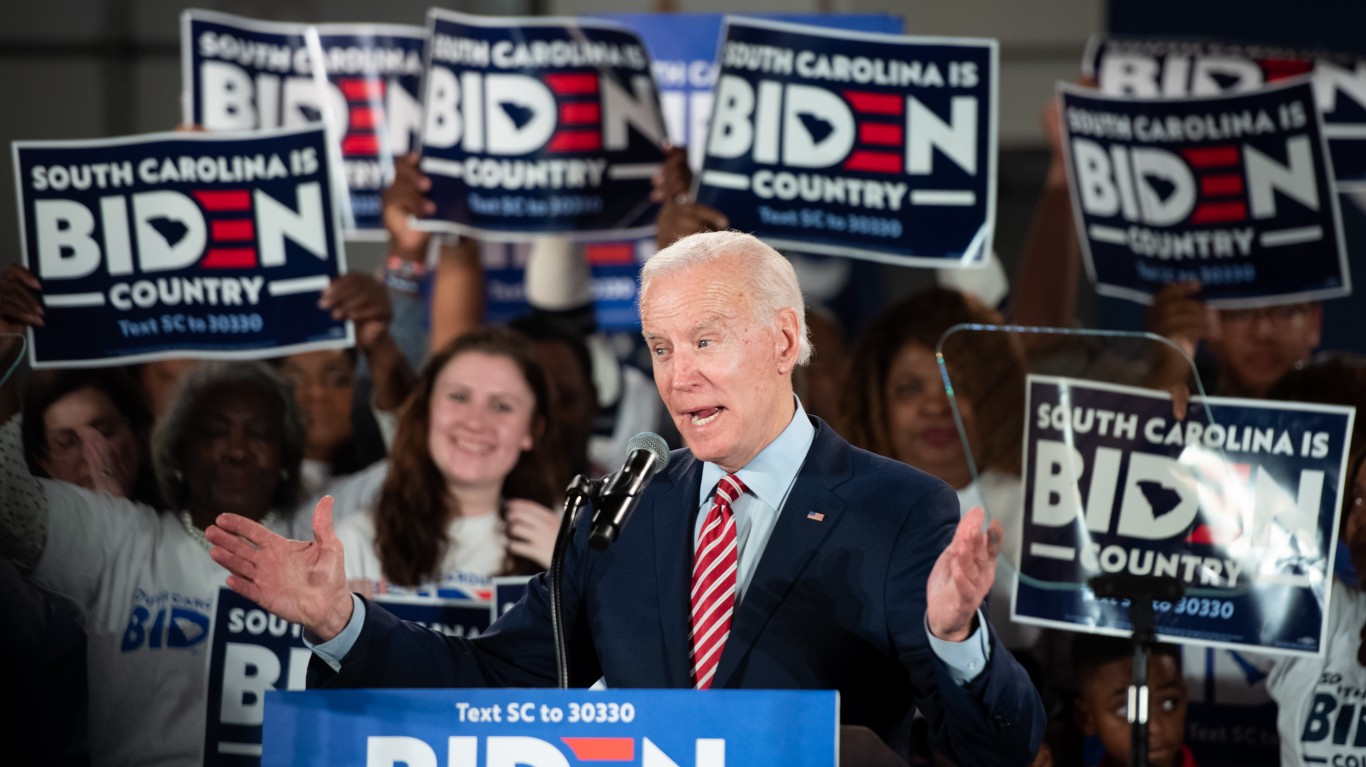

One thing we learned well in 2016 is not to trust the polls, regardless of what side you are rooting for. Just a week before the election, Hillary Clinton was considered a lock to win the presidency, but she ended up losing the electoral vote by a wide margin. Currently, the polls have former Vice President, Joe Biden, with a sizable lead over President Trump. If that holds up tomorrow, after three past tries for the highest office in the land, Biden could be sworn in as the 46th president of the United States.

[in-text-ad]

An outstanding UBS report handicaps every angle of this year’s races for president and Congress. They show the results of a blue wave with the Democrats regaining the presidency and the Senate, and they also show a red wave where Trump is reelected and the Republicans take back the house. Plus, they show the scenario if things remain the same as they are now.

To avoid a problem that we have encountered more and more in media and reporting these days, the UBS team said this as a forward to the report:

This report focuses exclusively on the investment aspect of the upcoming election. The authors are citizens and residents of the United States and, like all people around the world, hold a range of opinions and concerns about the issues of the day. You will not find those opinions in this report. Our jobs require us to be impartial observers, to view the world as it is, not as we think it should be. In line with that perspective, the objective of this report is straightforward. We aim to help investors prepare, as effectively as possible, for the US presidential election tomorrow.

Here we focus on the stocks the UBS team likes for investors to own with a Biden win. While 34 stocks make the list, we selected 10 in various sectors with solid upside potential. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

American Electric Power

This is one of the largest public utilities in the United States and is on the Merrill Lynch US 1 list of top stock picks. American Electric Power Co. Inc. (NYSE: AEP) is one of the largest electric utilities in the United States, delivering electricity to more than 5.4 million customers in 11 states.

The company ranks among the nation’s largest generators of electricity, owning nearly 38,000 megawatts of generating capacity in the United States. It also owns the nation’s largest electricity transmission system, a more than 40,000-mile network that includes more 765-kilovolt extra-high voltage transmission lines than all other U.S. transmission systems combined.

The stock was considered a good one for retiring baby boomers.

Shareholders receive a 3.30% dividend. The Wall Street consensus price target is $90.63. American Electric Power stock closed trading on Tuesday at $85.35 a share.

Apple

This technology giant has been on a roll since the sell-off, but there are some concerns on forward iPhone demand. Apple Inc. (NASDAQ: AAPL) designs, manufactures and markets consumer electronics and computers, and has developed its own proprietary iOS and Mac OS X operating systems and related software platform/ecosystem.

Revenues are derived principally from the iPhone line of smartphones, hardware sales of the Macintosh family of notebook and desktop computers, iPad tablets and iPod portable digital music players. The company also realizes revenue from software, peripherals, digital media and services.

Shareholders receive a 0.85% dividend. The consensus price target is $350.33. Apple stock closed most recently at $388.23.

Caterpillar

This large-cap leader was hit by trade worries in 2019, but it is offering a very solid entry point. Caterpillar Inc. (NYSE: CAT) is the world’s leading manufacturer of construction and mining equipment, and it is also a leading manufacturer of diesel engines and turbines for transport and industrial applications, as well as diesel-electric locomotives. Caterpillar also provides financing and related services through its Financial Products segment.

Caterpillar stock investors receive a 3.01% dividend. The $132.35 consensus price target is less than Tuesday’s close at $136.88.

Cisco

This is a mega-cap tech leader for more conservative accounts to consider. Cisco Systems Inc. (NASDAQ: CSCO) designs, manufactures and sells internet protocol (IP) based networking products and services related to the communications and information technology industry worldwide.

[in-text-ad]

It provides switching products, including fixed-configuration and modular switches, and storage products that provide connectivity to end users, workstations, IP phones, wireless access points and servers, as well as next-generation network routing products that interconnect public and private wireline and mobile networks for mobile, data, voice and video applications.

Cisco cybersecurity products give clients the scope, scale and capabilities to keep up with the complexity and volume of threats. Putting security above everything helps corporations innovate while keeping their assets safe.

Shareholders receive a 3.11% dividend. The consensus price objective is $49.19, and Cisco Systems stock closed at $46.26 on Tuesday.

Eastman Chemical

This stock has rallied smartly off the March lows and is another safe-haven for conservative accounts. Eastman Chemical Co. (NYSE: EMN) engages in the provision of specialty chemicals. It operates through the following segments.

The Additives and Functional Products segment includes chemicals for products in the transportation, consumables, building and construction, animal nutrition, crop protection, energy, personal and home care, and other markets. The Fiber segment offers cellulose acetate tow for use in filtration media, primarily cigarette filters.

The Advanced Materials segment of Eastman Chemical produces and markets its polymers, films and plastics with differentiated performance properties for value-added end uses in transportation, consumables, building and construction, durable goods, and health and wellness markets.

The Chemical Intermediates segment consists of large scale and vertical integration from the cellulose and acetyl, olefins and alkylamines streams to support operating segments with advantaged cost positions.

Eastman Chemical stock investors receive a 3.62% dividend. The $73.02 consensus target price compares with Tuesday’s close at $71.09.

Honeywell

This top industrial could be poised for a solid second half of 2020 if global growth picks up. Honeywell International Inc. (NYSE: HON) is a New Jersey-based, diversified, global technology and manufacturing company. Its operations are organized under four business groups: Aerospace, Home & Building Technologies, Safety & Productivity Solutions, and Performance Materials & Technologies.

The company is also a premier supplier of avionics, power and control systems for the aerospace industry. Last year, Jefferies analysts attended the company’s Honeywell Building Technologies Investor Showcase at the segment’s Atlanta headquarters and noted this:

HBT has improved its revenue and margin trajectory following the October 2018 spin-out of its residential business. This is being driven by management & cultural change (four of five segment leaders have been with the company for almost 2 years; President Vimal Kapur is new to HBT, coming from Honeywell’s Process Solutions segment last year). New leaders started reinvigorating products (rising vitality indexes across sub-segments).

Investors receive a 2.43% dividend. The posted consensus target is $159.15, and Honeywell International stock was last seen trading at $148.10.

Medtronic

This medical technology giant is a solid pick for investors looking for a safer position in the health care sector. Medtronic PLC (NYSE: MDT) develops, manufactures, distributes and sells device-based medical therapies to hospitals, physicians, clinicians and patients worldwide.

The company announced recently that Blackstone’s life sciences division will invest $337 million into the research and development of its diabetes device technologies. Under the terms of the agreement, Medtronic will receive funding for four diabetes programs over the next several years. Medtronic’s engineering, clinical and regulatory teams will conduct the development work for the programs.

Blackstone’s investment is sought to pull forward specific programs for its diabetes pump and continuous glucose monitoring pipeline devices that aim to address unmet patient needs. If the programs are successful, Medtronic will pay royalties that are expected to be in the low- to mid-single-digit range as a percentage of sales.

Investors receive a 2.45% dividend. The consensus price target is $110.17. Medtronic stock closed at $94.65.

NextEra Energy

With a very strong balance sheet, this company looks poised for a solid second half of 2020. NextEra Energy Inc. (NYSE: NEE) consists of two main business segments: the Florida Power & Light (FPL) regulated utility, and NextEra Energy Resources, a deregulated generator of predominantly wind, natural gas, nuclear and solar powered assets in North America. The company also holds a 65.1% share in the yieldco NextEra Energy Partners.

[in-text-ad]

FPL announced last summer a groundbreaking “30-by-30” plan to install more than 30 million solar panels by 2030 and make the state of Florida a world leader in the production of solar energy. It and NextEra Energy Resources are already the world’s largest producers of renewable energy from the wind and sun. When this plan is completed, FPL expects to be the largest utility owner and operator of solar in America.

Investors receive a very safe 2.13% dividend. NextEra Energy closed Tuesday at $262.55, above the $261.40 consensus estimate.

Nokia

This telecommunications company once ruled the cell phone arena, until the advent of the smartphone in 2007. Nokia Corp. (NYSE: NOK) owns two main businesses: 1) Nokia Networks, a network infrastructure equipment supplier to global wireless and wireline operators, and 2) Technologies, its patent/IPR licensing activities.

Last year, Nokia, NTT Docomo and Omron agreed to conduct joint field trials using 5G at their plants and other production sites. As part of the trial, Nokia will provide the enabling 5G technology and Omron the factory automation equipment, while NTT Docomo will run the 5G trial.

The trial follows the increasing demand for wireless communications at manufacturing sites driven by the need for stable connectivity between Internet of Things devices. As background noise from machines and the movement of people have the potential to interfere with wireless communications, the trial will aim to verify the reliability and stability of 5G technology deployed by conducting radio wave measurements and transmission experiments.

The $4.74 consensus target is above the latest Nokia stock closing price of $4.32 a share.

Nucor

This top steel company could continue to do very well if the economy sees some strength this year and nonresidential construction grows. Nucor Corp. (NYSE: NUE) is one of North America’s largest steel producers, with almost 27 million tons of finished steel capacity at 23 mini-mills throughout the United States. The company’s downstream steel products business includes rebar fabrication, steel joists/deck, cold finished bars, fasteners, building systems and wire mesh. Nucor also has 5 million tons of scrap processing capacity.

Nucor has always kept a very conservative balance sheet and is poised for slow but steady growth next year and beyond, especially if a huge infrastructure build-out becomes a reality. In addition, global weather catastrophes have also helped continue to drive the need for steel products.

Nucor stock investors receive a 3.92% dividend. The $61.00 consensus price target is well above Tuesday’s close at $41.06.

UBS feels these 10 stocks in a broad spectrum of sectors could do very well with a Biden victory. Despite the progressive rhetoric, it’s a pretty good bet that a more moderate Democrat like the former vice president would tend to slide toward the center after the election, as almost all politicians regardless of party tend to do. Plus at this juncture, the polls have him leading, so a win would not be the surprise the Trump victory over Clinton was in 2016.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.