The effects of COVID-19 on American workers — unemployment, reduced incomes, and even a fall into poverty for many — are all too familiar in many parts of the United States. However, while the pandemic has had some impact everywhere, there are some highly affluent parts of the country where people are so wealthy that the pandemic-driven downturn likely did not have a meaningful impact on quality of life.

In nearly every state, even relatively low-income states, there is at least one town where incomes are far higher than the median nationwide. To identify the richest town in every state, 24/7 Wall St. reviewed the median annual household income in cities, towns, villages, and Census designated places with populations of at least 1,000 and less than 25,000.

All of the places on this list have incomes well in excess of the national median household income of $65,712, with some places exceeding the maximum median household income recorded by the Census — $250,000. Generally speaking, the cities on this list with median household incomes exceeding $250,000 are in affluent states such as New York, New Jersey, and California.

One factor that has among the strongest correlations with income in the United States is education. Americans with a bachelor’s degree are far more likely to be employed and earn higher incomes than Americans with lower levels of education. Nationwide, 31.5% of adults have a bachelor’s degree. In the vast majority of places on this list, more than half of adults do, with some places recording adult bachelor’s attainment levels in excess of 80%. Incomes also tend to correlate with other factors, such as home values and poverty. The towns on this list tend to have very high home values and very low poverty rates.

Click here to see the richest town in every state.

Click here to see our methodology.

Alabama: Highland Lakes

> Median household income: $152,774 (Alabama: $50,536)

> Adults with at least a bachelor’s degree: 68.5% (Alabama: 25.5%)

> Poverty rate: 0.5% (Alabama: 16.7%)

> Median home value: $443,000 (Alabama: $142,700)

> Population: 5,519

[in-text-ad]

Alaska: Fishhook

> Median household income: $106,310 (Alaska: $77,640)

> Adults with at least a bachelor’s degree: 28.1% (Alaska: 29.6%)

> Poverty rate: 9.1% (Alaska: 10.7%)

> Median home value: $311,600 (Alaska: $270,400)

> Population: 6,788

ALSO READ: The US Cities Where Home Values Are Falling the Fastest

Arizona: Paradise Valley

> Median household income: $211,393 (Arizona: $58,945)

> Adults with at least a bachelor’s degree: 70.9% (Arizona: 29.5%)

> Poverty rate: 3.6% (Arizona: 15.1%)

> Median home value: $1,516,200 (Arizona: $225,500)

> Population: 14,362

Arkansas: Goshen

> Median household income: $141,389 (Arkansas: $47,597)

> Adults with at least a bachelor’s degree: 68.5% (Arkansas: 23.0%)

> Poverty rate: 0.9% (Arkansas: 17.0%)

> Median home value: $422,000 (Arkansas: $127,800)

> Population: 2,593

[in-text-ad-2]

California: Atherton

> Median household income: $250,000+ (California: $75,235)

> Adults with at least a bachelor’s degree: 81.9% (California: 33.9%)

> Poverty rate: 3.7% (California: 13.4%)

> Median home value: $2,000,000+ (California: $505,000)

> Population: 7,168

ALSO READ: States Where People Struggle Most With Student Debt

Colorado: Cherry Hills Village

> Median household income: $250,000+ (Colorado: $72,331)

> Adults with at least a bachelor’s degree: 84.3% (Colorado: 40.9%)

> Poverty rate: 3.5% (Colorado: 10.3%)

> Median home value: $1,727,100 (Colorado: $343,300)

> Population: 6,647

[in-text-ad]

Connecticut: Darien

> Median household income: $232,523 (Connecticut: $78,444)

> Adults with at least a bachelor’s degree: 82.9% (Connecticut: 39.3%)

> Poverty rate: 4.0% (Connecticut: 9.9%)

> Median home value: $1,471,700 (Connecticut: $275,400)

> Population: 21,742

ALSO READ: States Where People Are Struggling With the Most Debt

Delaware: North Star

> Median household income: $137,917 (Delaware: $68,287)

> Adults with at least a bachelor’s degree: 66.0% (Delaware: 32.0%)

> Poverty rate: 1.9% (Delaware: 11.8%)

> Median home value: $445,900 (Delaware: $251,100)

> Population: 7,503

Florida: Gulf Stream

> Median household income: $216,250 (Florida: $55,660)

> Adults with at least a bachelor’s degree: 73.9% (Florida: 29.9%)

> Poverty rate: 3.9% (Florida: 14.0%)

> Median home value: $2,000,000+ (Florida: $215,300)

> Population: 1,053

[in-text-ad-2]

Georgia: Berkeley Lake

> Median household income: $145,625 (Georgia: $58,700)

> Adults with at least a bachelor’s degree: 65.7% (Georgia: 31.3%)

> Poverty rate: 1.3% (Georgia: 15.1%)

> Median home value: $442,000 (Georgia: $176,000)

> Population: 1,839

ALSO READ: The Best and Worst States for Retirees

Hawaii: Maunawili

> Median household income: $141,136 (Hawaii: $81,275)

> Adults with at least a bachelor’s degree: 64.9% (Hawaii: 33.0%)

> Poverty rate: 2.8% (Hawaii: 9.4%)

> Median home value: $1,080,000 (Hawaii: $615,300)

> Population: 1,977

[in-text-ad]

Idaho: Hidden Spring

> Median household income: $131,094 (Idaho: $55,785)

> Adults with at least a bachelor’s degree: 65.4% (Idaho: 27.6%)

> Poverty rate: 3.2% (Idaho: 13.1%)

> Median home value: $427,400 (Idaho: $212,300)

> Population: 3,164

ALSO READ: Cities Where Home Values Are Rising the Fastest

Illinois: Winnetka

> Median household income: $250,000+ (Illinois: $65,886)

> Adults with at least a bachelor’s degree: 92.3% (Illinois: 34.7%)

> Poverty rate: 2.9% (Illinois: 12.5%)

> Median home value: $1,091,700 (Illinois: $194,500)

> Population: 12,428

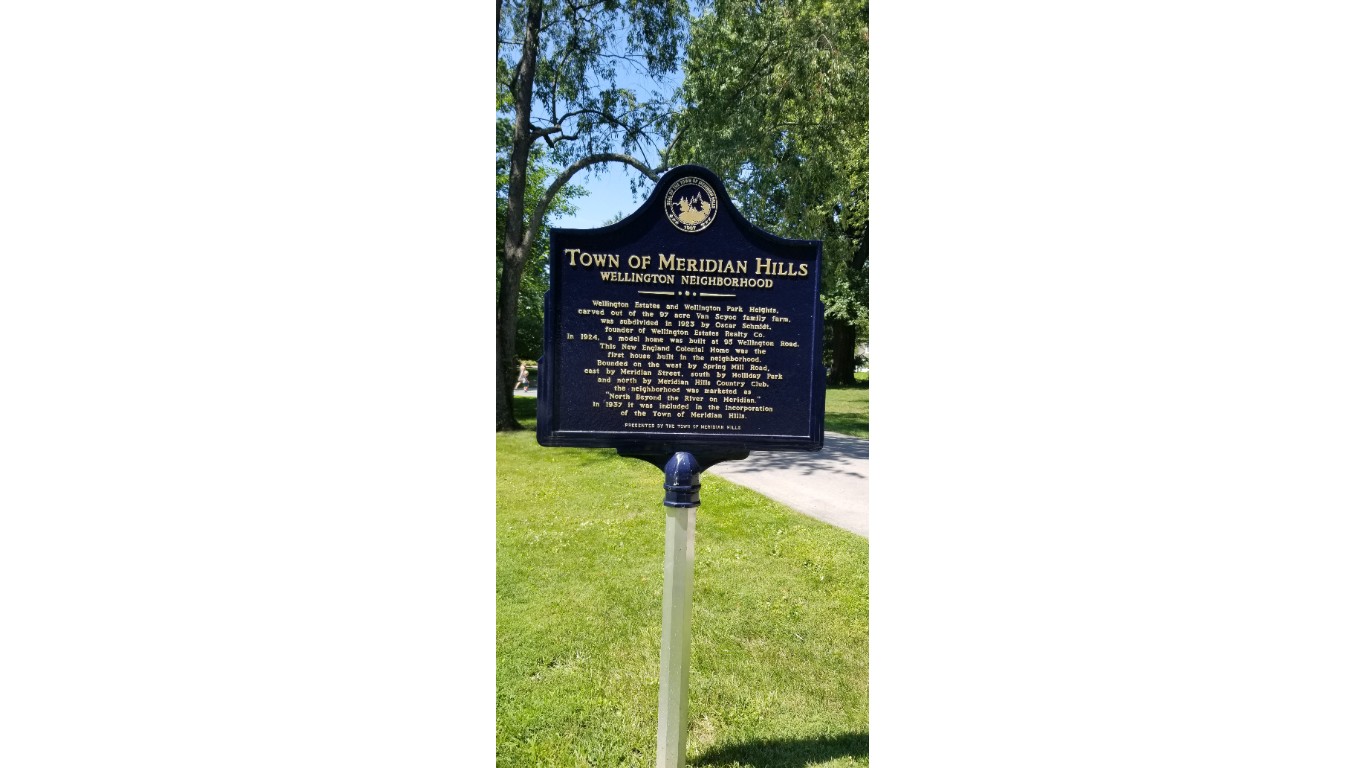

Indiana: Meridian Hills

> Median household income: $186,750 (Indiana: $56,303)

> Adults with at least a bachelor’s degree: 80.8% (Indiana: 26.5%)

> Poverty rate: 1.4% (Indiana: 13.4%)

> Median home value: $515,600 (Indiana: $141,700)

> Population: 1,741

[in-text-ad-2]

Iowa: Robins

> Median household income: $131,078 (Iowa: $60,523)

> Adults with at least a bachelor’s degree: 55.5% (Iowa: 28.6%)

> Poverty rate: 0.4% (Iowa: 11.5%)

> Median home value: $295,200 (Iowa: $147,800)

> Population: 3,457

ALSO READ: This County Has the Cheapest Homes in America

Kansas: Mission Hills

> Median household income: $250,000+ (Kansas: $59,597)

> Adults with at least a bachelor’s degree: 90.2% (Kansas: 33.4%)

> Poverty rate: 0.5% (Kansas: 12.0%)

> Median home value: $963,600 (Kansas: $151,900)

> Population: 3,574

[in-text-ad]

Kentucky: Indian Hills

> Median household income: $190,313 (Kentucky: $50,589)

> Adults with at least a bachelor’s degree: 81.5% (Kentucky: 24.2%)

> Poverty rate: 2.7% (Kentucky: 17.3%)

> Median home value: $529,000 (Kentucky: $141,000)

> Population: 2,961

ALSO READ: 28 Smart Ways to Make Extra Money

Louisiana: Paulina

> Median household income: $104,911 (Louisiana: $49,469)

> Adults with at least a bachelor’s degree: 39.8% (Louisiana: 24.1%)

> Poverty rate: 1.9% (Louisiana: 19.2%)

> Median home value: $311,600 (Louisiana: $163,100)

> Population: 1,280

Maine: Falmouth

> Median household income: $99,861 (Maine: $57,918)

> Adults with at least a bachelor’s degree: 62.4% (Maine: 31.8%)

> Poverty rate: 6.7% (Maine: 11.8%)

> Median home value: $428,700 (Maine: $190,400)

> Population: 1,949

[in-text-ad-2]

Maryland: Chevy Chase Village

> Median household income: $250,000+ (Maryland: $84,805)

> Adults with at least a bachelor’s degree: 92.8% (Maryland: 40.2%)

> Poverty rate: 1.0% (Maryland: 9.2%)

> Median home value: $1,724,500 (Maryland: $314,800)

> Population: 1,937

ALSO READ: States Spending the Most and Least on Gambling

Massachusetts: Dover

> Median household income: $216,250 (Massachusetts: $81,215)

> Adults with at least a bachelor’s degree: 80.8% (Massachusetts: 43.7%)

> Poverty rate: 0.5% (Massachusetts: 10.3%)

> Median home value: $951,800 (Massachusetts: $381,600)

> Population: 2,539

[in-text-ad]

Michigan: Orchard Lake Village

> Median household income: $182,273 (Michigan: $57,144)

> Adults with at least a bachelor’s degree: 63.6% (Michigan: 29.1%)

> Poverty rate: 7.9% (Michigan: 14.4%)

> Median home value: $645,500 (Michigan: $154,900)

> Population: 2,505

ALSO READ: How Much Home You Can Buy for 200K in Every State

Minnesota: Dellwood

> Median household income: $193,000 (Minnesota: $71,306)

> Adults with at least a bachelor’s degree: 76.7% (Minnesota: 36.1%)

> Poverty rate: 0.5% (Minnesota: 9.7%)

> Median home value: $616,300 (Minnesota: $223,900)

> Population: 1,298

Mississippi: Hernando

> Median household income: $79,195 (Mississippi: $45,081)

> Adults with at least a bachelor’s degree: 33.4% (Mississippi: 22.0%)

> Poverty rate: 5.8% (Mississippi: 20.3%)

> Median home value: $197,100 (Mississippi: $119,000)

> Population: 15,942

[in-text-ad-2]

Missouri: Frontenac

> Median household income: $217,768 (Missouri: $55,461)

> Adults with at least a bachelor’s degree: 82.8% (Missouri: 29.2%)

> Poverty rate: 3.0% (Missouri: 13.7%)

> Median home value: $694,300 (Missouri: $157,200)

> Population: 3,513

ALSO READ: States With the Largest Average Tax Refund

Montana: Helena Valley Northeast

> Median household income: $96,146 (Montana: $54,970)

> Adults with at least a bachelor’s degree: 37.7% (Montana: 32.0%)

> Poverty rate: 4.4% (Montana: 13.1%)

> Median home value: $356,100 (Montana: $230,600)

> Population: 3,557

[in-text-ad]

Nebraska: Hickman

> Median household income: $105,000 (Nebraska: $61,439)

> Adults with at least a bachelor’s degree: 44.1% (Nebraska: 31.9%)

> Poverty rate: 0.9% (Nebraska: 11.1%)

> Median home value: $209,000 (Nebraska: $155,800)

> Population: 2,447

ALSO READ: The Value of a Dollar in Every State

Nevada: Spring Creek

> Median household income: $99,854 (Nevada: $60,365)

> Adults with at least a bachelor’s degree: 20.5% (Nevada: 24.7%)

> Poverty rate: 7.7% (Nevada: 13.1%)

> Median home value: $232,900 (Nevada: $267,900)

> Population: 13,671

New Hampshire: Seabrook Beach

> Median household income: $105,855 (New Hampshire: $76,768)

> Adults with at least a bachelor’s degree: 54.9% (New Hampshire: 37.0%)

> Poverty rate: 9.1% (New Hampshire: 7.6%)

> Median home value: $549,200 (New Hampshire: $261,700)

> Population: 1,015

[in-text-ad-2]

New Jersey: Short Hills

> Median household income: $250,000+ (New Jersey: $82,545)

> Adults with at least a bachelor’s degree: 87.8% (New Jersey: 39.7%)

> Poverty rate: 4.1% (New Jersey: 10.0%)

> Median home value: $1,386,600 (New Jersey: $335,600)

> Population: 13,428

ALSO READ: 30 Richest Americans Of All Time

New Mexico: White Rock

> Median household income: $135,964 (New Mexico: $49,754)

> Adults with at least a bachelor’s degree: 66.0% (New Mexico: 27.3%)

> Poverty rate: 2.2% (New Mexico: 19.1%)

> Median home value: $301,500 (New Mexico: $171,400)

> Population: 5,751

[in-text-ad]

New York: Sands Point

> Median household income: $250,000+ (New York: $68,486)

> Adults with at least a bachelor’s degree: 83.1% (New York: 36.6%)

> Poverty rate: 1.8% (New York: 14.1%)

> Median home value: $2,000,000+ (New York: $313,700)

> Population: 2,862

ALSO READ: States Paying Teachers Most and Least

North Carolina: Marvin

> Median household income: $206,469 (North Carolina: $54,602)

> Adults with at least a bachelor’s degree: 73.3% (North Carolina: 31.3%)

> Poverty rate: 2.0% (North Carolina: 14.7%)

> Median home value: $677,800 (North Carolina: $172,500)

> Population: 6,553

North Dakota: Horace

> Median household income: $129,231 (North Dakota: $64,894)

> Adults with at least a bachelor’s degree: 47.5% (North Dakota: 30.0%)

> Poverty rate: 1.7% (North Dakota: 10.7%)

> Median home value: $297,800 (North Dakota: $193,900)

> Population: 2,741

[in-text-ad-2]

Ohio: The Village of Indian Hill

> Median household income: $207,174 (Ohio: $56,602)

> Adults with at least a bachelor’s degree: 87.0% (Ohio: 28.3%)

> Poverty rate: 2.7% (Ohio: 14.0%)

> Median home value: $955,500 (Ohio: $145,700)

> Population: 5,762

ALSO READ: The Largest Employer in Every State

Oklahoma: Nichols Hills

> Median household income: $186,912 (Oklahoma: $52,919)

> Adults with at least a bachelor’s degree: 82.7% (Oklahoma: 25.5%)

> Poverty rate: 4.7% (Oklahoma: 15.7%)

> Median home value: $799,900 (Oklahoma: $136,800)

> Population: 3,891

[in-text-ad]

Oregon: Cedar Mill

> Median household income: $145,057 (Oregon: $62,818)

> Adults with at least a bachelor’s degree: 64.7% (Oregon: 33.7%)

> Poverty rate: 4.8% (Oregon: 13.2%)

> Median home value: $598,500 (Oregon: $312,200)

> Population: 17,659

ALSO READ: The City in Every State With the Most Billionaires

Pennsylvania: Fox Chapel

> Median household income: $205,987 (Pennsylvania: $61,744)

> Adults with at least a bachelor’s degree: 83.6% (Pennsylvania: 31.4%)

> Poverty rate: 1.1% (Pennsylvania: 12.4%)

> Median home value: $662,400 (Pennsylvania: $180,200)

> Population: 5,121

Rhode Island: Ashaway

> Median household income: $104,337 (Rhode Island: $67,167)

> Adults with at least a bachelor’s degree: 30.6% (Rhode Island: 34.2%)

> Poverty rate: 3.3% (Rhode Island: 12.4%)

> Median home value: $232,000 (Rhode Island: $261,900)

> Population: 1,195

[in-text-ad-2]

South Carolina: Kiawah Island

> Median household income: $193,750 (South Carolina: $53,199)

> Adults with at least a bachelor’s degree: 81.8% (South Carolina: 28.1%)

> Poverty rate: 5.7% (South Carolina: 15.2%)

> Median home value: $1,532,800 (South Carolina: $162,300)

> Population: 1,676

ALSO READ: The Most Iconic Job in Every State

South Dakota: Dakota Dunes

> Median household income: $118,966 (South Dakota: $58,275)

> Adults with at least a bachelor’s degree: 47.6% (South Dakota: 28.8%)

> Poverty rate: 8.1% (South Dakota: 13.1%)

> Median home value: $326,500 (South Dakota: $167,100)

> Population: 3,156

[in-text-ad]

Tennessee: Belle Meade

> Median household income: $250,000+ (Tennessee: $53,320)

> Adults with at least a bachelor’s degree: 84.9% (Tennessee: 27.3%)

> Poverty rate: 2.3% (Tennessee: 15.2%)

> Median home value: $1,524,400 (Tennessee: $167,200)

> Population: 2,280

ALSO READ: You’ll Pay the Most in Taxes in These States

Texas: Hunters Creek Village

> Median household income: $250,000+ (Texas: $61,874)

> Adults with at least a bachelor’s degree: 87.2% (Texas: 29.9%)

> Poverty rate: 1.0% (Texas: 14.7%)

> Median home value: $1,744,500 (Texas: $172,500)

> Population: 4,825

Utah: Silver Summit

> Median household income: $147,404 (Utah: $71,621)

> Adults with at least a bachelor’s degree: 59.0% (Utah: 34.0%)

> Poverty rate: 0.3% (Utah: 9.8%)

> Median home value: $862,200 (Utah: $279,100)

> Population: 4,503

[in-text-ad-2]

Vermont: Jericho

> Median household income: $98,646 (Vermont: $61,973)

> Adults with at least a bachelor’s degree: 56.9% (Vermont: 38.0%)

> Poverty rate: 1.7% (Vermont: 10.9%)

> Median home value: $261,400 (Vermont: $227,700)

> Population: 1,315

ALSO READ: The 25 Lowest Paying Jobs In America

Virginia: Great Falls

> Median household income: $238,125 (Virginia: $74,222)

> Adults with at least a bachelor’s degree: 80.7% (Virginia: 38.8%)

> Poverty rate: 3.4% (Virginia: 10.6%)

> Median home value: $1,142,000 (Virginia: $273,100)

> Population: 14,872

[in-text-ad]

Washington: Yarrow Point

> Median household income: $250,000+ (Washington: $73,775)

> Adults with at least a bachelor’s degree: 84.2% (Washington: 36.0%)

> Poverty rate: 3.0% (Washington: 10.8%)

> Median home value: $2,000,000+ (Washington: $339,000)

> Population: 1,202

ALSO READ: The Poorest County In Every State

West Virginia: Cheat Lake

> Median household income: $89,310 (West Virginia: $46,711)

> Adults with at least a bachelor’s degree: 53.9% (West Virginia: 20.6%)

> Poverty rate: 8.4% (West Virginia: 17.6%)

> Median home value: $298,900 (West Virginia: $119,600)

> Population: 9,251

Wisconsin: River Hills

> Median household income: $161,719 (Wisconsin: $61,747)

> Adults with at least a bachelor’s degree: 72.2% (Wisconsin: 30.1%)

> Poverty rate: 2.7% (Wisconsin: 11.3%)

> Median home value: $642,900 (Wisconsin: $180,600)

> Population: 1,449

[in-text-ad-2]

Wyoming: Moose Wilson Road

> Median household income: $111,776 (Wyoming: $64,049)

> Adults with at least a bachelor’s degree: 52.6% (Wyoming: 27.4%)

> Poverty rate: 7.7% (Wyoming: 11.0%)

> Median home value: $1,073,600 (Wyoming: $220,500)

> Population: 1,398

ALSO READ: America’s 25 Richest Universities

Methodology:

To determine the richest town in every state, 24/7 Wall St. reviewed five-year estimates of median annual household income from the U.S. Census Bureau’s 2019 American Community Survey.

We used Census “place” geographies — a category that includes 29,573 incorporated legal entities and Census-designated statistical entities. Of those, 29,319 had boundaries that fell within one of the 50 states, while the rest were in the District of Columbia or Puerto Rico.

We defined towns based on population thresholds — having at least 1,000 people and less than 25,000 people — and 13,332 of the places fell within these thresholds.

Towns were then excluded if median household income figures were not available in the 2019 ACS or if the sampling error associated with a town’s data was deemed too high.

The sampling error was defined as too high if the coefficient of variation for a town’s median household income estimate was above 15% and greater than two standard deviations above the mean CV for all towns’ median household income estimates. We similarly excluded towns that had a sampling error too high for their population estimates, using the same definition.

The remaining 12,414 places were ranked within their state based on median household income. We used mean household income from the ACS to break ties.

Additional information on poverty, educational attainment, median home value, and population are also five-year estimates from the 2019 ACS.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.