CEOs are the highest ranking corporate executives — and their compensation often reflects as much. Across the 350 largest companies in the United States, the average CEO made $14.5 million in 2019. All things being equal, it would take the typical American about 400 years to earn that amount.

Not all CEOs are compensated equally however. At some of America’s largest companies, chief executives make well more than double the amount the typical CEO earns — and hundreds of times more than most of the people who work for them.

24/7 Wall St. reviewed available financial disclosures filed with the Securities and Exchange Commission by all publicly traded companies of the 100 largest U.S. companies by revenue to identify America’s highest paid CEOs. All executives on this list are ranked by their total compensation in fiscal 2019, while company revenue is listed for the most recent fiscal year. In addition to company revenue and CEO compensation, the ratio of CEO pay to the typical employee came from financial disclosures filed with the SEC. We only considered CEOs who are currently with their company. Most CEOs on this list head companies in the tech or financial services sectors.

The vast majority of working Americans are paid primarily through a wage or salary. For CEOs of major corporations, this is not the case. Typically, multi-million dollar executive compensation packages consist largely of stock options and incentives designed to reward performance. For the chief executives on this list, base salary often does not exceed $1.5 million and accounts for a relatively small share of their overall pay.

Whether or not the corporate leaders on this list are overpaid is a matter of debate. What is not, however, is that these executives are ultimately responsible for the success or failure of their business, effectively affecting the interests of thousands of employees and shareholders. Here is a look at the companies with the best and worst reputations.

Click here to see America’s highest paid CEOs.

25. Kathy J. Warden

> Company: Northrop Grumman

> Annual compensation: $19,620,379

> Company revenue: $33.8 billion

> CEO pay ratio: 177 times more than the typical employee

Kathy Warden is one of two female executives to rank on this list. Warden has been the CEO of defense contractor Northrop Grumman since Jan. 1, 2019, and was paid nearly $20 million in her first year in the role — 177 times more than the typical employee. Warden has been with the company since 2008 and held a variety of executive level positions. Before joining Northrop Grumman, Warden worked at defense contractor General Dynamics and manufacturing conglomerate General Electric.

[in-text-ad]

24. Michael Wirth

> Company: Chevron

> Annual compensation: $19,687,284

> Company revenue: $146.5 billion

> CEO pay ratio: 236 times more than the typical employee

With annual revenue of nearly $147 billion, Chevron is the second largest oil and gas company in the United States, trailing only Exxon Mobil. Michael Wirth, who has been with the company for decades, assumed the CEO role in 2018. His reported compensation was nearly $20 million in fiscal 2019.

Oil and gas companies have been hit hard during the COVID-19 pandemic. In that context, Chevron, under Wirth’s leadership, purchased struggling competitor Noble Energy for $13 billion. Chevron will take over Noble’s substantial natural gas fields in the Eastern Mediterranean, as well as its $8 billion debt load.

23. Darius E. Adamczyk

> Company: Honeywell International

> Annual compensation: $19,776,997

> Company revenue: $36.7 billion

> CEO pay ratio: 295 times more than the typical employee

Darius Adamczyk has been the CEO of industrial machinery manufacturer Honeywell International since 2017. Adamczyck, a Polish immigrant, was educated at Harvard, Michigan State, and Syracuse University and worked as an electrical engineer at GE. Before taking the top job at Honeywell, he was CEO of Metrologic, a company acquired by Honeywell in 2008.

Adamczyk’s total compensation in fiscal 2019 was $19.8 million — nearly 300 times higher than what the typical Honeywell employee earns. Though the company reported a slight dip in revenue in 2019 for the first time in at least four years, it also beat earnings estimates in each of the first three quarters of 2020.

22. David S. Taylor

> Company: Procter & Gamble

> Annual compensation: $20,498,812

> Company revenue: $71.0 billion

> CEO pay ratio: 309 times more than the typical employee

David Taylor joined Procter & Gamble in 1980 and was named CEO in 2015. The company is behind many common personal care and household product brands, including Bounty, Crest, Febreze, Gillette, Old Spice, Pampers, Puffs, and Tide. In fiscal 2019, Taylor made a reported $20.5 million.

During the COVID-19 pandemic, Taylor outlined the company’s priorities, which included ensuring the health and safety of its employees, maximizing the availability of cleaning products, and helping society at large overcome the challenges presented by the virus. P&G donated tens of millions of dollars in both products and cash to help those in need. The company has also reported a surge in sales, beating earning estimates in each quarter so far this year.

[in-text-ad-2]

21. Joseph W. Gorder

> Company: Valero Energy

> Annual compensation: $20,691,139

> Company revenue: $102.7 billion

> CEO pay ratio: 103 times more than the typical employee

Joseph Gorder made nearly $20.7 million as CEO of Texas-based oil and gas company, Valero in 2019. He was appointed CEO in 2014.

Under Gorder, Valero reported a drop in revenue in 2019 for the first time in four years. The company, however, has managed to beat earnings estimates in each of the first three quarters of 2020 — a year that has hit the oil and gas industry especially hard.

20. Mary T. Barra

> Company: General Motors

> Annual compensation: $21,327,881

> Company revenue: $137.2 billion

> CEO pay ratio: 203 times more than the typical employee

General Motors CEO Mary Barra is one of only two female CEOs to rank on this list — and the only woman to run one of the big three American automakers. Barra has been at the top of the second largest automaker in the United States since January 2014. As CEO, Barra is gearing up for the future and investing heavily in electric vehicles and self-driving cars.

Barra’s base salary stands at $2.1 million. After accounting for stock options and other awards, however, her total fiscal 2019 compensation was $21.3 million.

[in-text-ad]

19. Greg C. Garland

> Company: Phillips 66

> Annual compensation: $21,963,985

> Company revenue: $109.6 billion

> CEO pay ratio: 169 times more than the typical employee

With a reported compensation of $22.0 million in fiscal 2019, Phillips 66 CEO Greg Garland is the highest paid oil and gas executive on this list. Phillips first hired Garland in 1980 as a chemical engineer and named him CEO in 2014.

Phillips 66 is one of the five largest petroleum companies in the United States by revenue, and employs 14,500 people. Through its 13 refineries across the U.S. and Europe, the company has the capacity to process 2.2 million barrels of crude oil every day.

18. Douglas McMillon

> Company: Walmart

> Annual compensation: $22,527,249

> Company revenue: $524.0 billion

> CEO pay ratio: 1,076 times more than the typical employee

Formerly the CEO of Sam’s Club and Walmart International, Doug McMillon was named the chief executive of Walmart in 2014. McMillon began his career unloading trucks for the very company he now leads, and his bio page on Walmart’s site says he has made increasing associate wages a priority as CEO. Still, McMillon’s compensation in fiscal 2019 of $22.5 million was over 1,000 times more than what the typical employee earned — one of the most lopsided pay ratios of any of the largest U.S. companies.

With over half a trillion dollars in revenue in fiscal 2020, Walmart is the largest public company in the world by that measure. The company employs over 2.2 million people worldwide and, through its various brands, operates about 11,500 brick-and-mortar locations worldwide.

17. Kenneth C. Frazier

> Company: Merck

> Annual compensation: $22,570,328

> Company revenue: $46.8 billion

> CEO pay ratio: 246 times more than the typical employee

Kenneth C. Frazier took the top job at Merck, a New Jersey-based drug maker, in 2011. In fiscal 2019, Frazier made $22.6 million as the company’s CEO — nearly $7 million more than he made the previous year.

Merck has been active in researching COVID-19 treatments and vaccines. Over the last five years, the company has also invested $225 million in Moderna — one of only two companies so far to develop an FDA-approved COVID-19 vaccine.

[in-text-ad-2]

16. Mark Zuckerberg

> Company: Facebook

> Annual compensation: $23,415,973

> Company revenue: $70.7 billion

> CEO pay ratio: 94 times more than the typical employee

Facebook CEO Mark Zuckerberg’s official salary is only $1. However, through other forms of compensation, he was paid more than $23.4 million in fiscal 2019. Despite a multimillion dollar salary, Zuckerberg’s income is only 94 times higher than that of his typical employee. Most CEOs on this list earn several hundred times more than their workers.

Zuckerberg co-founded the social media giant in 2004 and has led the company ever since, taking it from a communication platform for his Harvard classmates to a multibillion dollar global behemoth. Facebook is currently facing antitrust charges brought on by the Federal Trade Commission and the attorneys general of most states. The suit aims to break Facebook up and alleges that the company has been abusing its dominance in the social media sector and engaging in anti-competitive behavior that ultimately hurts the consumer.

15. Larry Culp

> Company: General Electric

> Annual compensation: $23,584,600

> Company revenue: $95.2 billion

> CEO pay ratio: 486 times more than the typical employee

Larry Culp is the third CEO of General Electric since the late Jack Welch left the top job in 2001 — and the first chief executive in GE’s history to be hired from a different company. Formerly the CEO of industrial company Danaher, Culp was named CEO of the troubled conglomerate in 2018 following the ousting of John Flannery. In fiscal 2019, Culp was compensated $23.6 million, and if he can turn GE’s fortunes around following the devastation of its jet engine business caused by the COVID-19 pandemic, he stands to earn a lot more.

GE’s board recently extended Culp’s contract to last at least until August 2024, and if he can meet the stock price target of $16.67 in that period, he stands to earn as much as $230 million. The company’s stock is currently trading at around $11 a share.

[in-text-ad]

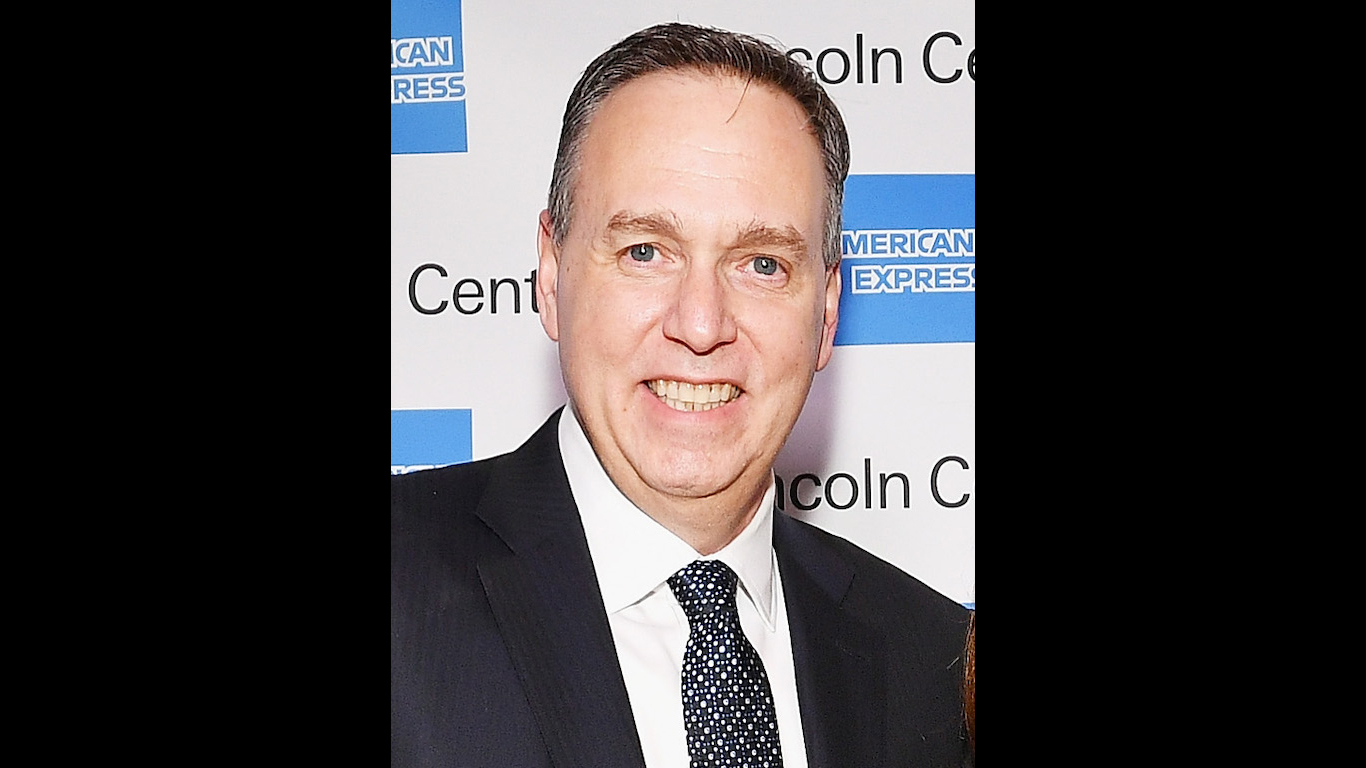

14. Stephen J. Squeri

> Company: American Express

> Annual compensation: $23,712,017

> Company revenue: $47.0 billion

> CEO pay ratio: 367 times more than the typical employee

Stephen Squeri began working for financial services company American Express in 1985 and, after rising through the ranks, took over as CEO in February 2018. In fiscal 2019, the most recent pay period the company has on file with the SEC, Squeri’s compensation totalled $23.7 million — up from $17.3 million the previous year. Though his base salary climbed by a modest $13,500 over that period, the value of his stock options nearly doubled, from just under $6 million to more than $10 million.

13. David M. Solomon

> Company: Goldman Sachs Group

> Annual compensation: $24,657,441

> Company revenue: $53.9 billion

> CEO pay ratio: 178 times more than the typical employee

As CEO of investment bank Goldman Sachs, David Solomon made nearly $25 million in fiscal 2019. Despite his eight-figure compensation, Solomon, who has served as the bank’s chief executive since October 2018, rides the subway to work, buys his own coffee, and often DJs at nightclubs on the weekend. Due in large part to bonuses, Solomon’s salary was about 20% higher in fiscal 2019 than it was the previous year.

12. Brian T. Moynihan

> Company: Bank of America

> Annual compensation: $25,406,963

> Company revenue: $113.6 billion

> CEO pay ratio: 276 times more than the typical employee

Bank of American CEO Brian Moynihan is one of several finance executives to report compensation in excess of $25 million in fiscal 2019.

Moynihan joined Bank of America in 2004 and was appointed CEO in 2010. When he took the top job, many were skeptical because of his relative lack of experience — especially at a time when the bank was still under investigation for its role in the 2008 financial crisis and after having only recently paid back the $45 billion federal bailout money it owed. For his leadership over the last decade — which was a tumultuous one for the financial services sector — Moynihan was chosen by a selection of other chief executives as CEO of the year in Chief Executive magazine.

[in-text-ad-2]

11. Michael Corbat

> Company: Citigroup

> Annual compensation: $25,503,915

> Company revenue: $103.4 billion

> CEO pay ratio: 482 times more than the typical employee

Citigroup CEO Michael Corbat was paid $25.5 million in fiscal 2019. Corbat has held the position since 2012. At $1.5 million, Corbat’s base salary accounts for a relatively small share of his total compensation. His stock options accounted for $17.2 million of his compensation in fiscal 2019.

Citigroup is one of the largest banking institutions in the United States by total assets. There are over 2,300 branch locations worldwide, serving 200 million customer accounts. The company beat earnings estimates in each of the last four quarters.

10. Charles Robbins

> Company: Cisco Systems

> Annual compensation: $25,829,833

> Company revenue: $49.3 billion

> CEO pay ratio: 182 times more than the typical employee

Cisco Systems CEO Charles H. Robbins, whose total compensation was $25.8 million in fiscal 2019, is one of several tech executives to rank on this list. Robbins has been with the company for over two decades and took over the top job on July 26, 2015.

Robbins is one of a handful of CEOs on this list who also has a salary listed for fiscal 2020 — and this year, his compensation slipped to $23.2 million. Though his salary and stock options increased in 2020, that was offset by a more than 50% decline in incentive pay. Cisco reported a 5% revenue decline in fiscal 2020 compared to fiscal 2019.

[in-text-ad]

9. Michael F. Neidorff

> Company: Centene

> Annual compensation: $26,438,425

> Company revenue: $74.6 billion

> CEO pay ratio: 383 times more than the typical employee

Michael Neidorff earned a reported $26.4 million in fiscal 2019 as CEO of Centene, a health care company that provides services to uninsured and underinsured individuals, largely through government subsidized programs. During the COVID-19 pandemic, Centene expanded efforts to combat food insecurity for vulnerable Americans, expanded its telehealth program, and offered additional mental health resources.

One of the longest serving CEOs on this list, Neidorff has had the top job at Centene since 1996. During Neidorff’s tenure, the company has expanded operations from just Wisconsin and Indiana to all 50 states.

8. Brian L. Roberts

> Company: Comcast

> Annual compensation: $28,809,952

> Company revenue: $108.9 billion

> CEO pay ratio: 461 times more than the typical employee

In his role as the CEO of media giant Comcast, Brian Roberts was compensated over $28.8 million in fiscal 2019. Comcast was founded by Roberts’s father, and the future executive began his first internship there at age 15. The company has grown considerably under Roberts’s leadership, acquiring AT&T, NBCUniversal, Dreamworks, and Sky.

7. James Dimon

> Company: JPMorgan Chase

> Annual compensation: $31,578,246

> Company revenue: $142.4 billion

> CEO pay ratio: 393 times more than the typical employee

JPMorgan CEO Jamie Dimon is one of the most high profile executives on Wall Street. He is also one of the most highly compensated, earning a reported $31.6 million in fiscal 2019. Dimon has held the top job at one of the world’s largest investment banks for 15 years — a period that has included the subprime mortgage crisis and some of the most turbulent years in American finance.

[in-text-ad-2]

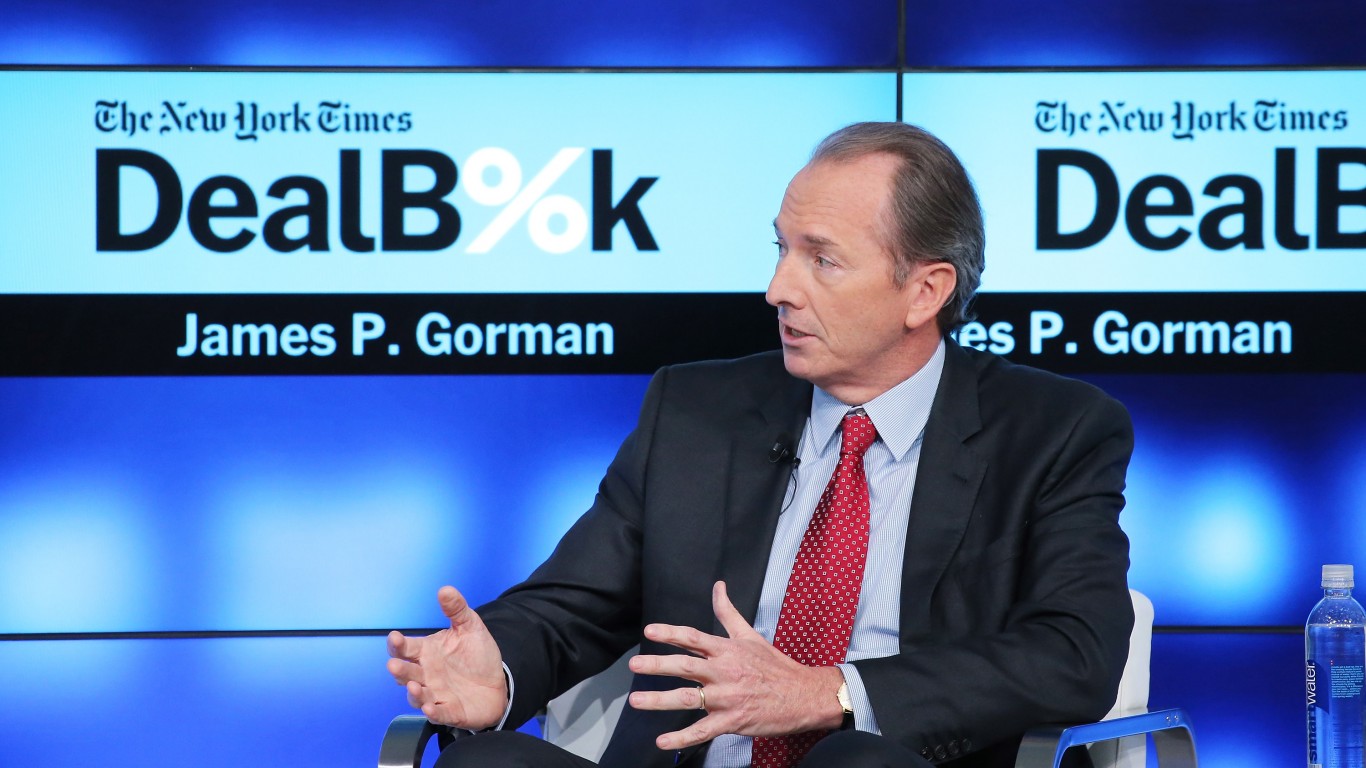

6. James P. Gorman

> Company: Morgan Stanley

> Annual compensation: $31,624,470

> Company revenue: $53.8 billion

> CEO pay ratio: 248 times more than the typical employee

James Gorman assumed the CEO role at investment bank Morgan Stanley in January 2010. Though Gorman’s base salary is $1.5 million, through bonuses and stock options, his total compensation in fiscal 2019 topped $31.6 million. Gorman was hired by Morgan Stanley in 2006 after working for financial services company Merrill Lynch and consulting firm McKinsey & Co.

Though Morgan Stanley is a much smaller bank in terms of market value than the other firms such as JPMorgan or Goldman Sachs, its stock has outperformed its Wall Street peers in the past year, appreciating by over 30% — more than double either competitor. Partially as a result, Gorman’s stock awards in fiscal 2019 were worth over twice as much as they were two years prior.

5. Charles W. Scharf

> Company: Wells Fargo

> Annual compensation: $34,286,574

> Company revenue: $103.9 billion

> CEO pay ratio: 550 times more than the typical employee

Charles Scharf took over as CEO of Wells Fargo in October 2019 — a time when the bank was struggling to recover from multiple scandals. The bank was accused of creating millions of fake accounts to boost sales figures and of charging auto loan customers for insurance they did not need without their knowledge. The wrongdoings were uncovered over several years beginning in 2016 and resulted in the ousting of former CEO John Stumpf and over a billion dollars in fines and penalties.

Scharf, a former executive of Visa, has a proven track record in the industry and has drawn top dollar to restore Wells Fargo’s reputation. He is the only CEO in finance on this list who was paid more than $30 million in fiscal 2019.

[in-text-ad]

4. Larry J. Merlo

> Company: CVS Health

> Annual compensation: $36,451,749

> Company revenue: $256.8 billion

> CEO pay ratio: 790 times more than the typical employee

Larry Merlo took over as president and CEO of CVS Health in 2011. One of the largest companies in the world, CVS Health has nearly 10,000 retail locations and 1,100 walk-in clinics and over 100 million pharmacy plan members.

Since his father passed away from cancer tied to tobacco use, Merlo has been a staunch anti-tobacco advocate. Under his leadership, CVS retail locations stopped selling tobacco products. Merlo has also been criticized for understaffing CVS locations and not prioritizing employee welfare.

3. Satya Nadella

> Company: Microsoft

> Annual compensation: $42,910,215

> Company revenue: $143.0 billion

> CEO pay ratio: 249 times more than the typical employee

Microsoft CEO Satya Nadella made $42.9 million in the 2019 fiscal year, more than all but two other CEOs of the 100 largest companies in the United States and 66% more than he made the year before. The increase was largely attributable to the value of stock options he was awarded. In the last two years, Microsoft’s share price has more than doubled.

Nadella joined Microsoft in 1992 and took over as CEO in 2014. Microsoft has already filed its financial disclosures for fiscal 2020, and for that year, Nadella made a reported $44.3 million.

2. Robert Swan

> Company: Intel

> Annual compensation: $66,935,100

> Company revenue: $72.0 billion

> CEO pay ratio: 695 times more than the typical employee

Intel CEO Robert Swan is the second highest paid executive in the United States. On top of a base salary of $1.2 million, Swan took home an additional $62 million in stock awards and $3.7 million in incentives. Swan took over as Intel’s CEO on Jan. 31 2019. Before being the top pick, Swan acted as the company’s interim CEO for seven months and was chief financial officer before that.

With Swan at the helm, Intel’s share price has been volatile, though the company is trading up about 4%. In each of the last four quarters, Intel has either met or beat earnings estimates.

[in-text-ad-2]

1. Sundar Pichai

> Company: Alphabet

> Annual compensation: $280,621,552

> Company revenue: $161.9 billion

> CEO pay ratio: 1,085 times more than the typical employee

As CEO of Google’s parent company Alphabet, Sundar Pichai’s compensation in fiscal 2019 totaled $280.6 million — by far the most of any CEO of one of the largest public American companies. The vast majority of that money — about $277 million — came in the form of stock awards that were tied to Pichai’s recent promotion. Pichai, who had been CEO of the company’s subsidiary Google since 2015, was named CEO of Alphabet in December 2019. The value of his stock options eclipsed his base salary of $650,000. Larry Page, the previous CEO of Alphabet and the company’s co-founder, had a base salary of just $1 that year.

Google is currently facing several antitrust lawsuits, including one brought on by nearly 40 U.S. states and territories, alleging that the tech giant has an illegal monopoly on search.

Credit Card Companies Are Doing Something Nuts

Credit card companies are at war. The biggest issuers are handing out free rewards and benefits to win the best customers.

It’s possible to find cards paying unlimited 1.5%, 2%, and even more today. That’s free money for qualified borrowers, and the type of thing that would be crazy to pass up. Those rewards can add up to thousands of dollars every year in free money, and include other benefits as well.

We’ve assembled some of the best credit cards for users today. Don’t miss these offers because they won’t be this good forever.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.