The effects of COVID-19 on American workers — unemployment, reduced incomes, and even a falling into poverty for many — are all too familiar in many parts of the United States. And some parts, especially small towns and cities, have been devastated by deindustrialization and job losses for decades. In these places, incomes are generally low, poverty rates are high, and many residents depend on government assistance to afford basic necessities.

In nearly every state, even relatively wealthy states, there is at least one town where incomes are far lower than the median nationwide. To identify the poorest town in every state, 24/7 Wall St. reviewed the median annual household income in cities, towns, villages, and Census designated places with populations of at least 1,000 and less than 25,000.

Even with an upper population limit of 25,000, most of the places on this list are quite small, with fewer than 5,000 residents.

The factor that has one of the strongest correlations with income in the United States is education. Americans with a bachelor’s degree are far less likely to be unemployed or earn lower incomes than Americans with lower levels of education. Nationwide, 31.5% of adults have a bachelor’s degree. In the vast majority of places on this list, less than 20% of adults do. Incomes also tend to correlate with other factors, such as home values and poverty. The towns on this list tend to have very low median home values and very high poverty rates.

Click here to see the poorest town in every state.

Click here to see our methodology.

Alabama: Ashland

> Median household income: $19,154 (Alabama: $50,536)

> Adults with at least a bachelor’s degree: 9.1% (Alabama: 25.5%)

> Poverty rate: 41.7% (Alabama: 16.7%)

> Median home value: $87,900 (Alabama: $142,700)

> Population: 1,447

[in-text-ad]

Alaska: Hooper Bay

> Median household income: $36,250 (Alaska: $77,640)

> Adults with at least a bachelor’s degree: 2.2% (Alaska: 29.6%)

> Poverty rate: 40.9% (Alaska: 10.7%)

> Median home value: $60,000 (Alaska: $270,400)

> Population: 1,141

ALSO READ: The US Cities Where Home Values Are Falling the Fastest

Arizona: Cibecue

> Median household income: $15,417 (Arizona: $58,945)

> Adults with at least a bachelor’s degree: 2.6% (Arizona: 29.5%)

> Poverty rate: 66.1% (Arizona: 15.1%)

> Median home value: $59,700 (Arizona: $225,500)

> Population: 2,173

Arkansas: Marianna

> Median household income: $17,156 (Arkansas: $47,597)

> Adults with at least a bachelor’s degree: 8.2% (Arkansas: 23.0%)

> Poverty rate: 32.3% (Arkansas: 17.0%)

> Median home value: $68,500 (Arkansas: $127,800)

> Population: 3,575

[in-text-ad-2]

California: Oasis

> Median household income: $19,457 (California: $75,235)

> Adults with at least a bachelor’s degree: 3.0% (California: 33.9%)

> Poverty rate: 51.8% (California: 13.4%)

> Median home value: N/A (California: $505,000)

> Population: 2,857

ALSO READ: States Where People Struggle Most With Student Debt

Colorado: Las Animas

> Median household income: $23,456 (Colorado: $72,331)

> Adults with at least a bachelor’s degree: 12.3% (Colorado: 40.9%)

> Poverty rate: 41.0% (Colorado: 10.3%)

> Median home value: $52,600 (Colorado: $343,300)

> Population: 2,269

[in-text-ad]

Connecticut: Canaan

> Median household income: $36,532 (Connecticut: $78,444)

> Adults with at least a bachelor’s degree: 16.6% (Connecticut: 39.3%)

> Poverty rate: 17.7% (Connecticut: 9.9%)

> Median home value: $170,300 (Connecticut: $275,400)

> Population: 1,050

ALSO READ: States Where People Are Struggling With the Most Debt

Delaware: Newport

> Median household income: $36,071 (Delaware: $68,287)

> Adults with at least a bachelor’s degree: 10.9% (Delaware: 32.0%)

> Poverty rate: 40.3% (Delaware: 11.8%)

> Median home value: $210,800 (Delaware: $251,100)

> Population: 1,182

Florida: Goulding

> Median household income: $21,053 (Florida: $55,660)

> Adults with at least a bachelor’s degree: 4.3% (Florida: 29.9%)

> Poverty rate: 32.7% (Florida: 14.0%)

> Median home value: $82,600 (Florida: $215,300)

> Population: 4,036

[in-text-ad-2]

Georgia: Royston

> Median household income: $21,125 (Georgia: $58,700)

> Adults with at least a bachelor’s degree: 13.8% (Georgia: 31.3%)

> Poverty rate: 35.3% (Georgia: 15.1%)

> Median home value: $99,700 (Georgia: $176,000)

> Population: 2,777

ALSO READ: The Best and Worst States for Retirees

Hawaii: Hawaiian Ocean View

> Median household income: $15,654 (Hawaii: $81,275)

> Adults with at least a bachelor’s degree: 14.7% (Hawaii: 33.0%)

> Poverty rate: 55.2% (Hawaii: 9.4%)

> Median home value: $135,000 (Hawaii: $615,300)

> Population: 5,011

[in-text-ad]

Idaho: Glenns Ferry

> Median household income: $27,583 (Idaho: $55,785)

> Adults with at least a bachelor’s degree: 11.7% (Idaho: 27.6%)

> Poverty rate: 39.1% (Idaho: 13.1%)

> Median home value: $103,000 (Idaho: $212,300)

> Population: 1,226

ALSO READ: Cities Where Home Values Are Rising the Fastest

Illinois: Centreville

> Median household income: $21,370 (Illinois: $65,886)

> Adults with at least a bachelor’s degree: 7.8% (Illinois: 34.7%)

> Poverty rate: 42.1% (Illinois: 12.5%)

> Median home value: $47,900 (Illinois: $194,500)

> Population: 4,999

Indiana: Cannelton

> Median household income: $28,922 (Indiana: $56,303)

> Adults with at least a bachelor’s degree: 7.0% (Indiana: 26.5%)

> Poverty rate: 30.8% (Indiana: 13.4%)

> Median home value: $65,200 (Indiana: $141,700)

> Population: 1,470

[in-text-ad-2]

Iowa: Centerville

> Median household income: $34,805 (Iowa: $60,523)

> Adults with at least a bachelor’s degree: 16.4% (Iowa: 28.6%)

> Poverty rate: 22.6% (Iowa: 11.5%)

> Median home value: $68,400 (Iowa: $147,800)

> Population: 5,458

ALSO READ: This County Has the Cheapest Homes in America

Kansas: Oaklawn-Sunview

> Median household income: $28,601 (Kansas: $59,597)

> Adults with at least a bachelor’s degree: 5.4% (Kansas: 33.4%)

> Poverty rate: 20.5% (Kansas: 12.0%)

> Median home value: $46,900 (Kansas: $151,900)

> Population: 3,441

[in-text-ad]

Kentucky: Vanceburg

> Median household income: $17,197 (Kentucky: $50,589)

> Adults with at least a bachelor’s degree: 3.7% (Kentucky: 24.2%)

> Poverty rate: 44.1% (Kentucky: 17.3%)

> Median home value: $57,100 (Kentucky: $141,000)

> Population: 1,462

ALSO READ: 28 Smart Ways to Make Extra Money

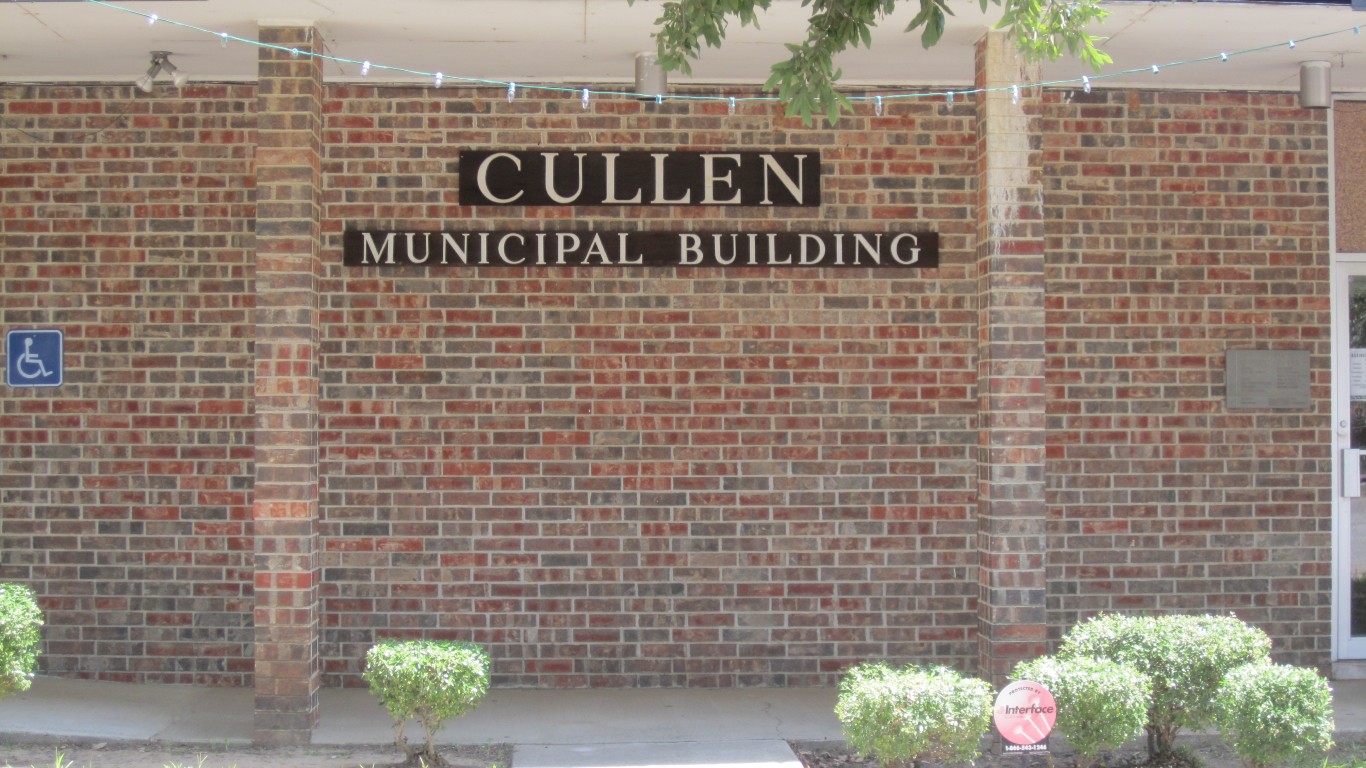

Louisiana: Cullen

> Median household income: $16,108 (Louisiana: $49,469)

> Adults with at least a bachelor’s degree: 5.3% (Louisiana: 24.1%)

> Poverty rate: 52.7% (Louisiana: 19.2%)

> Median home value: $43,200 (Louisiana: $163,100)

> Population: 1,131

Maine: Waldoboro

> Median household income: $16,932 (Maine: $57,918)

> Adults with at least a bachelor’s degree: 19.6% (Maine: 31.8%)

> Poverty rate: 38.8% (Maine: 11.8%)

> Median home value: $180,300 (Maine: $190,400)

> Population: 1,295

[in-text-ad-2]

Maryland: Crisfield

> Median household income: $29,688 (Maryland: $84,805)

> Adults with at least a bachelor’s degree: 10.1% (Maryland: 40.2%)

> Poverty rate: 35.5% (Maryland: 9.2%)

> Median home value: $107,700 (Maryland: $314,800)

> Population: 2,601

ALSO READ: States Spending the Most and Least on Gambling

Massachusetts: Turners Falls

> Median household income: $38,899 (Massachusetts: $81,215)

> Adults with at least a bachelor’s degree: 25.7% (Massachusetts: 43.7%)

> Poverty rate: 12.7% (Massachusetts: 10.3%)

> Median home value: $205,600 (Massachusetts: $381,600)

> Population: 4,010

[in-text-ad]

Michigan: Baldwin

> Median household income: $16,146 (Michigan: $57,144)

> Adults with at least a bachelor’s degree: 3.5% (Michigan: 29.1%)

> Poverty rate: 54.2% (Michigan: 14.4%)

> Median home value: $62,100 (Michigan: $154,900)

> Population: 1,149

ALSO READ: How Much Home You Can Buy for 200K in Every State

Minnesota: Baudette

> Median household income: $30,132 (Minnesota: $71,306)

> Adults with at least a bachelor’s degree: 16.9% (Minnesota: 36.1%)

> Poverty rate: 19.2% (Minnesota: 9.7%)

> Median home value: $94,200 (Minnesota: $223,900)

> Population: 1,030

Mississippi: Tchula

> Median household income: $14,489 (Mississippi: $45,081)

> Adults with at least a bachelor’s degree: 4.1% (Mississippi: 22.0%)

> Poverty rate: 54.1% (Mississippi: 20.3%)

> Median home value: $58,200 (Mississippi: $119,000)

> Population: 1,924

[in-text-ad-2]

Missouri: Winona

> Median household income: $21,750 (Missouri: $55,461)

> Adults with at least a bachelor’s degree: 10.7% (Missouri: 29.2%)

> Poverty rate: 35.1% (Missouri: 13.7%)

> Median home value: $51,700 (Missouri: $157,200)

> Population: 1,284

ALSO READ: States With the Largest Average Tax Refund

Montana: South Browning

> Median household income: $17,450 (Montana: $54,970)

> Adults with at least a bachelor’s degree: 18.6% (Montana: 32.0%)

> Poverty rate: 44.8% (Montana: 13.1%)

> Median home value: $72,500 (Montana: $230,600)

> Population: 1,600

[in-text-ad]

Nebraska: Terrytown

> Median household income: $36,875 (Nebraska: $61,439)

> Adults with at least a bachelor’s degree: 6.8% (Nebraska: 31.9%)

> Poverty rate: 28.4% (Nebraska: 11.1%)

> Median home value: $79,800 (Nebraska: $155,800)

> Population: 1,195

ALSO READ: The Value of a Dollar in Every State

Nevada: Schurz

> Median household income: $30,119 (Nevada: $60,365)

> Adults with at least a bachelor’s degree: 5.8% (Nevada: 24.7%)

> Poverty rate: 47.1% (Nevada: 13.1%)

> Median home value: $46,900 (Nevada: $267,900)

> Population: 1,026

New Hampshire: Ashland

> Median household income: $32,333 (New Hampshire: $76,768)

> Adults with at least a bachelor’s degree: 25.7% (New Hampshire: 37.0%)

> Poverty rate: 22.7% (New Hampshire: 7.6%)

> Median home value: $164,900 (New Hampshire: $261,700)

> Population: 1,363

[in-text-ad-2]

New Jersey: Salem

> Median household income: $24,926 (New Jersey: $82,545)

> Adults with at least a bachelor’s degree: 7.2% (New Jersey: 39.7%)

> Poverty rate: 42.2% (New Jersey: 10.0%)

> Median home value: $82,500 (New Jersey: $335,600)

> Population: 4,781

ALSO READ: 30 Richest Americans Of All Time

New Mexico: Navajo

> Median household income: $21,500 (New Mexico: $49,754)

> Adults with at least a bachelor’s degree: 3.8% (New Mexico: 27.3%)

> Poverty rate: 63.0% (New Mexico: 19.1%)

> Median home value: N/A (New Mexico: $171,400)

> Population: 1,450

[in-text-ad]

New York: Kaser

> Median household income: $21,541 (New York: $68,486)

> Adults with at least a bachelor’s degree: 3.8% (New York: 36.6%)

> Poverty rate: 70.8% (New York: 14.1%)

> Median home value: $1,080,900 (New York: $313,700)

> Population: 5,262

ALSO READ: States Paying Teachers Most and Least

North Carolina: Plymouth

> Median household income: $18,490 (North Carolina: $54,602)

> Adults with at least a bachelor’s degree: 5.9% (North Carolina: 31.3%)

> Poverty rate: 40.2% (North Carolina: 14.7%)

> Median home value: $86,900 (North Carolina: $172,500)

> Population: 3,478

North Dakota: Fort Totten

> Median household income: $22,917 (North Dakota: $64,894)

> Adults with at least a bachelor’s degree: 2.0% (North Dakota: 30.0%)

> Poverty rate: 66.3% (North Dakota: 10.7%)

> Median home value: $54,800 (North Dakota: $193,900)

> Population: 1,247

[in-text-ad-2]

Ohio: East Cleveland

> Median household income: $20,743 (Ohio: $56,602)

> Adults with at least a bachelor’s degree: 12.4% (Ohio: 28.3%)

> Poverty rate: 37.5% (Ohio: 14.0%)

> Median home value: $58,100 (Ohio: $145,700)

> Population: 17,200

ALSO READ: The Largest Employer in Every State

Oklahoma: Hugo

> Median household income: $25,212 (Oklahoma: $52,919)

> Adults with at least a bachelor’s degree: 11.4% (Oklahoma: 25.5%)

> Poverty rate: 42.8% (Oklahoma: 15.7%)

> Median home value: $67,400 (Oklahoma: $136,800)

> Population: 5,142

[in-text-ad]

Oregon: Cave Junction

> Median household income: $26,250 (Oregon: $62,818)

> Adults with at least a bachelor’s degree: 11.9% (Oregon: 33.7%)

> Poverty rate: 42.4% (Oregon: 13.2%)

> Median home value: $167,400 (Oregon: $312,200)

> Population: 2,479

ALSO READ: The City in Every State With the Most Billionaires

Pennsylvania: Shinglehouse

> Median household income: $21,786 (Pennsylvania: $61,744)

> Adults with at least a bachelor’s degree: 8.9% (Pennsylvania: 31.4%)

> Poverty rate: 32.6% (Pennsylvania: 12.4%)

> Median home value: $76,000 (Pennsylvania: $180,200)

> Population: 1,073

Rhode Island: Central Falls

> Median household income: $32,982 (Rhode Island: $67,167)

> Adults with at least a bachelor’s degree: 8.1% (Rhode Island: 34.2%)

> Poverty rate: 30.2% (Rhode Island: 12.4%)

> Median home value: $159,100 (Rhode Island: $261,900)

> Population: 19,429

[in-text-ad-2]

South Carolina: Blacksburg

> Median household income: $19,219 (South Carolina: $53,199)

> Adults with at least a bachelor’s degree: 10.7% (South Carolina: 28.1%)

> Poverty rate: 32.4% (South Carolina: 15.2%)

> Median home value: $83,000 (South Carolina: $162,300)

> Population: 1,939

ALSO READ: The Most Iconic Job in Every State

South Dakota: Mission

> Median household income: $21,029 (South Dakota: $58,275)

> Adults with at least a bachelor’s degree: 7.6% (South Dakota: 28.8%)

> Poverty rate: 58.7% (South Dakota: 13.1%)

> Median home value: $34,600 (South Dakota: $167,100)

> Population: 1,310

[in-text-ad]

Tennessee: Jamestown

> Median household income: $16,915 (Tennessee: $53,320)

> Adults with at least a bachelor’s degree: 5.7% (Tennessee: 27.3%)

> Poverty rate: 37.9% (Tennessee: 15.2%)

> Median home value: $67,600 (Tennessee: $167,200)

> Population: 1,949

ALSO READ: You’ll Pay the Most in Taxes in These States

Texas: Citrus City

> Median household income: $16,818 (Texas: $61,874)

> Adults with at least a bachelor’s degree: 2.3% (Texas: 29.9%)

> Poverty rate: 65.1% (Texas: 14.7%)

> Median home value: $62,100 (Texas: $172,500)

> Population: 3,288

Utah: Wendover

> Median household income: $33,750 (Utah: $71,621)

> Adults with at least a bachelor’s degree: 14.9% (Utah: 34.0%)

> Poverty rate: 33.0% (Utah: 9.8%)

> Median home value: $53,300 (Utah: $279,100)

> Population: 1,037

[in-text-ad-2]

Vermont: West Brattleboro

> Median household income: $31,918 (Vermont: $61,973)

> Adults with at least a bachelor’s degree: 37.0% (Vermont: 38.0%)

> Poverty rate: 19.1% (Vermont: 10.9%)

> Median home value: $167,400 (Vermont: $227,700)

> Population: 2,677

ALSO READ: The 25 Lowest Paying Jobs In America

Virginia: Jonesville

> Median household income: $19,276 (Virginia: $74,222)

> Adults with at least a bachelor’s degree: 18.4% (Virginia: 38.8%)

> Poverty rate: 34.5% (Virginia: 10.6%)

> Median home value: $103,100 (Virginia: $273,100)

> Population: 1,100

[in-text-ad]

Washington: Long Beach

> Median household income: $30,266 (Washington: $73,775)

> Adults with at least a bachelor’s degree: 14.0% (Washington: 36.0%)

> Poverty rate: 30.6% (Washington: 10.8%)

> Median home value: $200,800 (Washington: $339,000)

> Population: 1,468

ALSO READ: The Poorest County In Every State

West Virginia: Newell

> Median household income: $20,887 (West Virginia: $46,711)

> Adults with at least a bachelor’s degree: 8.8% (West Virginia: 20.6%)

> Poverty rate: 34.0% (West Virginia: 17.6%)

> Median home value: $46,500 (West Virginia: $119,600)

> Population: 1,284

Wisconsin: Little Round Lake

> Median household income: $21,985 (Wisconsin: $61,747)

> Adults with at least a bachelor’s degree: 4.9% (Wisconsin: 30.1%)

> Poverty rate: 55.7% (Wisconsin: 11.3%)

> Median home value: $80,700 (Wisconsin: $180,600)

> Population: 1,080

[in-text-ad-2]

Wyoming: Lusk

> Median household income: $38,477 (Wyoming: $64,049)

> Adults with at least a bachelor’s degree: 12.8% (Wyoming: 27.4%)

> Poverty rate: 25.1% (Wyoming: 11.0%)

> Median home value: $129,500 (Wyoming: $220,500)

> Population: 1,558

ALSO READ: America’s 25 Richest Universities

Methodology:

To determine the poorest town in every state, 24/7 Wall St. reviewed five-year estimates of median household income from the U.S. Census Bureau’s 2019 American Community Survey.

We used Census “place” geographies — a category that includes 29,573 incorporated legal entities and Census-designated statistical entities. Of those, 29,319 had boundaries that fell within one of the 50 states, while the rest were in the District of Columbia or Puerto Rico.

We defined towns based on population thresholds — having at least 1,000 people and less than 25,000 people — and 13,332 of the places fell within these thresholds.

Towns were then excluded if median household income figures were not available in the 2019 ACS, if 25% or more of a town’s population were enrolled in undergraduate, professional, or graduate school during the same period, or if the sampling error associated with a town’s data was deemed too high.

The sampling error was defined as too high if the coefficient of variation for a town’s median household income estimate was above 15% and greater than two standard deviations above the mean CV for all towns’ median household income estimates. We similarly excluded towns that had a sampling error too high for their population estimates, using the same definition.

The remaining 12,235 places were ranked within their state based on median household income. We used mean household income from the ACS to break ties.

Additional information on poverty, educational attainment, median home value, and population are also five-year estimates from the 2019 ACS.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.