Special Report

25 Companies Making the Most Money From Coronavirus

Published:

As states are dealing with new, more contagious strains of COVID-19, vaccine distribution has also been an issue; with seniors across the U.S. struggling to get their recommended doses.

In these unprecedented times, however, the news is not all bad. There are plenty of companies that have done well in 2020 and continuing into 2021, as the venerable stock index continues to set record highs in the face of a pandemic. And while that does have plenty of veteran market watchers scratching their heads, the fact remains that many investors are making money even as America continues to grapple with a generational crisis.

So which companies appear to be capitalizing on uncertain times? Take a look at how these stocks performed in 2020.

GoBankingRates is a 24/7 Wall St. content partner offering articles that help readers learn about money and better manage their finances. Its content is produced independently of 24/7 Wall St.

Click here to see the 25 companies making the most money from coronavirus.

25. Regeneron Pharmaceuticals (REGN)

> Dec. 31, 2019, closing price: $373.35

> Aug. 18 closing price: $557.19

> Percentage gain: 49.2%

[in-text-ad]

24. Thermo Fisher Scientific Inc. (TMO)

> Jan. 2 closing price: $326.37

> Nov. 3 closing price: $491.50

> Percentage gain: 50.6%

ALSO READ: Companies That Pivoted Quickly To Meet Pandemic Demands

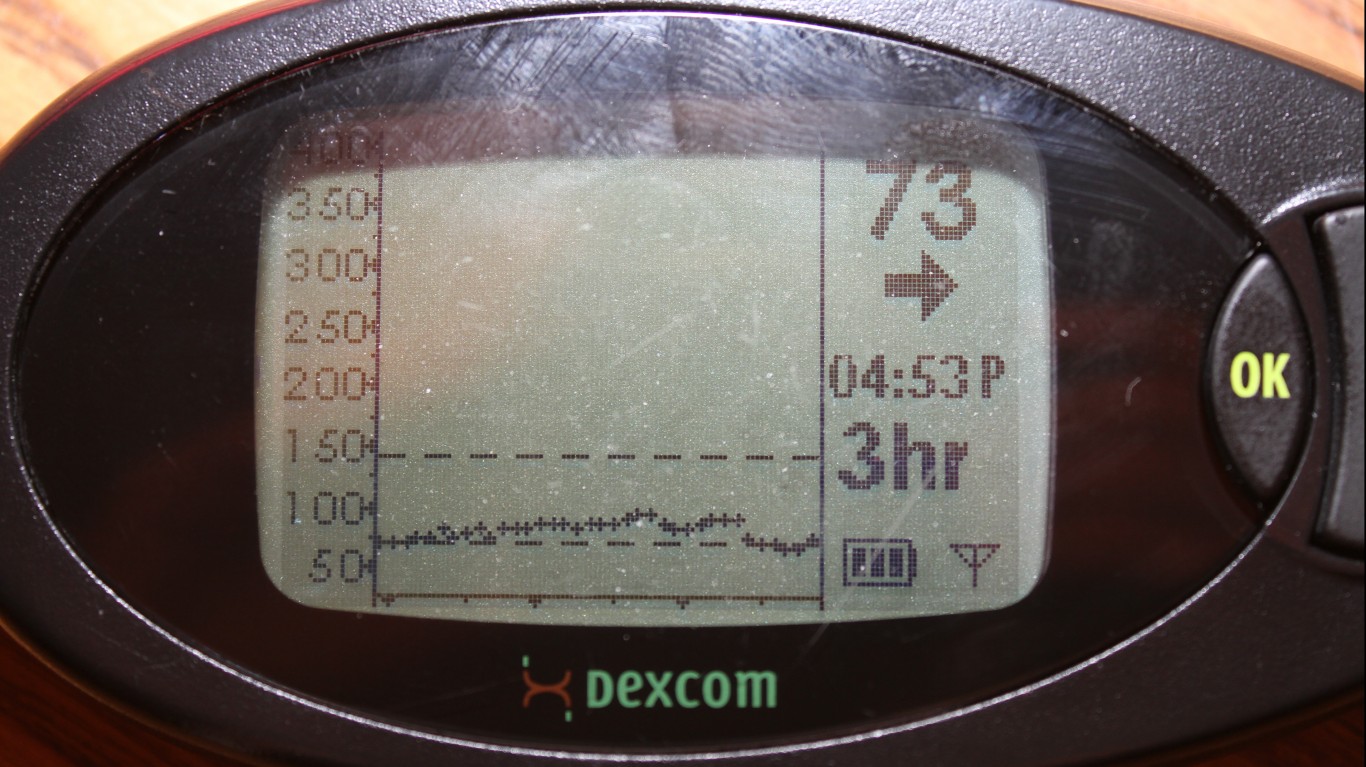

23. Dexcom (DXCM)

> Jan. 2 closing price: $219.38

> Nov. 3 closing price: $331.77

> Percentage gain: 51.2%

22. Danaher Corp. (DHR)

> Jan. 2 closing price: $155.11

> Nov. 3 closing price: $234.76

> Percentage gain: 51.3%

[in-text-ad-2]

21. Newmont Mining Corp. (NEM)

> Jan. 2 closing price: $43.22

> Nov. 3 closing price: $66.67

> Percentage gain: 54.3%

20. Abiomed Inc. (ABMD)

> Jan. 2 closing price: $168.81

> Nov. 3 closing price: $260.80

> Percentage gain: 54.5%

[in-text-ad]

19. Old Dominion Freight Line Inc. (ODFL)

> Jan. 2 closing price: $128.02

> Nov. 3 closing price: $198.14

> Percentage gain: 54.8%

ALSO READ: What’s Next for Disney and Other Big Companies in 2021

18. Synopsys Inc. (SNPS)

> Jan. 2 closing price: $142.87

> Nov. 3 closing price: $221.74

> Percentage gain: 55.2%

17. Adv Micro Devices (AMD)

> Jan. 2 closing price: $49.10

> Nov. 3 closing price: $76.58

> Percentage gain: 56.0%

[in-text-ad-2]

16. Cadence Design Sys. (CDNS)

> Jan. 2 closing price: $71.44

> Nov. 3 closing price: $113.59

> Percentage gain: 59.0%

15. Amazon.com Inc. (AMZN)

> Jan. 2 closing price: $1898.01

> Nov. 3 closing price: $3048.41

> Percentage gain: 60.6%

[in-text-ad]

14. Bio-Rad Laboratories (BIO)

> Jan. 2 closing price: $372.16

> Nov. 3 closing price: $601.57

> Percentage gain: 61.6%

ALSO READ: 30 Major Companies Giving Back During COVID-19

13. Paypal Holdings (PYPL)

> Jan. 2 closing price: $110.75

> Nov. 3 closing price: $179.81

> Percentage gain: 62.4%

12. Quanta Services (PWR)

> Jan. 2 closing price: $41.09

> Nov. 3 closing price: $67.32

> Percentage gain: 63.8%

[in-text-ad-2]

11. Align Technology (ALGN)

> Jan. 2 closing price: $283.68

> Nov. 3 closing price: $465.01

> Percentage gain: 63.9%

10. Servicenow Inc. (NOW)

> Jan. 2 closing price: $291.24

> Nov. 3 closing price: $480.05

> Percentage gain: 64.8%

[in-text-ad]

9. Idexx Laboratories (IDXX)

> Jan. 2 closing price: $265.02

> Nov. 3 closing price: $444.10

> Percentage gain: 67.6%

ALSO READ: The Most-Loved Company in Every State

8. Catalent Inc. (CTLT)

> Jan. 2 closing price: $56.60

> Nov. 3 closing price: $95.51

> Percentage gain: 68.8%

7. Pool Corp. (POOL)

> Jan. 2 closing price: $213.81

> Nov. 3 closing price: $364.18

> Percentage gain: 70.3%

[in-text-ad-2]

6. Fedex Corp. (FDX)

> Jan. 2 closing price: $155.10

> Nov. 3 closing price: $274.48

> Percentage gain: 77.0%

5. Rollins Inc. (ROL)

> Jan. 2 closing price: $33.34

> Nov. 3 closing price: $59.42

> Percentage gain: 78.2%

[in-text-ad]

4. West Pharmaceutical Services (WST)

> Jan. 2 closing price: $151.74

> Nov. 3 closing price: $277.03

> Percentage gain: 82.6%

ALSO READ: 14 Famous Companies That Aren’t Profitable

3. L Brands Inc. (LB)

> Jan. 2 closing price: $17.49

> Nov. 3 closing price: $33.73

> Percentage gain: 92.9%

2. Nvidia Corp. (NVDA)

> Jan. 2 closing price: $239.91

> Nov. 3 closing price: $520.78

> Percentage gain: 117.1%

[in-text-ad-2]

1. Etsy Inc. (ETSY)

> Jan. 2 closing price: $45.19

> Nov. 3 closing price: $130.45

> Percentage gain: 188.7%

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.